ASX Small Caps Lunch Wrap: Who got busted for ball tampering in front of the entire MCG yesterday?

Derek often has to pause while waves of pain wash over him, as he suffers from a malady known as "cricket ball" – which is a lot like tennis elbow, but much, much worse. Pic via Getty Images.

Local markets are set to end the year on a sour note today, as the benchmark slid to an inglorious -0.34% before lunch, driven lower by a downward lurch among a number of key commodities overnight.

Plus, Wall Street investors look like they’ve taken their foot off the gas for the year already as well, phoning in a lacklustre effort that had the ASX 200 Futures index pointing 0.4% lower a few hours before go-time this morning.

I’ll get to that in a minute or two, but first there’s been a spot of off-field action caught on camera during the Boxing Day test between Australia and Pakistan at the MCG, where – apparently – the cricket was proving to be a little on the slow side for one young couple.

While scanning the crowd for something, or anything, of interest, an eagle-eyed camera operator happened upon the pair enjoying a not-entirely broadcast friendly session in the nosebleed seats of the Ponsford Stand.

There was a rousing cheer from an appreciative MCG crowd when the camera’s feed was pushed live to the big screen, showing the couple indulging in a bit of “over the pants” action, as the young lady gave her companion’s short leg a solid workout.

Wait a minute what did we all just see? Yet you are complaining about missed catches? ♀️ #PAKvsAUS pic.twitter.com/8yA6pCagXv

— Kinza Tariq (@Kinnzayyy) December 28, 2023

Sadly, that young bloke was left to slouch miserably out of the stands while hiding his face from the jeering crowd, the kind of reception you’d expect for someone who’d just been comprehensively stroked over the boundary.

However, there is some good news – the young lady involved has reportedly been signed to a $17 million contract by the Gujarat Giants WPL franchise, with team coach Ram Mehar Singh citing her obvious talent as a “left-handed wristy, capable of getting plenty of ball movement off the seam” as the reason why he moved so quickly to bring her into the squad.

TO MARKETS

Local markets have come off the boil about 8 hours too early, opening the final day of trading for 2023 with a whimper before settling at around -0.35% as we head into lunch.

The reason for that is fairly easy to spot – a bunch of key commodities hit the skids overnight, letting a lot of the steam out of the Materials and Energy sectors that had been running pretty hot the past couple of days.

For starters, crude oil prices tumbled overnight, dropping around 3.0% and leaving Brent Crude trading at just over $77.25 a barrel. That has since made something of a recovery, climbing back to US$78.38 at the time of writing.

Meanwhile, the gold price fell by -0.5% to US$2,065.83 an ounce, and has continued to trickle down slowly as the morning wore on.

Iron ore prices – which had been enjoying something of a surge earlier in the week – also fell, tumbling by almost 2.0% to US$138.70 a tonne.

As you can see, it was all a bit chaotic – but the less risk-averse punters among us will be pleased to note that Bitcoin was as predictable and stable as ever while all that was going on.

I’m kidding, of course – Bitcoin was the usual utter shitshow we’ve come to know and love, shedding 3.0% in the last 24 hours to US$42,349 at lunchtime, and trending rapidly in the wrong direction.

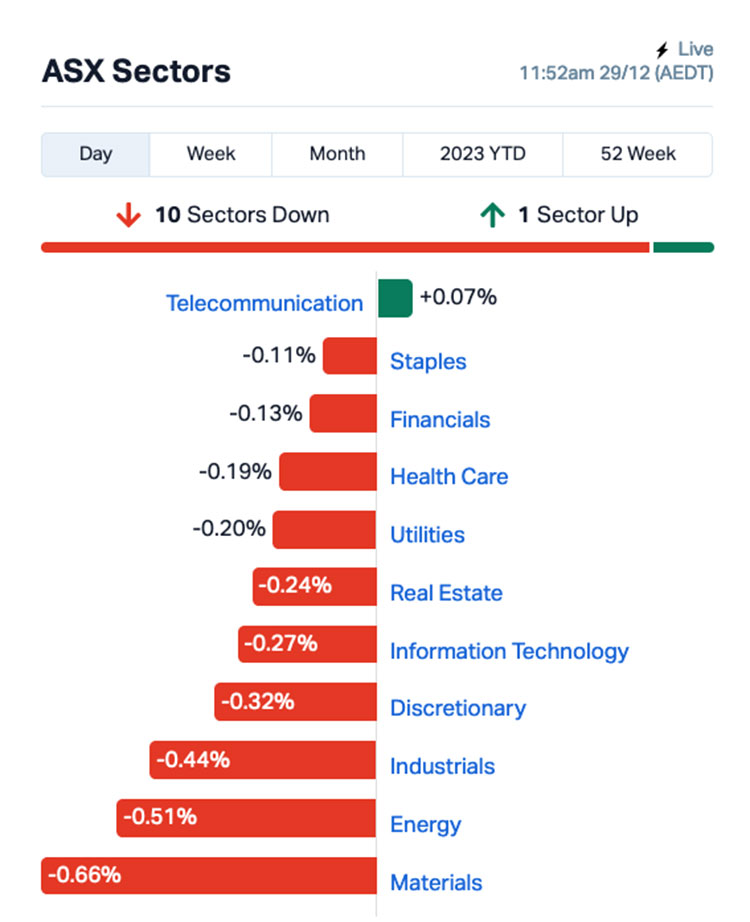

A look at the ASX sectors at lunch time, and you’d be forgiven for wondering when Moses was going to turn up to part the sea of red – everything’s falling this morning, aside from a handful of Very Brave Telcos, which have lifted that sector a measly 0.07% higher.

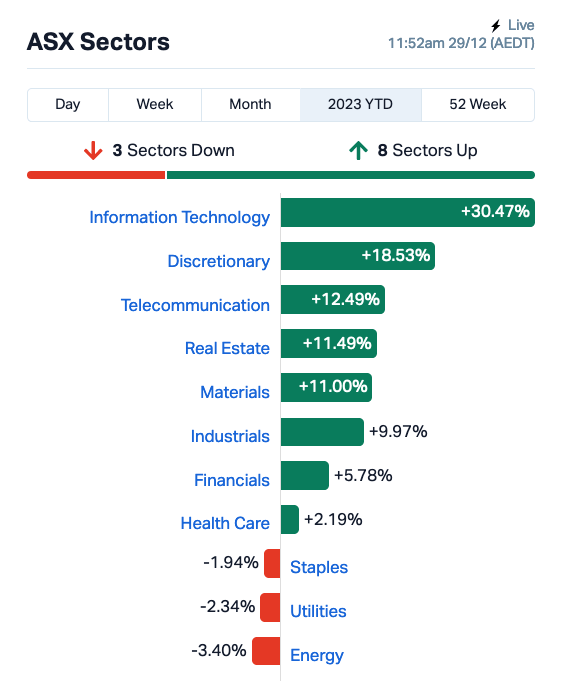

Now, given that it’s the final trading day of the year, here’s a sneak peek at how things have panned out for the market’s sectors for 2023 – and it’s a little bit of an eye-opener for anyone whose portfolio was a little bit Energy-heavy this year.

It has, quite clearly, been a solid year for investing in InfoTech, with that sector pumping out a very rewarding +30% gain for anyone with the stomach for riding the bleeding edges of 2023’s Absolutely-Not-A-Tech-Bubble.

There are no less than 13 ASX-listed tech companies boasting better than +100% returns for the year, with two companies – DUG Technology (ASX:DUG) and Nuix (ASX:NXL) – breaking +200% since the start of 2023.

Today, it’s Novonix’s (ASX:NVX) turn to bank some decent tech gains, adding close to +8.5%, with Latin Resources alongside it on +7.5% as one of the few large cappers making headway on a difficult final morning of trade for the year.

NOT THE ASX

Looking at US markets, and it wasn’t all that great in the US overnight – falling commodities took their toll on New York’s investor sentiment as well, leaving the S&P 500 up +0.4%, edging ever closer toward resetting a new record high.

Meanwhile, The blue chips Dow Jones index was up by +0.14%, and the tech-heavy Nasdaq fell by -0.03%.

Earlybird Eddy Sunarto was on the spot this morning to report that fresh data shows that US jobless claims ticked slightly higher in the week ending December 23rd, above what economists predicted.

And in housing data, the rate on the US 30-year fixed mortgage declined to 6.61%, the lowest since May, from 6.67% the previous week.

“Heading into the new year, the economy remains on firm ground with solid growth, a tight labor market, decelerating inflation, and a nascent rebound in the housing market,” said Freddie Mac’s chief economist, Sam Khater.

In stock news, China’s blue-chips Alibaba and JD.com staged their biggest jump in five months, rising by 3% and 5% respectively.

Boeing fell almost 1% after requesting airlines to inspect for a “possible loose bolt” in the rudder control system of its newer 737 MAX aircraft – which is not the kind of announcement you want to hear in the middle of peak tourism season… unless you feel like holidaying in Fiji, rather than the Gold Coast.

The biggest mover last night was medical device maker CytoSorbents, which fell -33% after saying that its investigational blood purification system, DrugSorb-ATR, did not meet the primary effectiveness endpoint in a pivotal trial.

In Asian market news, Japan’s Nikkei is down 0.31% this morning, after Russia dropped another not-very-subtle hint about how serious it is about stopping the movement of Patriot missile systems to Ukraine, by dropping a member of Putin’s ruling United Russia party, Vladimir Egorov, out the third floor window of his home.

Shanghai markets are still waking up, and if you listen carefully, you can probably hear Hong Kong’s Hang Seng snoring away merrily as well.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 29 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.002 | 100% | 2,224,512 | $4,728,824 |

| AMD | Arrow Minerals | 0.0075 | 50% | 97,703,950 | $17,368,825 |

| CLE | Cyclone Metals | 0.0015 | 50% | 2,209,999 | $10,471,172 |

| CPO | Culpeominerals | 0.077 | 35% | 27,387,073 | $6,644,055 |

| RGS | Regeneus Ltd | 0.004 | 33% | 239,384 | $919,311 |

| YOJ | Yojee Limited | 0.004 | 33% | 2,163,157 | $3,917,956 |

| YRL | Yandal Resources | 0.12 | 32% | 387,633 | $21,360,080 |

| OAU | Ora Gold Limited | 0.0075 | 25% | 27,905,996 | $34,136,928 |

| DOU | Douugh Limited | 0.005 | 25% | 408,496 | $4,328,276 |

| RIL | Redivium Limited | 0.006 | 20% | 415,157 | $13,654,274 |

| ACR | Acrux Limited | 0.061 | 20% | 601,619 | $14,771,180 |

| EQS | Equitystorygroupltd | 0.038 | 19% | 61,056 | $1,363,673 |

| OEQ | Orion Equities | 0.195 | 18% | 13,078 | $2,582,123 |

| PGD | Peregrine Gold | 0.35 | 17% | 240,052 | $20,098,944 |

| EEL | Enrg Elements Ltd | 0.007 | 17% | 180,453 | $6,059,790 |

| VRC | Volt Resources Ltd | 0.007 | 17% | 27,594 | $24,780,640 |

| GLA | Gladiator Resources | 0.022 | 16% | 1,610,038 | $11,538,640 |

| BIT | Biotron Limited | 0.115 | 15% | 5,094,907 | $90,227,551 |

| EYE | Nova EYE Medical Ltd | 0.31 | 15% | 1,418,966 | $51,469,801 |

| EXT | Excite Technology | 0.008 | 14% | 382,362 | $9,304,692 |

| FDR | Finder | 0.09 | 14% | 106,931 | $5,925,000 |

| OZZ | OZZ Resources | 0.093 | 13% | 103,668 | $7,587,470 |

| GUE | Global Uranium | 0.11 | 13% | 719,022 | $20,584,270 |

| MDR | Medadvisor Limited | 0.255 | 13% | 232,662 | $123,059,210 |

| RNE | Renu Energy Ltd | 0.017 | 13% | 690,024 | $10,124,510 |

Top of the charts this morning among the small cappers is Nova Eye Medical (ASX:EYE), which is up nearly 37% this morning on news that proposed changes to the US Medicare system that would have negatively impacted the company are no longer going to be pushed into effect.

The company was staring down the barrel of five major Medicare Administrative Contractors altering what’s known as Local Coverage Determinations to restrict or deny coverage for several procedures, including canaloplasty for minimally invasive glaucoma surgery at the end of January, 2024 – however, those proposals have now been completely withdrawn.

MTM Critical Metals (ASX:MTM) is also performing well this morning, up nearly 40% this morning as investors continue to get behind the company’s decision to acquire Flash Metals – and with it, three key exploration licences prospective for niobium and rare earth elements (REE) in the West Arunta region of WA – announced to the market 10 days ago.

Meanwhile, Inca Minerals (ASX:ICG) is up 30% on very slim volume, fintech Wisr (ASX:WZR) is up 22.5% on no news, and Base Resources (ASX:BSE) is up 18.5% this morning after releasing its Modern Slavery Report for 2023, outlining the company’s position on the issue and the steps it has taken this year to ensure that it’s operations and supply chains are free from slavery altogether.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 29 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ADS | Adslot Ltd. | 0.002 | -33% | 500,002 | $9,673,487 |

| BP8 | Bph Global Ltd | 0.001 | -33% | 84 | $2,753,345 |

| AMM | Armada Metals | 0.028 | -26% | 63,702 | $7,904,000 |

| 1AG | Alterra Limited | 0.006 | -25% | 1,733,100 | $6,657,177 |

| FAU | First Au Ltd | 0.003 | -25% | 27,576 | $6,647,973 |

| KNM | Kneomedia Limited | 0.002 | -20% | 100 | $3,833,178 |

| MKL | Mighty Kingdom Ltd | 0.014 | -18% | 1,229,246 | $7,146,283 |

| NTL | New Talisman Gold | 0.015 | -17% | 429,585 | $7,947,532 |

| MSG | Mcs Services Limited | 0.01 | -17% | 390,000 | $2,377,196 |

| ADY | Admiralty Resources. | 0.006 | -14% | 355,327 | $9,125,054 |

| IS3 | I Synergy Group Ltd | 0.006 | -14% | 150,112 | $2,128,563 |

| NNL | Nordicnickellimited | 0.125 | -14% | 90,000 | $10,483,125 |

| ADD | Adavale Resource Ltd | 0.007 | -13% | 394,333 | $5,972,709 |

| GSR | Greenstone Resources | 0.007 | -13% | 73,529 | $10,944,908 |

| MHC | Manhattan Corp Ltd | 0.0035 | -13% | 224,360 | $11,747,919 |

| SRZ | Stellar Resources | 0.007 | -13% | 49,400 | $9,192,212 |

| FDR | Finder | 0.079 | -11% | 99,938 | $6,675,000 |

| X2M | X2M Connect Limited | 0.04 | -11% | 5,665 | $8,216,705 |

| PUR | Pursuit Minerals | 0.008 | -11% | 700,182 | $26,495,743 |

| NRZ | Neurizer Ltd | 0.017 | -11% | 796,698 | $26,054,302 |

| FEG | Far East Gold | 0.13 | -10% | 25,690 | $26,187,900 |

| CTQ | Careteq Limited | 0.026 | -10% | 44,718 | $6,731,563 |

| AMT | Allegra Medical | 0.045 | -10% | 3,000 | $5,980,551 |

| DOU | Douugh Limited | 0.0045 | -10% | 124,000 | $5,410,345 |

| SBR | Sabre Resources | 0.029 | -9% | 322,350 | $11,586,840 |

That’s it from me for 2023… Thanks to everyone who took the time to drop me an email this year. Whether it was to tell me I’m awesome, or – more likely – give me unending amounts of static, it’s just nice to know that you’re there. I look forward to seeing you all back here on Tuesday, brutally hungover and wondering why you’ve woken up broke, sticky and confused, as we get 2024 off to the kind of start it deserves.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.