FREE WHELAN: New job. New firm. New catalyst. New market correction. Same playbook.

Experts

Experts

In this Stockhead series, investment manager James Whelan offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the moment from the point of view of a very professional money manager.

Good morning,

New job, new firm, but the same entirely Free Whelan.

I thank you for your continued support.

Speaking of support, on the 28th November I’ll be speaking at the Ensombl All Licensee Professional Development Day.

Naturally, I look forward to seeing you all there.

And so we go into another week with the world ending a little bit more.

The tragedy in the Middle East continues and, combined with reporting and US economic strength, has caused a fair correction in markets.

Let’s have a squizz at the technicals and see what they tell us…

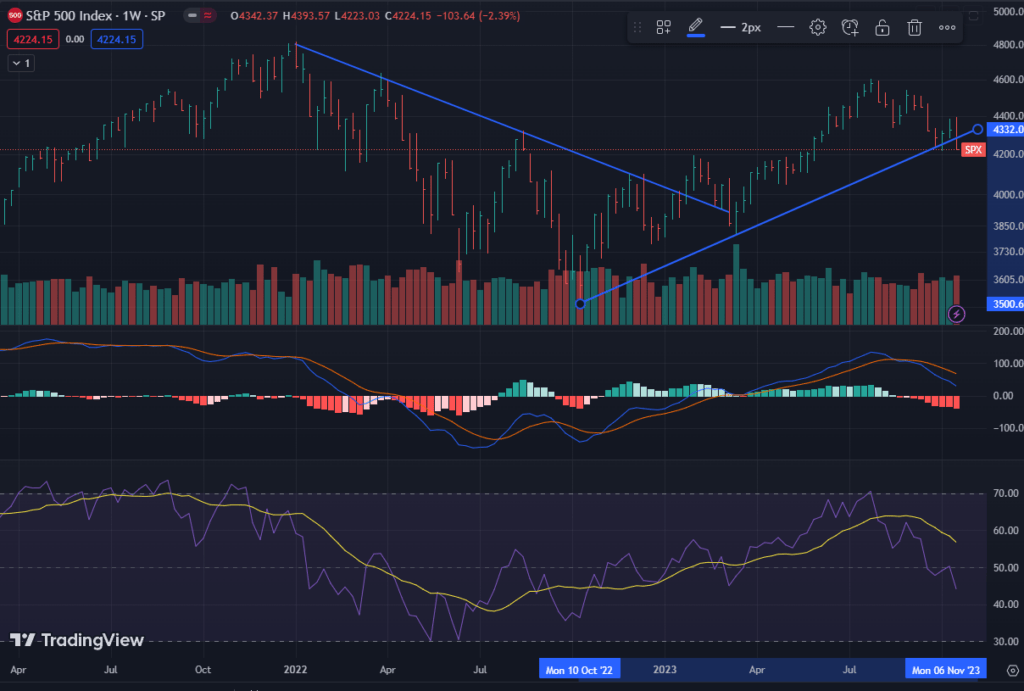

You can see from the chart above that on about the 21st August is when the technicals rolled over on the SPX. Not only has support been broken but the MACD and RSI are both telling a story and that story is “not yet”.

Remember that we want to be long term holders of the market, so using peaks to sell and troughs to buy is the way forward.

As a default wait for the RSI (purple line bottom chart) to get down into the high 30s before you commit.

As usual – always look at a zoomed-out chart for context and reference:

A fair amount of this has to do with the 10-year yield now hitting 5%.

That magic number that always represented the end of days. I’m still very much a fan of higher rates (generally speaking) – it means risk can be priced better in portfolios (you don’t have to make as much of a punt to return the same number) and also because it’s a great way of weeding out the zombies.

Covid was meant to do that but no one was allowed to fail in Covid so now here we are three years later.

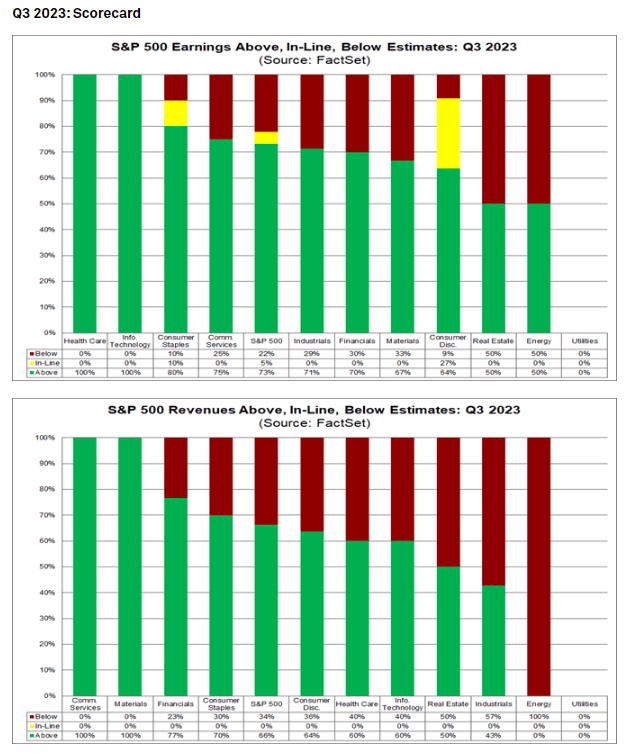

Earnings reporting is now in full swing and the analysts were massively over expectant on energy revenues and under bidders in Communication services.

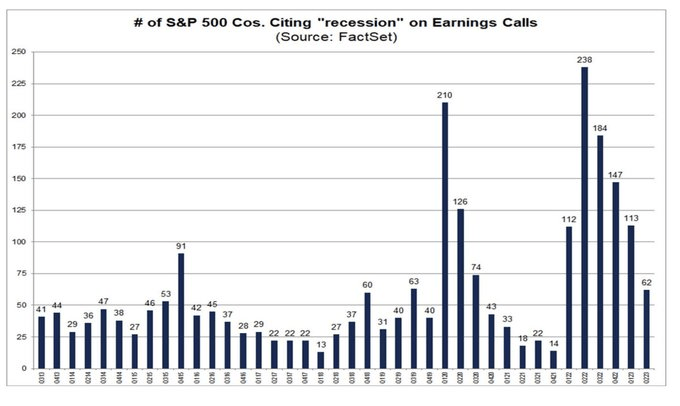

Whilst we’re there, remember a few weeks back I said focus on the outlook because that will give you a better insight into the strength of the economy and therefore rate expectations.

This chart tells you everything.

Number of companies mentioning “recession” on the earnings calls.

This matches comments by the Fed that the economy is doing better than anticipated.

Act accordingly.

The RBA will meet on the first Tuesday of November and it will be a “live” meeting.

I will go out on a limb and predict 25bps of hikes – but that’s only because the new Governor needs to prove a point about how serious they are about getting inflation back down.

This fellow at the below link has been tracking US house sales and who is linked to them. Remember the big scandal over the last few years has been about the volume of houses being bought by Private Equity, shutting many first home buyers out of the market?

Well it looks like the rates are high enough and rents are low enough to reverse that.

Wall Street Investors are beginning to sell their houses.

This listing in Phoenix was bought by a private equity fund in 2022 at the peak of the bubble.

Now they’re listing at an 11% loss.

It’s just the start. pic.twitter.com/RCLtUBMHGf

— Nick Gerli (@nickgerli1) October 21, 2023

That’s all for now with a big week ahead.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.