Kyle on Capital: Three easy ASX picks for when you finally yield to Mr Bond

Experts

Experts

Cyclicals look sickly. Copper’s come a cropper and – most importantly – surging global bond yields are showing signs of fatigue.

Stories drive markets, writes Kyle Rodda, senior financial market analyst at Capital.com.

And ours is about to change…

My new narrative hasn’t quite taken hold yet, however, some signals suggest the next step on the proverbial wall of worry investors need to climb is an imminent growth slowdown.

Growth is slowing. Oil prices are plunging. Copper remains in a downtrend. Cyclicals are looking sickly. Most importantly, global yields look like they might be finally rolling over.

That final point is the most important one because the run-up in long-dated yields has put downward pressure on equity prices and has been the most significant factor driving the recent market bearishness.

There have been three primary drivers of the run-up in long-dated bond yields:

A resilient US economy, which gave rise to the “higher for longer” mantra regarding US Fed policy

Increased bond issuance by the US Treasury as it looks to fund massive fiscal deficits

Greater supply as the Fed’s ongoing Quantitative Tightening unfolds

OFC, other factors could be at play, including other central banks unwinding their balance sheets, the Bank of Japan (BoJ) stepping away from its Yield Curve Control policy, and China reducing exposure to US dollar-denominated debt.

However, as far as we’re concerned those are the big three.

Supply and demand imbalances could remain a factor, putting upward pressure on yields. US public debt will probably stay high for the foreseeable future, and quantitative tightening will likely continue until something “breaks” in the financial system. However, growth and inflation expectations are shifting, especially following last week’s lukewarm US data.

The softer-than-expected Non-Farm Payrolls report captured most of the attention. The NFPs are a riot. But arguably, the strongest signal came from the ISM Business Surveys, especially the manufacturing report…

Which returned to levels consistent with a possible contraction in US economic activity:

Where the US economy goes, so goes the US 10-year yield, and where the US year yield goes, so goes the Australian 10-year yield.

It has plunged a remarkable 50 basis points in seven days.

While a volatile bond market has been the norm in recent years, given macroeconomic fundamentals, it could suggest we’ve seen a peak in yields. For ASX investors, the obvious question is: what does it mean for my portfolio? While growth stocks have rebounded, a meaningful slowdown in economic activity means it could be time to play some defence.

Here are three blue-chip stocks that historically perform well when long-term yields fall.

Before picking apart which stocks could benefit from a peak in global bond yields, here are the criteria I’m using to arrive at just three:

They are “blue chip” companies from the ASX200

They possess defensive qualities during a downturn

They pay a relatively stable dividend yield

They have a negative correlation with the Australian 10-year yield

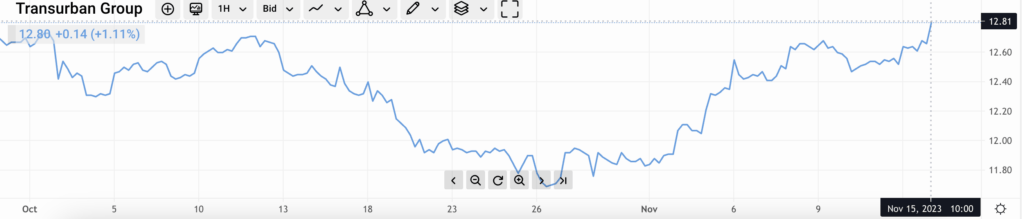

Transurban shares have trended lower in 2023 amid a volatile business and macroeconomic environment.

The share price rose to $15 and around the top of a three-year range as investors bought into the narrative the stock was a way to hedge inflation. The tolls the company charges are inflation-linked, making its profits partially resistant to the run-up in price growth in recent years.

However, Transurban shares are strongly correlated with Australian bond yield, with rising yields weakening the stock’s appeal despite its relatively hefty and stable dividend yield of around 4.6%. Investor sentiment towards the stock also weakened after the ACCC knocked back the company’s bid for Melbourne’s East Link.

Transurban shares are now at the bottom of its range, boosting its dividend yield, with analysts forecasting solid earnings growth that may drive it above 5%. A turn lower in economic growth and, subsequently, bond yields could boost the stock’s appeal, even if weaker economic conditions erode toll revenues.

Transurban shares have bounced from oversold levels and reverted to the 50-day moving average as technical resistance at $12.70 comes into view.

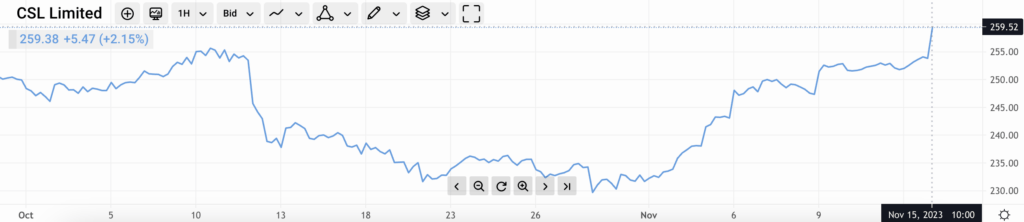

Once upon a time, a market darling. CSL shareholders have been in the wars in recent years following the major disruptions caused by the pandemic and the impacts of higher rates on the company’s valuation. The shocks to the company’s operations have subsided, and it would seem the collections, especially in the US, are beginning to improve. However, this year’s run-up in long-end rates has compressed CSL’s multiples, pushing its share price to a four-year low.

Despite this, analysts forecast a sustained return to double-digit topline growth as the company grows with its sizeable market. Arguably, CSL’s fundamentals haven’t changed. Instead, the macroeconomic backdrop has become less favourable to a business that thrived in a pre-pandemic world dominated by growth and quality stocks.

A peak and subsequent trend reversal in yields should reflate CSL’s multiples as the economic fundamentals lead to lower growth and inflationary pressures. If economic growth slows materially, the defensive qualities of the stock could also shine through.

The recent drop in yields has already boosted CSL’s share price. The stock has broken its downtrend and is trading just below a resistance zone between $255 and $265.

Telstra has dealt with both macro and micro headwinds in 2023. Investors had the rug pulled from underneath them when the company balked at selling some of its major infrastructure assets, which many investors thought would deliver a significant cash splash. Analysts are forecasting full-year earnings per share of $0.17 in FY24 as the business continues to provide sustained dividends.

However, with a current dividend yield of approximately 4.5%, the surge in long-end yields to 11-year highs has meant the pay-out doesn’t deliver attractive enough risk and reward.

By market standards, Telstra’s dividend yield is high, the company maintains a track record of delivering income to its investors, and if yields peak, it may draw investors towards the stock in a reach for income. The scenario will be particularly acute if economic activity slows so much that defensive sectors of the equity market attract more significant flows.

After Telstra’s recent correction, price action is becoming more constructive. The stock has carved out a rounding bottom formation and is testing previous support and now resistance at $3.90.

So. There you are. Three reliable protagonists for the new narrative.

Good luck,

Kyle.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.