S&P forecasts 21.3pc divvie rise for Q2, led by banks and REITS

Resilient Aussie banks lead a positive Q2 CY23 dividend outlook. Pic: Getty Images

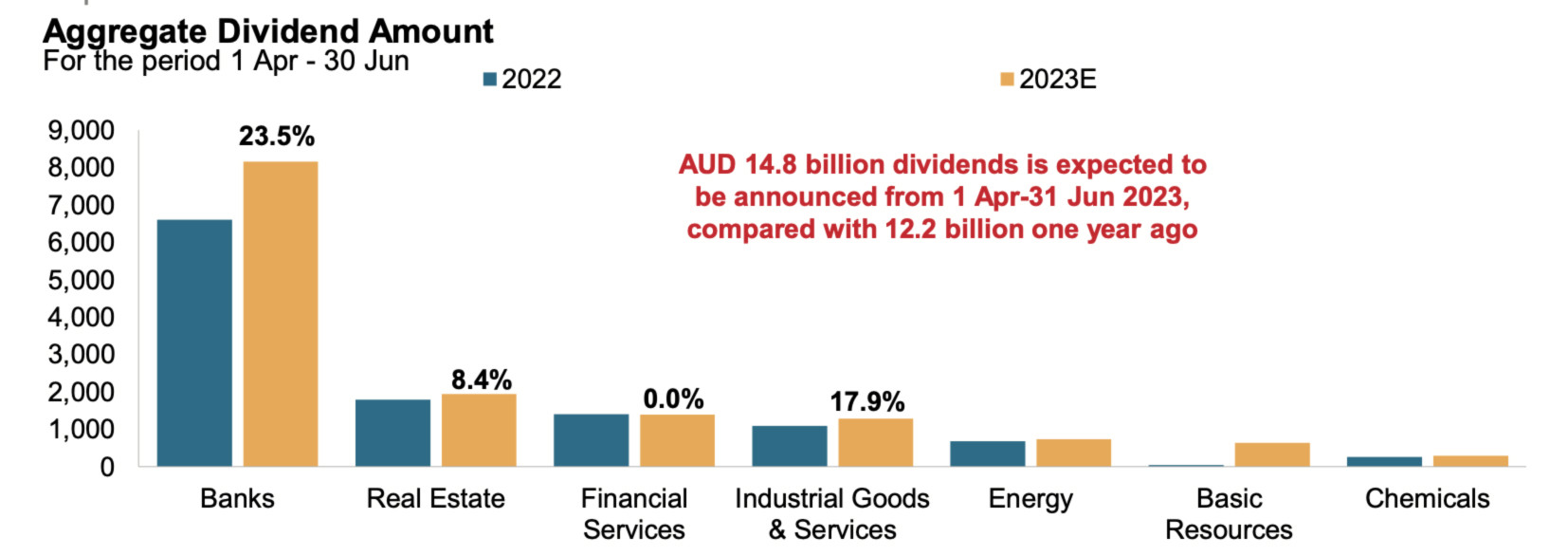

- Aggregate dividends from S&P ASX 200 companies forecast to rise 21.3% year on year for Q2 CY23

- Australian banks remain resilient with some of the Big 4 banks forecast to increase dividends

- Growth in dividends forecast for REITS with retail REITS seeing the biggest growth potential in Q2 CY23<

While global markets have been tumultuous this year with sticky inflation and interest rate rises there is some positive news for ASX dividend investors.

Aggregate dividends from S&P ASX 200 companies are forecast to increase by 21.3% year on year (yoy) to $14.8 billion for Q2 CY23, according to the S&P Global Market Intelligence April-June Dividend Outlook.

Banking and real estate invest trusts (REITs) are the biggest contributing sectors, with yoy growth rates of 23.5% and 8.4% respectively.

Resilient Aussie banking sector to increase dividends

The collapse of banks in the US and Swiss bank Credit Suisse recently elevated fears of another global financial crisis and put the Australian banking system under the microscope.

However, despite the banking turmoil happening in other regions, banks in Australia remain resilient, as attested to by the recent stress testing results by the Australia banking regulator, the Australian Prudential Regulation Authority (APRA).

S&P Global Market Intelligence said the big banks including National Australia Bank (ASX:NAB), Australia and New Zealand Banking Group (ASX:ANZ)andWestpac Banking Corporation (ASX:WBC), are expected to increase dividend payouts by 16.4%, 6% and 39.3% to 85 cents, 78.5 cents and 85 cents/share, respectively.

“Despite the external shocks, banks in Australia remain robust, attested by the results of the recent stress testing by the banking regulator,” the report said.

S&P Global Market Intelligence said bank dividends are expected to grow unevenly in the upcoming interim reporting season with NAB reporting a set of strong Q1 FY23 trading update, with cash earnings increased by 18% as compared with H2 FY22 quarterly average.

“This is primarily contributed by the margin tailwind,” the report said.

“WBC is expected to see a rebound in profit of around 43% from last year’s EPS of $1.48 to $2.12 this year.

“In contrary to the peers, WBC experienced a slight contraction of 6% in cash earnings last year owing to the $1.2 billion loss on sales of AU Life Insurance and less revenue contribution from business sold.”

Mild risks have been observed for dividends with an ex-date falling within upcoming April to June expiry with Dividend Points (DIPs) amounting to 47.6398 for the period April 1 – June 30, 2023.

Low amount confidence forecasts contribute only 1.8623 whereas low ex-date forecasts contribute only 0.64 of the total DIPs, representing merely 4% and 1% respectively.

“There is a huge portion of high ex-date confidence DIPs, as the banks typically guide the ex-date in advance,” S&P Global Market Intelligence said in its report.

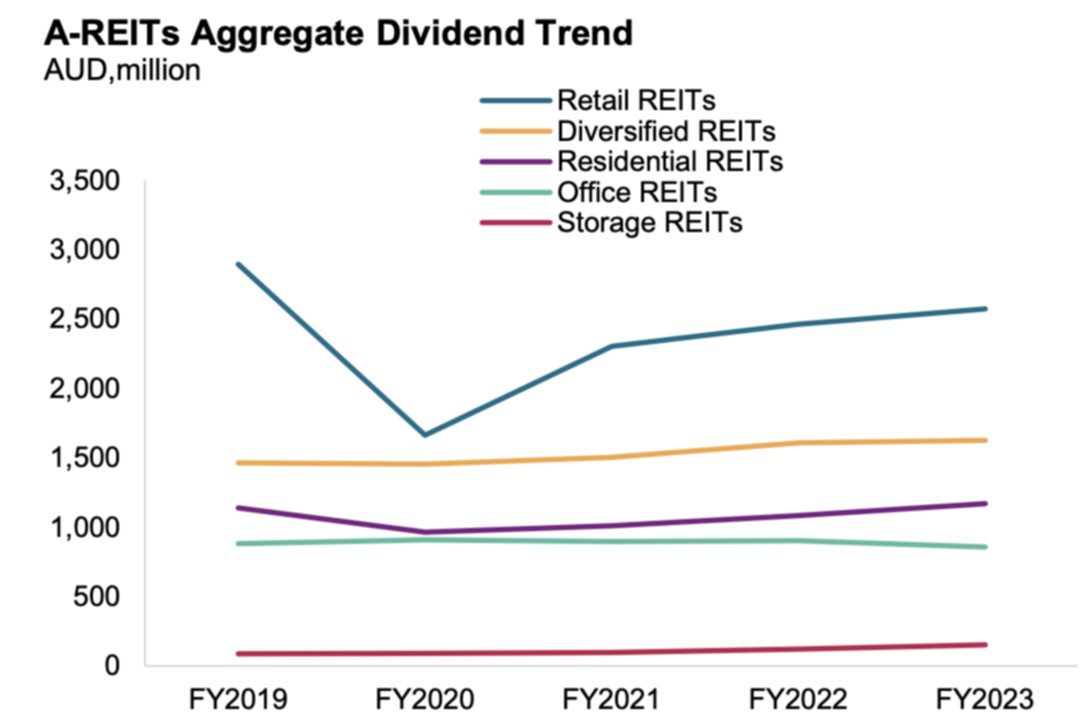

Steady growth in dividends forecast for REITs

With the well-structured debt profiles and proper short-term hedging against interest rate hikes, S&P Global Market Intelligence is forecasting steady growth in dividends from REITs, with retails REITs seeing the biggest growth potentials.

S&P Global Market Intelligence said current forecasts incorporate current clear guidance.

“Fundamentally, we also observed that majority of the REITs’ profile is well structured, with high portion (>50%) of the debt hedged against interest rate movement in short term,” the report said.

“This is likely to cushion the impacts of higher financing costs, and in turn to support the growth of distributions.”

Short-term dividend outlook for three index heavyweights positive

S&P Global Market Intelligence said after a record year in 2022, strong momentum continues for Macquarie Group (ASX:MQG), which saw its net profit for the nine months to December 31, 2022 slightly up on the same period one year ago.

The report said MQG’s commodities and global markets division, which buoyed the overall performances of the group in FY2022, continues to bank on the volatility in the energy market in recent quarter.

“With the positive outlook, we expect the company to pay $3.4/share, slightly lower than the record final dividend of $3.5 per share in May 2022.”

Toll roads operator Transurban (ASX:TCL) lifted its guidance for its FY23 full year dividend along with the FY23 interim results in February. Full-year dividend is guided between 53 to 57 cents/share.

In line with the guidance, S&P Global Market Intelligence expects TCL to declare a final dividend at 30.5/share in June and said outlook remains positive for the company.

“It posted a record Group EBITDA margin of 71.8%, the highest since pre-COVID19 underpinned by outperformance across all markets,” the report said.

“Apart from the recovery in the traffic volume, the company also benefited from the inflation-linked toll escalation of >6% in Sydney and Brisbane markets.”

S&P Global Market Intelligence expects building supplies company James Hardie (ASX: JHX) to resume dividend payments in the upcoming May to US 26 cents/share.

JHX suspended the FY23 interim dividend last year as the company experienced lower than expected sales and high input costs, squeezing its margin to 19.2%, significantly lower than the target of 30-33%.

Despite the suspension of cash dividend last year, the company continued to return to shareholders an amount of US$200 million.

Assuming the company is returning 40% of the operating income as per the latest shareholder return ratio, S&P Global Market Intelligence expects US26 cents/share of final dividend or equivalent size of share buyback (US$116 million) to be announced.

“Given the fluid situation, we flag a low confidence rank for the forecast,” the report said.

The MQG, TCL & JHX share price today:

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.