FREE WHELAN: It’s October and, statistically speaking, we should be able to hold on

Via Getty

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine money manager.

Returned from the Disaster Recovery site in Gippsland and whilst it was great to get rested and read some big picture ideas (and work on a big upgrade to our bond offering) I had this little reminder of 2019 on the last day.

This is the view from the place on Sunday:

A few grass fires and the sky turns a little scary. Expect more of this over the next few years.

Podcast was another beauty – the link is here.

Speaking of a little scary…

The end of the month of September and we see the end (?) of weekly declines in the S&P 500. Four in a row to be specific, which is the longest losing streak since December last year.

At the same time the USD has appreciated enough vs the AUD to soften that blow somewhat for holders of US equities on an unhedged basis so there’s that.

Broadly speaking the S&P 500 is off just over 5% for the month to October 1 and the AUD is off about 1.5% depending on how closely you squint at the chart.

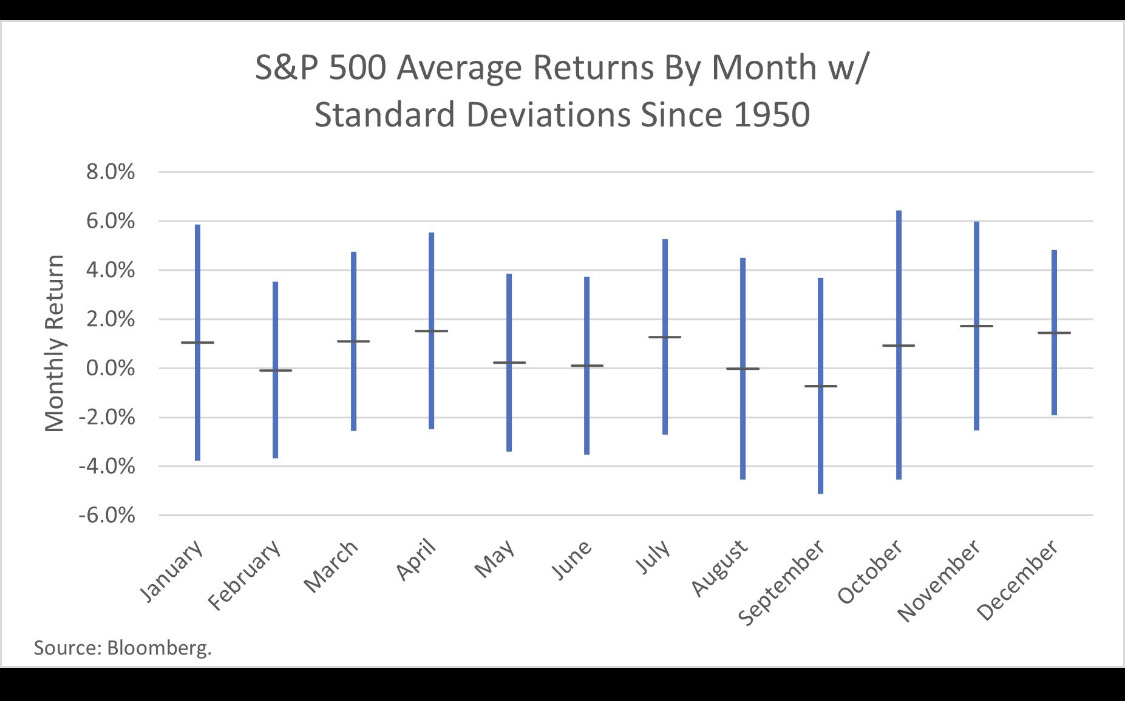

In more good news we now pull into sunny October and the statistical difference in the monthly averages tells a story we have felt time and again.

October puts us back into the statistically more possible positive column and sets the tone for the road home rally.

All we need is for US reporting to do its job as usual. All eyes on the second full week of October for that to get properly underway.

Issue is if companies report well and have bullish outlooks then that will add fuel to the stronger than expected US growth fire.

Fuel on that fire continues the “higher for longer” rates story that the Fed has been trying to get people to pay attention to and ironically it’s good news being bad news for markets again until something breaks.

This did the rounds this morning and tells quite a story:

Don’t forget that, as said by Jay Powell last year, it’s easier for them to fix something that breaks in doing this than it is to perpetuate the low rate calamity that has sustained us since the GFC.

There are three main theories as to why the spike in yields, covered this week by the FT.

Here’s a chart of the 10-year yield, the fed funds rate, and 10-year break-even inflation (the 10-year yield minus the 10-year inflation indexed yield) since early 2020.

The theories as to what’s happening are:

- Higher for longer Fed policy expectations

- Higher growth expectations

- Higher term premium

The jury is out (according to them) as to which one is the real reason so please aggressively question anyone who convincingly tells you the actual reason for what’s going on.

Let the facts speak…

…and act accordingly

Maybe there’s a grass fire out west but for now the best you can do is be aware of it and take photos while you review your plan. (See first photo above)

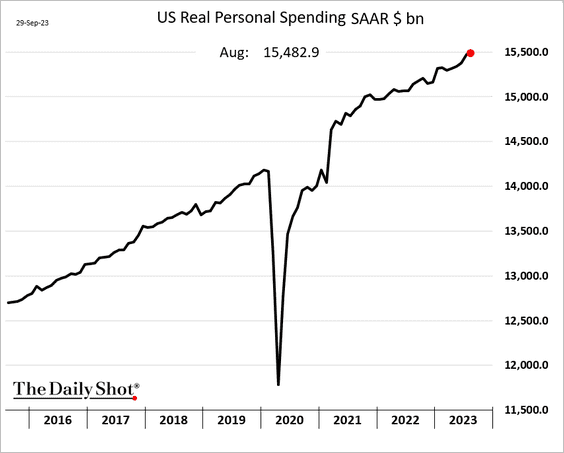

Despite all this the US consumer hates to listen with real consumer spending continuing upwards in August…

(Note the US consumer is ~60% of US GDP so ~15% globally. Their problem is our problem.)

Megatech

In better news we continue to bang the drum on the Megatech and I can’t repeat enough how good the opportunities will be to buy big stocks on big dips.

(Remember the thesis is that the biggest tech companies are so cashed up and have such strong stock prices that moves in rates don’t affect them in the way the text books say they should. Advances in AI only benefit them as well with regards to productivity and weathering any harder than expected landing.)

Conviction Long

We took a long position in Nvidia on said weakness and just overnight have been unofficially endorsed by Goldman Sachs adding the stock to its conviction list with a 39% upside to 12-month price target.

We continue to see this as a good long-term hold for the appropriate portfolios.

Finally…

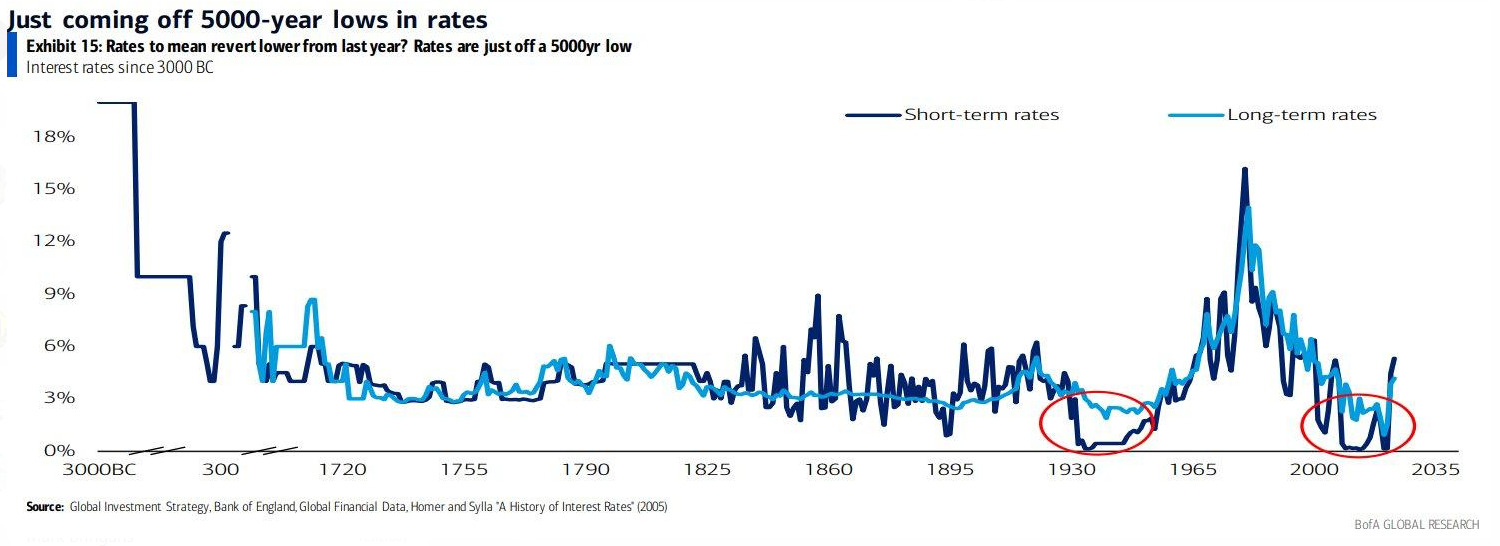

Two things to close, for those wondering where rates sit on the whole history of civilisation there’s this from BofA showing that, yes, over a long enough time frame, this is somewhat of a “thing”.

I’m thinking of builders in New Testament times getting on with it in a 7% rate environment. Apparently, those numbers now cripple everything in sight.

Lastly…

Here’s an update on how things are going in the US/China relationship:

We’ve reached the “China is taking the pandas back from US zoos” stage in the cycle.

All the best and stay safe,

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.