ASX November winners: The best 50 stocks as cooling inflation gives markets a little reprieve

News

News

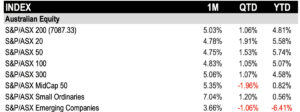

After a rough few months for the Aussie bourse, there were signs the storm was starting to ease in November. The benchmark S&P ASX 200 lifted 5% in November, while small and mids caps rose even higher, with S&P ASX small ordinaries up 7% and the S&P ASX MidCap 50 up 5.35%.

The S&P ASX Mid-Cap 50 and he S&P ASX Small Ordinaries are now back in the green for 2023. However, the S&P ASX Emerging Companies index is still down more than 6% for the year, according to S&P Dow Jones Indices.

After a rough 2023, it seemed the Aussie bourse and global markets finally caught a break in November.

There was still continued war in Ukraine and conflict between Israel and Hamas in November but there were also signs macro uncertainties were abating leading to the S&P ASX 200 VIX falling to 9.67, its lowest level since June 2018.

Bloomberg reported the S&P 500 had one of its biggest November rallies on record, while November saw the MSCI All Country World Index rise by 9.1%, marking its biggest rise since the same month two years ago and the third largest monthly upsurge in the past decade.

The Australian equity rally was helped along in November by latest CPI figures showing that the monthly inflation rate fell to 4.9% from 5.6% in October, beating expectations.

With 13 hikes in 18 months, the official cash rate is now at 4.35%, the highest it has been in 12 years as the central bank moved to bring down sticky inflation to its target 2-3%.

But in a sign inflation may finally be falling, there is speculation (optimism too) the central bank’s rate-hike cycle has peaked.

The US Federal Reserve is also taking a more dovish tone on the back of some promising data. The US core personal consumption expenditures (PCE) price index, a key measure used by the Fed to evaluate underlying inflation, has fallen, suggesting a reduction in price pressures.

Additionally, evidence from both the labor market and consumer spending indicates a gradual slowdown in growth, which could further influence the Fed’s decision to keep hiking rates at the cost of economic growth.

Red Leaf Securities CEO John Athanasiou told Stockhead now that inflation is starting to cool off, the S&P ASX small ordinaries index has outperformed other sectors.

“We anticipate that this trend will continue as inflation eases in 2024,” he says.

“Best options are in the small cap tech sector, they have a lot of catching up to do compared to their larger peers.

“The information technology sector is up 22% YTD but that’s the bigger end of town.”

The S&P/ASX 200 health care and real estate sectors had the sharpest turnarounds, both rising more than 10% in November.

As oil prices fell, energy was the worst performer, while defensive sectors including Utilities and Consumer Staples were also in the red.

All equity factor indices were in positive territory in November, with the S&P ASX 200 equal weight rising the most in line with the small cap outperformance.

While still in positive territory the thematically-targeted S&P ASX infrastructure and S&P ASX 200 Resources indices also trailed the otherwise-soaring equity markets with gains under 2%.

Fixed income indices in Australia were also back in positive territory in November after being down in September and October. Government bonds were just ahead of corporates.

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | NOVEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| CPM | Cooper Metals | 0.435 | 263% | $16,183,869 |

| TG1 | Techgen Metals Ltd | 0.085 | 204% | $8,458,392 |

| SHN | Sunshine Metals Ltd | 0.036 | 177% | $45,288,312 |

| GHY | Gold Hydrogen | 0.7 | 169% | $42,976,882 |

| IMU | Imugene Limited | 0.11 | 168% | $752,322,360 |

| WML | Woomera Mining Ltd | 0.024 | 167% | $31,036,058 |

| AZL | Arizona Lithium Ltd | 0.04 | 167% | $127,091,547 |

| LBT | LBT Innovations | 0.013 | 160% | $20,806,206 |

| TSL | Titanium Sands Ltd | 0.015 | 150% | $24,805,266 |

| CC9 | Chariot Corporation | 0.62 | 143% | $47,665,519 |

| TG6 | TG metals | 0.825 | 139% | $36,627,469 |

| EXL | Elixinol Wellness | 0.014 | 133% | $8,227,331 |

| TZN | Terramin Australia | 0.056 | 124% | $59,263,756 |

| TCG | Turaco Gold Limited | 0.11 | 120% | $61,664,000 |

| NFL | Norfolk Metals | 0.38 | 117% | $15,719,623 |

| KGD | Kula Gold Limited | 0.029 | 115% | $13,839,070 |

| XGL | Xamble Group Limited | 0.061 | 110% | $18,030,674 |

| NIS | Nickelsearch | 0.11 | 108% | $23,190,296 |

| FL1 | First Lithium Ltd | 0.62 | 107% | $47,635,134 |

| 4DX | 4Dmedical Limited | 0.955 | 103% | $344,847,103 |

| NSM | Northstaw | 0.073 | 103% | $8,769,271 |

| CLE | Cyclone Metals | 0.002 | 100% | $15,396,757 |

| KTA | Krakatoa Resources | 0.044 | 100% | $19,135,508 |

| RWD | Reward Minerals Ltd | 0.08 | 100% | $18,228,251 |

| CPV | Clearvue Technologie | 0.645 | 95% | $132,832,619 |

| PRS | Prospech Limited | 0.041 | 95% | $8,570,639 |

| BML | Boab Metals Ltd | 0.16 | 95% | $26,169,416 |

| IDT | IDT Australia Ltd | 0.11 | 93% | $36,905,344 |

| MKL | Mighty Kingdom Ltd | 0.0185 | 85% | $7,146,283 |

| STK | Strickland Metals | 0.185 | 85% | $293,175,022 |

| PLT | Plenti Group Limited | 0.605 | 75% | $105,017,699 |

| KNM | Kneomedia Limited | 0.0035 | 75% | $4,599,814 |

| OBM | Ora Banda Mining Ltd | 0.235 | 74% | $409,582,769 |

| CCO | The Calmer Co Int | 0.006 | 71% | $4,902,716 |

| MHK | Metalhawk | 0.17 | 70% | $14,440,600 |

| AMM | Armada Metals | 0.044 | 69% | $7,247,859 |

| DCL | Domacom Limited | 0.022 | 69% | $9,581,039 |

| PLG | Pearl Gull Iiron | 0.044 | 69% | $6,545,337 |

| BLU | Blue Energy Limited | 0.022 | 69% | $40,721,419 |

| AUE | Aurum resources | 0.185 | 68% | $6,570,000 |

| FND | Findi Limited | 1.09 | 67% | $43,308,869 |

| EQN | Equinox Resources | 0.3 | 67% | $31,992,501 |

| WSP | Whispir Limited | 0.49 | 66% | $65,545,932 |

| FRE | Firebrick Pharma | 0.061 | 65% | $6,697,338 |

| ARE | Argonaut Resources | 0.105 | 64% | $15,272,430 |

| OPT | Opthea Limited | 0.525 | 64% | $278,379,626 |

| FME | Future Metals NL | 0.059 | 64% | $23,845,418 |

| OZZ | OZZ Resources | 0.09 | 64% | $8,327,711 |

| YRL | Yandal Resources | 0.089 | 62% | $16,723,611 |

| WYX | Western Yilgarn NL | 0.11 | 59% | $5,214,038 |

Copper and gold hunter Cooper Metals (ASX:CPM) was up after confirming a high-grade copper discovery at its Brumby Ridge copper-gold prospect at the Mt Isa East project in northwest Queensland.

Results of drilling included 71m at 2.8% copper including 24m at 5.4% copper.

“This new result builds on the initial RC drill hole 23MERC024, which intercepted 50m at 1.32% Cu and 0.05g/t Au from 80m including 2m @ 6.1% Cu & 0.23g/t Au,” CMP says.

Sunshine Metals (ASX:SHN) rose with as Rob Badman best described “the microcap gold’n’copper-chasing Queenslander basking in recent warmth from a thick, high-grade gold hit out at its Liontown prospect at the Ravenswood West project, about 130km south of Townsville in northern Queensland”.

SHN intersected 17m at 22.14g/t gold with company believing it may have struck paydirt in a gold and copper rich feeder zone to the 2.3Mt zinc-gold-copper-lead-silver VMS resource at the Liontown deposit.

In the rebounding health sector Imugene (ASX:IMU) rocketed higher after announcing its novel cancer-killing virus, CF33-hNIS (VAXINIA), was granted fast track designation by the US FDA.

The designation was granted based on the promising data from IMU’s Phase 1 MAST trial where low doses of VAXINIA were administered to patients suffering with bile duct cancer.

And a 2023 IPO Gold Hydrogen (ASX:GHY) was also up in November. GHY holds the Ramsay project in South Australia’s Gawler craton and is already seeing some early success.

As Stockhead’s Emma Davies reported, its first well, Ramsay-1, was drilled to a depth of 1,005m on time and on budget.

Significant concentrations of natural hydrogen and helium confirmed historical measurements and demonstrated that an active system is present in the Ramsay project area.

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | NOVEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| NPMDA | Newpeak Metals | 0.028 | -72% | $9,995,579 |

| TMR | Tempus Resources | 0.006 | -67% | $2,057,537 |

| JAY | Jayride Group | 0.03 | -64% | $7,032,274 |

| REM | Remsense Technologies | 0.019 | -58% | $2,007,983 |

| 8VI | 8Vi Holdings Limited | 0.055 | -54% | $2,514,685 |

| BOD | BOD Science Ltd | 0.024 | -52% | $4,256,124 |

| MMM | Marley Spoon SE | 0.034 | -51% | $3,649,456 |

| ADS | Adslot Ltd | 0.002 | -50% | $9,673,487 |

| AMD | Arrow Minerals | 0.001 | -50% | $4,535,648 |

| ATH | Alterity Therapeutics | 0.0035 | -50% | $11,209,442 |

| ME1 | Melodiol Global Health | 0.002 | -50% | $8,865,840 |

| RR1 | Reach Resources Ltd | 0.006 | -50% | $17,656,634 |

| AQX | Alice Queen Ltd | 0.006 | -50% | $1,018,444 |

| 3DP | Pointerra Limited | 0.047 | -49% | $34,978,924 |

| GMR | Golden Rim Resources | 0.011 | -48% | $6,507,472 |

| EWC | Energy World Corporation | 0.015 | -46% | $61,578,425 |

| AL8 | Alderan Resource Ltd | 0.0065 | -46% | $6,641,168 |

| ICG | Inca Minerals Ltd | 0.011 | -45% | $7,013,226 |

| MKG | Mako Gold | 0.009 | -44% | $6,624,094 |

| NGY | Nuenergy Gas Ltd | 0.018 | -44% | $29,619,110 |

| NC6 | Nanollose Limited | 0.022 | -44% | $3,495,500 |

| PEC | Perpetual Resources | 0.012 | -43% | $9,450,441 |

| MPK | Many Peaks Minerals | 0.15 | -42% | $5,456,172 |

| HMD | Heramed Limited | 0.037 | -40% | $10,342,025 |

| WIN | Widgie Nickel | 0.11 | -39% | $40,222,582 |

| MXC | MGC Pharmaceuticals | 0.62 | -38% | $24,269,886 |

| 4DS | 4DS Memory Limited | 0.075 | -38% | $183,601,416 |

| SRX | Sierra Rutile | 0.11 | -37% | $44,544,827 |

| RNE | Renu Energy Ltd | 0.013 | -37% | $5,369,869 |

| CSS | Clean Seas Ltd | 0.265 | -37% | $45,509,616 |

| ACM | Aus Critical Mineral | 0.18 | -37% | $5,351,625 |

| VR1 | Vection Technologies | 0.024 | -37% | $27,038,135 |

| SRN | Surefire Rescs NL | 0.0095 | -37% | $17,449,154 |

| FLC | Fluence Corporation | 0.083 | -36% | $78,767,571 |

| TGH | Terragen | 0.018 | -36% | $6,643,460 |

| LM1 | Leeuwin Metals Ltd | 0.19 | -36% | $8,509,150 |

| PAR | Paradigm Bio. | 0.39 | -35% | $138,601,224 |

| MCL | Mighty Craft Ltd | 0.015 | -35% | $5,831,080 |

| NMT | Neometals Ltd | 0.2 | -35% | $121,236,442 |

| AXP | AXP Energy Ltd | 0.001 | -33% | $5,824,681 |

| AYM | Australia United Min | 0.002 | -33% | $3,685,155 |

| EMU | EMU NL | 0.001 | -33% | $1,667,521 |

| FRX | Flexiroam Limited | 0.022 | -33% | $13,212,144 |

| GBZ | GBM Rsources Ltd | 0.012 | -33% | $7,443,862 |

| IAM | Income Asset | 0.08 | -33% | $25,573,663 |

| LML | Lincoln Minerals | 0.006 | -33% | $10,163,072 |

| MHC | Manhattan Corp Ltd | 0.004 | -33% | $11,747,919 |

| NZS | New Zealand Coastal | 0.002 | -33% | $2,500,515 |

| RCL | Readcloud | 0.038 | -33% | $6,140,589 |

| RML | Resolution Minerals | 0.004 | -33% | $5,029,167 |

Tempus Resources (ASX:TMR) fell after announcing it will not acquire Aurora Lithium, a private company which owns the Cormorant and White Rabbit projects in central Manitoba, Canada. The company terminated a heads of agreement after completion of due diligence.

TMR also announced in November plans to undertake a an underwritten non-renounceable entitlement offer at $0.005/share to raise ~$1.714 million to evaluate potential new acquisitions and realise value from the Blackdome-Elizabeth assets.