ASX Small Caps Lunch Wrap: Who’s been busted stealing a massive quantity of dong this week?

Picture: Getty Images

It certainly feels like it’s Friday today, and it looks like the ASX is operating with about the same level of enthusiasm and energy as I am, opening its eyes at 10:00am and wilting almost instantly like a near-comatose, ignominiously saggy bag of unwilling meat and gristle.

But – the gods be praised – the market’s doing better than I am, because it’s managed to rally a bit, while I’m sitting here in my pjyamas, with only one shoe on, because that’s as far into “put on clothes and go get a coffee” that I managed to get.

There’s obviously more to say about the ASX in this, and I’ll get to it in a minute. But first, there’s news out of Vietnam that is utterly bonkers, which I feel compelled to share with you.

Yesterday, 67-year-old Vietnamese property developer Truong My Lan was sentenced to death over one of the most enormous fraud cases the world has ever seen.

Prosecutors say Truong My Lan systematically looted the Saigon Commercial Bank – one of the largest in the country – to the tune of at least 304 trillion dong.

That’s a whole lotta dong – and that’s the lower end of the reported sum, as reported by CNN. The BBC says Truong My Lan’s power to amass dong netted US$44 billion, which is about 1,099,120,000,000,000 dong, which is too much dong to even comprehend.

To put that in perspective, if you laid 1.1 quadrillion dong end to end, you’d be… bloody sore.

Truong My Lan’s story is a literal rags to riches tale – she started off selling cosmetics at a market stall with her mother in Ho Chi Minh City, but somehow managed to parlay the meagre profits you’d expect from that sort of enterprise into a small, but juicy, property portfolio.

She began to amass that portfolio in the wake of a sudden policy lurch by Vietnam’s famously very, very communist government, when it started pushing an economic reform package in 1986.

The government called it “Doi Moi” – and by the looks of things, other Vietnamese business people called it “Christmas Every Day For The Next 40 Years”.

Truong My Lan spent decades working with small banks, obtaining government permission to merge many little ones into one larger entity, operating under the strict government rules that stated no one person or company could own more than 5.0% of a bank.

She circumvented that rule by setting up hundreds of shell companies run by proxies on her behalf, buying up chunks of the bank until she controlled an estimated 90% stake.

And here’s where things get crazy. Over the course of 11 years, she directed those small shell companies to apply for billions of dollars worth of loans, forced the bank managers she had installed to approve the loans, and bribed – very generously – a number of people to look the other way while it happened.

The rest of the money was sunk into her other, public-facing company, the Van Thinh Phat group, buying up high-end property – luxury hotels and whatnot – with the loans to her shell companies making up 93% of the bank’s lending over the decade.

When the hammer dropped, 84 people were found guilty in one of the largest embezzlement prosecutions in the world, with sentences ranging from three years’ probation, through to life in jail – and, of course, death by lethal injection for Truong My Lan.

TO MARKETS

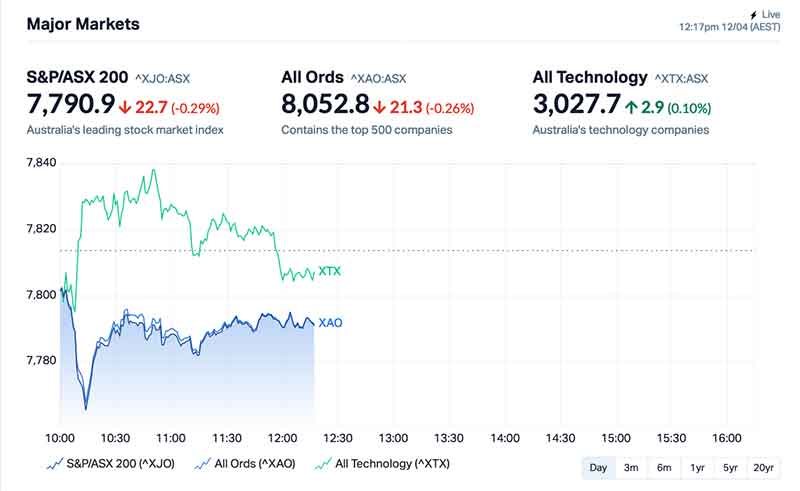

So… things aren’t ideal for the benchmark on Friday morning, after a mixed session on Wall Street evidently left people confused as to which way we’re supposed to be jumping today.

The market opened with a sharp drop, but a rally from Tech stocks helped sweeten the atmosphere for a while before lunch, but even that looked like it had gassed out by 12:30pm.

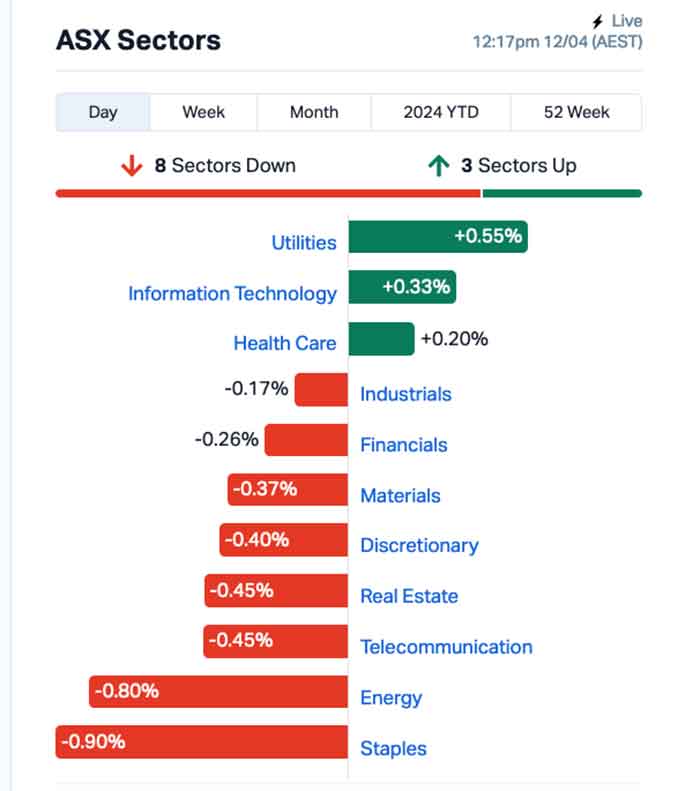

That left the Utilities sector out in front for the morning – but that’s up a miserly 0.55% just before lunch, and almost entirely due to meagre +0.9% to +1.3% rises from Origin Energy (ASX:ORG), Meridian (ASX:MEZ), AGL Energy (ASX:AGL) and Contact Energy (ASX:CEN).

Everything else is looking a little dire… and here’s a picture.

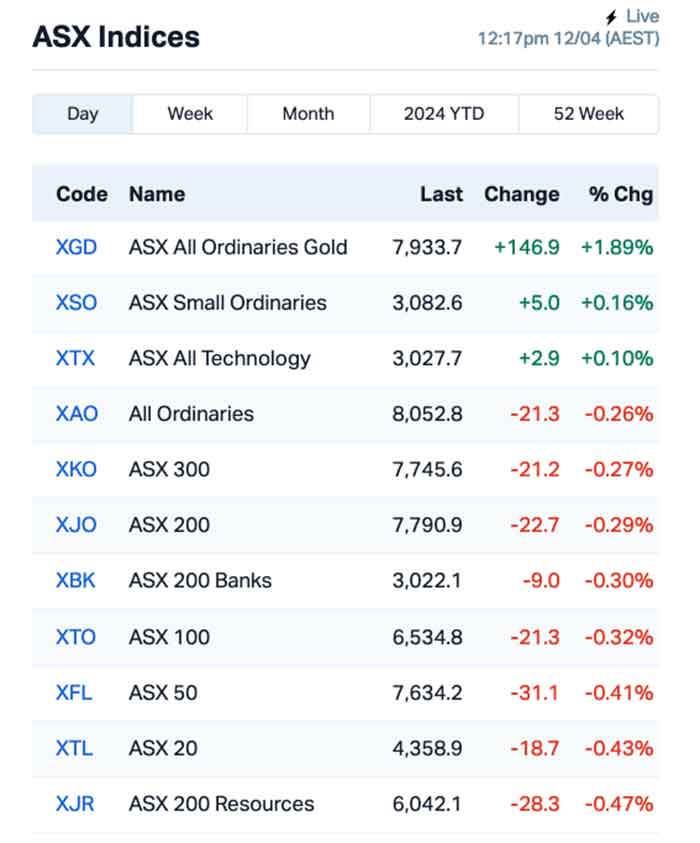

That market weakness, and the fact that the gold price rebounded by +1.6% to US$2,373.59 an ounce overnight, has pushed the goldies higher again this morning, outpacing the broader market on around +1.9%.

The ASX Small Ords and the XTX All Tech indices are also in positive territory, but it’s by the barest of margins as traction seems hard to find.

There’s a bit happening in the world of Big Bizness, most notably cement maker Boral’s (ASX:BLD) board indicating that it’s prepared to back a takeover from its largest shareholder, the Stokes family’s Seven Group Holdings (ASX:SVW), after the latter lifted its offer from $1.50 to $1.70 per share.

An uncharitable view of that deal would suggest that it’s a timely purchase, because it’s unlikely that Seven presently has enough cement on hand to sink its current, deeply sordid scandals deep beneath the waves off Bondi Beach.

But only a completely heartless, world-weary and cynical bastard would draw a link to the deal like that. So I won’t.

NOT THE ASX

In the US overnight, Wall Street got up to its now-normal shenanigans, plodding along like a tired old donkey until a late surge saw two of the three major indices rise up, while the Dow snoozed on, like the scrofulous old goat that it is.

The S&P 500 rose by +0.74% , the blue chips Dow Jones index was flat, and the tech-heavy Nasdaq surged by +1.68%.

The rebound was led by Big Tech stocks in the run up to quarterly earnings season, with Apple and Nvida both up more than 4%, Earlybird Eddy Sunarto reported this morning.

The other five members of the Magnificent Seven – Alphabet, Amazon, Google, Meta, Microsoft, and Tesla – also rose, while Amazon closed at a record high.

The rally came despite two US Fed officials – Fed Reserve Bank of Boston president Susan Collins and New York Fed president John Williams – speaking publicly about “the need for patience” in relation to rate cuts in the States.

There was some fantastic interest rate news from Argentina overnight, where the central bank has cut interest rates by 0.10%, taking the cash rate there to a far more reasonable 70.0%, and providing analysts with a much needed indication that literally everything in Argentina is sinking into The Bog of Eternal Stench.

Asian markets are mixed this morning, with Shanghai flat and Hong Kong down -1.46%.

Japan’s Nikkei is up 0.51% this morning, despite the sad news that former sumo wrestler Akebono, the first foreign-born yokozuna who hailed from Hawaii, has died of heart failure at the age of 54.

Local media is reporting that a private funeral will be held for the sumo legend, with up to 900 pall-bearers being flown in from around the world. Allegedly.

While we’re on the topic of dead sporting legends, former Buffalo Bills running back and 100% also a murderer OJ Simpson died last night… I just thought you should know.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 12 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

CODE COMPANY PRICE % TODAY VOLUME MARKET CAP NPM Newpeak Metals 0.031 182% 16,863,810 $1,099,469 CNJ Conico Ltd 0.0015 50% 998,365 $1,805,095 RMX Red Mount Min Ltd 0.0015 50% 345,454 $2,673,576 SIX Sprintex Ltd 0.025 39% 4,574,761 $8,578,455 JAV Javelin Minerals Ltd 0.002 33% 565,847 $3,264,346 BVR Bellavistaresources 0.145 32% 441,679 $5,457,207 FHS Freehill Mining Ltd. 0.009 29% 5,013,651 $20,970,911 CMO Cosmometalslimited 0.055 28% 483,085 $5,434,961 AMD Arrow Minerals 0.005 25% 4,563,314 $37,918,825 AVE Avecho Biotech Ltd 0.005 25% 338,694 $12,677,188 CTO Citigold Corp Ltd 0.005 25% 3,628,851 $12,000,000 XPN Xpon Technologies 0.02 25% 131,193 $4,857,731 BMG BMG Resources Ltd 0.017 21% 2,470,752 $8,873,160 SVG Savannah Goldfields 0.03 20% 468,119 $7,027,123 88E 88 Energy Ltd 0.006 20% 47,252,073 $125,620,313 BFC Beston Global Ltd 0.006 20% 1,453,588 $9,985,234 ESR Estrella Res Ltd 0.006 20% 1,030,000 $8,796,859 NTM Nt Minerals Limited 0.006 20% 100,674 $4,299,515 TAS Tasman Resources Ltd 0.006 20% 244,145 $3,563,346 PLN Pioneer Lithium 0.19 19% 72,267 $4,548,000 CY5 Cygnus Metals Ltd 0.075 17% 2,422,211 $18,659,785 E79 E79Goldmineslimited 0.035 17% 230,722 $2,440,022 TTM Titan Minerals 0.035 17% 4,652,113 $54,280,410 MKL Mighty Kingdom Ltd 0.0035 17% 500,000 $1,983,800 TMK TMK Energy Limited 0.0035 17% 310,000 $20,267,144

Friday morning saw Yet Another Materials minnow hitting triple digit gains, this time being NewPeak Metals’ (ASX:NPM) turn to mash the loud pedal. The company announced that it had finalised the sale of its share in a Finland gold project to a soon-to-be-listed Canadian company, and will receive CAD$500,000 cash, CAD$1m in shares of the listed company, and a milestone payment of CAD$1.5m in cash or shares on reporting of a 500,000oz gold resource.

Early morning, Newpeak was up +246%, but that eased as the morning wore on, leaving it around +145% at lunchtime.

Estrella Resources (ASX:ESR) was also on the move, after announcing it had uncovered a manganese host rock over 27km of strike at the Lautém project in Timor-Leste.

The company says that it has managed to secure a site in the city of Dili for its team to work with the samples that are being collected in the field, in a small office that has a sample preparation area established.

Elsewhere, Defence manufacturer HighCom (ASX:HCL) received a new order of ballistic products from “a military customer”, worth A$4.7 million.

As Reuben pointed out this morning, that’s good news for HCL, after it suffered a $13.4m loss in the December half “mainly due to the company not securing several large international orders in the Middle East”.

LOSERS

| CODE | COMPANY | PRICE | % TODAY | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| NPM | Newpeak Metals | 0.031 | 182% | 16,863,810 | $1,099,469 |

| CNJ | Conico Ltd | 0.0015 | 50% | 998,365 | $1,805,095 |

| RMX | Red Mount Min Ltd | 0.0015 | 50% | 345,454 | $2,673,576 |

| SIX | Sprintex Ltd | 0.025 | 39% | 4,574,761 | $8,578,455 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 565,847 | $3,264,346 |

| BVR | Bellavistaresources | 0.145 | 32% | 441,679 | $5,457,207 |

| FHS | Freehill Mining Ltd. | 0.009 | 29% | 5,013,651 | $20,970,911 |

| CMO | Cosmometalslimited | 0.055 | 28% | 483,085 | $5,434,961 |

| AMD | Arrow Minerals | 0.005 | 25% | 4,563,314 | $37,918,825 |

| AVE | Avecho Biotech Ltd | 0.005 | 25% | 338,694 | $12,677,188 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 3,628,851 | $12,000,000 |

| XPN | Xpon Technologies | 0.02 | 25% | 131,193 | $4,857,731 |

| BMG | BMG Resources Ltd | 0.017 | 21% | 2,470,752 | $8,873,160 |

| SVG | Savannah Goldfields | 0.03 | 20% | 468,119 | $7,027,123 |

| 88E | 88 Energy Ltd | 0.006 | 20% | 47,252,073 | $125,620,313 |

| BFC | Beston Global Ltd | 0.006 | 20% | 1,453,588 | $9,985,234 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 1,030,000 | $8,796,859 |

| NTM | Nt Minerals Limited | 0.006 | 20% | 100,674 | $4,299,515 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | 244,145 | $3,563,346 |

| PLN | Pioneer Lithium | 0.19 | 19% | 72,267 | $4,548,000 |

| CY5 | Cygnus Metals Ltd | 0.075 | 17% | 2,422,211 | $18,659,785 |

| E79 | E79Goldmineslimited | 0.035 | 17% | 230,722 | $2,440,022 |

| TTM | Titan Minerals | 0.035 | 17% | 4,652,113 | $54,280,410 |

| MKL | Mighty Kingdom Ltd | 0.0035 | 17% | 500,000 | $1,983,800 |

| TMK | TMK Energy Limited | 0.0035 | 17% | 310,000 | $20,267,144 |

ICYMI – AM EDITION

You haven’t missed a thing, apparently.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.