CleanTechs scrub up 40pc better than the ASX200 as sector matures

Tech

Tech

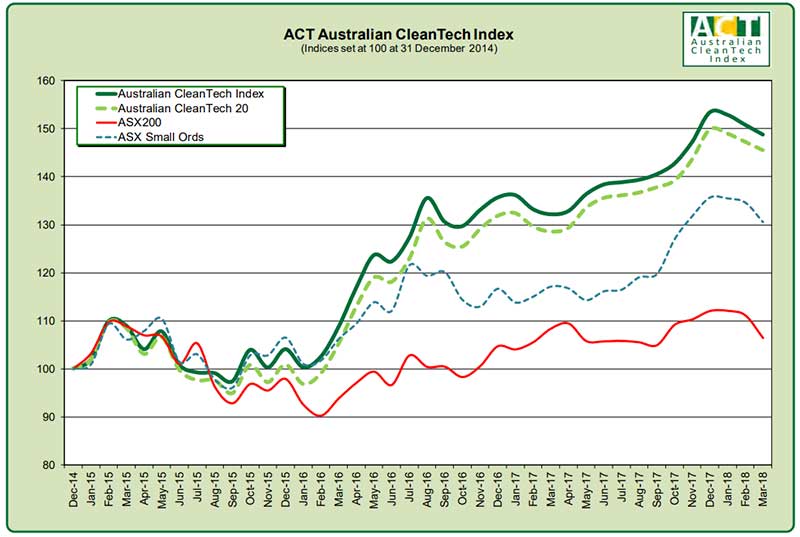

ASX-listed CleanTech stocks have outperformed ASX200 stocks by a margin of 40 per cent over three years according to advisory Australian CleanTech.

The group maintains an index of 86 ASX stocks that derive more than half their revenue from output that “positively enhances the communities and ecologies in which they reside”.

The index specialises in “economically viable products, services and processes that harness renewable materials and energy sources, dramatically reduce the use of natural resources and cut or eliminate emissions and wastes”.

That includes everything from biofuels to green buildings, land remediation and water treatment.

“Over the last 12 months, the Australian CleanTech Index recorded a gain of 12.6 per cent — 14.4 per cent ahead of the ASX200,” the group reported on Tuesday.

“Over the last three years, the Australian CleanTech Index leads the ASX200 by nearly 40 per cent.”

The index of 86 stocks fell 3 per cent for the March quarter, while the ASX200 was down 5 per cent and the ASX Small Ords was 3.8 per cent lower.

Performance over the March quarter was driven by 7 companies with gains of more than 15 per cent – including small-cap stars Australian Vanadium (ASX:AVL), Quantum Energy (ASX:QTM) and Cobalt Blue (ASX:COB).

But while the battery metal contingent contained some of the biggest movers in the period, it was water stocks that performed best.

An index of water stocks finished the quarter up 7.5 per cent, as the only gainer for the period as the thematic increasingly gains traction with investors.

Water stocks include the likes of Phoslock (ASX:PHK) which has seen a 300 per cent increase in the past 12 months.

Water was well ahead of the renewable energy index at -1.3 per cent and Waste Index at -3.8.

Sustainable minerals finished in fourth place at -13.1 per cent with efficiency and energy storage bringing up the rear at -16.3 per cent.

“We have had a few false starts but in the past couple of years mainstream industry and the wider community have realised that companies in the space offer good technologies that can save money as well as having an environmental benefit,” Australian CleanTech managing director John O’Brien told Stockhead.

“Looking back there were only 60 stocks a few years ago and now there are 86 – the sector is becoming more mature and hosts profitable companies that have passed the purely speculatively phase.”

Four companies were added to the index in the latest report, BlackEarth Minerals (ASX:BEM), Carbonxt (ASX:CG1), Pearl Global (ASX:PG1) and Simble Solutions (ASX:SIS).

That brings the total market capitalisation of the index to $41.1 billion – up from $6 billion when the index was first compiled back in 2007.

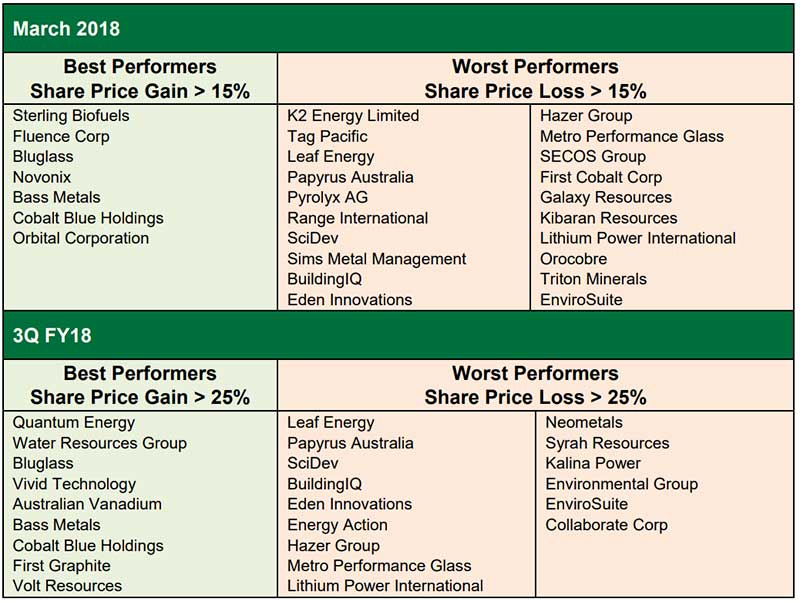

Here is a list of the best and worst performing CleanTech stocks in the March quarter, according Australian CleanTech: