ASX Tech Wrap: Nvidia and 4DS steal the show

Tech

The tech-heavy Nasdaq was sold off heavily (-1.9%) during the Thursday session in New York after providing the local IT Sector with some adventurous swings in a crikey-look-out-dynamo of a week for all involved.

The sugary-highs provided by Nvidia’s (NVDA) shiny new quarterly masterpiece wore off pretty quickly and US traders looked pretty sober last night, even as NVDA briefly touched fresh record highs, before retreating into a hole, down -0.1%.

And it could well be the market is becoming increasingly strung out by the annual gathering of the world’s top central bankers in Jackson Hole, Wyoming, where Jerome Powell will spill fresh beans on monetary policy in a keynote on Friday morning, Wyoming time.

The ASX Tech Sector meanwhile, was itself a red mess late on Friday, having alternated between hero and villain all bloody week.

Some of the bugger names in local tech copped it big time.

WiseTech (ASX:WTC) shares crashed midweek (-19%), tearing a near $2bn hole in billionaire boss Richard White’s bank account.

WiseTech did a lot right on the big day – reaping a swag of logistics segment revenue, lifting its dividend payout and delivering a net profit over $212m, up almost 10%.

But for once this earnings season, playing smart with the forward guidance cost someone big time.

The stock fell hard on weak earnings guidance, despite the pretty decent target of pulling more than a billion dollar-bucks in sales revenue.

Elsewhere Megaport (ASX:MP1) and Xero (ASX:XRO) lost more than 3% while Altium (ASX:ALU) dropped circa 2.5% after a not-decent-enough report.

And as we reported earlier this week, it looks like Tech IPOpen season could be back on the cards, after the next likely tech juggernaut – a computer processor and software maker called ARM – dropped off paperwork with the US Securities Exchange Commission. And it’s a Form F-1 registration statement, which in SEC lingo means the path is set for what will likely be the global initial public offering (IPO) of 2023. And 2022… and probably 2021.

Certainly, an Arm-listing would be a ray of sunshine on an otherwise wintry IPO market.

Hands down we’d see the single highest profile float of the last few years, and the action could be fierce especially with Google, Microsoft, Apple, Amazon and Nvidia showing what a good chip and a few ideas around AI can do to a stock price and a market cap.

Tumultuous is probably the word.

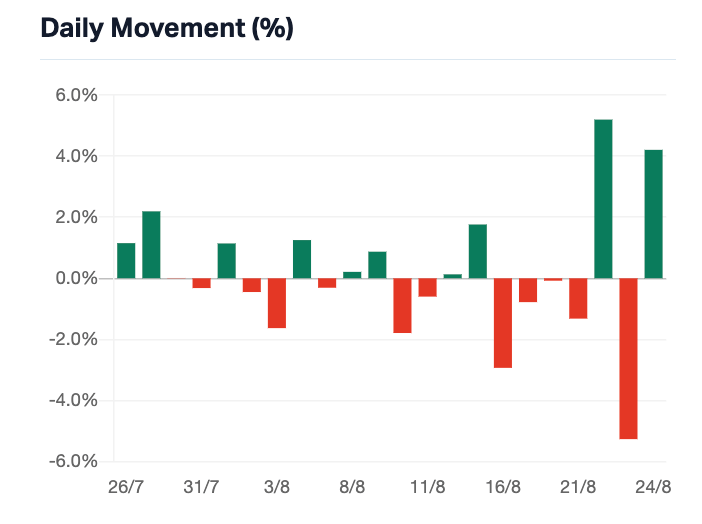

Better expressed in pics than words, so here’s about a month of gyrating (incl. the last five sessions) on the S&P/ASX 200 Information Technology (XIJ) Index.

Here are the best performing ASX tech stocks Monday August 21 – Friday August 25:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EMU | EMU NL | 0.002 | 100% | 500,000 | $1,450,021 |

| SBR | Sabre Resources | 0.066 | 47% | 67,389,283 | $13,116,878 |

| AOA | Ausmon Resorces | 0.004 | 33% | 300,000 | $2,907,868 |

| ELE | Elmore Ltd | 0.004 | 33% | 785,054 | $4,198,151 |

| AWJ | Auric Mining | 0.054 | 32% | 141,379 | $5,365,243 |

| BVS | Bravura Solution Ltd | 0.625 | 25% | 2,928,183 | $224,177,001 |

| GDM | Great Divide Mining | 0.25 | 25% | 1,135,465 | ~$2,300,000 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 23,688 | $6,847,219 |

| AUZ | Australian Mines Ltd | 0.019 | 19% | 9,193,685 | $10,461,158 |

| BXN | Bioxyne Ltd | 0.014 | 17% | 144,583 | $22,819,745 |

| CHK | Cohiba Min Ltd | 0.0035 | 17% | 710,126 | $6,639,733 |

| IEC | Intra Energy Corp | 0.007 | 17% | 2,612,557 | $9,724,690 |

| STP | Step One Limited | 0.53 | 16% | 208,086 | $84,329,832 |

| AX1 | Accent Group Ltd | 2.14 | 16% | 3,396,266 | $1,019,288,623 |

| TSO | Tesoro Gold Ltd | 0.022 | 16% | 582,002 | $20,018,639 |

| LLI | Loyal Lithium Ltd | 0.79 | 15% | 2,095,746 | $49,973,799 |

| REC | Recharge Metals | 0.23 | 15% | 265,923 | $21,116,895 |

| LLO | Lion One Metals Ltd | 1.2 | 15% | 58,005 | $14,430,764 |

| RBX | Resource B | 0.195 | 15% | 13,252 | $14,056,362 |

| 1AG | Alterra Limited | 0.008 | 14% | 602,999 | $4,875,868 |

| AJX | Alexium Int Group | 0.016 | 14% | 372,900 | $9,119,457 |

| ARV | Artemis Resources | 0.032 | 14% | 5,075,636 | $43,957,714 |

| ASR | Asra Minerals Ltd | 0.008 | 14% | 432,500 | $10,082,710 |

| MLS | Metals Australia | 0.04 | 14% | 10,720,433 | $21,841,267 |

| ERW | Errawarra Resources | 0.21 | 14% | 3,385,978 | $11,193,240 |

Here are the least performing ASX tech stocks Monday August 21 – Friday August 25:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SPT | Splitit | 0.043 | -35% | $24,344,497.32 |

| IRE | IRESS Limited | 6.57 | -35% | $1,152,491,054.58 |

| RKT | Rocketdna Ltd | 0.009 | -28% | $5,872,818.86 |

| ATV | Active Port Group | 0.1 | -26% | $17,655,742.50 |

| 3DP | Pointerra Limited | 0.09 | -25% | $68,058,341.36 |

| LVT | Livetiles Limited | 0.009 | -25% | $11,771,106.22 |

| SOV | Sovereign Cloud Hldg | 0.096 | -20% | $37,334,073.92 |

| TSK | Task Group Holdings | 0.45 | -20% | $172,139,369.96 |

| NOV | Novatti Group Ltd | 0.115 | -16% | $40,638,785.04 |

| DC2 | Dctwo | 0.026 | -16% | $3,398,618.31 |

| RCL | Readcloud | 0.059 | -16% | $7,310,237.34 |

| ESK | Etherstack PLC | 0.3 | -15% | $39,527,100.60 |

| WTC | Wisetech Global Ltd | 71.58 | -15% | $24,972,210,278.75 |

| WTC | Wisetech Global Ltd | 71.58 | -15% | $24,972,210,278.75 |

| TAL | Talius Group Limited | 0.009 | -14% | $20,561,754.03 |

| EOS | Electro Optic Systems | 0.93 | -13% | $164,386,565.76 |

| AHI | Advanced Health | 0.2 | -13% | $43,540,793.80 |

| DUB | Dubber Corp Ltd | 0.1175 | -13% | $44,688,371.75 |

| 1TT | Thrive Tribe Tech | 0.028 | -13% | $8,602,024.05 |

| SPX | Spenda Limited | 0.007 | -13% | $29,371,377.39 |

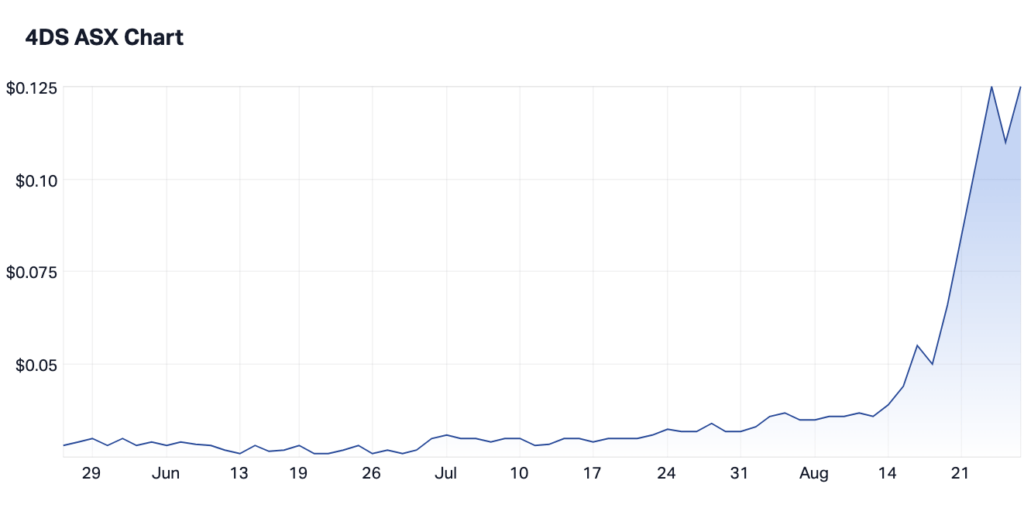

We here at Stockhead thought that the outlying Aussie semiconducting, computer processing, memory breaking 4DS Memory (ASX:4DS) was the play of the week and I believe the share price might reflect that.

In a trading halt Monday, few could’ve predicted that when 4DS revealed testing on its Fourth Platform Lot produced results that are “significantly better than the board and management team at 4DS were expecting,” the share price might react by jumping about 140% in 50 minutes.

Since then (below is the last 3 months and the spike is Monday) it’s been a rollercoaster that ASX wanted answers for:

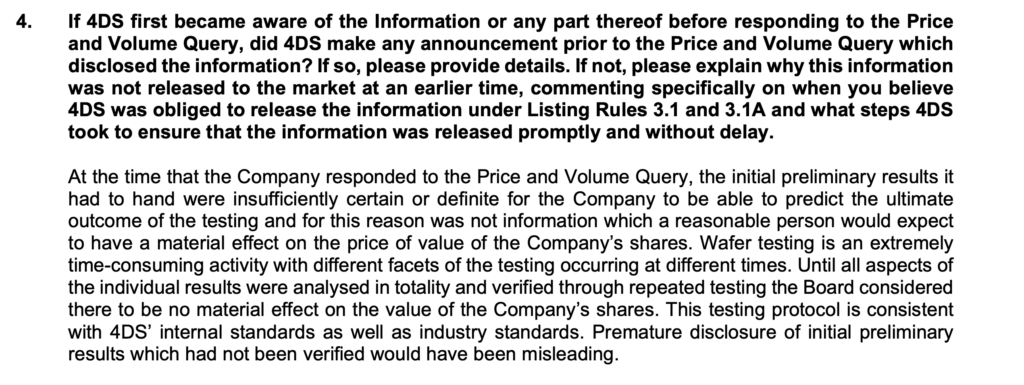

That’s quite an improvement. Here’s part of the 4DS response to its the speeding ticket it copped after the share price took off again on Friday:

What does it all mean? Simple. After a really close look at the new data (and after a difficult 12 months ironing out development issues) 4DS has now shown for the first time a fully functioning megabit array with 60nm memory cells, access transistors and write circuitry.

Within the fully functioning megabit array 4DS now confirms these terrific milestones:

– Read and write speeds at 27 nanoseconds

– Endurance well in excess of 2 billion cycles; and

– Retention is persistent and tuneable

Chief technology officer Ting Yen said this week “these significant and robust results validate 4DS’ optimisation strategy and the decision to establish a duplicate of Imec’s custom testing hardware and software for the megabit array”, which they did at the 4DS Fremont facility.

Imec, BTW, is a top R&D and innovation hub in nano-electronics and digital technologies.

Over the coming weeks 4DS says additional analysis of the megabit array will continue and a meeting is being scheduled with Imec in early October to discuss strategic plans.

Here’s some background that’s not mine, (mine is here and it’s pretty handy). This comes courtesy of our friends at Morningstar who, while not covering the stock, may well change their minds after this week.

4DS Memory

4DS, formerly Fitzroy Resources Limited, is a semiconductor development company of non-volatile memory technology, pioneering Interface Switching ReRAM for next generation gigabyte storage in mobile and cloud. 4DS owns a patented IP portfolio, comprising 33 USA patents granted and 1 patent application, which have been developed in-house to create high-density Storage Class Memory.

4DS also has a joint development agreement with Western Digital subsidiary HGST, a global storage leader, which accelerates the evolution of 4DS technology.

The 4DS Technology and Storage Class Memory

4DS is pioneering Interface Switching ReRAM, a unique area-based ReRAM technology best positioned for Storage Class Memory in mobile devices and cloud data centers.

Storage Class Memory is an emerging non-volatile memory segment positioned between the most successful system memory (DRAM) and the most successful silicon storage (NAND Flash).

Ideally, Storage Class Memory has DRAM (speed & endurance) and NAND Flash (cost & retention) characteristics.

There are many opportunities for new memories in the vast space between DRAM and NAND Flash, each with different speed, endurance and retention metrics. The two most extreme opportunities are “The space close to NAND Flash” and “The space close to DRAM”, each with different priorities for systems with respect to speed, endurance, and retention.

(Thanks to Morningstar’s Christine St Anne.)

Here’s the local IT Sector scorecard for Friday:

On Friday, Bravura Solutions (ASX:BVS) is up +26% – a gain directly attributable to an earnings report that starts out with “achieved guidance across all metrics with a significant closing cash balance”, before explaining why it’s not all good news by any reasonable measure.

The finance sector management software maker jumped after dropping some unpleasant results which may have given investors the nudge that the worst is behind it.

Bravura’s operating expenses rose from $221.3 million to $257.7 million, operating EBITDA declined $53.4m, from $45.3 million in the pcp to a deficit of $8.1 million and an adjusted NPAT of -$23.1 million, which represents a $48.8m decline against the pcp figure of $25.7 million.

Bravura did save about $25m for FY23 and says it’ll realise another $15m in FY24.

From the earnings announcement:

Bravura’s trading performance has driven the requirement and urgency for change. This has resulted in a new CEO, chair and refreshed board joining Bravura in 2HFY23.

FY23 was a year of underperformance and great disappointment for shareholders, and the Company acknowledges it will take time to rebuild trust.

That last line was wrong, apparently. So here’s the new CEO, Andrew Russell, one of Bravura’s non-executive directors:

“Bravura remains a very good business with great technology customers and people. We are fully committed to rebuilding trust and value to shareholders and customers.”

That’s bit more positive. Good one Andrew.

IperionX (ASX:IPX) this week snapped up a rather prestigious R&D 100 award for its snappy innovation around Hydrogen Assisted Metallothermic Reduction (HAMR) technology – which is a cheap/sustainable process for producing high-value titanium powder.

Titanium as the name suggests is heaps better than steel and stuff for a lot of new tech applications, but its cost has traditionally limited its use to high performance applications.

Until now.

A breakthrough discovery made by Dr Zak Fang (great name) and the team at the University of Utah – that hydrogen can destabilise the bond between titanium and oxygen – led to the development of the innovative, low cost HAMR process.

HAMR can produce titanium metal from either 100% titanium scrap or from titanium minerals.

The resulting high-qual titanium powder can be used all over the tech universe.

Great for additive manufacturing, powder metallurgy or to deliver products in a broad range of demanding applications, including aerospace, defence, and biomedical, with dramatically lower costs and increased sustainability.

IperionX (ASX:IPX) CEO Anastasios Arima said the award underscores the transformative potential of the HAMR process in the metallurgical sector:

“It is pleasing that Dr. Zak Fang, his team at the University of Utah, and IperionX have been recognized for the development and commercialization of the HAMR technology to produce low cost, sustainable titanium metal powders, highlighting an important contribution to innovation and the significant progress made to develop and commercialize this truly revolutionary titanium technology.”

Industrial water treatment tech minnow Parkway Corporate (ASX:PWN) has received firm commitments to raise $4 million via the placement of 285,714,286 shares at 1.4 cents/share.

The placement was initially targeting $3 million, with PWN agreeing to accept $1 million in over-subscriptions, resulting in the placement being upsized to $4 million.

Managing director Bahay Ozcakmak says local and overseas institutions, professional and sophisticated investor have taken part in the placement, including a cornerstone investor from the US.

“We are particularly pleased a US based strategic investor has agreed to increase its interest in Parkway, by providing cornerstone support for the capital raising,” Ozcakmak added.

Funds raised will be used to advance a range of strategic growth initiatives, including those outlined in its recently unveiled Master Plan, and provide general working capital.

“Proceeds from the capital raise will enable PWN to continue to expand its internal capabilities, including in relation to the modularisation, fabrication, and integration of its key process technologies.”

Iress (ASX:IRE) told the market on Monday that its revenue had fallen 2 per cent on the previous corresponding period to $315m. Its earnings before interest, tax, depreciation and amortisation was down 17 per cent to $29.4m, and net profit was down 31 per cent. It posted a $139.8m loss.

So once again the platform maker is looking ripe for a takeover, with private equity always hanging about the troubled waters surrounding IRE.

The company lost almost one third of its market cap this week, now splashing wildly with arms in the air at circa $1.3bn with its share price closing at $6.44.

I think they have a hotline to Goldman Sachs at the ready, and the shark fins will probably be in sight by Monday.

Some of these stocks might be Stockhead partners, but I don’t know which ones and they get no special favours from me.