We need ‘+330 mines in 12 years’ to feed battery demand. These ASX graphite, lithium, nickel and cobalt stocks can answer the call

Pic: MediaProduction, E+/ Via Getty Images

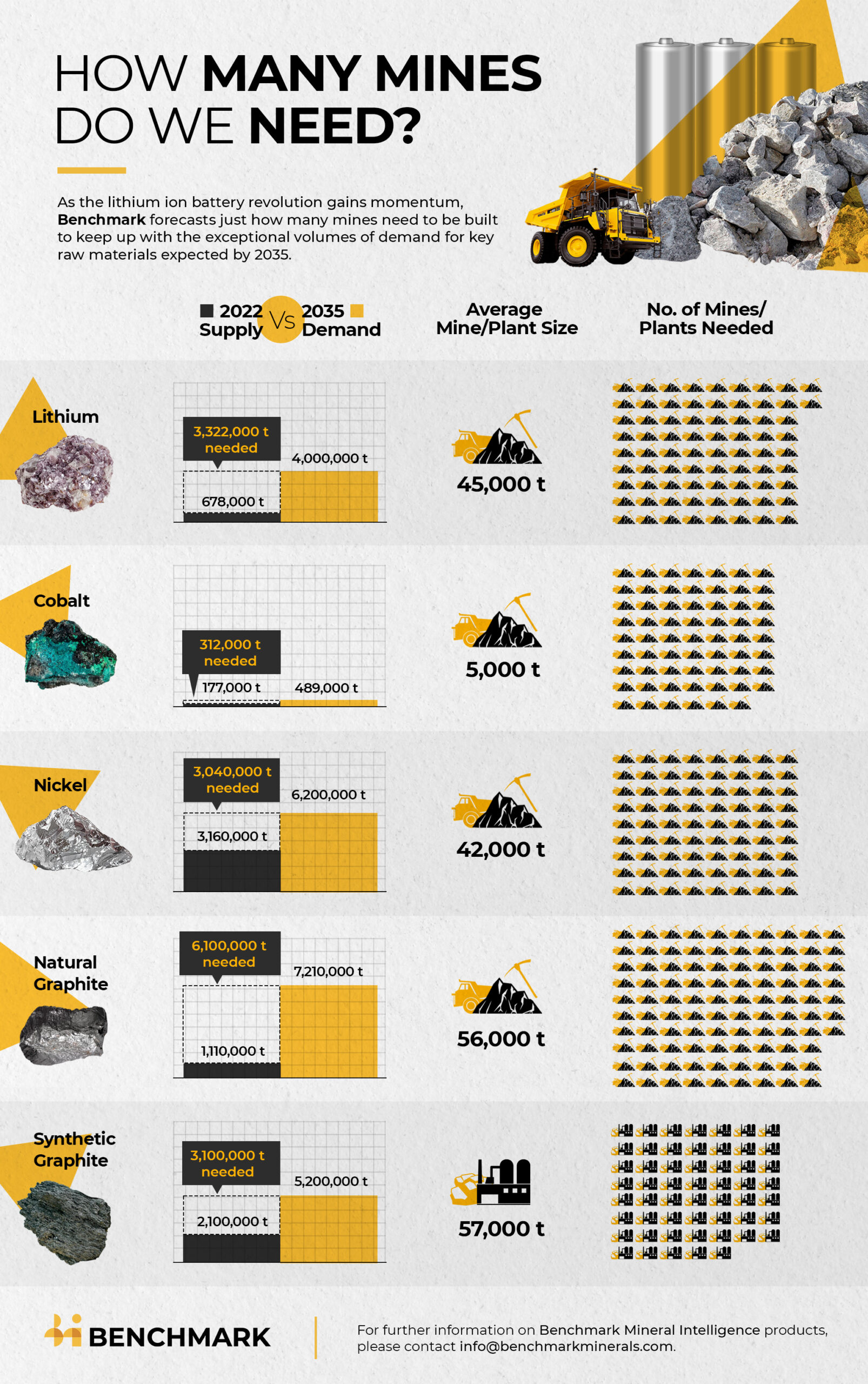

- At least 384 new graphite, lithium, nickel, and cobalt mines are needed in the next 12 years, Benchmark predicts

- 97, 56,000tpa natural flake graphite mines will need to be built

- 74 new lithium mines with an average size of 45,000 tonnes LCE by 2035

- 72 nickel mining projects with an average size of 42,500 tonnes, and 62 new cobalt mining projects of 5,000 tonnes each

We need over 300 new mines to feed a 500% increase in battery demand by 2035, Benchmark Mineral Intelligence predicts.

At least 384 new graphite, lithium, nickel, and cobalt mines are needed in the next 12 years, which drops to an almost-as-unwieldy 336 if recycling of raw materials is factored in.

A very tough ask, for several reasons.

One – the chance of finding an economic mineral deposit in the first place is frightfully small.

There are many thousands of listed and unlisted exploration companies globally, and yet probably only 25 bona fide discoveries are made per year, famous resources sector investor Rick Rule says.

“Only one in 3000 mineralised anomalies becomes a mine,” he says.

Two – it takes a long time to build a mine from scratch.

Minrex Consulting managing director Richard Schodde estimated an average delay between discovery and development of 12.4 years, based on data for 4676 significant non-bulk mineral discoveries made in the world since 1950.

That lead time is getting worse, he says.

“Depending on the commodity, only 50-70% (by number) and 60-80% (by contained metal) of discoveries turn into mines, and the average delay period has blown out to ~20 years,” Schodde said in 2017.

“In other words, it is getting progressively harder and slower to turn a discovery into a mine.

“This has profound implications on the industry’s long-term ability to supply new metal to customers.”

Companies like Sandfire (ASX:SFR), which went from discovery hole to first copper production in just over three years at DeGrussa, are exceptions to the rule. Another would be Sirius, which took just 5five years to get the Nova nickel discovery into production.

There are many more reasons why that ‘+300-mines in 12 years’ target looks unlikely – like NIMBYism and jurisdictional risk — which puts those juniors with established resources and a clear plan to enter production in the next eight years in a very strong position.

“The data highlights the height of the raw material challenge facing global automakers as they look to scale up production of electric vehicles this decade,” Benchmark says.

“Demand for lithium-ion batteries is set to grow six-fold by 2032. Yet supplies of lithium, graphite, nickel, and cobalt will need to keep pace with demand, especially post 2030.

“While recycling of raw materials will have the most impact on future cobalt supply, it’s not yet set to have much impact on materials such as graphite.”

Today we look at a bunch of advanced ASX graphite, lithium, cobalt, and nickel project developers — plus a couple of recycling projects — which are first in line to feed Benchmark’s predicted shortfall.

Don’t be mad if your favourite stock is missing, just let us know. Nicely. We love you all.

GRAPHITE

While graphite demand is primarily driven by the steel market, rapid growth in electric vehicle production is expected to drive a big uptick in demand and pricing over the next few years.

There is 10 times more graphite than lithium in a lithium-ion battery, with each EV requiring ~55kg of flake graphite to make the battery anode.

There are currently ~70 mines operating globally with the majority located in China and Africa.

To meet demand for anode materials, another 97, 56,000tpa natural flake graphite mines will need to be built, Benchmark says, assuming no contribution from recycling.

Natural graphite is normally mixed with synthetic graphite in lithium-ion battery anodes.

For synthetic graphite, which is produced using pet needle coke or coal tar pitch, a total of 54 plants with an average size of 57,000 tonnes will need to be built by 2035.

Massive numbers, which could drop depending on future battery chemistries and an uptick in anode recycling.

Novonix (ASX:NVX) is the first and only US supplier of synthetic graphite to be qualified with a Tier 1 battery cell manufacturer (Phillips 66).

Minnow Volt Resources (ASX:VRC) and more established players Talga (ASX:TLG) and Mineral Commodities (ASX:MRC) aspire to build integrated graphite mine and battery anode material production capacity in Europe.

In Africa, there’s advanced mine project developers Triton Minerals (ASX:TON), Walkabout Resources (ASX:WKT) and Black Rock Mining (ASX:BKT).

Australia is building its own graphite downstream cohort through advanced project developers like Ecograf (ASX:EGR) and International Graphite (ASX:IG6).

Then there’s Sarytogan Graphite (ASX:SGA), a recent ASX listing whose primary asset is its namesake project in Kazakhstan.

The project contains an Inferred JORC Resource of 209 Mt @28.5% TGC (containing 60Mt of graphite) making it the highest grade and second largest graphite deposit of its ASX peers.

ASX GRAPHITE STOCKS

LITHIUM

To meet the world’s lithium requirements would require 74 new lithium mines with an average size of 45,000 tonnes by 2035, according to Benchmark.

Effective recycling could pare that back to 59 mines at 45,000t LCE (lithium carbonate eq).

That is still a lot of LCE, especially considering many of the next crop of producers are starting small (~10,000t to 20,000t) and working their way up to half-century run rate after a few years on the tools.

We cover the next class of potential lithium producers a lot.

They include stocks like Core (ASX:CXO), Vulcan (ASX:VUL), Liontown (ASX:LTR), Sayona (ASX:SYA), Leo Lithium (ASX:LLL), Lake Resources (ASX:LKE) and Piedmont (ASX:PLL), give or take a few.

But what happens beyond the next couple of years? The baton will then fall to these guys, and these guys.

NICKEL AND COBALT

72 mining projects with an average size of 42,500 tonnes will be required to meet battery demand for refined nickel, Benchmark says.

Battery facing nickel and nickel-cobalt development companies in Australia include Ardea Resources (ASX:ARL), Australian Mines (ASX:AUZ), Mincor (ASX:MCR), Panoramic (ASX:PAN), Sunrise Energy Metals (ASX:SRL) and Queensland Pacific (ASX:QPM).

Overseas there’s current producer Nickel Industries (ASX:NIC) — which has traditionally serviced the stainless steel industry but is making moves into battery nickel – as well as Blackstone Minerals (ASX:BSX).

ASX NICKEL STOCKS

Recycling is set to have the biggest impact on cobalt mining, Benchmark says.

“Without recycling, the world would need to build 62 new cobalt mining projects of 5,000 tonnes each by the end of 2035,” it says.

“With forecast recycled volumes, however, that number falls by almost half to 38.”

Thing is, there aren’t many cobalt-specific stocks on the ASX, or around the world – most cobalt is produced as a by-product of copper or nickel mining.

ASX stocks bucking the trend are Cobalt Blue (ASX:COB), whose Broken Hill cobalt project (BHCP) is one of the only large scale, non-African, greenfield primary cobalt projects in the world.

The 81,000t BHCP could be in production by mid to late 2025.

It would produce +3,500tpa cobalt metal eq over 20 years at a very low all-in sustaining cost of $US12/lb – making it profitable even at record low prices.

$1bn market cap cobalt miner/project developer Jervois Global (ASX:JRV) will also be a direct beneficiary of higher cobalt demand.

JRV is on track for first cobalt and copper concentrate production from its ‘Idaho Cobalt Operations’ in late Q3 2022.

Its Finland operations also pulled in revenues of $U1S96m (adjusted profits of $US11.9m) in the first half of 2022.

ASX COBALT STOCKS

BATTERY RECYCLING

There are a handful of potential solutions besides building more mines, which include tech innovation to thrift raw materials, new battery chemistries (like sodium-ion), and recycling.

In a recent interview with Argus, France’s Veolia head of EV battery recycling, Emeric Malefant, says recycling will be crucial to the EV revolution.

It’s not just Veolia. All the big boys are into it, and the recycling plants being proposed are only getting bigger and bigger.

The clear frontrunner on the ASX is Neometals (ASX:NMT)

NMT reinvented itself as a battery recycling stock after selling out of its minority stake in the Mt Marion lithium mine a few years ago.

In March, the company’s battery recycling JV, Primobius, officially opened its 10tpd commercial lithium-ion battery (LIB) recycling plant in Germany.

In May, it executed a cooperation agreement with iconic German carmaker Mercedes-Benz’ recycling subsidiary LICULAR.

Meanwhile, an investment decision for its first 50tpd operation with Stelco in Canada is expected in the September Quarter of 2022.

Other ASX stocks coming at the recycling thematic from different angles include Hannans (ASX:HNR) (part owned by NMT) and Lithium Australia (ASX:LIT).

ASX BATTERY RECYCLING STOCKS

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.