Battle to a Billy: Which ASX lithium stock will be next to hit the $1bn market cap?

Picture: Getty Images

Many of today’s largest ASX lithium companies were nobodies before battery metals bull market 2.0 kicked off circa January 2021.

At the time lithium prices were on the respirator and only the toughest ASX stocks (usually with the best projects) had stayed the course.

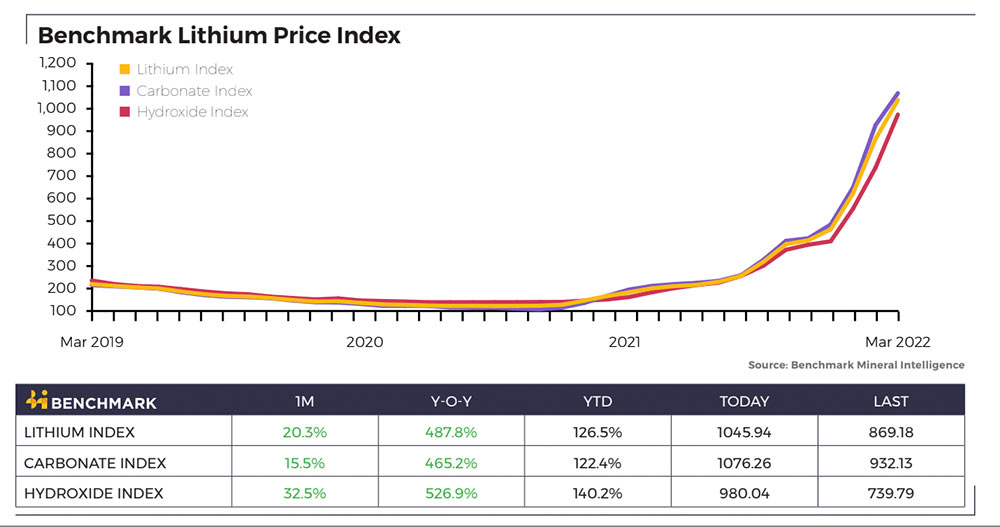

Lithium prices across the board have since gone parabolic. These stocks, and their investors who took risks during the dark days, are now receiving their due.

Just check out the share price increases of these + $1bn ASX lithium miners/near term producers since January 2021:

Pilbara Minerals (ASX:PLS) +238%

Allkem (ASX:AKE) +204%

AVZ Minerals (ASX:AVZ) +606%

Liontown Resources (ASX:LTR) +400%

Lake Resources (ASX:LKE) +3,228%

Sayona Mining (ASX:SYA) +3,600%

Core Lithium (ASX:CXO) +971%

Firefinch (ASX:FFX) +544%

Wonderful stuff.

But this boom isn’t peaking yet, experts say. Battery makers will continue to need all the quality lithium they can get their hands on.

Who’s next to one billy?

A few weeks back we asked:

Which #ASX lithium stock do you think will be the next to reach $1 billion market cap?

— Stockhead (@StockheadAU) April 7, 2022

Arizona Lithium was clear favourite (~40%) after 650 votes, followed by Argosy and Galan at 22% and 20%, respectively.

Here’s a rundown of each +$300m market cap ASX lithium stock (yes, it’s an arbitrary cut-off, don’t @ us please) in the Battle to a Billy.

ARGOSY MINERALS (ASX:AGY)

Market Cap: $663m

AGY is taking the road less travelled when it comes to ASX lithium project development.

Its flagship ‘Rincon’ lithium brines project in Argentina has no DFS (detailed economic project study) and a moderately sized official resource.

But these things pale in importance to the processing flowsheet, AGY says, which it has worked on for years to get just right.

AGY is now looking like being one of the ASX’s next producers, with a manageable 2,000tpa operation set to begin churning out battery quality lithium carbonate from mid-2022.

This may look small next to Lake Resources’ 50,000tpa aspirations, but AGY will be in production far sooner to take advantage of the insane pricing mentioned above.

2000t a year of product sold on the spot market at current prices of +$US60,000/t is a total of $US120m in revenues. Per year.

If all goes well with the 2000tpa ramp up, AGY will then look to expand the operations to 12,500tpa.

GALAN LITHIUM (ASX:GLN)

Market Cap: $600m

GLN has two high grade lithium brines projects in South America – its flagship Hombre Muerto West (HMW) and Candelas – which have combined long term production potential of 34,000tpa LCE.

GLN has been plugging away toward production decision at the 2.3 million tonne HMW project, with a definitive feasibility study (DFS) on budget and on track for completion by end-CY2022.

Pilot plant operations (a smaller version of the real thing) are expected to be operational in Q2 2022.

Canaccord Genuity Group mining analyst Reg Spencer recently named GLN as one of his top lithium picks.

Through 2021, almost all advanced lithium brine developers in Argentina were acquired by a Chinese company, Spencer says, making GLN an attractive investment.

“It is one of the few independent lithium brine developers left in Argentina and while its Hombre Muerto Project is not the only brine project we like, what they offer in terms of valuation upside is what makes it attractive,” he says.

“Lake Resources also has a lithium brine project in Argentina, but they are capped at $2 billion whereas Galan is capped at $500 million [in late March].

“When you look at market cap relative to peers, it looks to me there is significant M+ A appeal there.”

GLOBAL LITHIUM (ASX:GL1)

Market Cap: $350m

This WA hard rock explorer has made huge strides since listing at 20c per share in May last year.

In March, GL1 announced a maiden 9.9Mt resource grading 1.14% lithium and 49ppm tantalum for the ‘Manna’ lithium project in the goldfields.

It almost doubles the company’s attributable resource base in WA (Marble Bar project 100%, Manna project 80%) to 18.4Mt lithium.

GL1 says there is scope for significant growth at Manna, where the resource was defined by just 3,636m drilling at relatively shallow depths “with mineralisation open in all directions”.

A drilling program of at least 20,000m is being planned to further grow the resource and to upgrade the classification.

A 380-hole, 60,000m RC drilling program also kicked off at Marble Bar in Q1, targeting the area south of the Archer resource. It is expected to take 4-5 months to complete.

GL1 has notably inked a 10-year offtake deal with Suzhou — also GL1’s largest shareholder at 9.4% — and attracted Chris Ellison’s Mineral Resources (ASX:MIN) which took a 5% stake as part of a ~$30 million cap raise.

Iron ore and lithium miner MinRes operates the Wodgina and Mt Marion JVs in the Pilbara and Goldfields, respectively, not far from Marble Bar and Manna.

ARIZONA LITHIUM (ASX:AZL)

Market Cap: $411m

A punter favourite focused on the ‘Big Sandy’ sediment-hosted lithium deposit in the US, where it hopes to benefit from the Biden government’s drive to build a local battery materials supply chain.

Big Sandy has a resource 32.5 million tonnes grading 1,850 parts per million lithium for 320,800 tonnes of lithium carbonate equivalent.

It is just 960km away from Tesla’s Gigafactory in Nevada.

This resource covers just 4% of AZL’s project area, which contains an exploration target of between 271.1Mt to 483.15Mt at 1,000 – >2,000ppm Li2.

The proceeds of a recent $32.5m placement will be applied to “the design and construction of the research facility for the Big Sandy lithium Project, land acquisition, exploration drilling and the immediate commencement of PFS once the scoping study has concluded”, the company says.

AZL is awaiting all-important Bureau of Land Management approval to start a program of 145 exploration holes and bulk sampling.

LATIN RESOURCES (ASX:LRS)

Market Cap: $300m

This red-hot Brazilian explorer keeps hitting high grade lithium at its ‘Salinas’ project.

In March, first assay results from the initial two drill holes at the ‘Southern Target’ area of the Salinas project “confirmed a potential new high-grade lithium discovery”, LRS says.

Highlights include 4.31m at 2.22% Li2O from 83.82m and 8.13m at 2.00% Li2O from 111.3m.

Ore grade is usually around 1%, so this is good stuff.

Last week, it raised $35m to begin an “aggressive” resource definition program at the prospect.

LRS hopes to secure a total fleet of four rigs in Brazil, with a focus on drilling at least 25,000m to drive a maiden JORC resource.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.