Battery sector cries out for more graphite as shortfall looms

Pic: Tyler Stableford / Stone via Getty Images

There are signs that demand for battery grade graphite could outstrip supply in 2021, leading to a much-needed price response.

While graphite demand is primarily driven by the steel market, rapid growth in electric vehicle production is expected to drive a big uptick in demand and pricing over the next few years.

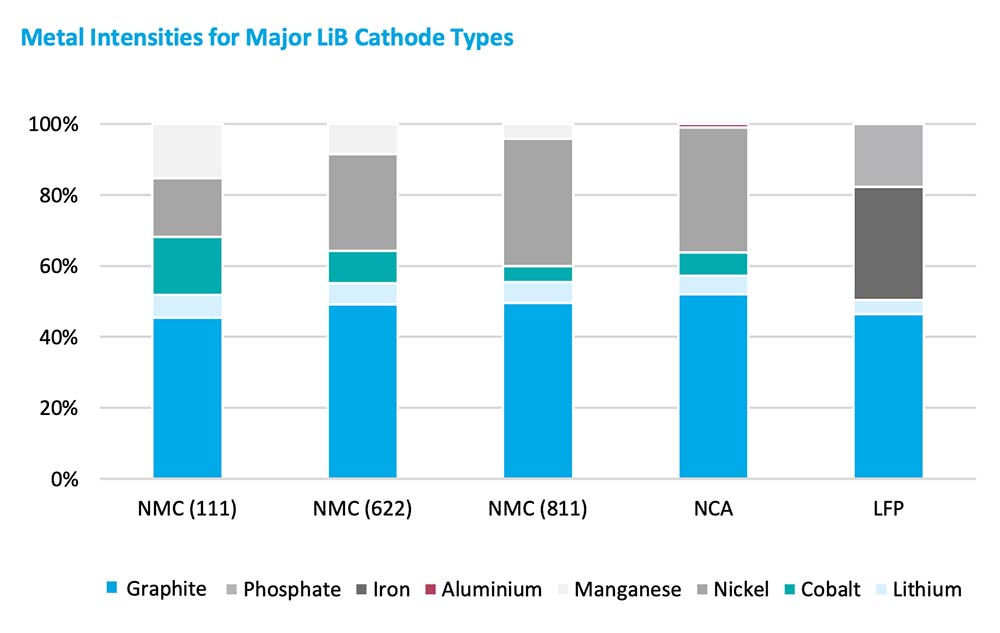

There is 10 times more graphite than lithium in a lithium-ion battery, with each EV requiring ~55kg of flake graphite to make the battery anode.

The process from the mine to battery is a complex one.

First, graphite ore is processed into a flake concentrate, which is then shaped in a process called ‘spheronisation’.

Then it has to be purified to 99.95 per cent.

At that point we have a potato shaped particle, sized to a certain diameter, which is +99.95 per cent graphitic carbon.

Here’s a what that looks like:

Just joking, they’re tiny.

Then these particles must be coated. Once coated, spherical purified graphite is called ‘active anode material’.

Now it is ready for sale to a cell maker.

In December, Benchmark Mineral Intelligence said anode producers reported increased orders “as industry sentiment rallied around global EV sales figures”, with manufacturers announcing plans to build out capacity as a result.

This brings the total planned capacity in the anode pipeline to 1,124,100 tonnes per year as assessed by the Benchmark Anode Assessment, bolstering the mid-term demand outlook for graphite.

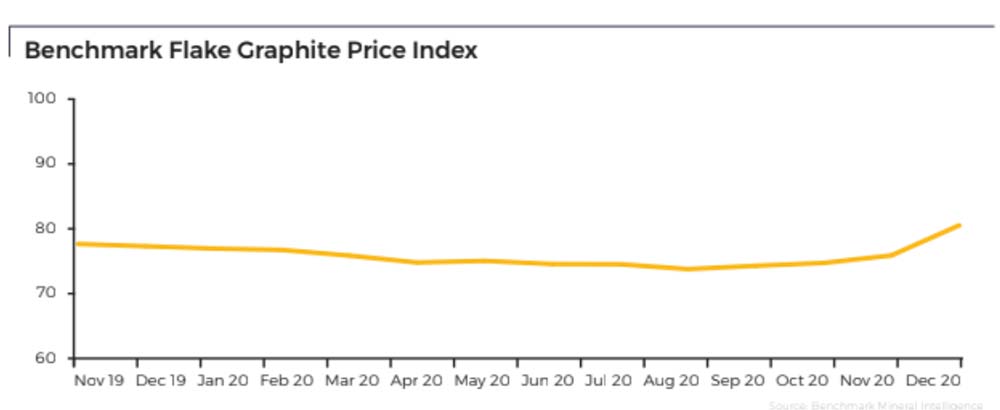

Prices are already responding.

The Benchmark Graphite Price Index was up by 6.2 per cent in December — the largest month on month increase since May 2018.

“We estimated anode demand at about 200,000MWh for 2020. Demand is projected to grow by a CAGR of 25 per cent for the next 10 years, reaching over 2,000,000 MWh of demand by 2030,” Benchmark Mineral Intelligence analyst George Miller told Stockhead.

While there is plenty of capacity to produce anode material, the market is limited by the quantity of raw graphite being mined as an input, Miller says.

“Benchmark forecasts a growing supply deficit for -100 mesh flake concentrate, most appropriate for spherical graphite manufacturing [used to make batteries], which is expected to reach over 2.2 million tonnes by 2030,” he says.

Battery makers know this. In September, South Aussie explorer Renascor Resources (ASX:RNU) inked a non-binding offtake deal with one of China’s biggest battery material suppliers.

This memorandum of understanding (MOU) — a non-binding agreement that generally comes before a legally binding one — covers up to 10,000 tonnes a year of Purified Spherical Graphite (PSG) from the Siviour project over 10 years.

In December, Korea’s POSCO – a global major in the lithium-ion battery anode supply chain – shelled out $US7.5m for 15 per cent of project developer Black Rock Resources (ASX:BKT).

Renascor and Black Rock share price charts:

The short, medium and long term outlook for quality graphite plays is very strong, Miller says.

“The likelihood is that new [mine] supply that gets financed in the coming years will be suited best to supplying the battery market,” he says.

China’s graphite dominance is set to change

Right now, China controls 71 per cent of worldwide natural graphite supply, 65 per cent of worldwide synthetic graphite supply, and 100 per cent of commercial spherical graphite supply.

Europe and the US are making concerted efforts to control their own supply chains, which means bringing new, non-Chinese supply on stream.

This will only be accelerated by China’s recent moves to favour its burgeoning domestic industry over global markets.

“China’s behaviour in the graphite market has also become more inward-looking,” Miller says.

“As African mining operations have been squeezed into care and maintenance by low market pricing, and Chinese producers have looked to supply the robust recovery of their domestic industrial and EV market this year, imports and exports of graphite into China have been declining.

“This means that there is a growing need for more flake graphite supply to come online outside of China to cater to international end markets, as Chinese supply begins to satisfy a larger proportion domestic demand rather than international orders.”

Making big $$ by moving up the supply chain

The refining and purification process from mined graphite to battery ready coated anode is intensive.

But as in lithium, there is a more general trend for graphite explorers/miners to move downstream to capture more value.

A lot more value.

“As a rough guide -100 mesh concentrate is today selling for about $US600-$US700/t,” Talga (ASX:TLG)managing director Mark Thompson says.

“Once spheronised and purified it probably sells for around $US3000/t.

“As a coated anode material — depending on the quality – it should be getting + $US7000/t. That’s for a medium quality anode material.

“All the money is made in the final bit, because it hard to do.”

Talga — which is making a coated anode material for cell makers — aims to kick off 19,000 tonnes per annum of commercial production at its Swedish anode project in 2023.

Other downstream-facing stocks include Mineral Commodities’ (ASX:MRC), which, like Talga, wants to target Europe’s booming lithium-ion sector.

In Australia, EcoGraf (ASX:EGR) signed a $US98m ($137.2m) agreement with the WA government to build the first spherical graphite processing facility outside China, with construction set to begin in mid-2021.

Struggling graphite miner Syrah Resources (ASX:SYR) has recently completed a BFS for its Vidalia anode facility in the US, which is targeting 10,000t of active anode material production each year.

Talga, MRC, Ecograf and Syrah share price charts:

No graphite substitutes on the horizon

New tech is popping up all the time, but graphite anode is here to stay, Thompson says.

“It works, it is cheap, safe, and performance in constantly improving,” he says.

“Even if companies solved some of the inherent issues with these new technologies over the next five or 10 years, they then have to solve the commercial issues, and the scalability issues.”

Benchmark’s George Miller agrees.

“Silicon anode chemistries are forecasted to occupy just 5 per cent of the anode market by 2030 according to the Benchmark Flake Graphite Forecast,” he says.

Synthetic [graphite] offers great consistency, which is key in cell production, but it is expensive, and production is energy intensive which therefore also raises issues linked to emissions.

“Anode producers will often blend the two [synthetic and natural] for the best-performing anode chemistries,” Miller says.

“We see natural graphite as being a larger part of the market in the longer term, primarily due to cost and environmental concerns.”

Graphite plays on the ASX, like their battery metals brethren, are now buoyed by a very positive demand outlook.

Graphite players are stirring

Here’s how a basket of ASX-listed graphite stocks has performed over the month>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| CODE | COMPANY | 1 WEEK CHANGE % | 1 MONTH CHANGE % | 6 MONTH CHANGE % | 1 YEAR CHANGE % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| BAT | Battery Minerals | -13 | 0 | 100 | 233 | 0.02 | $44.9M |

| BEM | Blackearth Minerals | 0 | 7 | 18 | -2 | 0.046 | $6.9M |

| BKT | Black Rock Mining | 5 | 29 | 121 | 134 | 0.115 | $82.0M |

| BSM | Bass Metals | 20 | 50 | 140 | -14 | 0.006 | $22.1M |

| EGR | Ecograf | 24 | 24 | 215 | 193 | 0.205 | $65.5M |

| MNS | Magnis Energy Technologies | -10 | -5 | 59 | 30 | 0.175 | $127.8M |

| MRC | Mineral Commodities | -7 | 10 | 66 | 47 | 0.39 | $177.9M |

| RNU | Renascor Resources | 23 | 33 | 23 | 33 | 0.016 | $30.0M |

| SYR | Syrah Resources | -4 | 28 | 230 | 67 | 1.11 | $553.4M |

| TLG | Talga Group | -2 | 5 | 242 | 329 | 1.85 | $500.0M |

| TON | Triton Minerals | 4 | 4 | 2 | 50 | 0.054 | $61.3M |

| WKT | Walkabout Resources | -8 | -17 | -8 | -31 | 0.12 | $43.6M |

| VRC | Volt Resources | 9 | 9 | -37 | -8 | 0.012 | $26.0M |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.