Anode play Talga has timed the battery boom to perfection

Pic: Getty Images.

Special Report: Talga’s share price has smashed through 10-year highs this year. Managing director Mark Thompson says this reflects a company “moving closer and closer to significant income”.

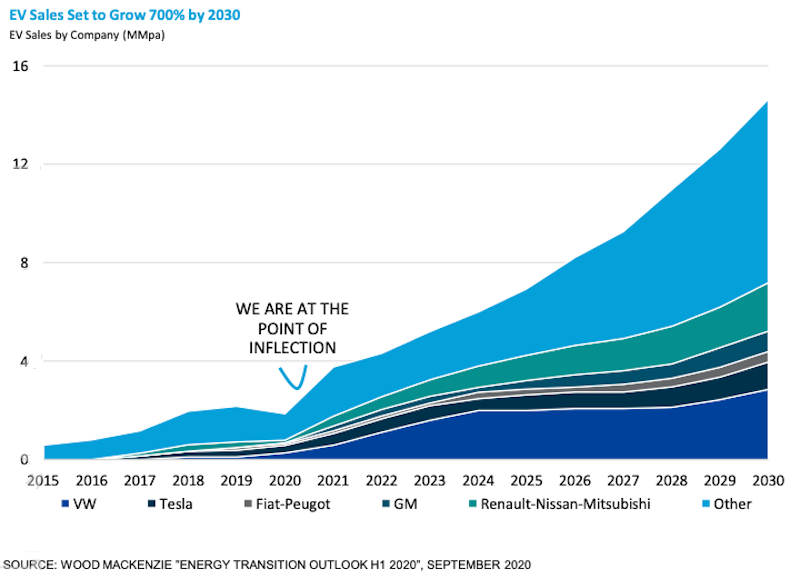

After a few false starts, the global battery boom is expected to arrive in 2021.

Tesla currently looks unstoppable and bullish battery metals sentiment is re-emerging with a vengeance.

This time there’s a key difference, says Mark Thompson, managing director of emerging anode play Talga (ASX:TLG).

“This boom will be driven by real consumers and governments and the economics of the end product – electric vehicles — not speculation by investors on the raw material supply chain,” he says.

“You now have sales data showing a doubling to tripling of EV sales in almost every market.

“Next year there will be 20 models of electric SUV for sale. This year there are probably three or four.

“It’s finally happening after many years of false starts.”

Now every investor wants to get exposure to that supply chain again, says Thompson — to get invested in what no doubt will be a long term trend.

The small number of ASX stocks that progressed their battery materials projects over the last few years, regardless of investor sentiment, are the ones which will arguably benefit the most in the short to medium term.

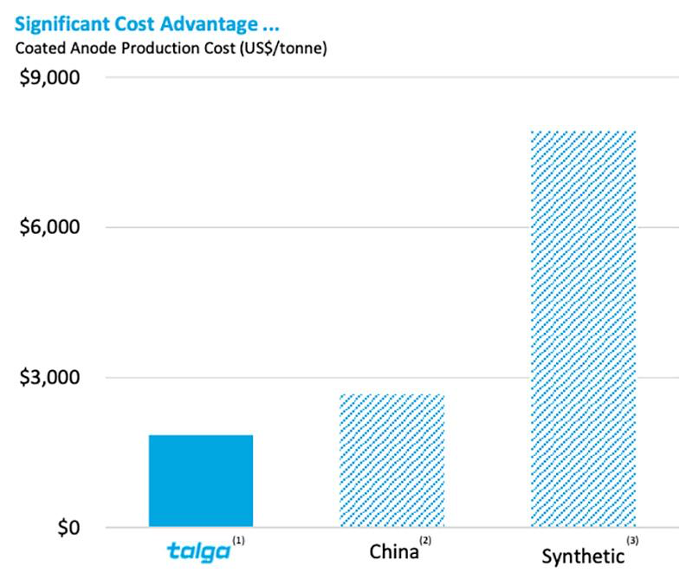

One of these Talga, which plans to be the first and largest battery anode producer in Europe. As an anode producer Talga expects to blow the competition out of the water on cost:

In 2020, the stock has smashed through 10-year highs.

It is up ~260 per cent over the past 12 months, and an incredible 820 per cent from market lows in March.

Talga boss Mark Thompson says this is reflective of a company “moving closer and closer to significant income”.

An anode supply crunch is coming

It also reflects a growing realisation that, despite the large number of graphite hopefuls globally, car and battery makers will struggle to source enough anode.

~3.5 million tonnes of graphite anode will be required by 2029, up from ~600 thousand tonnes today.

That’s why there’s a trend for graphite plays to move downstream from mining (which is low margin) towards anode production (which is high margin).

But even if these companies succeed, they are still producing raw materials, Thompson says. Not anode.

“A lot of graphite promoters, when they go downstream into a little bit in purification or shaping, they create nicknames,” he says.

“Instead of graphite they call it some sort of anode material.

“But to the battery buyers it isn’t anode until it is coated, fully specced, qualified and is being bought by a cell maker.

“That’s the difference between us and them.”

Another difference — most graphite deposits actually don’t produce much anode per tonne.

One of the few exceptions is Talga’s super high-grade deposit in Sweden, with graphite flakes already the perfect size for anode.

The company’s resource at Vittangi –19.5 million tonnes grading 24% graphite — yields 10 times more anode per tonne than your average flake graphite mine.

“For your average 10 per cent deposit, it’s about 20kg of anode for every 1000kg of rock. The yields of anode are just not that big,” Thompson says.

“No other listed company has the flake size and consistency that we have. That’s why we do what we do.

Only a small fraction of global graphite resources can be converted into anode. People don’t realise that there is nowhere near enough, Thompson says.

“There’s going to be an anode shortage, and that shortage is starting now,” he says.

Upcoming milestones

In 2023, Talga aims to kick off commercial production at a very environmentally friendly facility capable of producing about 19,000 tonnes of low-cost commercial anode a year.

2021 will be a big year. A recent $25m raise will fund development of a Electric Vehicle Anode (EVA) ‘pilot’ plant.

This is a key step to finalise the EV customer validation processes currently underway.

“We are already in qualification processes with various carmakers, and they need bigger samples as part of that qualification before they can enter into purchase contracts,” Thompson says.

“We published earlier this year that we had commercial interest in over three times our planned 2023 production capacity” Thompson says.

“We have now published we can do 100,000t of demand, and we see even more demand going forward.”

That means Talga need scalability, confirmed by a recently announced Niska scoping study which supports a 450% increase to current European anode production plans.

Talga’s planned total anode production will meet approximately 100GWh of annual lithium-ion battery capacity from 2025-26.

“Even though the production from Niska will be several years after initial production from Vittangi, we just need to get things rolling now from a permitting, stakeholder, customer point of view,” Thompson says.

“There are groups interested in financing bigger production, and this is already a very strategic asset for Europe.

“I think there will be numerous expansions from there with other deposits, multiple refineries – I think this will continue to grow for Talga.”

Plans for 2021 also include drilling out the deposits, which remain open.

There will be a bunch of studies, including two on building refineries in the UK.

“We will also start purchasing long lead items and prepare for the first train on the commercial refinery,” Thompson says.

“There will be continued interaction between us and government agencies, funding agencies and partners — a continuous flow of milestones on the way to production.”

This article was developed in collaboration with Talga, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.