Zero to Hero: This is how copper play Sandfire went from 4c to over $8 in 18 crazy months

Pic: John W Banagan / Stone via Getty Images

From the many hundreds of listed small cap explorers, barely a handful will become long-term success stories. But pick the right one as an investor and gains can be monumental.

In early 2009, struggling explorer Sandfire Resources (ASX:SFR) discovered what would later become the world-class DeGrussa copper-gold mine, rapidly transforming its fortunes from a 4c penny stock into a ~$1bn mining company.

Sandfire – originally called Borroloola Resources – was a private little company established in the early 2000s by current chief exec Karl Simich, prospector Graeme Hutton, and mining entity Miles Kennedy.

The original objective was to peg open crown land where Hutton believed there was an opportunity to find something big.

Hutton had been the founder of numerous other companies, most notably Kimberley Diamonds and Metana Minerals.

“Graeme was a big prospector – a bit of a ‘Mark Creasy’ type,” Simich says.

“He was legendary; the sort of person who would go out walking the Kimberly with a water bag, a dog, and a gun and disappear for three weeks.”

Following a simple little IPO the company listed in March 2004, changing its name to Sandfire Resources.

“We were busy at the time — Miles and I were at Kimberley Diamonds, original owner of the Ellendale diamond mine – so we [embedded a management team] and did the IPO as major shareholders,” Simich says.

Hutton stayed on as technical director.

In mid-2007 two very significant things happened, both on the same day.

First, Kimberley Diamonds received a hostile $300m takeover bid from South African company Gem Diamonds.

“We were put under an extraordinary amount of pressure from our banks who essentially said ‘there’s two ways this thing can go; accept the bid or we can foreclose on the loan. Take your pick’,” says Simich.

“We didn’t have much of a choice. We were boxed.

“Then we got a call later that same night to tell us that Graeme had died.

“I was supposed to go on a family holiday but there was so much happening I took my wife and kids to Bali, dropped them off, and then came back on the return flight.

“I went home that night and I was just numb.”

After the Kimberley Diamonds takeover, Simich came on as managing director of Sandfire in early 2008 without much fanfare.

It was a company in the doldrums, he says.

“With Graeme gone it had become a bit wayward and rudderless. But we had all our original projects so we stuck to our guns, we stuck with the program through late 2007 and 2008.”

In mid-2008 — after months of negotiations — Sandfire entered into a $7m transaction for a 19.9 per cent company stake with major Korean steel producer POSCO.

POSCO was actually interested in the explorer’s Borroloola project in the Northern Territory, which was prospective for manganese.

“They technically invested on the 30th June 2008 – which was important because we had no money,” Simich says.

“We were on the bones.”

Going into the back end of 2008 the global economy got worse and worse. You could feel something wasn’t quite right, Simich says. Then the GFC hit.

“On the 30th of November 2008, I remember talking to technical director John Evans – the lead geologist who ultimately led the discovery of DeGrussa, on ground that Graeme Hutton pegged,” Simich says.

“We had just been unsuccessful in technical results for the manganese, we didn’t have a lot of money, and the world was in terrible shape.

“I said — ‘I’ve seen this movie before, I saw the 1987 crash, we have a duty to our shareholders to preserve the assets of the company’.

“We decided that day to retrench everyone, batten down the hatches, close the door but keep the lights on.”

A turning point

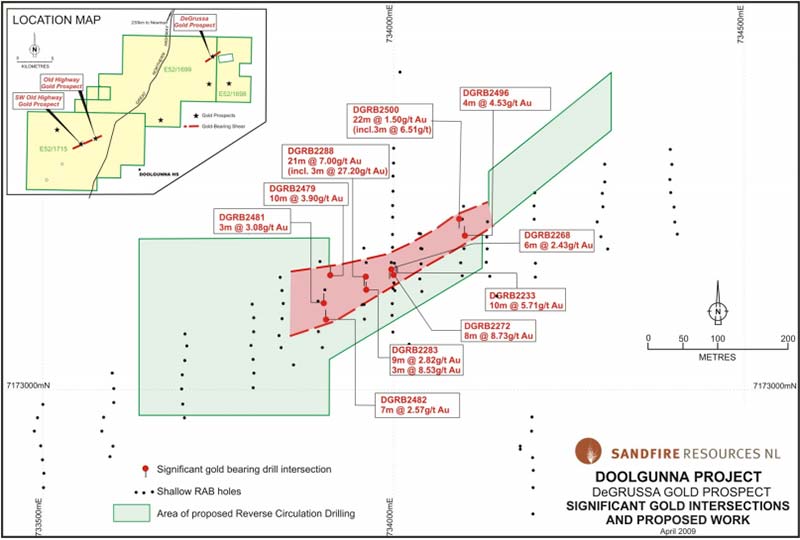

In early 2009, the pair decided that if Evans could find a small gold orebody up at a prospect called Old Highway at the Doolgunna project — where Sandfire had some early great gold results — Simich could score a processing plant from some friends out of the Northern Territory.

“We would toll treat the ore and share the profits,” Simich says.

“The target was a small resource of 10,000oz; enough to pay the bills and keep the lights on.”

But they had problems accessing the ground and, as a consequence, didn’t end up drilling Old Highway. Instead, they went a few kilometres up the road to another prospect called DeGrussa, where previous high-grade gold intersections included 8m at 8.8 grams per tonne (g/t).

That small gold drilling program in May 2009 was a failure.

But before they packed up, a young geologist called Margaret Hawke was given “permission” to drill six extra drill holes in an area where Sandfire had some interesting anomalous gold intersections the year before.

“It was funny because when the approvals finally came through to drill those six holes, she said ‘thank god – because I’ve already done it’,” Simich says.

“The guy in the rig had a job up the road, and had told her ‘I’m either drilling today, or I’m going’. So, he drilled.”

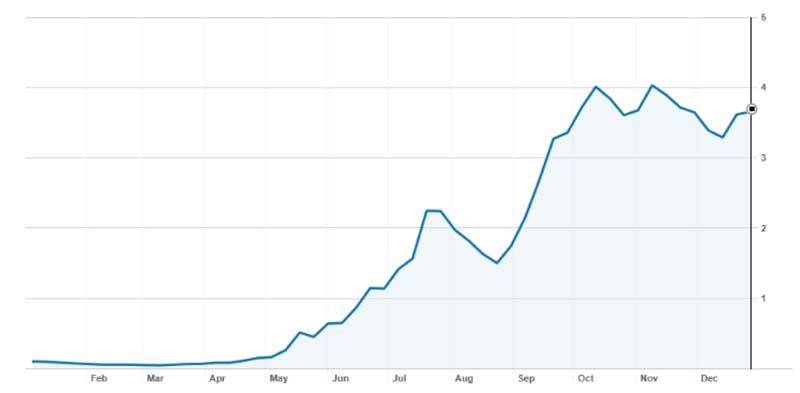

On 18 May 2009, Sandfire announced a new high-grade gold-copper discovery at DeGrussa; all thanks to Hawke’s impromptu drilling campaign.

Results from the reverse circulation (RC) drilling included 22m grading 3.6 per cent copper, 3.8g/t gold, and 13.4g/t silver, 100m from surface. The deeper holes had terminated in mineralisation, indicating that this thing kept going at depth.

It turns out the original shallow gold anomalism was the ‘halo’ for something much bigger.

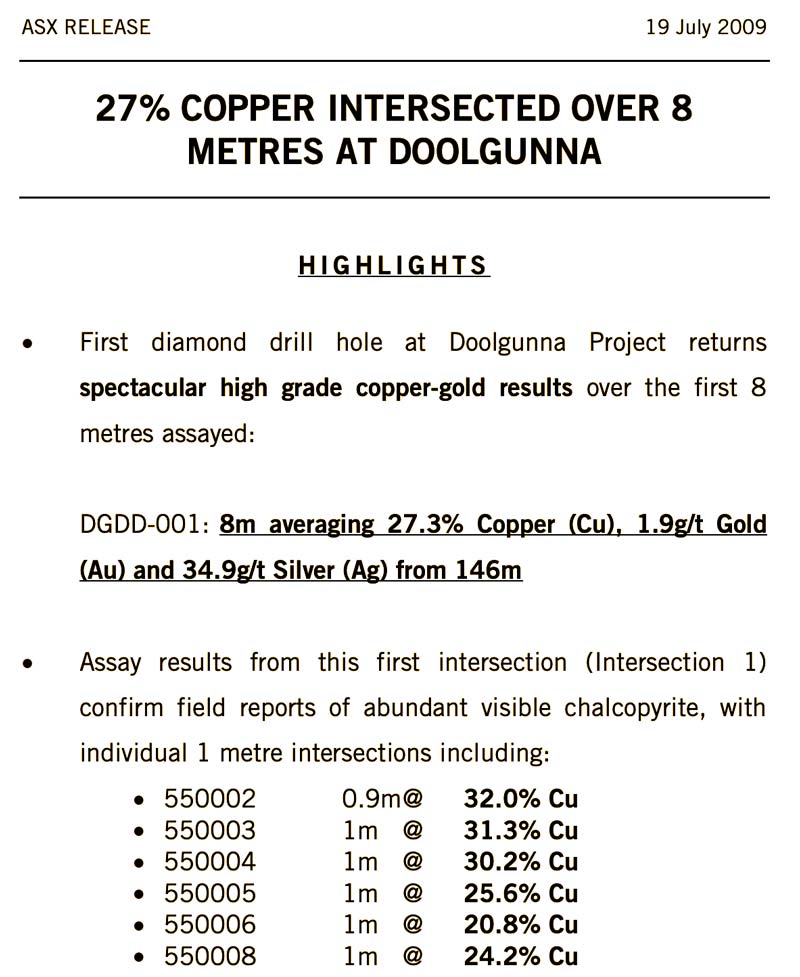

The hits kept coming. Very quickly – or as quickly as Sandfire could at the time, given its limited resources – a diamond drill rig was transported to site.

In July, this maiden diamond drill hole intersected an incredible 27 per cent copper over 8m.

“I remember being at Diggers and Dealers in August with a 1m core intersection that was running 25 per cent copper,” Simich says.

“People didn’t quite understand or believe it. It was too good to be true.”

Sandfire very quickly made two discoveries; DeGrussa and Conductor 1.

“I asked John Evans how much he needed to drill a resource. He said ~$10m, so we raised $12m in September 2009,” Simich says.

“The share price was at $2.40 at the time. I had every broker in the world telling me what I should or shouldn’t do and eventually I landed on an entitlement issue to our current shareholders.

“We did that at a 50 per cent discount – $1.20 per share.

“The stock followed the rights issue and sunk to $1.30, but quickly recovered.”

By that point the share price had done 14 cartwheels, doubled, then tripled, and halved and doubled again.

“I can’t recall how many trading halts we called as we went along,” Simich says.

“You’re talking about a share price that went from 4c to above $2 — and up and down like a yoyo.

“I’ve never seen another company in a situation like that. It was extraordinary. People didn’t know what to make of it.”

The nearology effect saw many of them enjoy short-term share price spikes as investors poured millions into the ground searching for another company-making DeGrussa-style deposit in the region. Unsuccessfully, for the most part.

There was volatility in other aspects as well. Simich calls a mid-2010 raid on the register “very unsavoury”.

“There was a group of people assembled to deliver a shareholding into [copper miner] OZ Minerals, unbeknownst to me,” he says.

OZ (ASX:OZL) then appeared on the register in early July having been delivered a 19 per cent shareholding at a cost of about ~$100m.

“10 mins after the trade I get a call from OZ boss Terry Burgess who says ‘we’ve just bought some shares in your company, Karl.’

“I expected to have a takeover bid lodged on us within four minutes.

“It didn’t happen, but Terry said he was going to be in Perth the following week. What a surprise.”

On Monday morning Burgess rolled up, put a big file on the table and said they wanted a board seat.

Sandfire said no.

“At that point we had two major shareholders in OZ and POSCO, which became a bit of a standoff,” Simich says.

“I think just having that standoff actually enabled us to focus on the task at hand – DeGrussa.

“We were moving so fast people were saying ‘this thing is going to fail – there’s no way in the world this is going to happen’. But clarity of vision was super clear, because we had only one thing to do.”

In early 2010, maybe six months from discovery, the company advertised for a project director to develop DeGrussa.

From 90 applicants, Sandfire chose experienced miner Martin Read whose application “was on a piece of A4 paper, ripped in half with three bullet points on it”.

“He’s an exceptional individual. He just got on with it. He and his team are the ones that achieved those tight timetables to production,” Simich says.

“And that was after we said ‘don’t take any shortcuts; it will take all the time it takes’.”

In March 2010 the company raised another $65m to complete final feasibility studies into project development.

By November 2010, about 18 months from discovery, the company had established a resource of 644,000t of copper and 724,000oz of gold. A subsequent definitive feasibility study projected operating cashflow of $2.4bn on $4.2bn revenues over life of mine.

In December, Sandfire completed a $103m capital raising to help fund development — and has never touched equity markets since.

“We raised $103m at $7 per share in about five minutes,” Simich says.

$1bn market cap Sandfire became Australia’s newest copper producer in 2012, on time and on budget.

The start of production just over three years from the discovery drill-hole represents an outstanding achievement, says Simich.

“I spoke to a shareholder who bought another 1 million shares at an average price of 5c in February 2009 [when things were at their worst] and subsequently made about $30m out of Sandfire,” Simich says.

“I asked him after the event — ‘why did you buy a million shares?’

“He said it was because the geological story told to him by Graeme Hutton and John Evans never changed.”

NOW READ:

This is how $3m market cap minnow Ramelius became an $850m gold miner

Gold Road Resources: a +$1.2 billion success story

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.