Resources Top 5: Why are vanadium stocks flying today?

Mining

Here are the biggest small cap resources winners in early trade, Wednesday January 4.

The Tony Sage-backed minnow has acquired the Block 103 project in Canada, which it calls “the largest undeveloped magnetite iron ore project in the world”.

Block 103 covers 7,275 hectares in the Labrador Trough, one of the largest iron ore belts in the world accounting for 99% of Canada’s iron ore.

It has a historical non-JORC resource of 7.2 billion tonnes grading 29.2% iron, based on 4km of the 12km of strike.

Over $35m has been spent on the project thus far, CLE says.

Magnetite projects are normally a lot costlier to build than hematite mines due to the need to process the lower grade ore into a concentrate.

But that concentrate is typically super-high grade, meaning it captures a significant premium over the 62% Fe benchmark and is suited to low emissions steelmaking.

“The green transition and global targets towards net-zero carbon emission have made magnetite ore more desirable as it will be pivotal in emissions reduction for the iron ore and steel industries,” Sage says.

“We see tremendous potential for Block 103 to become a crucial piece of the iron ore supply worldwide whilst promoting the reduction of carbon emissions in the steel industry.”

CLE will pay the vendor, private Aussie company Labrador Iron, 2.16 billion CLE shares at the deemed price of 0.25c per share.

Labrador, which was incorporated in 2021, bought the project from TSX listed M3 Metals in May last year.

(Up on no news)

Precious metals/ critical minerals explorer KRR has been very quiet, with its last announcement of note coming on October 25.

It has three main project areas: Tennant Creek (copper-gold), Speewah (vanadium-titanium-iron), and a downstream high purity alumina development, all in Australia.

In its September quarterly, KRR said the Tennant Creek region has become very competitive for exploration in recent months.

“Significant gold and copper results have been reported including those by Castile, Emmerson and Tennant Minerals at Rover, Bluebird, and Hermitage, as well as King River’s recent high grade gold results in the Kurundi Gold region,” it said.

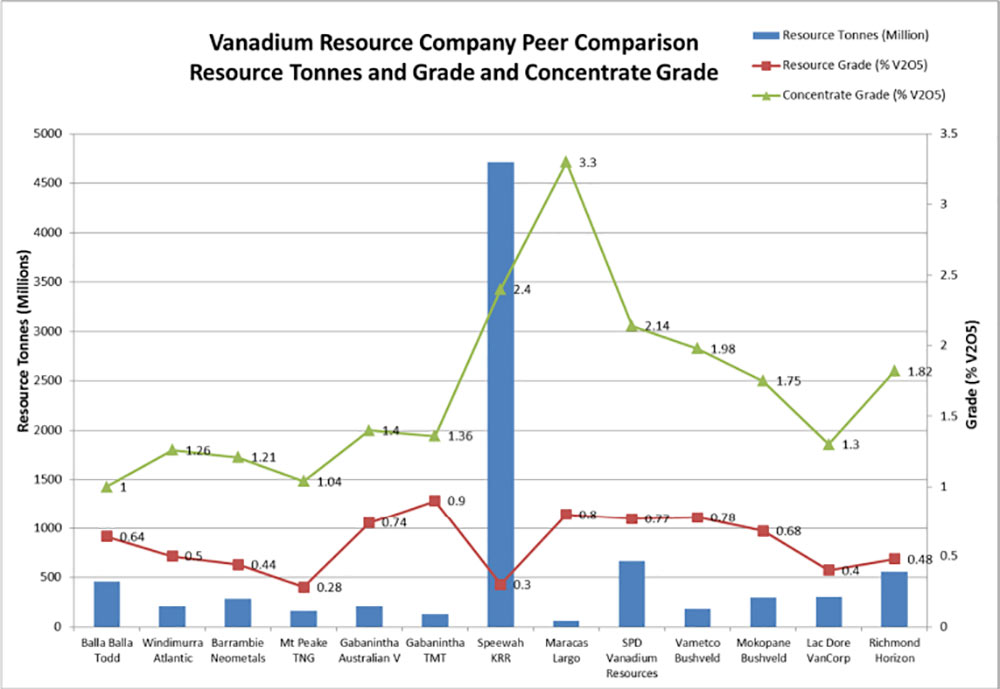

The company’s most advanced asset is Speewah, “Australia’s largest vanadium-in-magnetite deposit based on tonnes and V2O5 content”.

KRR has initiated discussions with potential buyers and/or partners for Speewah development, it said.

It has also approached several International and Australian groups for potential partnering in the exploration and development of the gold projects in Tennant Creek.

Further information will be released if these discussions progress, the company says.

(Up on no news)

The vanadium explorer listed in September last year following a $5m IPO.

CMG has Japanese petroleum heavyweight Idemitsu on the register, with the conglomerate holding a 32% slice of the company.

It’s main game is the Lindfield vanadium project in Queensland, which has a resource of 210Mt at 0.39% V2O5 (vanadium pentoxide).

A recently completed drilling campaign will be used to add to the existing JORC resource, and complete metallurgy and pilot plant test work and a scoping study.

These drill results are pending.

While adoption of vanadium redox flow batteries has been relatively slow, representing just 10% of the stationary battery market to date, the battery metal is widely expected to become a key resource as the world moves increasingly towards electrification to support net zero emissions.

In fact, vanadium consumption in batteries is forecast to grow at an average compound rate of 41% per year from 2022 to 2031.

Advanced explorers and near-term producers will be in demand if gold returns to favour in 2023.

In 2020, vanadium-titanium explorer AUT caught a rocket after buying Pickle Crow, one of Canada’s highest-grade historical gold mines which produced 1.5 million ounces of gold at a grade of 16g/t until 1966.

Since then, the company – spearheaded by the same team that made Bellevue Gold (ASX:BGL) such a success — has drilled out a 2.3Moz resource grading 7.8g/t.

A new 50,000m drilling program to further grow the resource is due for completion sometime early in the new year.

AUT has also retained a vanadium leg. It still holds a 90% interest in the Limestone Well vanadium-titanium project, a stone’s throw from Neometals’ advanced Barrambie deposit in WA.

The advanced phosphate stock has recovered some losses today after a mining concession application over the Chaketma project in Tunisia was not approved.

The company has been advised by specialist Tunisian lawyers that it has strong grounds to seek reversal of this decision, PHO said yesterday.

It’s the latest in a long run of difficulties for PHO, which was previously in the investor doghouse due to a multi-year dispute with its Tunisian partner over Chaketma.

PHO regained full control of the project after scoring a big win in the local courts.

“PhosCo remains committed and focused on the grant of a mining concession application over Chaketma and, despite the Minister not accepting our application, we will continue to engage with government about advancing Chaketma,” managing director Simon Eley said yesterday.

“Fortunately, there is a clear legal process to preserve and protect PhosCo’s rights under the Tunisian mining code and investment law to move forward, building on the positive dialogue initiated with government since regaining control of CPSA.

“Our team is hard at work and more determined than ever to see the development of the world-class Chaketma Phosphate Project – a project of significance to both PhosCo and Tunisia.”