Resources Top 4: Sultan pumped for WA nickel drilling with JV partner Rio

Pic via Getty Images

- Sultan Resources and its JV partner Rio Tinto submit PoW for nickel drilling at Lake Grace, WA

- Mt Malcolm has spotted more pegmatite action out at lithium hotspot Lake Johnston

- Freehill Mining and king River Resources also travelling well on the bourse today

Here are some of the biggest resources winners in early trade, Monday December 18.

Sultan Resources (ASX:SLZ)

Mid year, this minerals-exploring minnow turned heads when it entered into a joint venture agreement to find the next tier 1 nickel project in WA, with none other than Aussie mining behemoth Rio Tinto (ASX:RIO).

Despite that, SLZ is still down 74% YTD. Today, however, the share price is moving strongly with a +35% gain at the time of writing on the back of a recent update on the JV project.

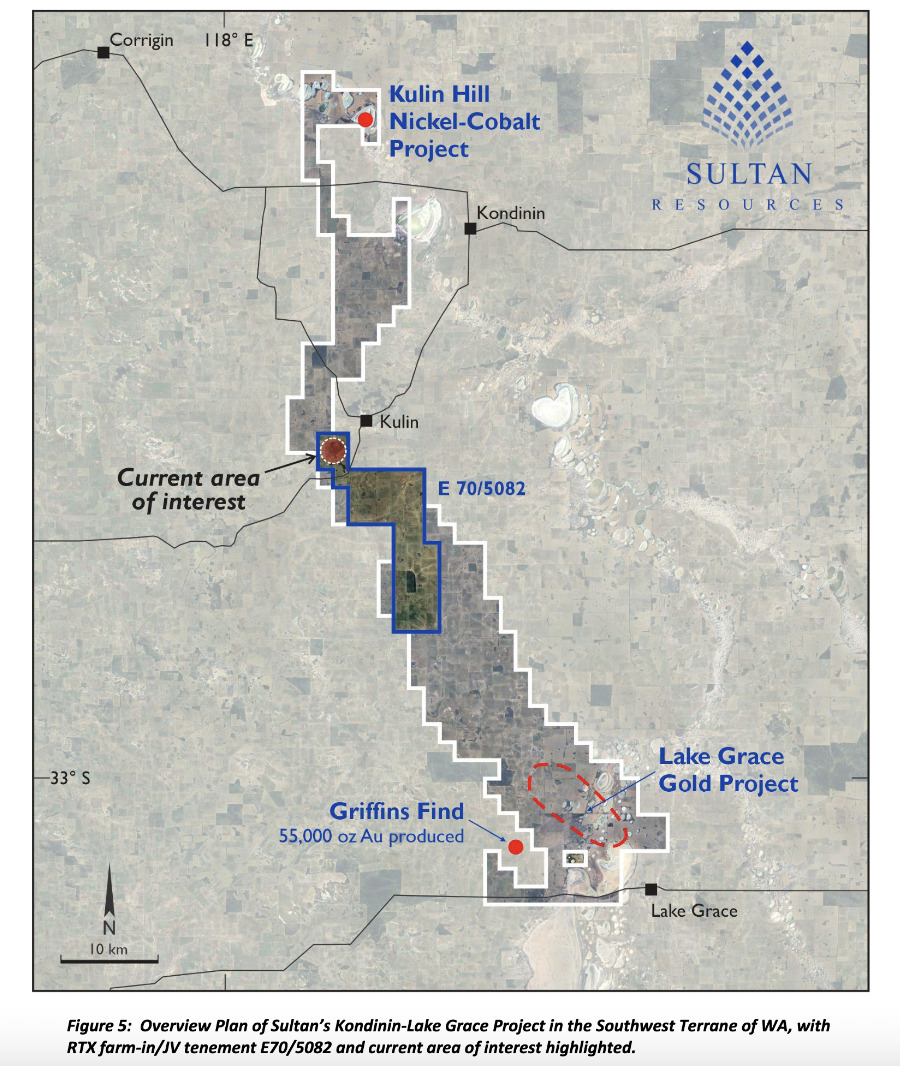

It’s focused on the Calesi nickel prospect near Kulin in WA, which is situated on the exploration licence pertaining to the JV with Rio. It forms part of the broader Kondinin-Lake Grace exploration project.

Sultan notes that a Program of Works (PoW) has been submitted to the Department of Mines, Industry Regulation and Safety (DMIRS) for initial drilling at the Calesi nickel prospect.

It says Calesi is defined by a “significant, late time airborne electromagnetic survey conductivity anomaly”.

Meanwhile, Rio Tinto Exploration has formally exercised its option to earn an 80% interest in the Calesi exploration licence, and is sole-funding the drill campaign, which is expected to commence spinning in Q1 2024.

Read more about the Sultan and Rio JV here.

SLZ share price

Mt Malcolm Mines (ASX:M2M)

This small goldie turned Lake Johnston lithium hunter is on the move today on news of visual confirmation of pegmatites in a historic drill spoil.

This follows an on-ground inspection of the company’s Lake Johnston project tenure.

M2M notes that, aside from the sighting in the old drill spoil, a further five drill holes have pegmatite logged at the site, extending known pegmatite in drilling to the central west portion of the drilled area.

In particular, field observations confirmed a maximum width of approximately 10m of pegmatite in two drill holes.

Past exploration (between 1981-2016) at the site focused on gold and nickel mineralisation, and no analysis for lithium was conducted at that time.

The whole The Lake Johnston area is emerging as a highly prospective province for LCT pegmatite mineralisation.

M2M’s Lake Johnston project is roughly 450km east of Perth, 120km west of Norseman and about 60km east of the well-known Earl Grey (Mt Holland) lithium project owned by Chilean lithium giant SQM and Wesfarmers (ASX:WES).

Earl Grey boasts a total mineral reserve of 186 Mt at 1.53% Li2O and is one of the largest known hard rock lithium deposits in Australia and the world.

M2M share price

Freehill Mining (ASX:FHS)

This small iron ore player has big ambitions to transform its wholly-owned Yerbas Buenas magnetite project into Chile’s next major iron ore mine.

Down 20% YTD, it’s up and to the right 60% over the past month and 33% over the past 24 hours.

It looks like some directors have been buying FHS. One Paul Davies, buying 3.6m shares for $10,800.

And company chairman Ben Jarvis, snapping up more than 20.6m shares for more than $61k.

Any other news worth noting, though? Nothing we’re seeing, although Jarvis’ chairman’s address to the company’s AGM last month was upbeat, including the following statement:

“The Company is very committed to recommencing magnetite mining at YB, to be funded by the cash flows from our expanding waste materials business.

More broadly, our operations at YB have been underpinned by improved operational procedures where management is working closely with an experienced contractor to ensure the requisite processes around product quality, efficiency and safety are adhered to.

“We are confident that the magnetite will add a new revenue stream once we commence production and we capitalise on what is a large and valuable resource.”

FHS share price

King River Resources (ASX:KRR)

Goldie KRR (formerly King River Copper) is one of the best-performing ressies in early trade today, and that can be put down to a drilling update coming from its Tennant Creek tenements in the NT.

The company has announced it’s wrapped up its first phase of RC drilling at its Providence target area, where a “complex geophysical/geological zone has been identified” with 17 holes completed for 2,790m.

This drilling is the first part of the KRR’s larger $2M drill budget to follow up on targets generated from an extensive 2023 geophysics programme.

The company notes that initial drilling has been “very promising with structure, veining, chlorite/hematite alteration and ironstone zones intersected in multiple holes confirming the presence of Warramunga formation rocks under shallow alluvial cover with structural and alteration styles similar to the nearby deposits to the northwest.”

Assays are pending with the first results expected mid-January.

KRR share price

At Stockhead we tell it like it is. While Sultan Resources and Mt Malcolm Mines are Stockhead advertisers at the time of writing, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.