You might be interested in

Mining

Mt Malcolm Mines cheered by Golden Crown test work achieving 94.3pc gold recoveries

Mining

Mt Malcolm soars to record heights with a whopping 61.39g/t gold intersection at Golden Crown

Mining

Mining

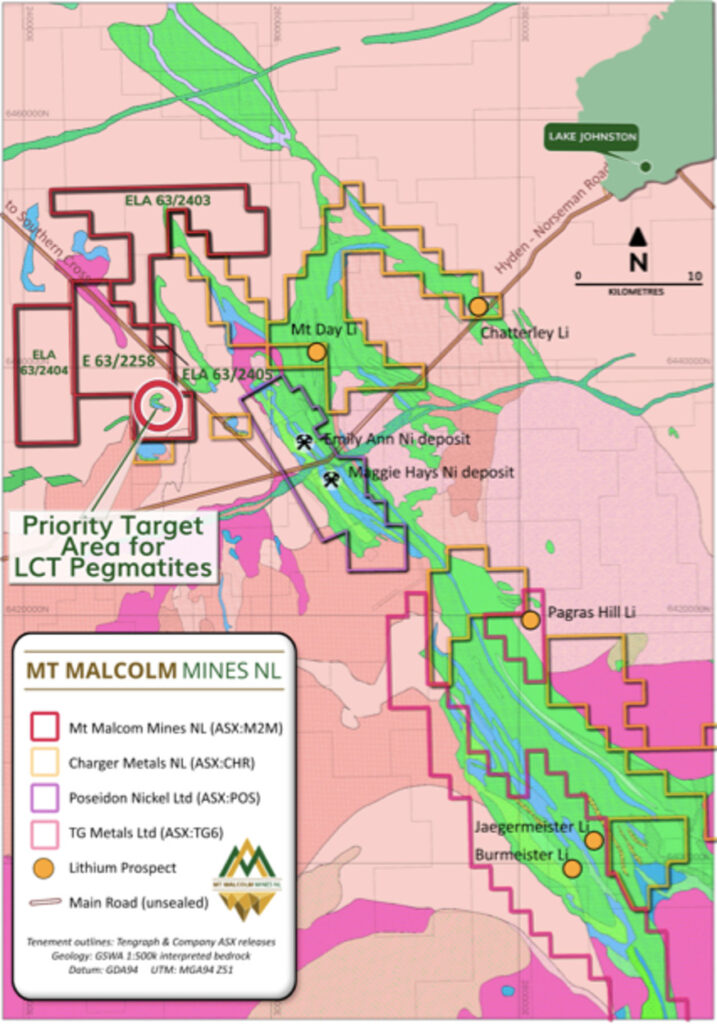

Special Report: Mt Malcolm Mines is building its large lithium footprint at Lake Johnston where recent exploration success by TG Metals (ASX: TG6) has sparked a pegging rush.

The TG6 share price has soared from 11c to 91c in the space of a month after reporting grades of up to 2.28% Li2O from the first holes drilled into the Burmeister lithium soil anomaly.

TG6 is not the only Lake Johnston explorer enjoying success, with Charger Metals (ASX: CHR) moving higher after inking a lucrative farm-in agreement with Rio Tinto’s (ASX: RIO) exploration arm.

Mt Malcolm Mines’ (ASX:M2M) project is 10km west of CHR’s Lithium Caesium Tantalum (LCT) pegmatite prospects at Mt Day, 25km southwest of the Chatterly LCT pegmatites, and 20km north west of the Pagrus pegmatite prospects.

The company has now look to bolster its position in the red hot region, making three applications for Els 63/2403, 63/2404 and 63/2405 at Lake Johnston.

If granted, the additional EL applications in the belt expand potential exploration footprint to 200km2.

“This is an exciting time for the company as we merge into other commodities,” M2M MD Trevor Dixon said.

“Lake Johnston is developing as an emerging lithium region with the recent TG Metals (ASX:TG6) spodumene discoveries in recent times.

“We find ourselves in good company with the recent Rio Tinto and Charger Farm-in agreement reaffirming the potential prospectivity of Lake Johnston and its potential to host large scale lithium deposits.”

M2M has also advised it’s raising $1.1m via a placement at 2.5 cents per share to accelerate its lithium and multi-element exploration activities.

The funds will be used for:

The company’s chairman has also committed to subscribe for a total of $50,000 in the placement, subject to shareholder approval.

The company intends to carry out several staged exploration programs targeting lithium and rare earth mineralisation, including site visits to confirm pegmatitic drill spoil in the Goldfields and Bullion RAB drilling with geological mapping and rock chip sampling of outcropping pegmatite intrusions.

Soil geochemical sampling will be conducted over the areas that have the potential for lithium mineralisation, with follow up reverse circulation drilling planned over the area where a cluster of pegmatites were previously encountered in historical drilling and areas returning positive soil geochemical results.

A POW has been lodged with the with Department of Mines Industry Regulation and Safety and is anticipated to be granted later this year.

This article was developed in collaboration with Mt Malcolm Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.