This formidable team of Bellevue alumni has its sights set on the copper mid tier

Picture: Getty Images

The talent-stacked team which transformed Bellevue (ASX:BGL) into one of Australia’s biggest, highest grade gold miners now has its sights set on the copper mid-tier.

Since January 2017, BGL’s share price has rocketed from 2.5c to ~$1.52c per share as it fast tracks one of Australia’s highest grade gold mines back into production.

Central to its success were execs Steve Parsons, Ray Shorrocks, Michael Naylor, and Kevin Tomlinson, who are now looking for a Bellevue-like payday via their new explorer Firefly Metals (ASX:FFM).

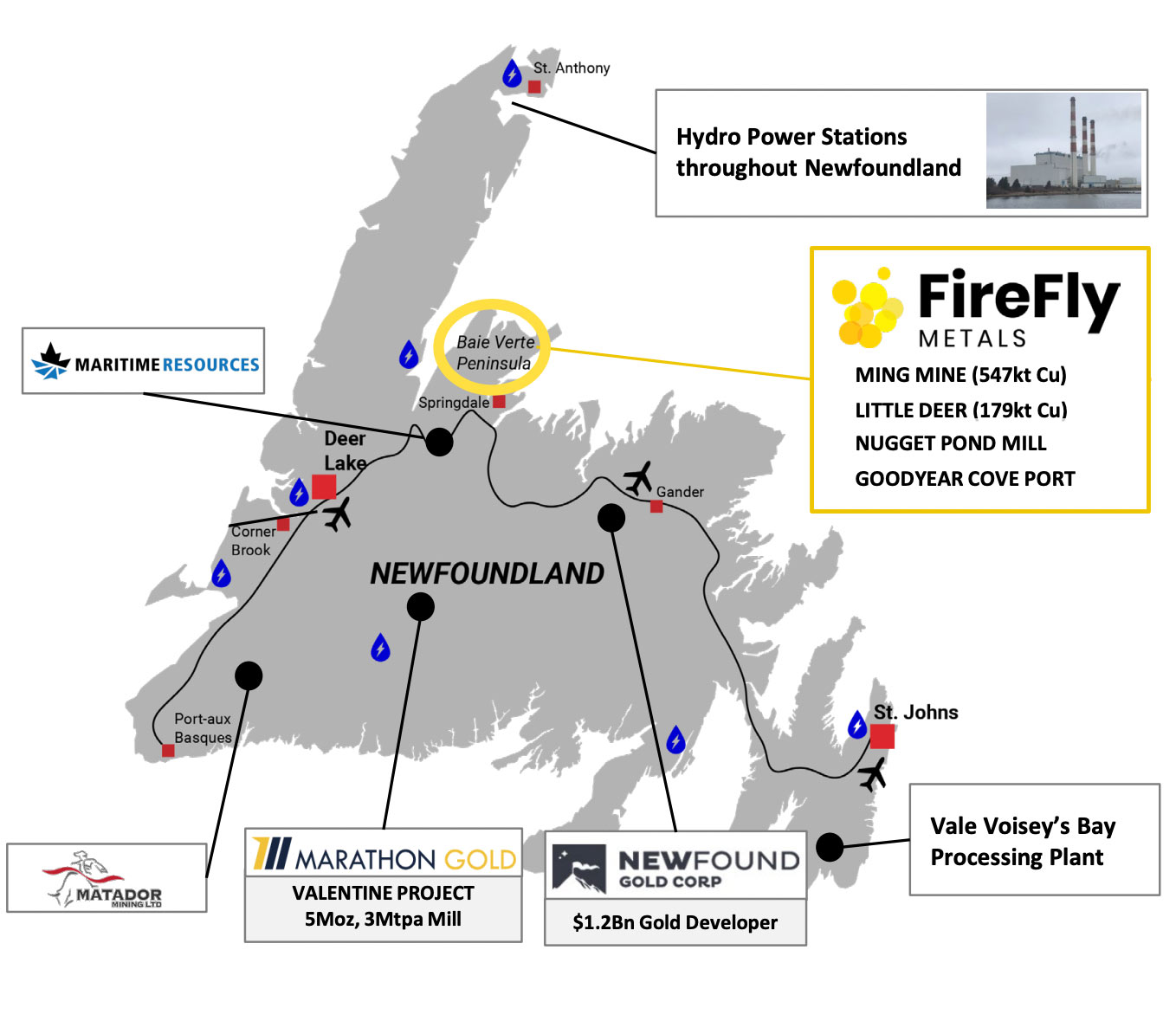

Their company maker is a Canadian copper-gold project called Green Bay.

Green Bay was acquired late 2023 for $65m in cash and shares after previous owner Rambler Metals and Mining went bankrupt.

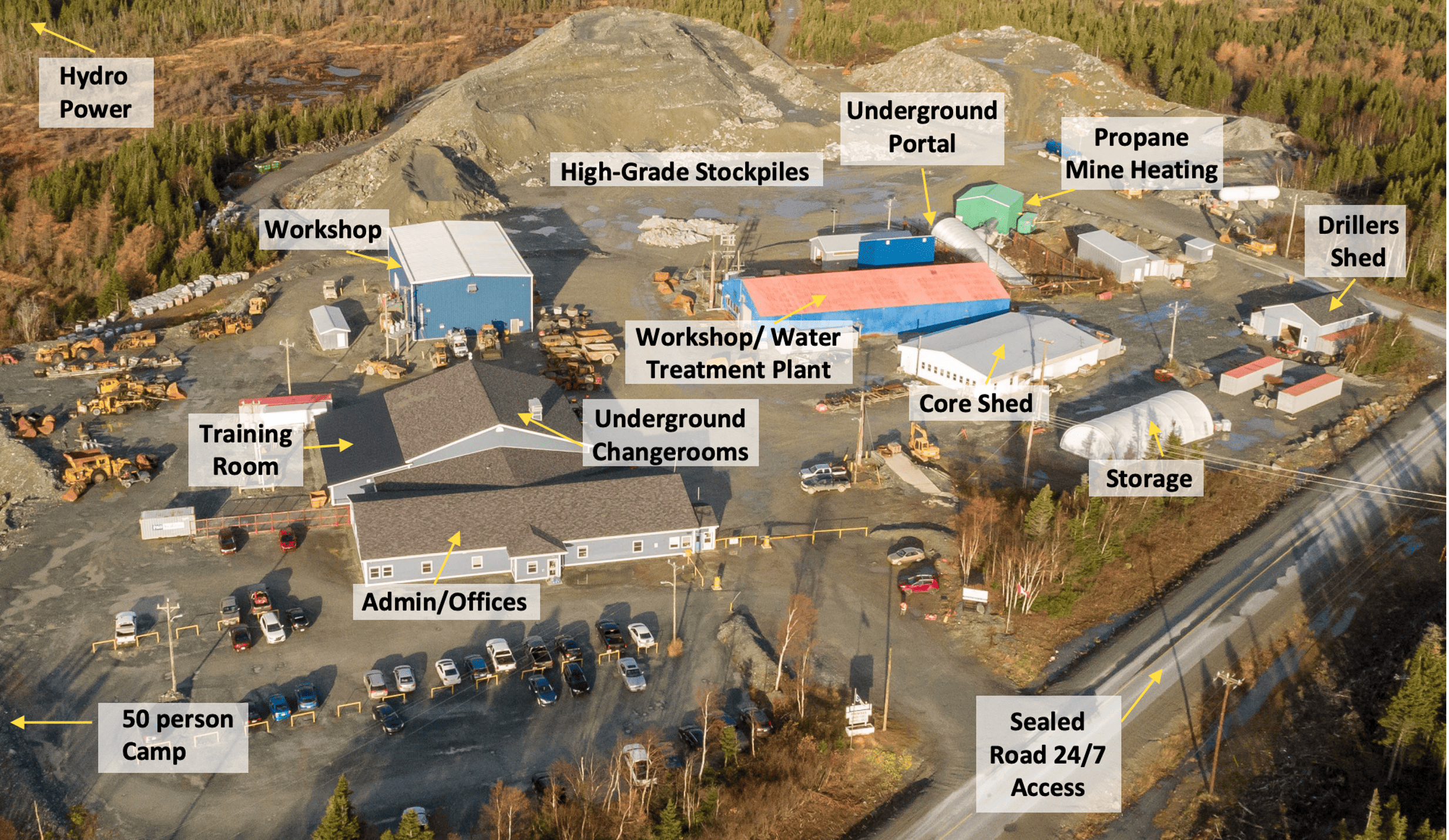

It comes with a ~40Mt resource grading 2.1% copper (plus gold credits) for 811 999t of copper equivalent, mostly at the Ming mine, and $250m worth of infrastructure.

There’s always a healthy scepticism amongst investors when a mining project is acquired out of bankruptcy. Is it a dud? Are we throwing good money after bad?

Not at all, says Steve Parsons, who says his team of BGL and Northern Star alumni continue to live by the mantra “geology first”.

“This is one of the best projects I have ever seen geologically, ever, in my whole history of working in the industry,” he told Stockhead.

“There were several reasons [Rambler] went under. It is a bit like that TV show Air Crash Investigation, which I really like because it makes you realise how difficult it is for a plane to crash.”

Like a plane crash, there is never any one reason why a mine fails, Parsons says. There were several things that went very bad for Rambler all at the same time.

“One of those is that they took on way too much debt,” he says.

“They also had this massive, 40Mt orebody and a very small processing plant – they were squeezing something potentially world class into a tiny jam jar. That made it a higher cost operation.

“The processing plant was also located 40km away from the site, which made it a high-cost trucking exercise.”

Firefly also says there was a lack of investment in drilling prior to mining, which led to poor extraction and reactionary mine planning & decision making.

But the mine was still profitable, even at low copper prices. What tipped Rambler over the edge was its unsustainable debt pile and a poorly thought out gold stream/royalty deal. It meant they made no profits from the substantial gold credits.

“The final bit of debt they also took on came with a gold stream and a gold royalty associated with it,” Parsons says.

“The orebody is 1.85% copper and 0.5g/t gold – so from all that gold, and there was a lot of it, they didn’t make any profit whatsoever.

“It was all taken by the stream and the royalty. That was a quarter of their profits gone. They just ran out of money.”

That deal was thankfully extinguished by the bankruptcy process.

Most importantly, all the issues that culminated in Rambler’s failure are fixable and have nothing to do with the orebody itself.

Its why there were ~30 parties bidding for Green Bay besides Firefly, which won the asset based on its veteran team and its part cash, part scrip offer.

“I think the previous creditors could see that scrip would be worth more. They believed the project was sound,” Parsons says.

“We knew a few of them quite well, and so I think they had real faith we could turn this project around.”

‘Geology first’

“One of the things we really pride ourselves on is that everything we look at goes back to the basics of the geology,” Parsons says.

“With Bellevue we could see that was going to turn into something substantial very quickly. With Auteco/Firefly, we saw that at Pickle Crow, one of the world’s highest grade gold projects.

“We weren’t expecting to jump into another project but because Green Bay was so robust geologically, our view was that this has real potential to turn into something globally significant.

“It’s exactly what we see with Pickle Crow, and exactly what we saw with Bellevue.”

Bellvue provides a template for success in other ways. Very simple, straightforward step-out growth, for example.

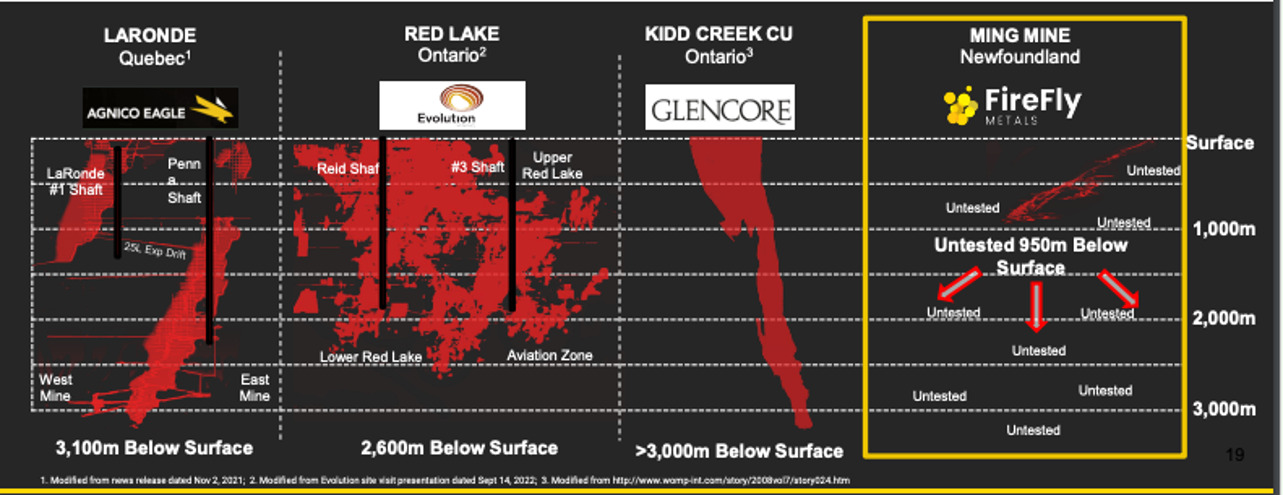

“The orebody is completely open,” Parsons says.

“In fact, we are drilling it right now and are seeing very good visuals, as you would expect. We expect to see this orebody just carrying on.”

Weekly copper drilling highlights pic.twitter.com/OYwjH35o9a

— MinerDeck (@MinerDeck) December 14, 2023

The other factor is that neither property had actual exploration work done for 30 years, which means there’s a real chance of additional discoveries.

But the big similarity is that all that underground infrastructure.

“Bellevue was able to fast-track quickly into production after discovery [thanks to existing infrastructure]. That mine was up and running in almost record time,” Parsons says.

“Here at Green Bay and there’s something like $250m of underground infrastructure ready to go with a shaft and a decline, ventilation, and hydro power.

“This should be fast-tracked into production as well. If you can show a pathway to production that is quick, low cost and has scale then shareholders should be rewarded.”

The road to the mid tier

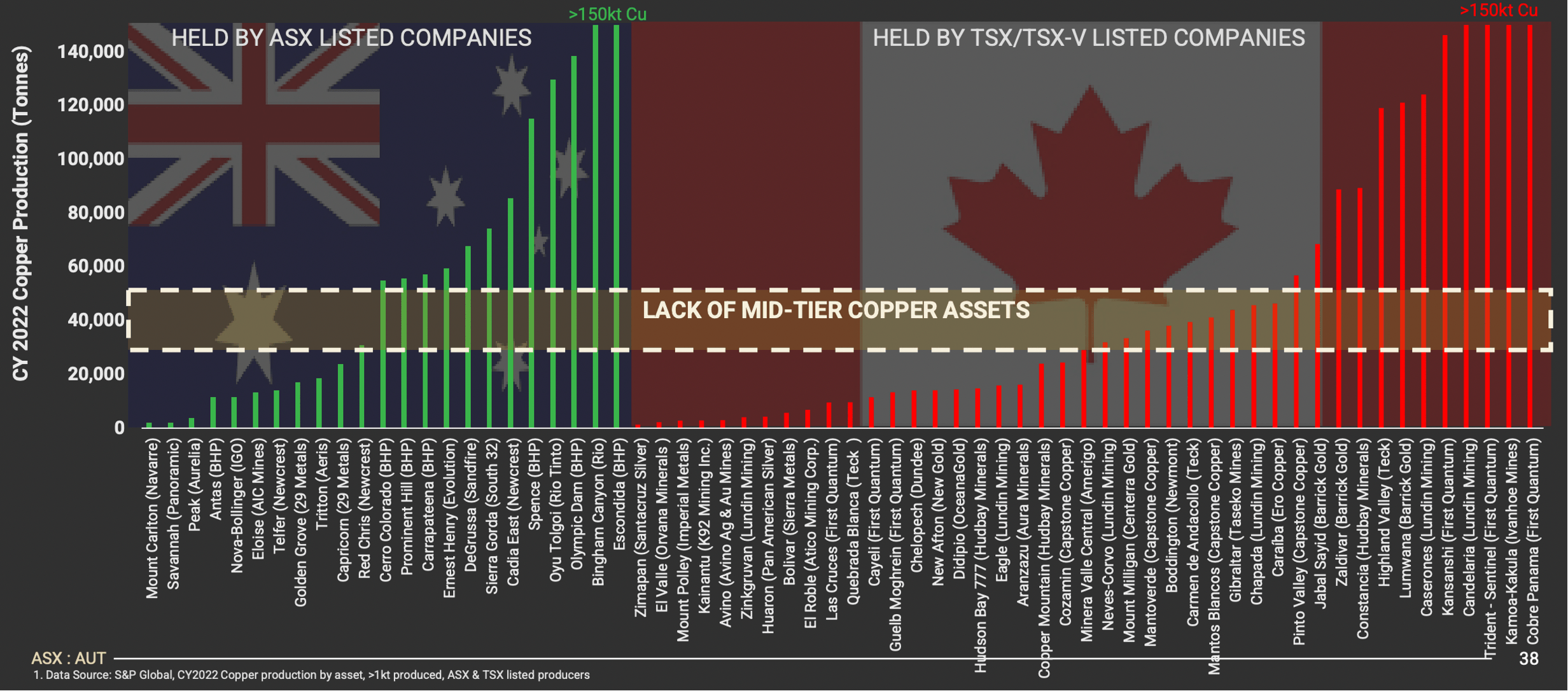

The ASX and TSX/TSXV copper mid-tier has been plundered by M&A over the past few years, with only Sandfire (ASX:SFR) left standing on the local bourse.

Firefly is hoping to change that.

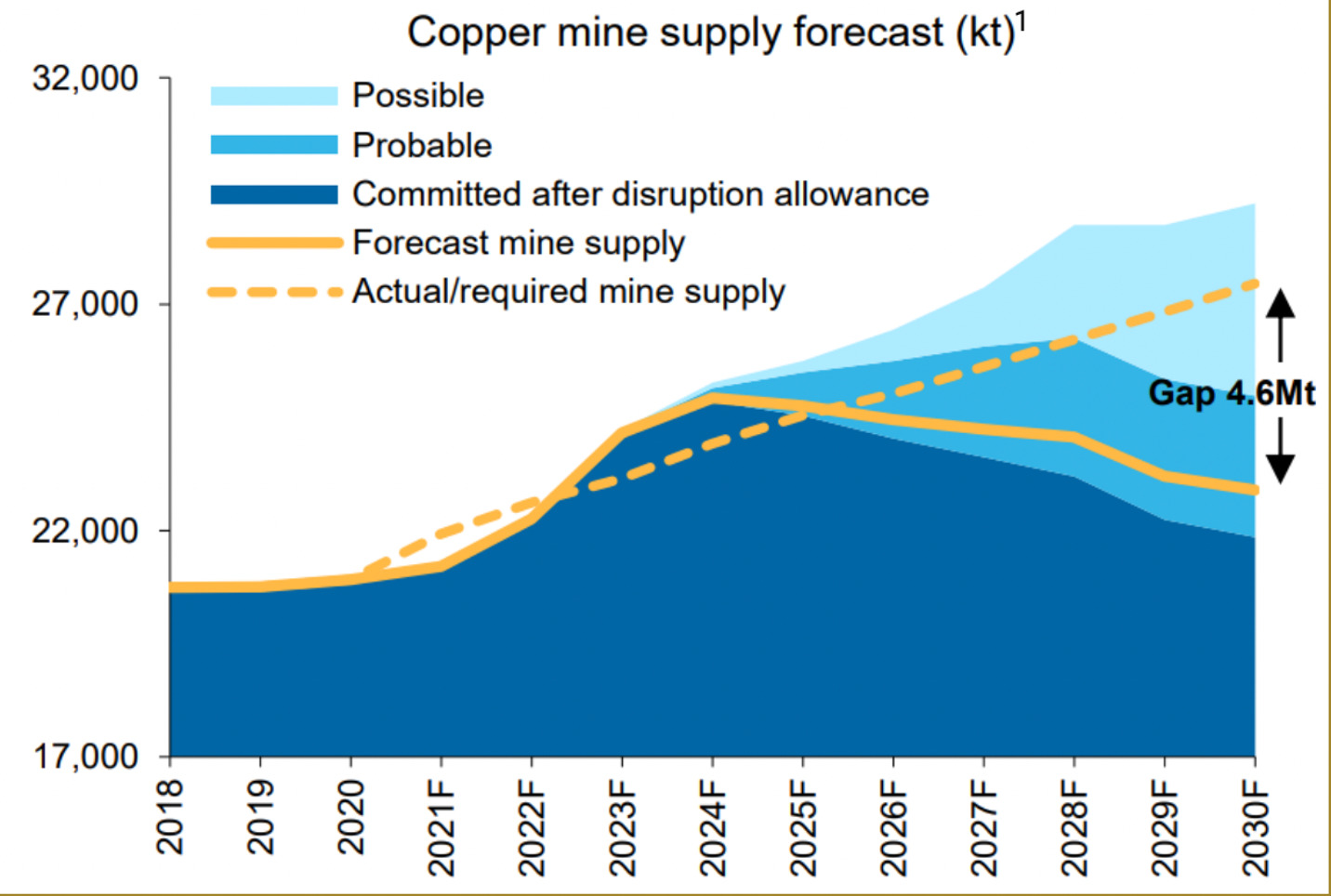

Parsons believes the company’s plan to supersize Green Bay could put it in an enviable position ahead of a widely predicted copper boom.

“When it was in production [Green Bay] was doing 10-12,000t copper a year. I’m not sure where that sits in the scheme of things and it’s not really relevant, as we are not planning on turning it back on,” Parsons says.

“Our view is that we would like to see a 2Mtpa, 4Mpta or perhaps even bigger processing plant on site. If the head grade is anywhere between 1.9-2.2% copper eq, you are talking good scale, in the top few copper producers on the ASX.

“We’d probably be next after Sandfire if we produce those sorts of numbers. That’s our goal.”

Firefly’s plans for Green Bay in 2024 include a lot of drilling.

“The drill rigs are on site so 2024 is really a year of drill results, stepping out, resource growth, demonstrating that this orebody is robust, and then moving it quickly though economic study work,” Parsons says.

“2024 is going to be a very exciting year for us.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.