Resources Top 5: A monstrous manganese resource ‘exceeds expectations’

Mining

Here are the biggest small cap resources winners in early trade, Wednesday April 13.

The explorer has boosted resources by ~600% — to 104 million tonnes at 10.5% manganese — at the ‘Flanagan Bore’ project (51% ownership) in the Pilbara.

Manganese is an essential ingredient in steel making, where it is used to harden steel and remove impurities from iron, like oxygen and sulphur. That market accounts for more than 80% of end user demand.

But increasingly manganese producers are looking to find a niche in supplying high purity stuff to the EV market, where the metal is a major component in long range nickel-cobalt-manganese batteries.

The resources defined at Flanagan Bore’s ‘LR1’ and ‘FB3’ deposits were based on results from a maiden 4,312m drill program completed in December.

“The company is very fortunate that from our first drill program at Flanagan Bore, we have been able to deliver a large-scale, high quality manganese mineral resource,” BCA exec director Brendan Cummins says.

“In my experience, this is uncommon and is testament to the robustness of the mineralisation we have discovered at FB3 and LR1.”

Defining an Indicated resource of greater than 100Mt has “more than exceeded our expectations” at such an early stage for the project, Cummins says.

“In addition, the outcropping higher-grade zones averaging 12.8% manganese within this mineral resource exhibit impressive geological and grade continuity, both of which are extremely positive factors for resource optimisation and potential mining scenarios,” he says.

“The large tonnage resource also enables the company to consider using elevated cut-off grades to increase the mine feed grade whilst maintaining sufficient tonnage for a long-life mining operation.”

Flanagan’s Bore will probably only get bigger from here.

Cummins says there are several other manganese targets that have only been partly tested or remain untested such as FB1, FB5 and FB6 “with the potential to deliver significant additional tonnage to the project”.

Flanagan Bore is part of the Carawine JV and is subject to a farm-in and joint venture agreement with Carawine Resources (ASX:CWX). BCA is earning up to 75% in the project by sole-funding an additional $2.5m of exploration spending.

CWX is currently in a trading halt pending drilling results from its unrelated ‘Big Freeze’ copper-gold prospect.

(Up on no news)

This energetic WA junior is juggling several balls right now.

Two of these are lithium related – the wholly owned ‘Coolgardie West’ project, and the ‘Nepean’ joint venture with Auroch Minerals (ASX:AOU).

Last week, LSR announced surprise lithium hits from the re-assaying of old drilling at the Nepean nickel-lithium project JV.

Auroch owns an 80% interest and is the operator of the WA project.

The results include 1m at 0.88% Li2O, from 78m within 4m at 0.35% Li2O from 78m – and were intersected accidentally as the drilling was targeting nickel mineralisation.

Bonus.

LSR has also recently expanded regional exploration plans at its Coolgardie West project in WA off the back of “significant gold and lithium potential” and plans to drill multiple traverses over the pegmatite “as soon as practicable”.

The $20m market cap stock is up 60% year-to-date.

SCN raised $3m to advance lithium and base metals exploration in WA.

It was done at 5.1c per share — a 23% discount to the last closing price – but punters didn’t seem to care. The stock had gained 32% to 8.9c in early trade Wednesday.

The focus will be the ‘Pharos’ project in WA, which hosts several high-quality lithium, PGE-Ni-Cu, gold and copper prospects.

Several targets have been prioritised for initial testing, SCN says.

“Scorpion has recently identified a 50km zone of pegmatite intrusion within Pharos which will be a priority focus for the upcoming exploration campaign,” the company says.

“The zone contains mostly greenstone hosted pegmatite intrusions adjacent to a contact with a Rb-Cs enriched altered late granite.

“This area has seen significant historic exploration and small-scale production activity for Sn, Ta, W, Beryl and Emeralds (Poona and Aga Khan – Figures 1 and 2), all of which are present in most significant rare metal provinces (e.g. Pilbara and Greenbushes, WA).”

The $25m market cap stock is up 40% year-to-date.

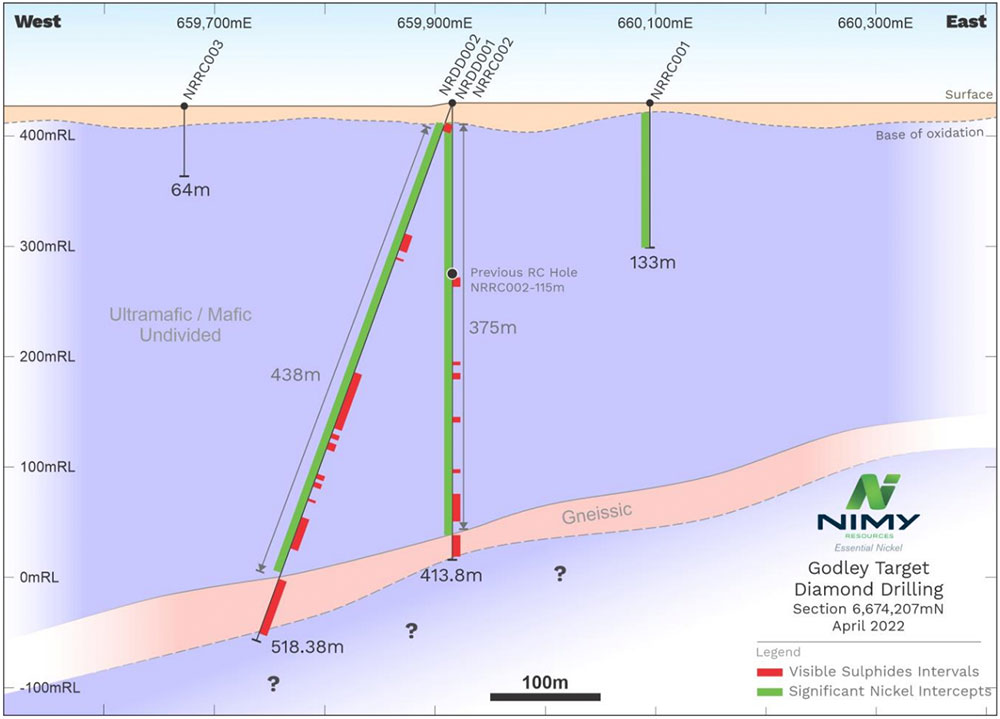

Freshly listed NIM hit a 438m-long nickel-copper zone — including semi-massive (good grade) sulphides – at ‘Godley’, part of the ‘Mons’ nickel project in WA.

This is hole #2. Hole #1 hit an also very good 275m-long mineralisation zone.

Assays are pending for both holes, which started from the same spot but were orientated differently.

You can see that here:

“This is a highly promising start to our drilling campaign at Mons,” NIM chair Simon Lill says.

“We have now intersected nickel sulphides with nickel and copper mineralisation over substantial widths in two holes.

“These results provide strong evidence that Godley hosts a large mineralised system with potential for high-grade zones.

“We will now prioritise down-hole EM to help us with drill targeting at Godley while at the same time drilling is underway at the Dease target 7km to the north, where we recently discovered a nickel-bearing gossan at surface.”

DHEM surveying involves sending a probe attached to a wire cable down a completed drill-hole.

The probe is able to detect conductive sulphide mineralisation off-hole, with the potential to “see” mineralisation up to 75m away.

The technique is widely used in base metal exploration, and has played a pivotal role in some of the share market’s most famous discoveries – like Sandfire Resources’ (ASX:SFR) DeGrussa and Monty discoveries and Sirius Resources’ Nova-Bollinger discoveries.

$21m market cap NIM is up 104% year-to-date.