High Voltage: EV sales pick up in Australia as Americans fret over Chinese Seagulls

Pic via Getty Images

- The stats are in and it’s official, the EV sales narrative in Australia went up a gear last year

- The Seagull is swooping into the Americas, and the Americans are worried

- Leading weekly battery metals gainers on the ASX include: IG6, LRD, BKT

What’s moving, what’s shaking in the land of the lithium lizards (and other battery metals)? Let’s see…

We’ll tell you what’s moving and shaking car sales stats across Australia – EVs.

And in case you needed to hear it, that has no small amount of relevance to the re-fuelling lithium-hunting, lithium-producing narrative in Australia, given the commodity is the most crucial component within EV batteries – now and for the foreseeable.

Also… what’s got American car manufacturers shaking in their rawhide boots? The Chinese, specifically BYD and its supa-cheep Seagull runabout.

More on both these things… presently.

First, though, let’s check in on some relevant global battery metals market activity. Okay, pretty much just the lithium “spot” pricings outta lithium and EV markets dominant China.

As the Lithium Price Bot tells us, the recent surge in lithium carbonate has cooled a tad for the moment – it happens – but it still looks bottomy from where we’re sitting.

2024-03-20#Lithium Carbonate 99.5% Min China Spot

Price: $15,621.94

1 day: $0.00 (0.0%) ➡️

YTD: 14.19%#Spodumene Concentrate (6%, CIF China)Price: $1,079.00

1 day: $4.0 (0.37%) 📈

YTD: -17.95%Sponsored by @portofino_porhttps://t.co/IVBXLQUzGi

— Lithium Price Bot (@LithiumPriceBot) March 20, 2024

At the most recent market close in China, lithium carbonate futures fell a tad – by about 1.3%, putting a halt to the recent futures contango (upswing). Nevertheless, they were still a good deal above the average lithium carbonate spot price shown above.

Australian EV sales see record year in 2023

Diehard, Summernats-digging, Mad Max-loving petrol heads: been flipping the bird at a few more Teslas or BYDs on the roads lately? There’s a reason for that.

If you haven’t seen it yet, the Electric Vehicle Council – the national body representing the EV industry in Australia – has published its Electric Vehicle Industry Recap for 2023. The findings are fairly illuminating.

Key takeaways below, but the most key-turning of all key takeaways is that subhead above – 2023 was a record one for EV sales in Australia, with a greater range of choice for buyers and more affordable options than seen in the past.

Even in the Northern Territory, where you’d be excused for thinking it’s illegal to drive anything but a petrol/diesel-guzzling Hilux, there are some signs of the electric vehicle narrative being slowly embraced.

For example, three new EV charging stations recently opened in Katherine, Tennant Creek and Alice Springs as part of a $78.6 million deal between the Federal Government and NRMA to establish a national EV fast-charging network.

Notably, though, from the EV Council report…

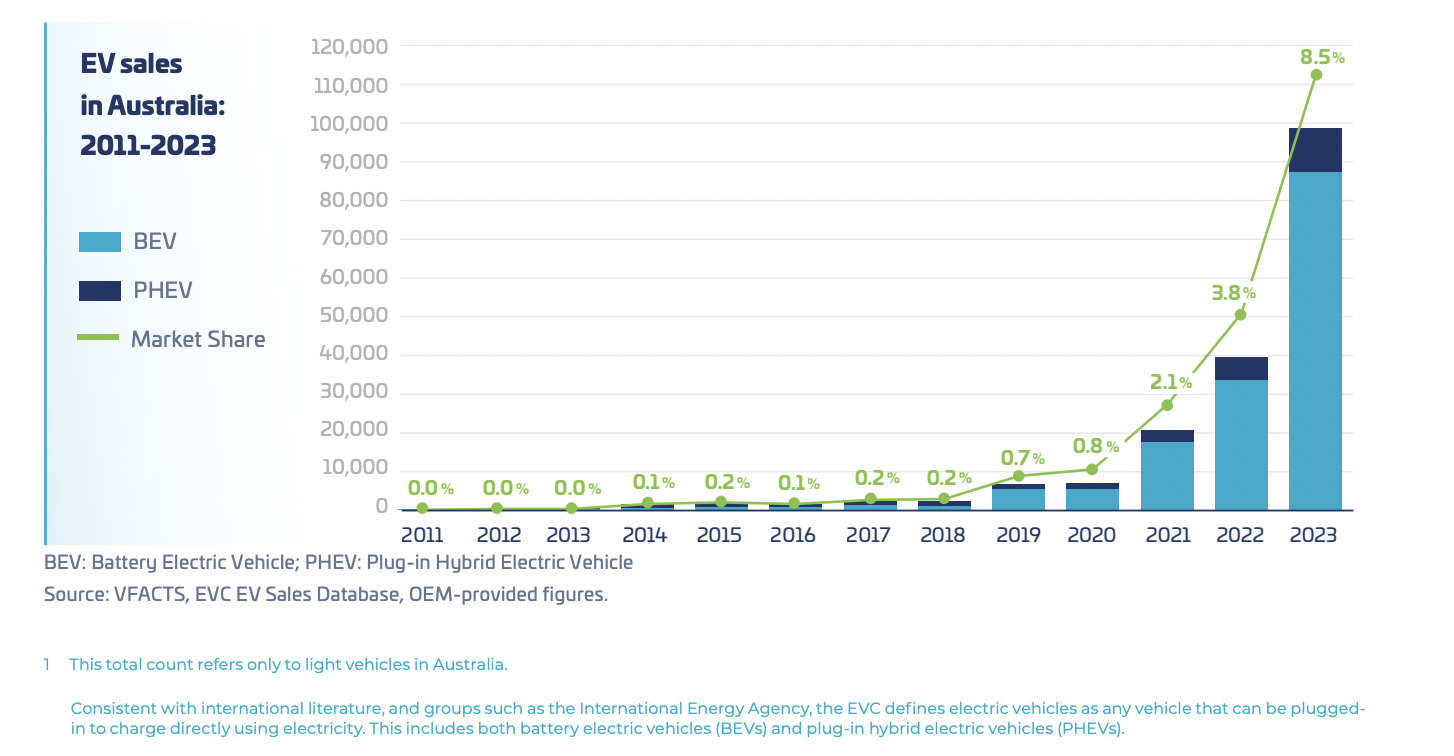

- Australian EV sales (including BEVs and PHEVs) grew by 120% in 2023

- Nearly 9% of new vehicle sales in Australia in 2023 were pure electric vehicles (BEVs and PHEVs)

- The total Australian EV fleet surpassed 180,000 electric vehicles

- Charging infrastructure locations increased by 75 per cent, with 348 locations added across Australia

Here’s a graph from the report. Not too hard to spot the growing narrative, really, is it…

Meanwhile, there’s another factor that will play into the Aussie EV industry’s hands before too long, and that’s the Federal Government’s plans to introduce new fuel efficiency standards in order to make EVs more price-competitive compared with petrol cars.

Car makers nervy as Chinese Seagull swoops

Another in-case-you-missed-it note here… but Chinese EV-making titan BYD is continuing its assault on the global auto manufacturing trade, with its prime weapon of mass deflation being the super-duper cheap auto, the Seagull.

This little thing here, making big global squawks and currently spreading into the Americas…

Goldman: "China now installs more industrial robots and graduates more engineers than the rest of the world combined. In 2023 it became the world’s largest auto exporter. Electric vehicles priced as low as $9,700 for the well-reviewed BYD Seagull subcompact – comparable to the… pic.twitter.com/x10QyP9NX3

— ₦₳V𝚜𝚝é𝚟𝚊 🇷🇺 ᴢ (@Navsteva) March 19, 2024

The BYD Seagull is a city runabout EV that came about, somewhat outta the blue, last year. It’s the smallest vehicle among the BYD range and it sports sharp, angular looks, a dash shaped like a seagull’s wing, apparently, and not two, not four but SIX airbags plus a rotating touchscreen infotainment system.

It also charges well enough and drives okay from city point A to city point B, according to reviews we’ve seen here and there.

Another 3583 BYD NEVs (Destroyer 05 & others) departing Xiaomo port on 3/4 to Brazil, will stop in South Africa

Another RoRo ship w/ 3700 NEVs (Seagull, Song+ DM-i) just arrived in Brazil

BYD cannot get those RoRo ships fast enough, so much demand to Latam countries

PHEVs sales… pic.twitter.com/VNLHoSR54A— tphuang (@tphuang) March 12, 2024

And the reports are, it could be hitting Aussie shores before the end of the year, along with other offerings from the Chinese company, including, according to Carsales.com.au, a plug-in hybrid ute, as yet unnamed.

But in the meantime, it’s American car manufacturers who are quaking in their boots over in Detroit. The threat hasn’t hit them hard yet, because for the moment they’re staving off the Seagull’s arrival. But maybe it’s only a matter of time.

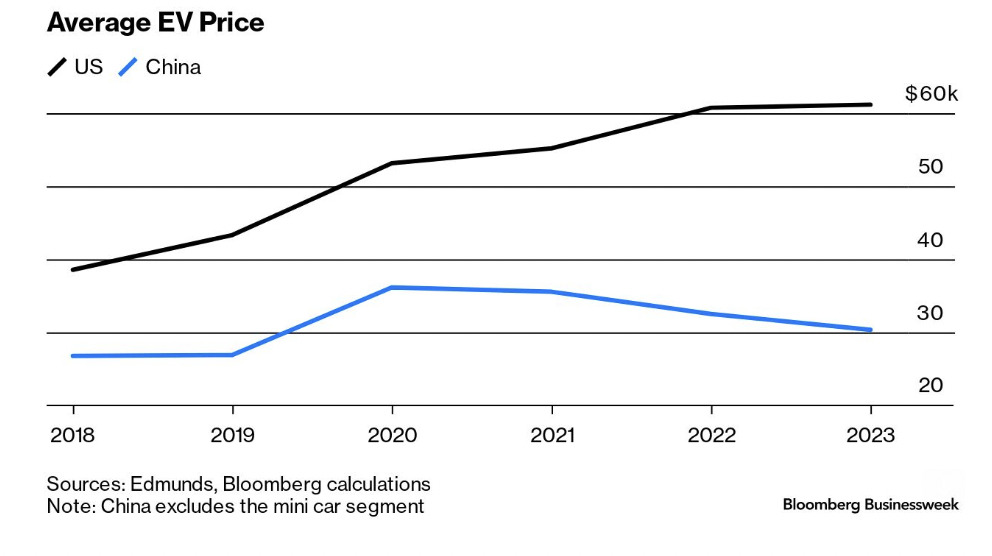

Why is this thing perceived as such a threat by the likes of Ford, General Motors and Tesla? As mentioned, its price tag is so ridonculously far below any other EV before it, coming in at around US$9,700.

As Bloomberg noted this week – “that undercuts the average price of an American EV by more than $50,000 (and is only a little more than a high-end Vespa scooter)”.

The media outlet continued:

“Such aggressive pricing by BYD, which surpassed Tesla in late 2023 to become the world’s top seller of electric vehicles, is indicative of how Chinese automakers will likely force US manufacturers to pivot away from mainly producing expensive second cars for the affluent and toward more reasonably priced EVs for the everyman.”

And just to back that up, here’s another striking graph – courtesy of Bloomberg…

“The Chinese offensive is possibly the biggest risk that companies like Tesla and ourselves are facing right now,” noted Carlos Tavares, CEO of Chrysler parent Stellantis in February. “We have to work very, very hard to make sure that we bring our consumers better offerings than the Chinese.”

ASX battery metals form guide:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop. (Note: figures accurate per ASX at 4pm March 20.)

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| PVW | PVW Res Ltd | 0.025 | -7% | -26% | -67% | $2,535,119 |

| A8G | Australasian Metals | 0.071 | -1% | -19% | -54% | $3,700,555 |

| INF | Infinity Lithium | 0.071 | -3% | -5% | -35% | $32,844,039 |

| LPI | Lithium Pwr Int Ltd | 0.565 | 0% | 4% | 95% | $361,898,974 |

| PSC | Prospect Res Ltd | 0.08 | 10% | 11% | -54% | $37,066,557 |

| PAM | Pan Asia Metals | 0.16 | 0% | 0% | -54% | $26,850,684 |

| CXO | Core Lithium | 0.165 | -25% | -30% | -80% | $331,225,009 |

| LOT | Lotus Resources Ltd | 0.415 | 6% | 28% | 137% | $732,486,442 |

| AGY | Argosy Minerals Ltd | 0.15 | -6% | 30% | -73% | $217,683,162 |

| AZS | Azure Minerals | 3.62 | 0% | 0% | 1216% | $1,660,420,062 |

| NWC | New World Resources | 0.038 | 3% | -3% | -5% | $90,739,682 |

| QXR | Qx Resources Limited | 0.017 | -11% | -15% | -45% | $17,761,246 |

| GSR | Greenstone Resources | 0.007 | 0% | 0% | -67% | $9,576,794 |

| CAE | Cannindah Resources | 0.06 | -12% | -22% | -63% | $34,684,797 |

| AZL | Arizona Lithium Ltd | 0.026 | 0% | -4% | -43% | $106,719,689 |

| RIL | Redivium Limited | 0.005 | 67% | 0% | -55% | $8,192,564 |

| COB | Cobalt Blue Ltd | 0.145 | -3% | -22% | -59% | $54,848,187 |

| ESS | Essential Metals Ltd | 0 | -100% | -100% | -100% | $135,278,382 |

| LPD | Lepidico Ltd | 0.0055 | -8% | -8% | -50% | $38,191,540 |

| MRD | Mount Ridley Mines | 0.002 | 0% | 0% | -50% | $15,569,766 |

| CZN | Corazon Ltd | 0.009 | 0% | 0% | -40% | $5,540,381 |

| LKE | Lake Resources | 0.068 | -30% | -50% | -87% | $114,637,676 |

| DEV | Devex Resources Ltd | 0.29 | -9% | -11% | 21% | $132,357,201 |

| INR | Ioneer Ltd | 0.16 | 3% | 14% | -40% | $337,921,944 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0.037 | -3% | -8% | -5% | $22,783,117 |

| RLC | Reedy Lagoon Corp. | 0.004 | 0% | 0% | -31% | $2,478,163 |

| GBR | Greatbould Resources | 0.06 | -8% | 0% | -29% | $35,921,232 |

| FRS | Forrestaniaresources | 0.018 | -22% | -18% | -81% | $2,912,143 |

| STK | Strickland Metals | 0.087 | -2% | 9% | 135% | $142,827,770 |

| MLX | Metals X Limited | 0.355 | 0% | 15% | 31% | $335,688,445 |

| CLA | Celsius Resource Ltd | 0.014 | 8% | 17% | -13% | $33,690,775 |

| FGR | First Graphene Ltd | 0.052 | -9% | -12% | -40% | $37,560,248 |

| HXG | Hexagon Energy | 0.025 | 56% | 79% | 127% | $13,848,729 |

| TLG | Talga Group Ltd | 0.795 | -9% | 4% | -46% | $305,702,108 |

| MNS | Magnis Energy Tech | 0.042 | 0% | 0% | -87% | $50,378,922 |

| OZL | OZ Minerals | 0 | -100% | -100% | -100% | $8,918,404,433 |

| PLL | Piedmont Lithium Inc | 0.19 | -10% | -17% | -77% | $71,009,013 |

| EUR | European Lithium Ltd | 0.075 | 12% | -13% | 10% | $92,019,786 |

| BKT | Black Rock Mining | 0.082 | 30% | 30% | -29% | $95,480,099 |

| QEM | QEM Limited | 0.155 | -3% | -9% | -21% | $24,222,674 |

| LYC | Lynas Rare Earths | 5.8 | -1% | -2% | -12% | $5,355,798,545 |

| ESR | Estrella Res Ltd | 0.0045 | 0% | 13% | -59% | $7,037,487 |

| ARL | Ardea Resources Ltd | 0.72 | 20% | 71% | 41% | $145,792,517 |

| GLN | Galan Lithium Ltd | 0.385 | -11% | 13% | -62% | $147,949,901 |

| JLL | Jindalee Lithium Ltd | 0.74 | -8% | -12% | -69% | $47,182,291 |

| VUL | Vulcan Energy | 2.88 | 0% | 40% | -52% | $521,381,214 |

| SBR | Sabre Resources | 0.017 | -6% | -23% | -37% | $7,110,977 |

| CHN | Chalice Mining Ltd | 1.11 | -15% | -3% | -82% | $425,914,818 |

| VRC | Volt Resources Ltd | 0.005 | 0% | -17% | -55% | $22,715,587 |

| NMT | Neometals Ltd | 0.15 | -23% | 7% | -73% | $87,193,444 |

| AXN | Alliance Nickel Ltd | 0.04 | 3% | -11% | -56% | $29,033,585 |

| PNN | Power Minerals Ltd | 0.18 | 0% | 6% | -48% | $16,164,579 |

| IGO | IGO Limited | 7.58 | -2% | 5% | -38% | $5,868,825,551 |

| GED | Golden Deeps | 0.046 | 7% | 12% | -34% | $4,967,461 |

| ADV | Ardiden Ltd | 0.15 | 0% | -6% | -42% | $10,315,388 |

| SRI | Sipa Resources Ltd | 0.019 | 6% | -21% | -21% | $4,335,005 |

| NTU | Northern Min Ltd | 0.033 | 10% | 10% | -6% | $195,062,315 |

| AXE | Archer Materials | 0.455 | 12% | 26% | -1% | $107,035,745 |

| PGM | Platina Resources | 0.02 | -9% | 11% | 11% | $12,463,607 |

| AAJ | Aruma Resources Ltd | 0.018 | 6% | 6% | -68% | $3,544,047 |

| IXR | Ionic Rare Earths | 0.018 | -5% | -5% | -40% | $78,017,486 |

| NIC | Nickel Industries | 0.77 | -7% | 13% | -11% | $3,428,647,904 |

| EVG | Evion Group NL | 0.023 | 0% | -21% | -63% | $7,265,143 |

| CWX | Carawine Resources | 0.105 | 0% | 6% | 9% | $24,793,172 |

| PLS | Pilbara Min Ltd | 3.9 | -6% | 8% | 6% | $11,797,114,344 |

| HAS | Hastings Tech Met | 0.605 | -2% | -17% | -79% | $80,207,324 |

| BUX | Buxton Resources Ltd | 0.11 | -8% | -15% | -42% | $19,923,393 |

| ARR | American Rare Earths | 0.295 | 7% | -24% | 48% | $140,625,640 |

| SGQ | St George Min Ltd | 0.021 | 5% | -9% | -65% | $20,759,349 |

| TKL | Traka Resources | 0.002 | 33% | 0% | -58% | $3,501,317 |

| PAN | Panoramic Resources | 0.035 | 0% | 0% | -72% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | 11% | $48,441,219 |

| IPT | Impact Minerals | 0.015 | 7% | 25% | 88% | $42,970,558 |

| LIT | Lithium Australia | 0.029 | 7% | 0% | -19% | $37,891,042 |

| ARN | Aldoro Resources | 0.078 | -1% | -18% | -66% | $10,500,652 |

| JRV | Jervois Global Ltd | 0.024 | -25% | 0% | -81% | $64,860,496 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | $751,215,521 |

| SYR | Syrah Resources | 0.525 | -24% | -14% | -66% | $366,518,402 |

| FBM | Future Battery | 0.061 | -2% | 2% | 33% | $33,092,871 |

| ADD | Adavale Resource Ltd | 0.005 | 0% | -17% | -61% | $5,055,861 |

| LTR | Liontown Resources | 1.24 | -6% | -2% | -25% | $3,016,944,411 |

| CTM | Centaurus Metals Ltd | 0.325 | 16% | 12% | -60% | $148,499,201 |

| VML | Vital Metals Limited | 0.004 | 0% | -20% | -81% | $23,580,268 |

| BSX | Blackstone Ltd | 0.065 | 0% | 8% | -59% | $31,450,267 |

| POS | Poseidon Nick Ltd | 0.007 | -13% | -13% | -81% | $25,994,743 |

| CHR | Charger Metals | 0.125 | 4% | -11% | -52% | $9,677,531 |

| AVL | Aust Vanadium Ltd | 0.016 | -6% | -11% | -48% | $146,342,854 |

| AUZ | Australian Mines Ltd | 0.013 | -13% | -13% | -62% | $16,984,643 |

| TMT | Technology Metals | 0 | -100% | -100% | -100% | $67,134,856 |

| RXL | Rox Resources | 0.16 | -3% | -3% | -40% | $60,943,453 |

| RNU | Renascor Res Ltd | 0.084 | -1% | -13% | -58% | $210,770,822 |

| GL1 | Globallith | 0.52 | -15% | -1% | -59% | $143,145,914 |

| BRB | Breaker Res NL | 0 | -100% | -100% | -100% | $158,126,031 |

| ASN | Anson Resources Ltd | 0.094 | -15% | 7% | -56% | $118,378,995 |

| SYA | Sayona Mining Ltd | 0.038 | -10% | -41% | -83% | $411,731,841 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.175 | -13% | 35% | -13% | $80,590,648 |

| ATM | Aneka Tambang | 1.1 | 0% | 0% | 0% | $1,434,014 |

| TVN | Tivan Limited | 0.059 | 0% | 23% | -22% | $94,421,199 |

| ALY | Alchemy Resource Ltd | 0.008 | 0% | 14% | -47% | $9,424,610 |

| GAL | Galileo Mining Ltd | 0.245 | -4% | 0% | -56% | $47,429,982 |

| BHP | BHP Group Limited | 43.81 | 3% | -5% | 1% | $220,946,367,315 |

| LEL | Lithenergy | 0.565 | -6% | 35% | -7% | $59,745,800 |

| MMC | Mitremining | 0.35 | 21% | 32% | 52% | $28,532,772 |

| RMX | Red Mount Min Ltd | 0.002 | 0% | -20% | -33% | $5,347,152 |

| GW1 | Greenwing Resources | 0.071 | 1% | -12% | -67% | $14,318,867 |

| AQD | Ausquest Limited | 0.011 | 0% | 10% | -31% | $9,076,641 |

| LML | Lincoln Minerals | 0.0055 | -8% | -8% | -78% | $9,372,249 |

| 1MC | Morella Corporation | 0.003 | 0% | 0% | -67% | $18,536,398 |

| REE | Rarex Limited | 0.017 | 0% | -6% | -63% | $10,934,185 |

| MRC | Mineral Commodities | 0.024 | -4% | 0% | -55% | $23,627,342 |

| PUR | Pursuit Minerals | 0.0045 | -10% | -10% | -79% | $14,719,857 |

| QPM | Queensland Pacific | 0.042 | -5% | 8% | -60% | $86,539,233 |

| EMH | European Metals Hldg | 0.285 | 2% | -16% | -54% | $39,801,789 |

| BMM | Balkanminingandmin | 0.066 | -3% | -11% | -76% | $4,688,674 |

| PEK | Peak Rare Earths Ltd | 0.23 | 12% | 5% | -49% | $49,199,226 |

| LEG | Legend Mining | 0.016 | 14% | -6% | -59% | $40,662,681 |

| MOH | Moho Resources | 0.006 | 0% | -8% | -68% | $3,235,069 |

| AML | Aeon Metals Ltd. | 0.008 | 33% | 14% | -69% | $7,674,804 |

| G88 | Golden Mile Res Ltd | 0.011 | 0% | -15% | -31% | $4,523,451 |

| WKT | Walkabout Resources | 0.12 | 9% | 0% | -4% | $77,195,067 |

| TON | Triton Min Ltd | 0.015 | -6% | -6% | -52% | $23,420,890 |

| AR3 | Austrare | 0.11 | 5% | -8% | -58% | $17,151,408 |

| ARU | Arafura Rare Earths | 0.2 | 38% | 33% | -61% | $473,611,949 |

| MIN | Mineral Resources. | 67.84 | 2% | 13% | -16% | $13,313,666,254 |

| VMC | Venus Metals Cor Ltd | 0.086 | -9% | -12% | 10% | $16,316,667 |

| S2R | S2 Resources | 0.125 | -17% | -4% | -4% | $56,607,249 |

| CNJ | Conico Ltd | 0.0025 | 0% | 25% | -74% | $3,925,237 |

| VR8 | Vanadium Resources | 0.041 | 5% | 11% | -41% | $22,972,308 |

| PVT | Pivotal Metals Ltd | 0.014 | -13% | -18% | -59% | $9,857,656 |

| BOA | Boadicea Resources | 0.023 | -12% | -15% | -70% | $2,960,468 |

| IPX | Iperionx Limited | 2.25 | 3% | 4% | 217% | $457,383,426 |

| SLZ | Sultan Resources Ltd | 0.012 | -40% | -14% | -77% | $2,568,624 |

| NKL | Nickelxltd | 0.03 | -17% | -17% | -51% | $2,810,085 |

| NVA | Nova Minerals Ltd | 0.265 | -4% | -5% | -42% | $55,885,866 |

| MLS | Metals Australia | 0.022 | -8% | -27% | -44% | $15,562,130 |

| MQR | Marquee Resource Ltd | 0.021 | 5% | -5% | -5% | $8,267,688 |

| MRR | Minrex Resources Ltd | 0.014 | 8% | 8% | -44% | $15,188,145 |

| EVR | Ev Resources Ltd | 0.011 | 0% | -8% | -27% | $14,533,986 |

| EFE | Eastern Resources | 0.008 | -11% | 0% | -33% | $9,314,598 |

| CNB | Carnaby Resource Ltd | 0.55 | 16% | -15% | -45% | $91,193,949 |

| BNR | Bulletin Res Ltd | 0.065 | -6% | -20% | -29% | $19,084,866 |

| AX8 | Accelerate Resources | 0.033 | 10% | 10% | 43% | $20,129,054 |

| AM7 | Arcadia Minerals | 0.07 | 0% | 21% | -67% | $7,524,457 |

| AS2 | Askarimetalslimited | 0.084 | -5% | 5% | -83% | $6,685,368 |

| BYH | Bryah Resources Ltd | 0.01 | 25% | 0% | -52% | $4,789,989 |

| DTM | Dart Mining NL | 0.017 | 21% | 31% | -58% | $3,413,694 |

| EMS | Eastern Metals | 0.029 | 4% | -28% | -53% | $2,390,361 |

| FG1 | Flynngold | 0.045 | 7% | -17% | -46% | $7,386,341 |

| GSM | Golden State Mining | 0.01 | -9% | -17% | -71% | $3,352,448 |

| IMI | Infinitymining | 0.072 | 1% | -31% | -56% | $9,619,025 |

| LRV | Larvottoresources | 0.075 | 25% | 14% | -43% | $14,534,757 |

| LSR | Lodestar Minerals | 0.002 | 0% | 0% | -56% | $4,046,795 |

| RAG | Ragnar Metals Ltd | 0.02 | 5% | -9% | 50% | $9,479,619 |

| CTN | Catalina Resources | 0.004 | 0% | 0% | -33% | $4,953,948 |

| TMB | Tambourahmetals | 0.076 | -6% | -20% | -21% | $6,635,228 |

| TEM | Tempest Minerals | 0.01 | 25% | 43% | -55% | $5,191,244 |

| EMC | Everest Metals Corp | 0.079 | -1% | -2% | 5% | $12,978,366 |

| WML | Woomera Mining Ltd | 0.0045 | 13% | -10% | -63% | $4,872,556 |

| KZR | Kalamazoo Resources | 0.087 | -7% | -17% | -38% | $15,557,515 |

| LMG | Latrobe Magnesium | 0.049 | -2% | -8% | -25% | $92,985,701 |

| KOR | Korab Resources | 0.01 | 11% | 25% | -50% | $3,670,500 |

| CMX | Chemxmaterials | 0.053 | -12% | -24% | -56% | $4,667,159 |

| NC1 | Nicoresourceslimited | 0.165 | -11% | -13% | -63% | $18,018,095 |

| GRE | Greentechmetals | 0.29 | 4% | 23% | 123% | $23,677,793 |

| CMO | Cosmometalslimited | 0.038 | 9% | -17% | -67% | $3,468,007 |

| FRB | Firebird Metals | 0.12 | 9% | 0% | -11% | $17,795,175 |

| S32 | South32 Limited | 2.99 | 3% | 2% | -28% | $14,131,286,732 |

| OMH | OM Holdings Limited | 0.43 | 6% | -4% | -40% | $314,165,288 |

| JMS | Jupiter Mines. | 0.195 | 8% | 5% | -15% | $352,710,957 |

| E25 | Element 25 Ltd | 0.235 | 15% | -6% | -62% | $56,557,887 |

| EMN | Euromanganese | 0.098 | 18% | 24% | -64% | $20,607,259 |

| KGD | Kula Gold Limited | 0.008 | 0% | -11% | -58% | $3,699,695 |

| LRS | Latin Resources Ltd | 0.19 | -12% | -10% | 65% | $545,886,795 |

| CRR | Critical Resources | 0.015 | -6% | 0% | -62% | $30,223,455 |

| ENT | Enterprise Metals | 0.003 | 0% | 0% | -67% | $2,405,913 |

| SCN | Scorpion Minerals | 0.039 | 34% | 105% | -39% | $12,283,686 |

| GCM | Green Critical Min | 0.006 | 50% | 0% | -45% | $6,819,510 |

| ENV | Enova Mining Limited | 0.03 | -19% | 0% | 150% | $20,537,880 |

| RBX | Resource B | 0.045 | 10% | -18% | -67% | $3,720,802 |

| AKN | Auking Mining Ltd | 0.018 | -5% | -36% | -72% | $4,707,074 |

| RR1 | Reach Resources Ltd | 0.003 | 9% | 64% | 9% | $9,016,640 |

| EMT | Emetals Limited | 0.005 | 0% | -9% | -44% | $4,250,000 |

| PNT | Panthermetalsltd | 0.038 | 0% | -22% | -71% | $3,312,314 |

| WIN | Widgienickellimited | 0.052 | -31% | 18% | -82% | $16,684,923 |

| WMG | Western Mines | 0.165 | 3% | -6% | -8% | $11,230,980 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | -50% | $2,133,790 |

| CAI | Calidus Resources | 0.165 | 10% | 0% | -23% | $101,086,600 |

| GT1 | Greentechnology | 0.15 | -21% | 3% | -77% | $47,812,815 |

| KAI | Kairos Minerals Ltd | 0.013 | 0% | 0% | -16% | $36,692,771 |

| MTM | MTM Critical Metals | 0.074 | -10% | -5% | -30% | $9,322,227 |

| NWM | Norwest Minerals | 0.027 | -7% | -13% | -18% | $8,984,238 |

| PGD | Peregrine Gold | 0.22 | -15% | -12% | -47% | $15,543,037 |

| RAS | Ragusa Minerals Ltd | 0.029 | -22% | 7% | -65% | $4,277,964 |

| RGL | Riversgold | 0.008 | -11% | -11% | -53% | $7,741,292 |

| SRZ | Stellar Resources | 0.014 | 17% | 100% | 40% | $21,544,246 |

| STM | Sunstone Metals Ltd | 0.011 | -8% | 0% | -66% | $38,507,167 |

| ZNC | Zenith Minerals Ltd | 0.095 | -3% | 1% | -54% | $35,238,088 |

| WC8 | Wildcat Resources | 0.725 | 1% | 27% | 2489% | $850,627,830 |

| ASO | Aston Minerals Ltd | 0.015 | 0% | -25% | -86% | $18,130,900 |

| THR | Thor Energy PLC | 0.024 | 0% | -17% | -52% | $4,604,303 |

| YAR | Yari Minerals Ltd | 0.007 | 17% | -13% | -61% | $3,376,505 |

| IG6 | Internationalgraphit | 0.185 | 68% | 37% | 0% | $16,017,860 |

| LPM | Lithium Plus | 0.14 | -18% | -30% | -44% | $13,328,171 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | -17% | -44% | $5,216,413 |

| KOB | Kobaresourceslimited | 0.1 | -13% | -38% | -30% | $14,997,917 |

| AZI | Altamin Limited | 0.05 | -7% | 2% | -33% | $21,942,452 |

| FTL | Firetail Resources | 0.043 | -14% | -4% | -67% | $6,700,750 |

| LNR | Lanthanein Resources | 0.003 | 0% | -40% | -82% | $5,864,727 |

| CLZDC | Classic Min Ltd | 0.014 | -72% | -72% | -86% | $12,890,085 |

| NVX | Novonix Limited | 0.9 | -10% | 6% | -35% | $437,538,321 |

| OCN | Oceanalithiumlimited | 0.058 | -5% | 4% | -83% | $3,244,590 |

| SUM | Summitminerals | 0.063 | -2% | -19% | -55% | $2,859,428 |

| DVP | Develop Global Ltd | 2.39 | 3% | -1% | -18% | $582,368,594 |

| OD6 | Od6Metalsltd | 0.085 | -8% | -23% | -54% | $5,171,457 |

| HRE | Heavy Rare Earths | 0.043 | 0% | -14% | -54% | $2,600,981 |

| LIN | Lindian Resources | 0.125 | -7% | -14% | -49% | $146,870,085 |

| PEK | Peak Rare Earths Ltd | 0.23 | 12% | 5% | -49% | $49,199,226 |

| ILU | Iluka Resources | 7.38 | 7% | -1% | -27% | $3,119,261,982 |

| ASM | Ausstratmaterials | 1.19 | 16% | 13% | -12% | $165,124,062 |

| ETM | Energy Transition | 0.036 | 3% | 6% | -23% | $50,402,153 |

| VMS | Venture Minerals | 0.019 | 6% | 12% | -10% | $45,333,594 |

| IDA | Indiana Resources | 0.079 | -1% | -5% | 52% | $49,386,965 |

| VTM | Victory Metals Ltd | 0.28 | 0% | 12% | 51% | $22,384,905 |

| M2R | Miramar | 0.019 | 27% | -10% | -60% | $2,679,652 |

| WCN | White Cliff Min Ltd | 0.014 | -13% | 0% | 40% | $22,741,424 |

| TAR | Taruga Minerals | 0.008 | 14% | -11% | -53% | $5,648,214 |

| ABX | ABX Group Limited | 0.056 | -15% | -21% | -49% | $16,502,661 |

| MEK | Meeka Metals Limited | 0.035 | -8% | -5% | -19% | $44,449,522 |

| RR1 | Reach Resources Ltd | 0.003 | 9% | 64% | 9% | $9,016,640 |

| DRE | Dreadnought Resources Ltd | 0.017 | -6% | -15% | -73% | $59,186,740 |

| KFM | Kingfisher Mining | 0.088 | -1% | -2% | -59% | $4,673,205 |

| AOA | Ausmon Resorces | 0.002 | -33% | -33% | -60% | $2,117,999 |

| WC1 | Westcobarmetals | 0.048 | 9% | 7% | -47% | $5,556,815 |

| GRL | Godolphin Resources | 0.036 | 20% | -16% | -29% | $6,092,713 |

| DM1 | Desert Metals | 0.031 | 15% | 7% | -77% | $7,431,919 |

| PTR | Petratherm Ltd | 0.02 | 5% | -20% | -66% | $4,495,023 |

| ITM | Itech Minerals Ltd | 0.078 | 1% | -8% | -68% | $9,415,834 |

| KTA | Krakatoa Resources | 0.009 | -10% | -40% | -70% | $4,248,965 |

| M24 | Mamba Exploration | 0.025 | 0% | -24% | -74% | $4,602,057 |

| LNR | Lanthanein Resources | 0.003 | 0% | -40% | -82% | $5,864,727 |

| TKM | Trek Metals Ltd | 0.035 | -5% | -15% | -49% | $17,957,690 |

| BCA | Black Canyon Limited | 0.1 | -9% | -9% | -56% | $7,014,146 |

| CDT | Castle Minerals | 0.0065 | -7% | 8% | -66% | $7,346,958 |

| DLI | Delta Lithium | 0.315 | -3% | 0% | -10% | $228,290,285 |

| A11 | Atlantic Lithium | 0.375 | -4% | 0% | -23% | $240,377,550 |

| KNI | Kunikolimited | 0.26 | 11% | 21% | -37% | $22,907,731 |

| CY5 | Cygnus Metals Ltd | 0.054 | 2% | -22% | -78% | $14,577,957 |

| WR1 | Winsome Resources | 0.92 | -2% | 19% | -40% | $177,430,097 |

| LLI | Loyal Lithium Ltd | 0.28 | 2% | -8% | 2% | $24,986,196 |

| BC8 | Black Cat Syndicate | 0.2 | -15% | -2% | -43% | $61,495,335 |

| BUR | Burleyminerals | 0.06 | 18% | -10% | -70% | $6,257,805 |

| PBL | Parabellumresources | 0.069 | 11% | -18% | -80% | $3,364,200 |

| L1M | Lightning Minerals | 0.066 | -6% | -7% | -56% | $2,786,854 |

| WA1 | Wa1Resourcesltd | 11.71 | -2% | 8% | 841% | $718,862,186 |

| EV1 | Evolutionenergy | 0.1 | 10% | -5% | -61% | $25,889,286 |

| 1AE | Auroraenergymetals | 0.1125 | -2% | -22% | 17% | $18,308,797 |

| RVT | Richmond Vanadium | 0.325 | -6% | -14% | -14% | $27,155,459 |

| PMT | Patriotbatterymetals | 0.915 | -2% | 3% | -26% | $561,345,116 |

| PAT | Patriot Lithium | 0.08 | 7% | -20% | -67% | $5,221,285 |

| BM8 | Battery Age Minerals | 0.105 | -28% | -32% | -71% | $11,470,040 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | -64% | $4,408,998 |

| VHM | Vhmlimited | 0.5 | -6% | -17% | -28% | $80,036,385 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | 9% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.011 | -8% | 0% | -39% | $19,863,078 |

| SRL | Sunrise | 0.46 | 8% | 15% | -66% | $42,406,924 |

| SYR | Syrah Resources | 0.525 | -24% | -14% | -66% | $366,518,402 |

| EG1 | Evergreenlithium | 0.095 | -17% | -14% | 0% | $5,341,850 |

| WSR | Westar Resources | 0.012 | -8% | -29% | -67% | $2,224,290 |

| LU7 | Lithium Universe Ltd | 0.02 | -9% | -9% | -33% | $7,381,916 |

| MEI | Meteoric Resources | 0.24 | 14% | 33% | 150% | $457,727,564 |

| REC | Rechargemetals | 0.054 | -13% | -39% | -64% | $7,933,828 |

| SLM | Solismineralsltd | 0.096 | -13% | -26% | -29% | $7,495,416 |

| DYM | Dynamicmetalslimited | 0.185 | -5% | 6% | 9% | $7,020,000 |

| TOR | Torque Met | 0.15 | -3% | -9% | 36% | $22,958,028 |

| ICL | Iceni Gold | 0.023 | 0% | -39% | -72% | $5,670,904 |

| TMX | Terrain Minerals | 0.0045 | -10% | -10% | -18% | $6,442,518 |

| MHC | Manhattan Corp Ltd | 0.003 | 0% | 0% | -40% | $8,810,939 |

| MHK | Metalhawk. | 0.07 | 8% | -1% | -42% | $6,959,011 |

| ANX | Anax Metals Ltd | 0.024 | 20% | 26% | -61% | $11,933,855 |

| FIN | FIN Resources Ltd | 0.018 | -10% | 20% | 64% | $11,686,837 |

| LM1 | Leeuwin Metals Ltd | 0.086 | 8% | -5% | 0% | $4,029,244 |

| HAW | Hawthorn Resources | 0.07 | -4% | -16% | -20% | $23,451,093 |

| LCY | Legacy Iron Ore | 0.014 | -7% | -13% | -22% | $107,989,676 |

| RON | Roninresourcesltd | 0.1 | -5% | -20% | -29% | $3,682,501 |

| ASR | Asra Minerals Ltd | 0.005 | 0% | -17% | -55% | $8,319,979 |

| PFE | Panteraminerals | 0.044 | -12% | -28% | -53% | $10,493,401 |

| KM1 | Kalimetalslimited | 0.41 | -8% | -2% | 0% | $34,353,943 |

| LRD | Lord Resources | 0.076 | +43% | +40% | -62% | $2,820,000 |

| LTM | Arcadium Lithium PLC | 6.92 | -7% | -7% | 0% | $2,876,859,185 |

Some standout chargers over the past seven days include:

International Graphite (ASX:IG6) +68%

Redivium (ASX:RIL) +67%

Hexagon Energy Materials (ASX:HXG) +56%

Arafura Rare Earths (ASX:ARU) +38%

Scorpion Minerals (ASX:SCN) +34%

Traka Resources (ASX:TKL) +33%

Black Rock Mining (ASX:BKT) 30%

Miramar Resources (ASX:M2R) +27%

Lord partners with MinRes

One of the most eye-catching performers in ASX-listed battery metals this week has been Lord Resources (ASX:LRD), which now has a strategic partnership with high-flying Mineral Resources (ASX:MIN) after securing a farm-in agreement out at the Horse Rocks Lithium Project.

MD Barnaby Egerton-Warburton is pretty double-barrel stoked about it all…

“The agreement validates the strong work Lord has already completed at the Horse Rocks Lithium Project and provides the opportunity to collaborate with a world-class exploration team drawing on their knowledge and expertise of this highly prospective lithium region,” said Egerton-Warburton.

Subject to the satisfaction of conditions – including MinRes completing satisfactory due diligence on the tenement – the Aussie mining titan will spend a cool $1 million in exploration, to earn 40% of the project.

Lord says the Farm-in Agreement will let it maintain exposure to a high-value project while also going in hard on the exploration at its Jingjing lithium project.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.