Resources Top 5: The critical minerals hopeful that hasn’t slowed down

Pic: Coompia77/iStock via Getty Images

- 5E Advanced Materials surges as it confirms a Q2 start for a new boron and lithium project in California

- TG Metals back in the good books as more high grade hits revive Lake Johnston lithium narrative

- OD6 lauds metallurgical test work on Splinter Rock REE project

5E Advanced Materials (ASX:5EA)

It’s been a torrid time for the so-called critical minerals, which fell prey to the psychosis brought on by boom time conditions a couple of years ago as every man and their dog tried to bring a mine online.

That saw Indonesia, with China’s help, dramatically ramp up production from its bountiful nickel laterite resources — halving prices in a year.

In lithium, Chinese battery makers funded high cost, environmentally sketchy lepidolite mines and obscure African projects to flood the market and outpace electric vehicle demand growth.

That’s seen battery metals equities crunched in the past year.

But one US player is flying today after announcing it remains on track to kickstart commercial operations at a new boron and lithium mine in California in the second quarter of this year.

5EA is planning to open what will be only the second major boric acid operation in America. The other is a non-core asset owned and operated by Rio Tinto (ASX:RIO) which has been in business since 1927.

And new sources of the ‘supermaterial’ — used alongside rare earths metals in permanent magnets, fire retardants, ceramics, fertiliser, detergent and more — are essential given the concentrated nature of the market.

Rio’s business and miners in Turkey are responsible for around 85% of the world’s supply. Did someone say KFC?

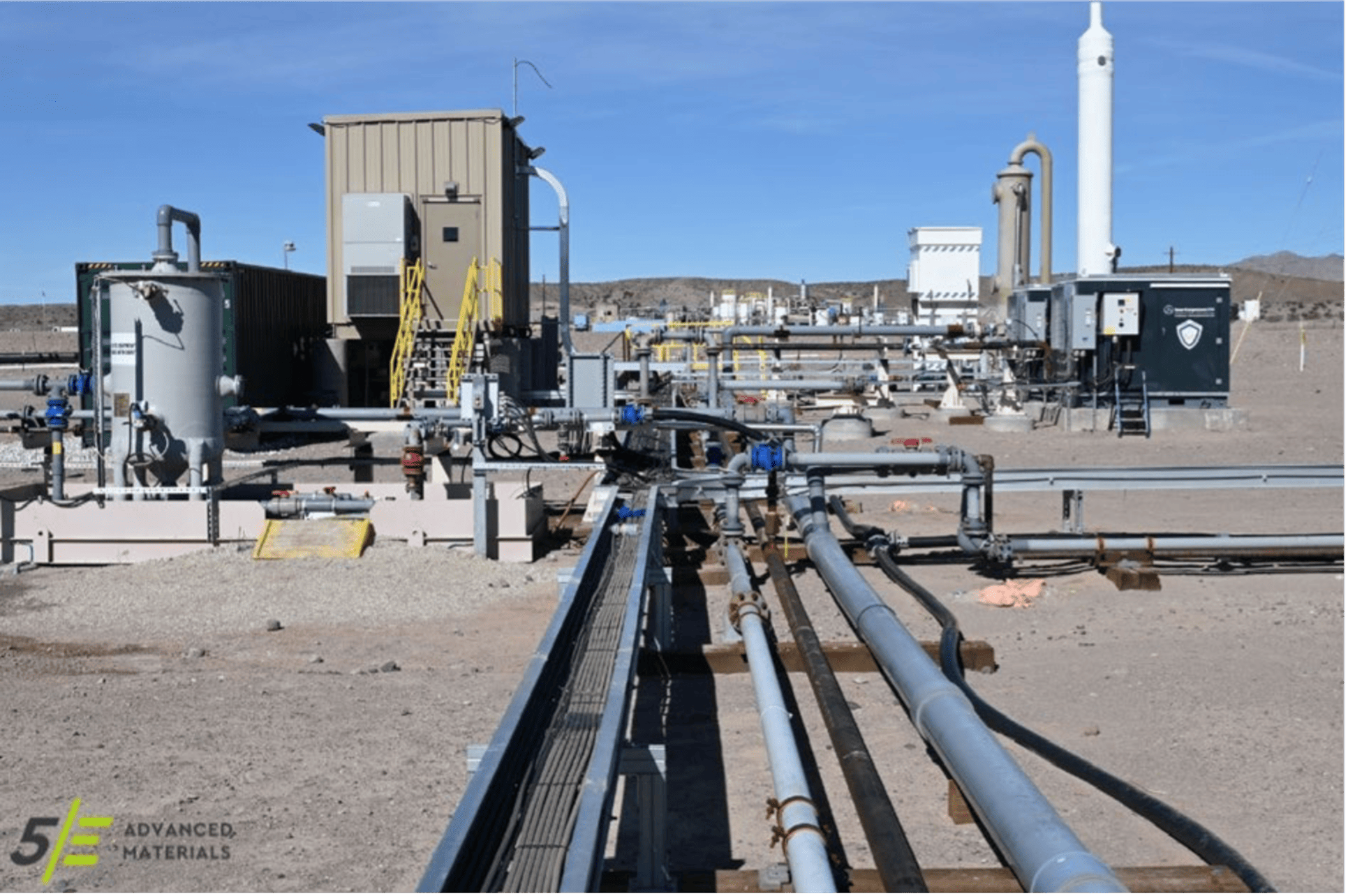

5EA began mining at its Boron Americas Complex at Fort Cady last month, where it plans to produce 2000tpa of boric acid and 100tpa of lithium carbonate from a starter plant in 2024 before ramping up in a US$389m expansion to 90,000tpa and 1100tpa in 2026.

It envisages a further three stages before hitting its full production rate of 450,000tpa boric acid and 5500tpa lithium carbonate by 2031 — at a total cost of almost US$2 billion. In order to get there 5EA says it is seeking funding through the US Government’s Departments of Defense and Energy and attempting to get boron placed on an updated critical minerals list.

“This is an exciting time for all stakeholders of the Company as we finalize a number of initiatives that will see us commence initial production next quarter” 5E CEO Susan Brennan said.

“Our operations team is working diligently to transition our facility to operational status, and we are concurrently ramping up our commercial and marketing activities in order to leverage the value of our boron and lithium with potential customers.

“I cannot emphasise enough the importance 5E will represent in the US in the coming months as a new and secure producer of critical materials needed for clean energy economies.”

5E Advanced Materials (ASX:5EA) share price today

TG Metals (ASX:TG6)

One of the more unusual lithium narratives of 2023 has re-emerged, with the company that started a lithium rush in the nickel and gold heartland of the Lake Johnston region of WA back in black on the back of fresh assays.

Lake Johnston is located to the south of a pretty fertile lithium region around Southern Cross, where Wesfarmers and SQM are about to officially open the massive new Mt Holland mine.

But nickel has historically been the main game down there, with Norilsk and later Poseidon Nickel (ASX:POS) keeping court over the Emily Ann and Maggie Hays nickel deposits.

A rush on spodumene in the area began as lithium prices began their precipitative fall late last year, after hits by TG Metals at its Burmeister project, which spawned a host of nearology plays for the project southwest of Norseman including by mining giant Rio Tinto.

TG6 surged to $1.10 in November last year before falling lithium prices cruelled interest in hard rock plays in recent months. But its latest assays have brought party-goers back to the dance.

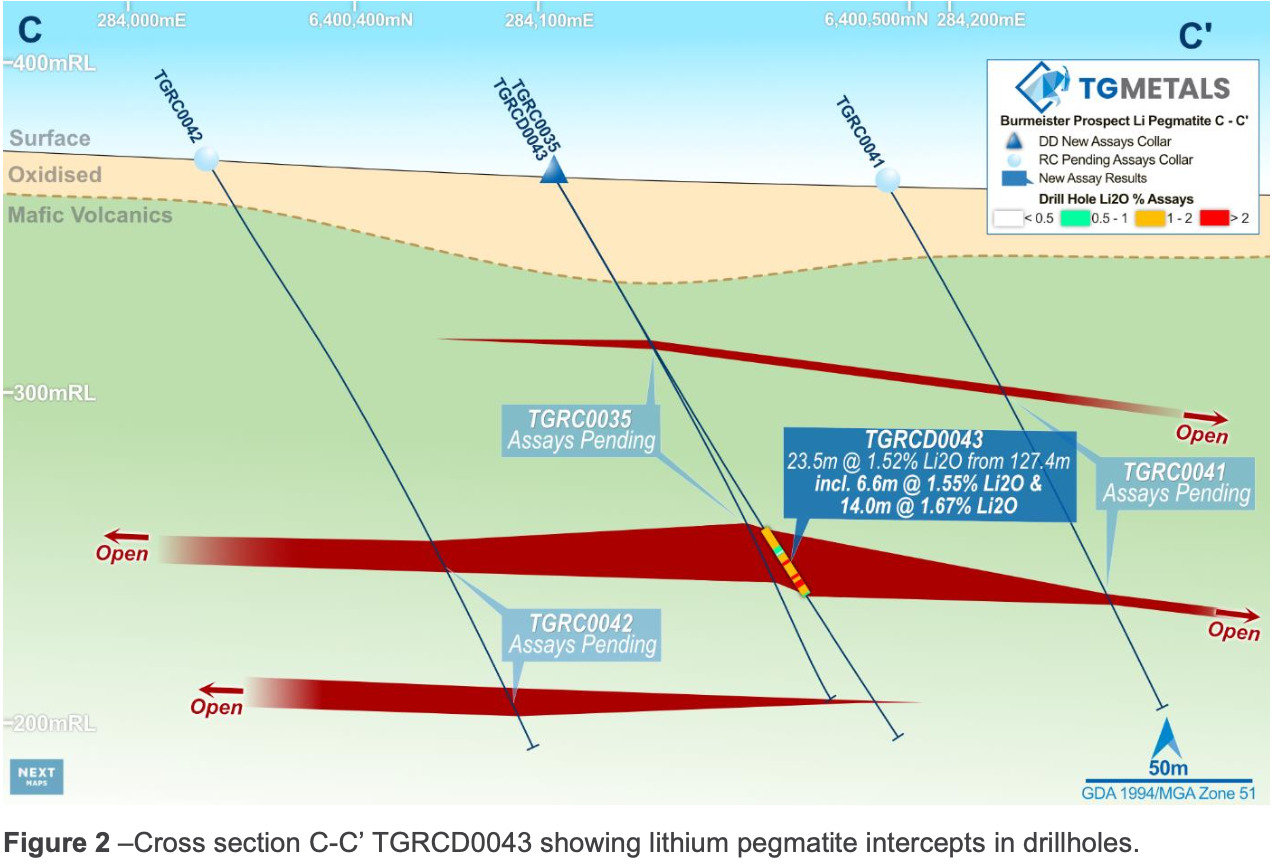

Out of 2848m of RC and 821m of diamond drilling at the project, some high grade hits have stood out.

They include 23.5m at 1.52% li2O from 127.4m, including 6.6m at 1.55% from 127.4m and 14m at 1.67% from 136.5m.

Another strike came in at 10.5m at 1.6% Li2O from 87.2m, with a further hit in the same hole intersecting 7.6m at 1.37% Li2O from 119.4m and 1.6m at 2.32% from 97.7m including 1m at 3.01% Li2O from 98.3m — the highest grade portion of the project uncovered to date.

Anything above 1% Li2O is typically economic at the right scale and reasonable lithium prices.

“These initial results from the 2024 drilling confirm Burmeister as a significant high grade spodumene lithium discovery with excellent potential as a near term major deposit,” TG6 CEO David Selfe said.

“This large mineralised system continues to show upside with thick pegmatite intervals intersected up dip from the original discovery holes. The drilling program has provided sufficient core sample for our first round of metallurgical testwork which will now begin in earnest. The results of this will add to the planning for resource drill out at Burmeister.

“Permitting on the promising Jaegermeister prospect is progressing well with field activities nearing completion.

“In addition, we will be testing wider expanses of the soil anomaly with seismic geophysics to further inform the lithium pegmatite geological model and our drill targeting. We look forward to the next round of drilling on Burmeister and the first drilling on our other highly prospective targets at Jaegermeister and Tay.”

TG Metals (ASX:TG6) share price today

OD6 Metals (ASX:OD6)

From one critical mineral to another a few hundred kilometres east towards the sleepy farming community of Esperance, OD6 Metals says metallurgical recoveries from test work at the Australian Nuclear Science Organisation ‘affirm the Splinter Rock project as Australia’s premier clay-hosted rare earth deposit’.

There will be more water to run under the bridge on that one.

But OD6 says it had seen recoveries of up to 90% of magnet rare earths on testwork from Splinter Rock, where prospects are named after rugby union positions.

ON AVERAGE it says recoveries came in at 62% MagREE at a 25g/l concentration of hydrochloric acid, including 40-90% at Centre (60% average), 41-62% at Flanker (53% average), 30-84% at Prop (average 70%) and 40-89% at Scrum (65%), with recovery rates of neodymium, praseodymium, dysprosium and terbium all similar.

Further met leaching and processing optimisation work is under way. Australia has only one major rare earths producer — Lynas (ASX:LYC), which operates the massive carbonatite hosted Mt Weld mine near Laverton in WA’s Goldfields.

Some production is likely to come soon from monazite, a waste rock at mineral sands operations containing REEs and the initial feed stock for a refinery set to be opened later this decade by Iluka Resources (ASX:ILU) at Eneabba near Geraldton.

But a cottage industry has emerged among explorers hoping to develop clay rare earths deposits, a style of mineralisation which counts as the primary source of heavy rare earths in southern China.

If technically viable, they could provide a quicker and cheaper path to market given the cheaper mining and processing pathways available for shallow, clay-based deposits over deep hard rock resources.

“The outstanding results from our metallurgical leaching studies continue to affirm the Splinter Rock project as Australia’s premier clay-hosted rare earth deposit. With consistent recoveries averaging over 60% across multiple prospects, and notably high recoveries observed for each of the fifteen rare earth elements, our confidence in the project’s potential remains high,” OD6 MD Brett Hazelden said of the metallurgical test results.

“The Inside Centre area within the Centre Prospect continues to shine, boasting dimensions of approximately 2km in length by 1km in width and thicknesses of up to 69 meters. Grades ranging between 1,400ppm to 2,200ppm TREO further underscore the project’s value proposition, complemented by leach recoveries averaging 64%. These metrics align closely with the essential value drivers we believe are crucial for the economic viability of clay-hosted rare earth projects.

“Of particular significance is the remarkable performance across all four Magnetic Rare earth elements, (Nd, Pr, Dy, and Tb), indicating a diversified resource base that is not reliant on just one or two elements.

“This diversification is a key factor for ensuring the economic sustainability of the project and sets Splinter Rock apart as a highly promising venture in the rare earth sector.”

Splinter Rock contains a mineral resource of 344Mt at 1308ppm total rare earth oxides — ~23% magnet rare earths — at a 1000ppm cut off grade, including 149Mt at 1423ppm TREO at the Centre prospect.

OD6 Metals (ASX:OD6) share price today

Legacy Minerals (ASX:LGM)

(Up on no news)

Legacy is one day out from news it has identified a unique platinum group metals discovery in New South Wales’ Lachlan Fold Belt, best known for its copper and gold porphyries among other things.

It did so with the held of AI technology, uncovering the first known magmatic related PGE-Ni-Cu find in the region, similar in nature to discoveries like Nova and Julimar in the West.

Legacy had some pretty solid backing even before the results were released yesterday, including a $15m JV and farm-in deal with the world’s biggest gold miner Newmont (ASX:NEM), now the owner of the nearby Cadia mine after its takeover of Newcrest.

As MD Christopher Byrne told Stockhead’s Jess Cummins in an article out … today, Legacy is looking more at analogies to deposits in volcanic locales like PNG, Indonesia and South America.

““The volcanos are really the drivers of these systems so to have one in the area that we are in is quite unique,” he told our reporter.

“What’s so special about the Lachlan Fold belt is the variability in the geology, there’s many different styles of mineralisation there.

“We’re quite excited about that JV and we’re only about 65km from Glenlogan, the project we are farming out with S2 Resources.”

That’s the very same S2 Resources (ASX:S2R) run by legendary explorer Mark Bennett, whose discography includes such rolled gold hits as Nova, Thunderbox and Wahgnion.

He is obviously bullish about the Glenlogan ground given it’s competing for capital with ground S2 won in a hotly contested tender adjacent to the Fosterville gold mine in Victoria.

Legacy Minerals (ASX:LGM) share price today

Nimy Resources (ASX:NIM)

(Up on no news)

Nimy Resources shares have more than halved year to date and it is of course a tough time to be a Western Australian nickel sulphide explorer, at a time when even market leader BHP is complaining of the ‘structural’ change to the market brought about by Indonesia’s supply rush.

It’s up strongly on only a handful of trades today, rising around 15% to 6.3c on little more than a wing and a prayer, unless someone out there knows something we don’t.

Conditions have been a touch brighter in nickel land in the past couple days, rising back above US$17,000/t on the LME in response to news of production curbs in Australia and elsewhere.

But prices came under pressure again yesterday as Christel Bories, the CEO of France’s Eramet, said Indo suppliers could take up 75% of the market in five years in an interview with the Financial Times.

Eramet has operations in Indonesia’s Weda Bay and New Caledonia, where laterite producers are currently in struggle town.

Still, Nimy is pushing along with plans to drill the Masson prospect at its Mons project — a new region of sulphide hosted mineralisation intersected in drilling last year.

It has worked out a way to wait out the storm for small juniors and conserve cash by inking a $500,000 drill for equity deal with Raglan Drilling, which will allow Nimy to pay out up to 25% or $500,000 of its bill to Raglan in shares which will be voluntarily escrowed for 12 months.

Nimy Resources (ASX:NIM) share price today

At Stockhead we tell it like it is. While OD6 Metals and Legacy Minerals were Stockhead advertisers at the time of writing, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.