How Legacy Minerals attracted an American gold behemoth and legendary prospector to its stable

Pic via Getty Images

- Legacy Minerals gears up for an active 2024 across its portfolio of projects in NSW’s Lachlan Fold and New England Fold Belts

- The Bauloora project is the subject of a $15m farm-in agreement with Newmont while Glenlogan is the focus of a $6m farm-in with S2 Resources

- A $3m capital raising at the end of ’23 allows the explorer to carry out multiple drilling and exploration programs throughout the year

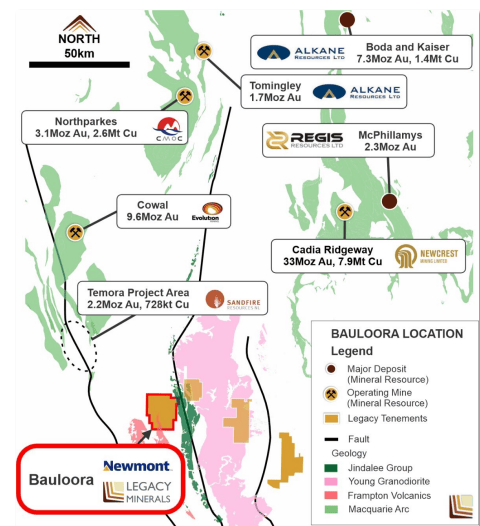

NSW’s highly endowed Lachlan and New England fold belts have long charmed explorers for hosting monster scale copper-gold deposits, but not many can lay claim to finding these targets in underexplored corners, picking up where Rio Tinto left off.

With ongoing market weakness and depressed share prices dominating the headlines for much of 2023, it’s hard to imagine a $12.79m market cap company winning the attention of a $38.78bn mining major to search for Tier 1 deposits.

One wouldn’t expect the same company to also attract the likes of well-known mine finders like Mark Bennett, a geo famed for his role in the discovery of the Nova nickel, Thunderbox and Wahgninon gold mines with Sirius Resources, LionOre and Western Mining Corporation.

But while some explorers struggled to keep their heads above the water, Legacy Minerals (ASX:LGM) was busy doing deals, the first being a $15m joint venture and farm-in agreement with US-based gold company Newmont Corporation last April.

Leveraging epithermal expertise

LGM’s Bauloora project is a large, early-stage, low sulphidation epithermal asset in NSW’s Lachlan Fold Belt that has seen only about 5,000m of drilling across the entire project area throughout its exploration history.

By any standard, the project is extremely untested, with much of the exploration work undertaken before and after the Newmont deal having focused on demonstrating the sheer scale of the system.

This included field activities like geological mapping, rock chip sampling, petrography, gradient array IP surveys, detailed ground magnetic surveys, and widespread soil sampling across the 30km2 primary vein field.

Unlike porphyries which are deep, massive bodies, epithermal deposits are higher grade and close to the surface and perceived as less ‘capital intensive’ due to the billions of dollars required to get porphyries up and running.

For context, the Cerro Negro mine in South America produces roughly 350,000oz per annum, which gives a good indication as to how large these systems can get.

According to LGM managing director Christopher Byrne, the scale and mineralisation of the vein field is analogous to deposits found in PNG, Indonesia and South America, areas where there’s more volcanic activity.

“The volcanos are really the drivers of these systems so to have one in the area that we are in is quite unique,” he says.

“What’s so special about the Lachlan Fold belt is the variability in the geology, there’s many different styles of mineralisation there.

“We’re quite excited about that JV and we’re only about 65km from Glenlogan, the project we are farming out with S2 Resources.”

Following in Rio’s footsteps

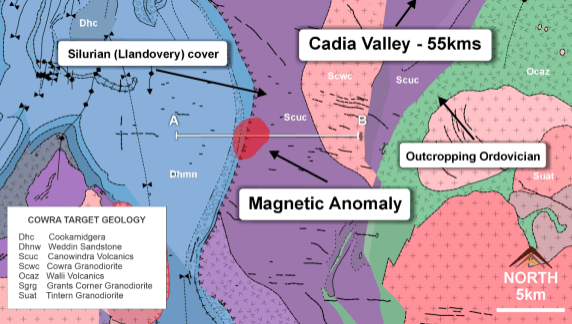

Legacy Minerals agreed to a $6m deal with S2 Resources (ASX:S24) to farm out its Glenlogan copper gold project, also in NSW’s Lachlan Fold Belt and less than 55km from Newcrest Mining’s (ASX:NCM) giant Cadia Valley porphyry complex at the end of January.

The region is home to more than 105Moz of discovered gold and million tonnes of copper, housing major gold and copper mines like Cadia-Ridgway, one of Australia’s three largest gold producers, and major discoveries such as Alkane Resources’ (ASX:ALK) 10.1Moz gold equivalent Boda find.

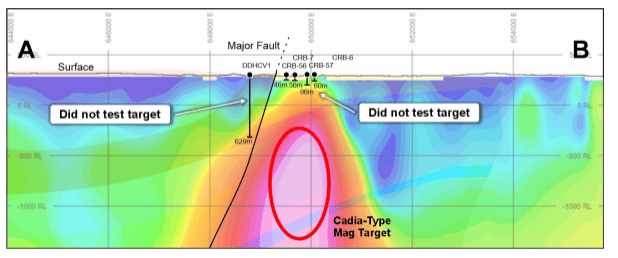

Glenlogan was last explored by Rio Tinto in 1994, with historical data captured from that period showing the potential for a buried, Cadia-style copper-gold porphyry target that may be amenable to bulk mining techniques.

But apart from that initial geophysical and magnetic survey, Byrne says the project has had virtually nothing done to it over the last 30 years.

“Part of the reason why Rio Tinto walked away was because the target they identified was 800m below surface – they considered it too deep to be economic for mining methods, but a lot has changed since then,” Byrne says.

“If you look at BHP’s Oak Dam, that orebody starts from 700 to 900m from surface.

“Modern exploration technology is helping us realise Glenlogan’s full potential and we were the first company to go back and remodel what Rio Tinto did,” he says.

“Huge improvements in geophysical and inversion modelling brought the target closer to surface essentially, between 450 – 500m.

“This is compared to the depth modelled by Rio Tinto 30 years ago at 800m. We’re now looking at optimal locations for drilling which will begin within the next few months.”

Legendary prospector takes interest

The 85km2 tenement package sparked the interest of the Mark Bennet backed S2R, the man who led Sirius Resources from inception through to its $1.8b merger with Independence Group (ASX:IGO).

From Bennett’s point of view, it was the strength and shape of the anomaly at Glenlogan that caught his attention and lured him into a five-year deal to earn a 70% interest over two phases.

“Drilling deep holes is not for the faint hearted, but the potential size of the prize is worth the risk, especially should it be comparable to other gold-copper deposits elsewhere in the district,” he said at the time.

“The acquisition of Glenlogan fits well with our ongoing process of maintaining a diversified pipeline of opportunities by identifying and exploring potentially high impact targets in under explored areas.”

Discovery uplift and long-term value

For LGM’s shareholders, the potential discovery uplift from this type of deposit is enormous.

“Alkane is a good example of an NSW explorer that added about $200m onto their market cap after their breakthrough hit at the Boda discovery in 2019,” Bryne says.

“The deep and hidden nature of the prospects in NSW’s Lachlan Fold Belt is a big reason why the region remains underexplored.

“What’s really quite exciting about this project is the relatively binary nature in what the drilling is going to show, within the first couple drill holes we’re going to know reasonably conclusively that we’re in a porphyry fertile district.

“So, while our projects may be in a brownfields environment, they are new, greenfields opportunities – they haven’t been spun out of lots of listed companies, which means they are fresh and interesting because they haven’t been tested.”

Another monster-scale project in LGM’s portfolio

And it doesn’t stop there.

Legacy Minerals acquired an ancient volcano in NSW’s New England Fold Belt at the Drake project in July 2023.

The ‘Drake’ project comprises a collapsed caldera which bears “similar geological characteristics to other major Pacific Rim settings and deposits, [like the] Porgera Goldfield”.

Calderas, the ‘cauldron like’ hollows which form in an extinct volcano, can host rich ore deposits.

Porgera – which produced +20Moz between 1990 and 2017 — is the second largest mine in Papua New Guinea and one of the world’s top 10 gold mines.

There are multiple ancient copper and gold mines and historical drilling at Drake, which is essentially unexplored by modern standards, LGM says.

“Drake is another large system, we’re looking at a potentially porphyry related system but there’s a lot of different styles of mineralisation to work through,” Byrne says.

“We’re in the process of generating targets as we speak.”

AI guided exploration at Fontenoy

Artificial intelligence-guided exploration with alliance partner, Earth AI, has led to the discovery of magmatic PGE-nickel-copper mineralisation at the Fontenoy project within the Lachlan Fold Belt – the first known discovery of this mineralisation style in the area.

Magmatic nickel-copper styles of mineralisation, targeted globally due to their potential to contain a suite of elements of significant value, have the potential to be very large deposits with examples including Sirius Resources’ Nova-Bollinger and Chalice’s Gonneville deposit at the Julimar project, which boats palladium numbers in deep drilling that “don’t exist anywhere else”.

While the project has been the subject of historical drilling for shallow nickel-laterite deposits, previous work had not tested for the potential of PGEs or magmatic related mineralisation.

Drilling and surface geochemical surveys are planned at the ‘Gramont’ discovery and the wider Fontenoy project to follow up on these results and define targets.

At Stockhead we tell it like it is. While Legacy Minerals Holdings is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.