Renascor optimises coarse flake metrics at Siviour to get more high-value graphite to market as part of Phase I production

Mining

Mining

Special Report: Renascor Resources has increased coarse flake graphite production metrics 10% from the Siviour mine for Phase I of its proposed Battery Anode Material (BAM) project to sell into high-value industrial markets.

The Siviour graphite deposit in South Australia is touted as one of the largest outside Africa, with reserves of 16.8Mt @ 8.2% for 1.4Mt of contained graphite – enough to support production of 140,000tpa for the next four decades.

Last year, Renascor Resources (ASX:RNU) completed its BAM study that can deliver a globally competitive purified spherical graphite product – and now for Phase 1, the company says it will increase upstream coarse flake production so it can maximise initial revenues.

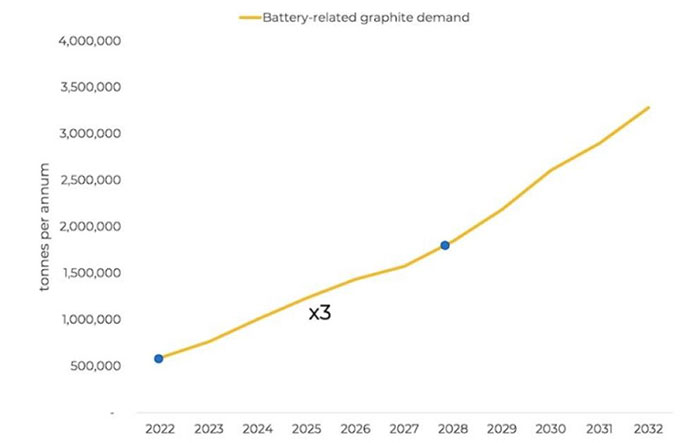

The graphite market is experiencing significant growth, primarily due to the growth of the global EV market, with BMI predicting battery-related graphite demand will increase 300% by 2028, and accelerate through to 2032.

By adjusting the flowsheet parameters of the Siviour processing plant, Renascor says it can increase the production of size fractions greater than 150 microns (+100 mesh) by ~60% – meaning total coarse flake graphite will increase from a projected 17% to 27% of ore processed from the deposit.

The company completed locked-cycle tests that incorporated adjustments to the flow sheet parameters designed to reduce reagent costs and to increase the production of coarse flake by adjusting the primary grind size.

RNU MD David Christensen says this will provide the company with additional initial cashflow and aid in the overall development of the BAM project.

“The revisions to the flowsheet parameters announced today are part of our strategy to optimise and accelerate the production of graphite from our Siviour mine in alignment with projected near-term shortages in supply,” Christensen says.

“As we look to conclude favourable agreements with offtake partners and advance to a final investment decision, we intend to take advantage of our favourable cash position to continue to accelerate the development of Siviour.

“This is with a view to minimising the planned construction period and to develop an early mover advantage as a secure, long-term provider of 100% Australian graphite products.”

This article was developed in collaboration with Renascor Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.