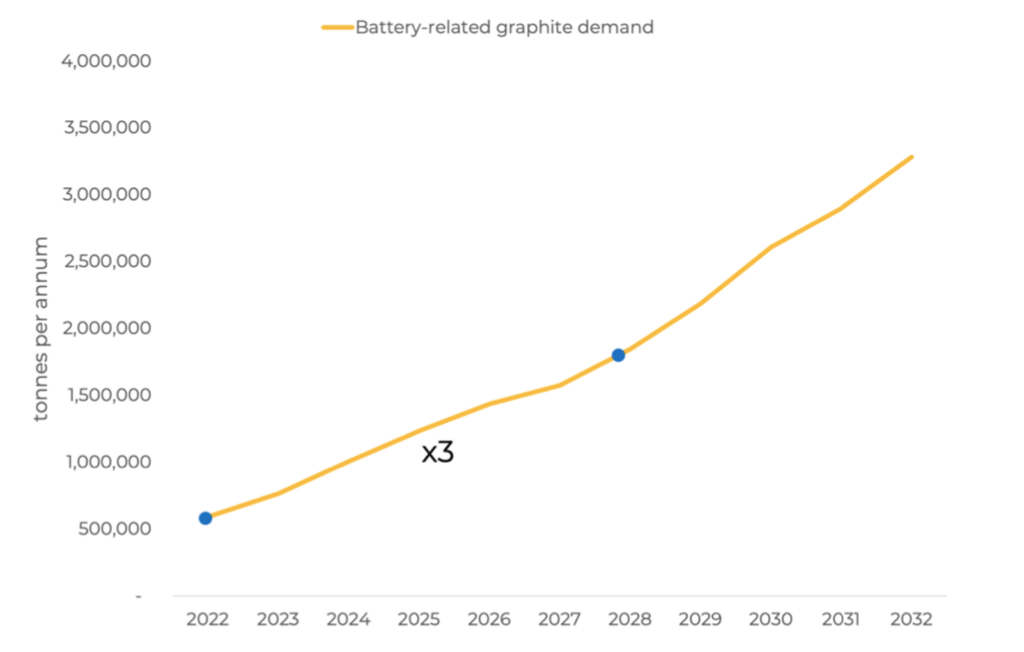

Renascor accelerates Siviour upstream development to coincide with forecast 300pc surge in graphite demand

Mining

Mining

Renascor Resources is accelerating development of its graphite concentrate operation, the upstream portion of its planned Battery Anode Material (BAM) graphite mine and manufacturing operation in South Australia.

Benchmark Mineral Intelligence predicts an increase in battery demand of 300% by 2028 and Renascor Resources (ASX:RNU) MD David Christensen expects this will result in the market looking outside of China for supply.

“The growth of the lithium-ion battery and anode markets continues to put pressure on the graphite market to meet increasing demand,” he said.

“While aggressive competition amongst Chinese synthetic graphite producers has led to downward pressure on graphite prices in recent months, the long-term graphite demand trend continues to support the need for large, low-cost graphite mines like Siviour.

“Renascor expects positive growth for natural graphite to be supported, in particular, as graphite supply chains move outside of China to supply the North American and European markets.

“Our current work programs are aimed at preparing Renascor to advance quickly into the detailed design, procurement and construction phase to meet expected shortfalls as the graphite market continues its transition from an industrial to a battery mineral.”

At Renascor’s Sivior development in South Australia, value engineering and design work is being undertaken in preparation for the detailed design, procurement and construction phase.

The plan is to integrate its Siviour mine with a downstream manufacturing facility that will produce purified spherical graphite (PSG) that is used in the anodes of lithium-ion batteries – delivering a compelling alternative to dominant Chinese supply as graphite demand is forecast to surge.

As part of this plan, the company recently completed a Battery Anode Material (BAM) study that highlighted Renascor can deliver a globally competitive gross operating cost for Purified Spherical Graphite of US$1,782 per tonne over the first 10 years and US$1,846 per tonne over LOM, including Graphite Concentrate operating costs of US$405 per tonne over first 10 years and US$472 per tonne over LOM.

The study also flagged a post-tax unleveraged NPV of $1.5bn, unleveraged IRR of 26%, and average annual EBITDA of $363m.

This is all thanks to the company’s ability to use its own graphite concentrates as feedstock – which seem to keep growing with Renascor announcing a 25% resource increase last month to 6Mt at 6.9% TGC.

This is enough to comfortably support a 40-year mine life at Siviour with graphite concentrate production of up to 150,000tpa.

All of which bodes well for the company being able to deliver a compelling alternative to Chinese PSG supplies and a competitive advantage with potential offtakers seeking to diversify their existing supply channels.

Renascor’s strategy is to accelerate the start-up of the graphite concentrate operation to secure a potential early-mover advantage by entering the market at the time of growing undersupply.

Renascor expects this undersupply will lead to increased prices.

Synthetic graphite pricing has fallen in recent months due to a period of low power and coke feedstock costs, as well as low utilisation rates of Chinese graphitization capacity.

This follows significant capital investment in the Chinese synthetic graphite sector in 2022 which has led to aggressive pricing competition amongst Chinese synthetic producers.

However, Renascor expects that as utilisation rates increase and Chinese battery demand continues to grow, synthetic graphite pricing will increase, supporting higher prices for natural graphite concentrates.

Meanwhile, policy initiatives such as the US Inflation Reduction Act (IRA) are incentivizing the growth of non-Chinese graphite supply chains to meet new demand.

As a result, the outlook for graphite remains strong, with the overall market for graphite concentrates expected to increase by approximately 60% from 1.2 million tonnes to 2.9 million tonnes by 2029.

Renascor has already obtained primary mining approvals with the award of the Program for Environment Protection and Rehabilitation and completed a Definitive Feasibility Study (DFS) level assessment in the recently announced BAM study.

Work programs are now focused on advancing engineering designs in preparation for the detailed design, procurement, and construction phase of the graphite concentrate operation.

Current work underway includes:

The company is concurrently advancing downstream programs, including optimisations to the purification and water treatment circuit and further engineering design work for power and non-process infrastructure.

This article was developed in collaboration with Renascor Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.