Resources Top 5: Graphite player Renascor gets some Albo love, to the tune of $185m

"Is that some graphite in my pocket? Or am I just happy to see me?" (Pic via Getty Images)

- Graphite miner Renascor benefits big time from Aussie gov’s critical minerals focus

- Meanwhile iron ore juniors Akora and Burley are capital raising…

- … and Nexus and Adavale share prices are also on the rise

Here are some of the biggest resources winners in early trade, Wednesday April 17.

Renascor Resources (ASX:RNU)

This growing graphite player has received some key funding news this week and its share price is accordingly busting on up and to the right as we type.

“Made in Australia?” You know it. And Albo and co are pushing the Future Made in Australia Act hard right now.

A whopping great $185m loan from the Australian Government to Renascor has now been conditionally approved under the gov’s $4 billion Critical Minerals Facility scheme. Confirmed by Export Finance Australia (EFA).

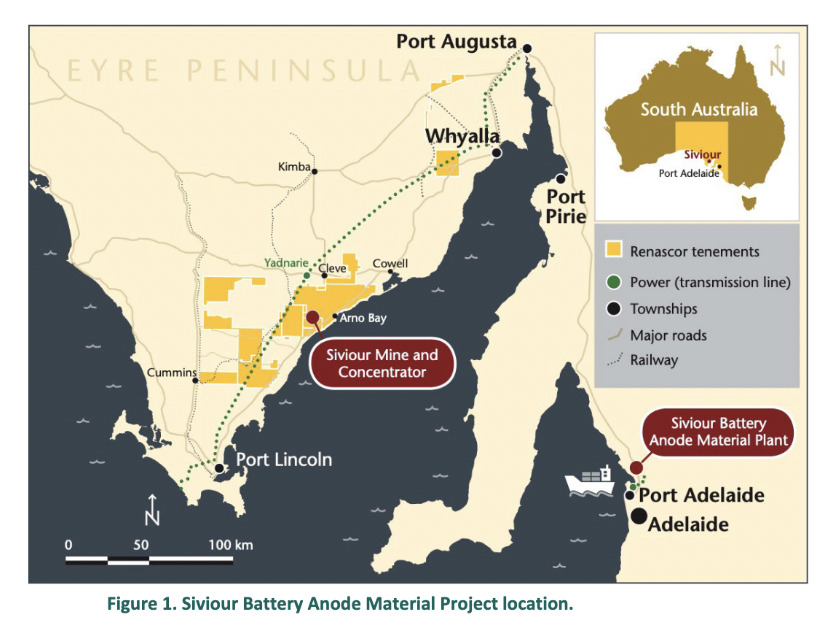

And that funding is to be utilised to fast track the construction of the upstream portion of the BAM (Battery Anode Material) manufacturing project, which is a graphite concentration operation within the company’s flagship Siviour graphite project.

It’s a capital injection into a promising upstream graphite mine and concentrator facility in South Australia, essentially.

The BAM project combines the Siviour Graphite Deposit in South Australia, the largest reported graphite reserve outside of Africa, and a state-of-the-art processing facility, with the objective of manufacturing purified spherical graphite – “through Renascor’s eco-friendly purification process” no less.

It’s a critical minerals narrative. It’s an EV batteries narrative.

Spherical graphite is battery-grade graphite, and is used specifically for anodes in lithium-ion batteries.

“Renascor Resources will deliver the sustainable and ethically sourced production of Australian-made purified graphite, for use in lithium-ion batteries required for electric vehicles and renewable technologies,” reads an Australian government media release sent out into the wilds today.

Renascor’s MD David Christensen said, among other things:

“In the Siviour graphite deposit, Renascor is fortunate to be endowed with a large world class asset. The support from the Australian Government and EFA is testament to the gravity of the opportunity for Renascor, and Australia, to become a world-leading supplier of graphite into the lithium-ion battery supply chain.”

Renascor recently reported a power connection upgrade for its 100%-owned Siviour graphite project. Read about that > here.

Meanwhile, in related critical minerals government-funding news by the way, Alpha HPA (ASX:A4N) is set to receive $400 million from Albo and co, to help it deliver Australia’s first high-purity alumina processing facility in Queensland.

The government release notes that the Alpha HPA project in Gladstone is expected to create about 490 jobs during construction and more than 200 jobs on completion.

RNU share price

AKORA Resources (ASX:AKO)

This explorer of iron ore (which is extremely hard to say first thing in the morning) makes the grade here today with a 16% intraday gain at time of writing.

News? Yep. It’s announced it’s organised a capital raising for up to $3.8 million through a placement of fully paid ordinary shares to raise approximately $0.8 million – and a 1 for 5 pro-rata non-renounceable entitlement offer of fully paid ordinary shares to eligible shareholders to raise approximately $3 million.

This has been a “Strategic Investor Process” which the company notes has involved multiple parties, with the aim to establish the most suitable funding partner for the development of Akora’s projects.

PAC Partners and Harbury Advisors are acting as joint lead managers to the equity raising.

The company also notes the following:

“The Equity Raising is not underwritten however AKORA’s largest Shareholder, Futureworld Management Pty Ltd has committed to investing up to $1.5 million as part of the Equity Raising, by taking up its full entitlement of ~$0.27 million plus (to the extent that shortfall is available) an additional $1.23 million under the Shortfall Offer, representing a total investment of $1.5 million.”

Akora is focused on the development of four high-grade iron ore projects in Madagascar, including its flagship operation, the Bekisopa project, which has a 194.7Mt Inferred JORC Resource.

AKO share price

Nexus Minerals (ASX:NXM)

This $28m+ market capped explorer is travelling along nicely today, with the pleasant tune of +20% intraday gains blaring from the stereo.

There’s no major news to report here, although the gold and critical minerals hunter did release a strong quarterly activity report the other day. Some of the following points were highlighted for the quarter ending March 31…

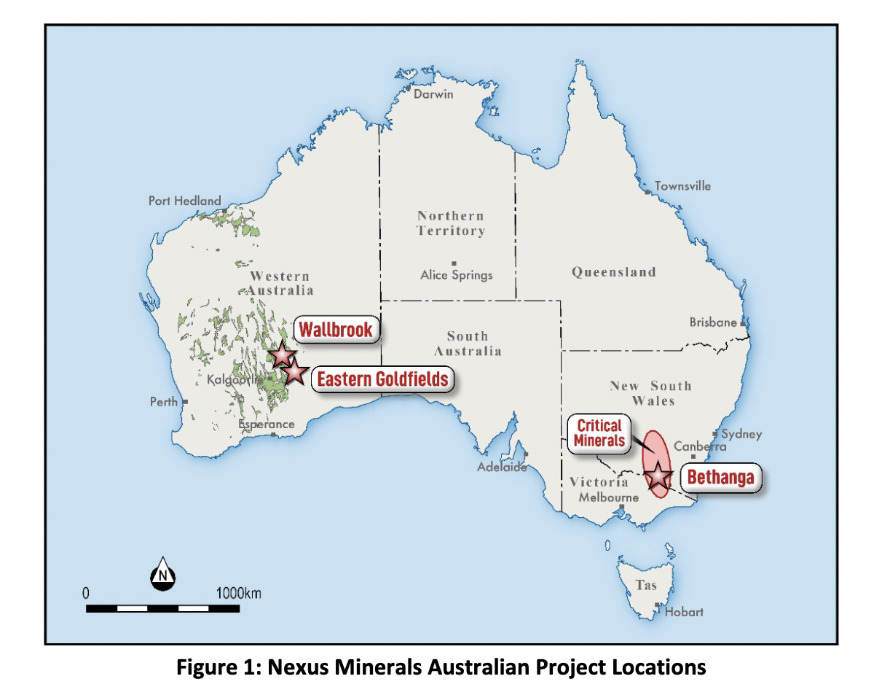

• The compamy’s Wallbrook gold project in the Eastern Goldfields of WA saw an update commencing for the Crusader-Templar mineral resource estimate. That’s expected in the early June quarter.

• Nexus is currently evaluating the Crusader-Templar resource area for open pit mine options, and multiple regional targets have been defined for aircore drill testing in the June quarter.

• Meanwhile, the Bethanga porphyry Cu-Au project in Northeast Victoria has seen a diamond drill program completed in early April (3 holes for 1,516m). Geological logging and sampling of drill core for analysis is underway.

But wait, there’s more, but we suggest you head over to the company’s latest ASX-released quarterly report for further details.

NXM share price

Adavale Resources (ASX:ADD)

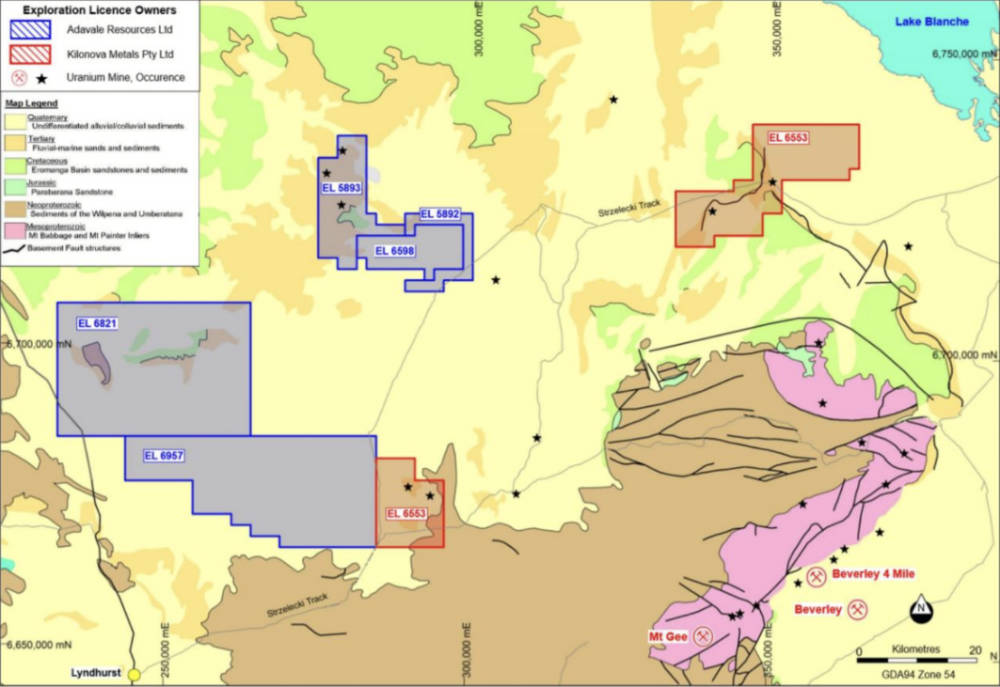

Adavale Resources is up again today on yesterday’s news that it’s poised to launch maiden uranium exploration at its Mundowdna and Mundowdna South licences in South Australia.

And that’s an operation that will be utilising historical geophysical data to identify potential paleochannels rich in uranium deposits.

The company had obtained the historical airborne electromagnetic survey data over the two licences, which are interpreted to host an extensive series of covered paleochannels – a potential sign of significant uranium mineralisation.

Per our report on this from April 16 …

The survey dataset has a whopping 400,000 data points and was obtained from the South Australian Resources Information Gateway (SARIG) data portal. It strongly complements the exisiting data Adavale Resources has already been using.

ADD noted that the extensive EM dataset provided a significant time and cost saving by confirming that there is a significant paleochannel system within its licence package.

For more details on the company’s uranium hunt, read > here.

ADD share price

Burley Minerals (ASX:BUR)

Capital raising a-go-go. Here’s a small Perth-based explorer focused on iron ore and lithium across Tier 1 locations in WA and Canada.

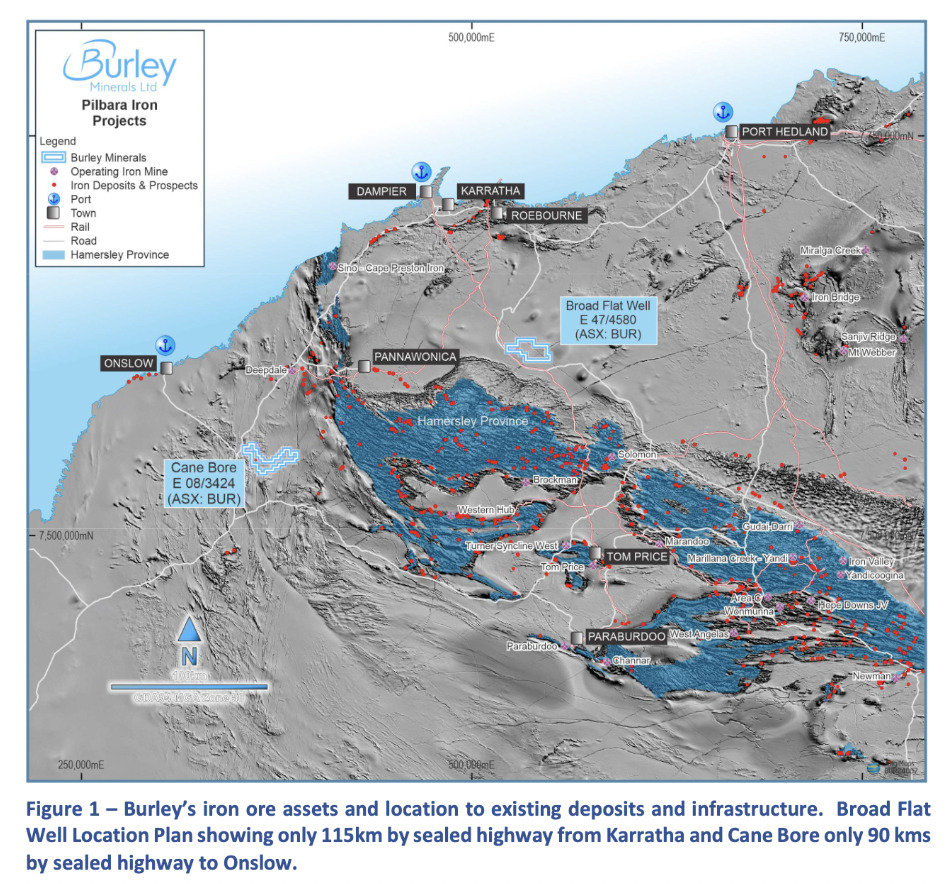

The focus here, though? Funding for its exploration operations in the Hamersley iron ore province of WA.

Burley has delivered news today of a $1.8m capital raise consisting of a combination of a share placement and share purchase plan.

A $1.3m placement will take place at $0.05 per share to existing shareholders representing a 6% premium to the last closing price.

The share purchase plan meanwhile will look to raise approximately $500,000 at $0.05 per share.

The company says that the funds will be funnelled into progressing maiden drilling operations at both the Broad Flat Well and Cane Bore iron ore projects.

Burley’s MD Stewart McCallion gave some further context:

“This additional funding will allow Burley to progress maiden drilling at its Pilbara iron ore assets. It is highly encouraging that the drilling permit has been approved for Broad Flat Well, and regulatory approvals are making headway for Cane Bore.

“Both projects have high-lying Channel Iron Deposits, are easy to access and are close to transport infrastructure and ports.”

BUR share price

At Stockhead we tell it like it is. While RNU and ADD are Stockhead advertisers at the time of writing, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.