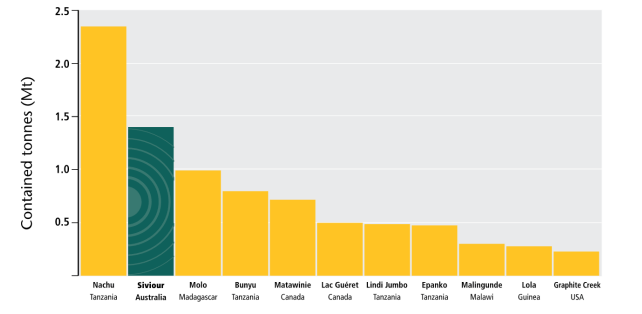

Renascor now has the largest graphite ore reserve outside Africa

Mining

Mining

An updated ore reserve confirms Renascor’s Siviour graphite project in South Australia as the largest total ore reserve of graphite outside of Africa and the second largest reported proven resource of graphite in the world.

While mineral ‘resource’ has reasonable prospects for eventual economic extraction, ore reserves are the higher confidence – they are the parts of a resource that a company knows can be economically mined.

Renascor’s (ASX:RNU) new ore reserve estimate includes a proven reserve of 16.8Mt at 8.2% TGC for 1.4Mt of contained graphite, adding further confidence to the flagship project on South Australia’s Eyre Peninsula.

It reflects a 13% increase in total reserves and an 8% increase in proven reserves and provides additional confidence in the size and quality of the Siviour deposit as a consistent source of high-quality graphite supporting a life of mine (LOM) of 40+ years.

Renascor’s (ASX:RNU) recently completed Battery Anode Material Study (BAM Study), which was used as the basis for the updated ore reserve, estimates the Siviour ore body can deliver a globally competitive gross operating cost for purified spherical graphite of US$1,782 per tonne over the first 10 years and US$1,846 per tonne over the LOM.

The BAM study superseded all previous studies and confirmed Siviour as a low-cost, high-value supplier of 100% Australian-made graphite for the global lithium-ion battery anode sector.

Renascor plans to integrate its world class Siviour deposit with a downstream manufacturing facility, also in South Australia, and the BAM Study provides a clear path to creating a competitive advantage as a low-cost producer of purified spherical graphite.

Highlight outcomes of the optimised BAM Study include a post-tax unleveraged NPV of A$1.5 billion with a post-tax unleveraged IRR of 26%, and average annual EBITDA of A$363 million.

According to RNU managing director David Christensen, these results confirm Siviour’s status as amongst the most significant graphite deposits in the world, which has attracted conditional funding support from the Australian Government and non-binding commitments from leading anode manufacturers.

“The upgraded Ore Reserve announced today, as well as the significant Proven Reserve, adds further confidence to the Siviour project,” he says.

“We look forward to using these results to assist in securing binding offtake and funding and advancing into construction and operation of an important new supply line for the lithium-ion battery industry.”

This article was developed in collaboration with Renascor Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.