IPO Watch: Copper is a blind spot for ASX investors and this near term miner wants to change that

Mining

Mining

With BHP’s (ASX:BHP) monster deal to acquire OZ Minerals and the closure of Sandfire Resources’ (ASX:SFR) DeGrussa mine you’d be forgiven for thinking your opportunities to invest in Aussie copper were limited to pulling on a balaclava and stripping the copper wire from the back of your local IGA.

We don’t recommend you do that, because there is copper all over Australia and the raft of copper mines previously gathering dust in the portfolios of private investors and overseas supermajors is slowly coming to fill a void in the local market.

The most high profile has been the acquisition by New York listed blank cheque SPAC Metals Acquisition Corp, which paid US$775m in cash and US$100m in shares for the 50,000tpa CSA mine in Cobar, and is looking at an ASX IPO in the next three months.

Seen as a likely acquirer of other Aussie copper assets like the nearby Northparkes mine and Glencore’s Mt Isa Mines operations, Mick McMullen’s MAC is well-heeled with former FMG boss Nev Power on board as chairman and former Northern Star (ASX:NST) boss Bill Beament involved as well.

But there are moves happening all across the market, including a new listing yesterday that is just weeks away from production at an historic copper hub in Queensland.

Enter stage left True North Copper (ASX:TNC).

A reverse takeover conducted through the shell of fellow QCopper play Duke Exploration, TNC raised $37.3 million at 25c per share in a reverse takeover offering with the aim of commissioning the Cloncurry hub within weeks.

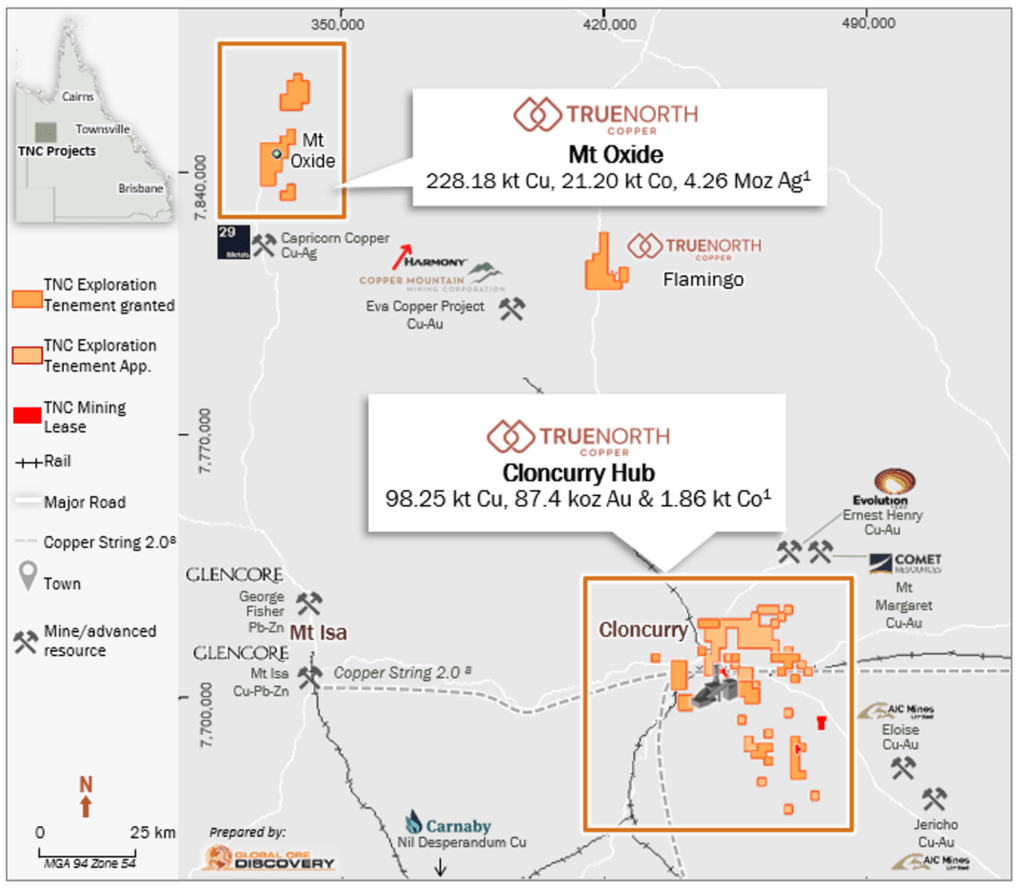

Armed with a measured, indicated and inferred JORC resource base of 326,000t copper, 87,400oz gold and 4.3Moz of silver along with a concentrator, SX and copper sulphate crystallisation plant, TNC closed yesterday even at 25c per share and an effective market cap of around $115 million.

Its Cloncurry Hub was in operation under the auspices of Soul Patts’ (ASX:SOL) Round Oak Minerals copper mining business until 2018 until it became non-core to the miner as it purchased IGO’s Jaguar mine in WA and Stockmans development in Queensland, now part of the portfolio of copper mid-tier Aeris Resources (ASX:AIS).

Containing 98,250t copper, 87,400oz gold and 1860t of cobalt in resources, that is the part of the business that will be mined in the near term.

Following the recommissioning of the SX plant at Cloncurry, the first sales of copper sulphate crystal – a copper chemical used in agriculture and mineral processing – from high grade oxide stockpiles will be made to Australia’s largest importer Sinoz in late June and early July.

Mining of the copper sulphide orebodies at Great Australia is expected to begin from around the end of the September quarter, with toll treatment at Evolution’s (ASX:EVN) Ernest Henry mine the likely processing pathway.

Longer term TNC is looking to develop the Vero deposit, part of the Mt Oxide project immediately north of 29Metals’ (ASX:29M) Capricorn copper mine.

Managed by now Chinese owned Perilya since the mid-80s, the 228,000t copper, 21,200t cobalt Vero was considered the next cab off the rank for the then Australia and now Dominican Republic focused miner from 2008 to 2012 when it spent $52 million and completed over 100,000km of diamond drilling to prove up the resource.

TNC closed a $35m deal to buy the project off Perilya earlier this month.

In both cases a weak copper market and lack of focus on the Australian scene left plenty of value in the ground; value TNC now thinks it can capture.

TNC managing director Marty Costello, whose resume includes over eight years consulting to Australia’s third largest gold miner Evolution Mining through its formative years says the company plans to produce 10,000 to 15,000t of copper a year from Cloncurry over a 7-8 year mine life.

A reserve is due soon for the operation, with the revenue to bankroll exploration at Vero, which Costello sees as an option on building TNC into a much more substantial copper investment play.

Copper has an exciting future as per most analysts’ expectations. The energy transition is expected to see demand double by 2050 and RBC last week predicted a lift in prices from ~US$3.80/lb to US$4.50/lb to incentivise new production in the face of a predicted 10Mtpa shortfall by 2035.

That’s equivalent to 10 Escondidas — the world’s largest copper operation.

Costello agrees the future is bright, but says he is not getting preoccupied with the ‘macro around copper’. It’s informed his conviction to get a low cost operation up and running now which can generate cashflow even at times of subdued copper prices.

The copper sulphate product is also an important component for that — it generates a premium over LME spot prices.

“At this point in time, it’s all about being profitable, regardless of what copper price we will encounter in the future,” he said.

“That rang true in my experience in the early days with Evolution Mining and (chairman) Jake (Klein).

“I think there were many years up until around 2011, ’12,’13 when Evolution was sort of hovering around the 32 cents mark.

“His focus was very much focusing on the business itself and making sure you’re profitable regardless of what price the metal is so that’s what we’re doing at True North Copper.”

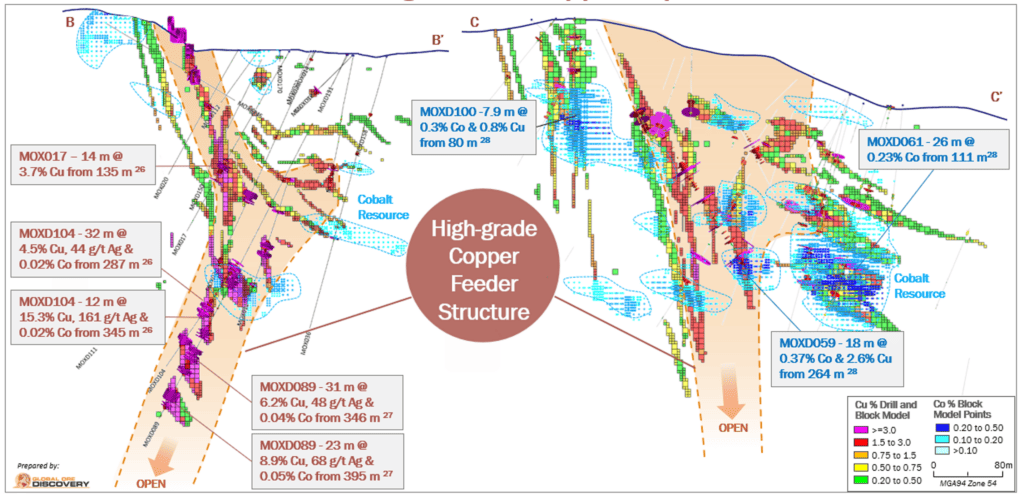

While Cloncurry is the lower hanging fruit, the Vero resource at Mt Oxide, which is 100m offset as well from one of Australia’s highest grade cobalt deposits, looms as the prospect with larger scale potential for TNC.

“We’ve we started drilling at Vero last week on our first of 12 holes, and that program is looking to extend our existing resources down dip and along strike,” Costello said.

“The Vero resource is actually constrained. Its deepest hole ended in an intercept of 23m at 9% copper and nearly two ounces per tonne silver.

“We’ll be looking to extend that mineralisation and further mineralisation to a much greater depth so that drill hole is going down to 460m.

“The drill rig is working out there at the moment so Mt Oxide and Vero is all about resource extension, expansion and also continuing on with our scoping studies.”

Costello makes a comparison between Vero, which has a 1.2km strike and continues to a depth of 395m, to the early days of Sandfire’s legendary DeGrussa, which became a more than 60,000tpa copper producer after its surprise discovery in WA’s Paterson Province in 2009.

“It’s got the sort of grades that conjure the memories of the … Conductor Two discovery holes at Sandfire,” he said.

“We’ve got grade, which is very hard to find copper deposit these days, we’ve got scale and not only that, we also have one of Australia’s highest grade cobalt resources — a discreet cobalt ore body which sits about 100m offset to the main high grade copper ore body.”

Costello said there was a high level of institutional interest in the stock, which will retain Duke director Ian McAleese as its chair.

Well known mining investor Tembo Capital, whose Australian investment director Tim Dudley will sit on the TNC board, holds an almost 30% stake.