Resources Top 4: Talisman hits hot base metal action at Durnings (Not Burning’s. Or Bunnings)

"This one's called… Bluebirds of Serenity" (Pic via Getty Images)

- Talisman hits massive sulphide base metals at its Durnings prospect in Central NSW

- Argent also makes a base metal (and silver) discovery in NSW

- LML and TNC are two other standout gainers on the bourse this morn

Here are some of the biggest resources winners in early trade, Wednesday March 27.

Talisman Mining (ASX:TLM)

Copper-gold hunter Talisman is standing out on the bourse today. Why? Well, partly because of a typo, actually.

“A significant base metals discovery has been confirmed at Burning’s.”

At first we read that as Bunnings and immediately craved sausage on white bread with sauce. It should actually say: Durnings.

Sorry to point that out, Talisman/ASX. (Ahem, no one’s infallible here, either.)

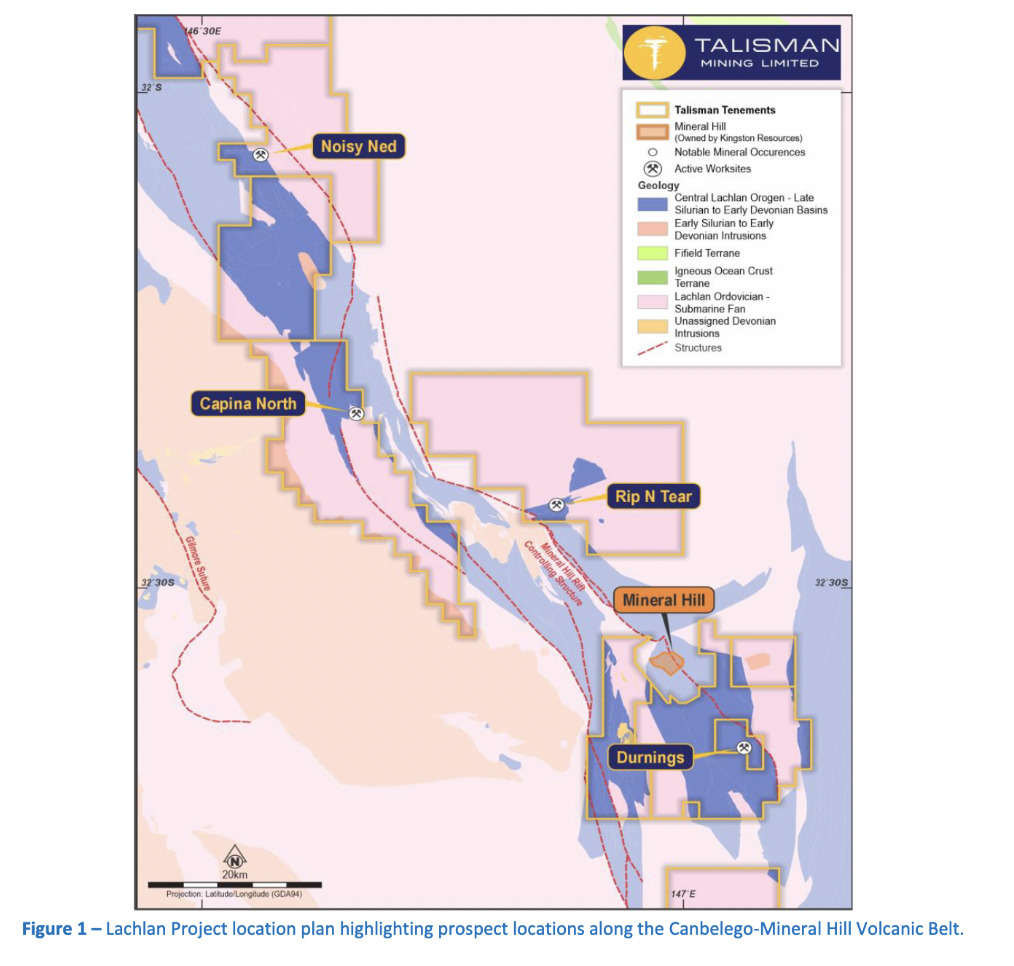

That aside, what are the specifics? The $43m (at time of writing) company notes it’s hit multiple zones of sulphides in its initial diamond drilling – part of the follow-up program of reverse circulation and DD drilling that commenced recently at the Durnings prospect, part of Talisman’s 100%-owned Lachlan Project in central NSW.

Sulphides? It’s talking massive sulphide galena-sphalerite-chalcopyrite (lead-zinc-copper) mineralisation.

The company notes: “In addition to the significant mineralised zones logged in the first follow-up diamond hole, several step-out RC holes have potentially intersected the Upper mineralised zone along strike and recorded anomalous sulphur (S), zinc (Zn), lead (Pb) and copper (Cu) readings from pXRF field analysis.”

It all apparently points to the idea of Durnings emerging as a greenfields base and precious metal discovery of some note.

TLM share price

Argent Minerals (ASX:ARD)

Argent, a precious and base metals hunter, has revealed it’s made a “massive silver-base metal mineralisation discovery” northeast from the main Kempfield polymetallic deposit in NSW.

More specifically, two major mineralisation extensions from the Kempfield deposit have been discovered through surface sampling along strike from Lode 300 Mineralised Block, which contains 5.1Moz Ag at 102 AgEq (g/t), totalling 65.1 Moz silver equivalent resource.

The company notes that high-grade surface rock chips highlight big potential here.

Current dimensions of the Lode 300 is 650m strike by 150m in width. And the mineralised extension is about 1.72km along strike with an average width of 100m, hosted within a gossanous barite lithology with the zone still open to the west and northeast.

Here’s some high-grade factoids for you…

Assay results received from the Kempfield NW Zone with silver assays up to 177g/t

Ag, 1.89% Pb and 1.21% Zn received, including highlights of:

177g/t Ag (5.7 oz Ag/t), 1.89% Pb & 0.16% Zn

115g/t Ag (3.7 oz Ag/t) & 0.33% Pb

104g/t Ag (3.44 oz Ag/t)

But wait, there’s more. Actually there is, but head to the company’s ASX announcement today if you want to get across it all.

Two major mineralisation extensions from the Kempfield Deposit, NSW have been discovered from a rock chip sampling program with results up to 177g/t Ag. 185 assays still pending.

Read: https://t.co/HT8GKxbdK5 #ARD #silver pic.twitter.com/5dxBcfzpnh

— @Argent_Minerals_Limited (@ArgentLimited) March 26, 2024

ARD share price

Lincoln Minerals (ASX:LML)

South Aussie explorer Lincoln’s main (actually highly diverse) hunt is graphite, gold, copper and iron ore, with its cornerstone project the Kookaburra Gully (KG) graphite project on the Eyre Peninsula.

Why’s LML surging today? High-grade graphite intercepts up to 30.5% TGC at the KG project, that’s why.

Deets…

We've received high-grade #graphite results from our drilling program at the Kookaburra Graphite Project in South Australia. The drilling has extended high-grade graphite mineralisation to the north, with significant intercepts found at shallow depths. Notable results include… pic.twitter.com/z3O4X8NAaK

— Lincoln Minerals (@LincolnMinerals) March 26, 2024

Multiple high-grade graphite intercepts in recent step-out drilling extend the Kookaburra Gully Mineral Resource mineralisation to the north, both at surface and downdip.

Lincoln notes that eight of 11 holes that targeted the northern portion of the designed open-pit intersected graphite extend open-pit to the north.

Shallow-depth results include:

• 24m @ 16.8% TGC from 1m

• 29m @ 11.3% TGC from 5m

• 16m @ 20.3% TGC from 69m

Lincoln CEO Jonathon Trewartha said this:

“These exceptionally high-grade graphite results from drilling at Kookaburra Gully confirm our confidence that we will continue to rapidly develop what is already the second largest graphite resource on Eyre Peninsula.”

And this, too:

“What makes these results particularly exciting is that the drilling results are expected to add to our high-grade core of 2.0 Mt at 15.2% TGC that starts at surface. The exceptionally high-grade mineralisation at surface positions us well to be in the lower quartile of the cost-curve once the Pre-Feasibility Study is updated in Q4 of this calendar year.”

LML share price

True North Copper (ASX:TNC)

Queensland copper cobalt company True North’s share price is heading truly north on news regarding one of its key operations – the Cloncurry Copper project.

Essentially, it has a mining restart, with the wheels set to turn, drills set to spin and the mining of ore to get underway at the Wallace North site in early Q4 this year.

This means that all the prep work undertaken by the company so far at the site has been progressing well after it all dried out post monsoonal rain in February and March.

This has included mobilisation of mining equipment and support infrastructure, preparation of existing access and haulage roads for upcoming mining activities.

Not to mention (but mention we will) the completion of short-term mine scheduling by TNC’s technical service teams and the onboarding of skilled mining fleet operators.

In other words, TNC’s been pretty bloody busy.

True North Copper’s MD, Marty Costello, said:

“This is an exciting and transformative phase for TNC… CCP project economics confirm a robust mining operation that is low risk and low-cost. Projected mine revenue is A$367M

with a free cash flow of A$111M.”

TNC share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.