Resources Top 5: Small cap investors Let the Sunshine In as SHN posts Queensland resource upgrade

Pic: Olga Turgova/iStock via Getty Images

- Sunshine Metals up 40% on resource upgrade at Liontown deposit in North Queensland

- NickelX, Chariot up on no news

- True North Copper draws down on debt funding for revival of Cloncurry Copper Project

Here are some of the biggest small cap resources winners in early trade, Wednesday February 7.

SUNSHINE METALS (ASX:SHN)

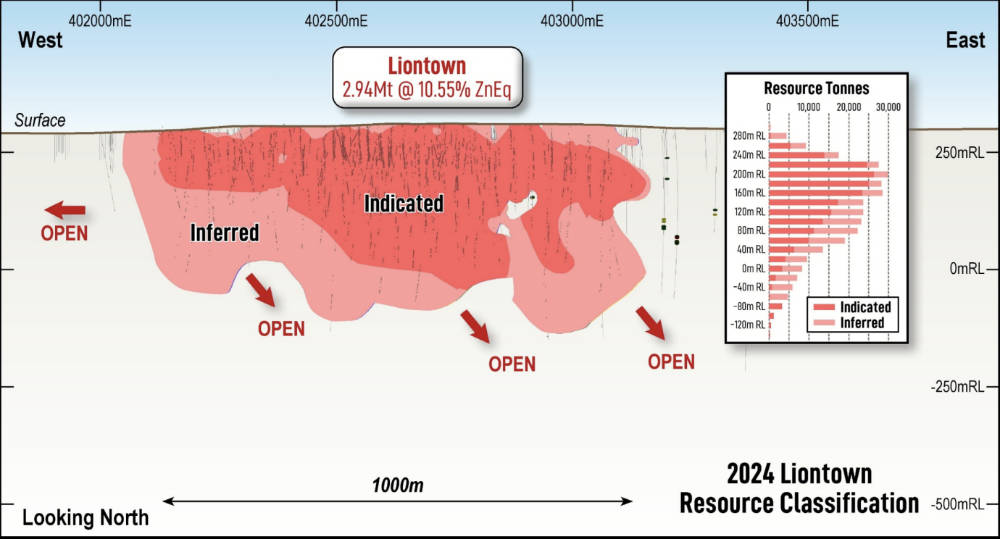

A major resource upgrade at Sunshine’s Liontown deposit in the heart of Queensland’s gold country to the south of Queensland has investors back on the horse at the $17m capped junior explorer.

The gold and base metals hunter has posted a 21% increase in resources at Liontown part of the broader Ravenswood Consolidated project where it holds a commanding land package in the shadow of major gold mines like Mt Leyshon, Ravenswood and Mt Carlton.

It now boasts 2.94Mt at 10.6% zinc equivalent, with an even bigger 116% lift in indicated resources to 1.85Mt 1t 10.9% ZnEq — 63% of the total resource.

Gold ounces have lifted 10% to 132,000oz, with copper tonnages 60% up at 29,000t.

The broader Ravenswood project contains 5.45Mt of known resources at a 12% ZnEq grade, indicated resources making up 47% of the total. The rise in indicated resources is important, because those have been drilled with enough density to be placed in a mining reserve.

Sunshine MD Damien Keys said the resource was a ‘substantial step forward’, based on drilling conducted since 2020 and including ‘high impact, first pass’ drilling that caught the market’s attention late last year.

“Particularly encouraging is the growth in contained copper and gold which we began focusing on since taking control in September 2023. Drilling has recommenced at Liontown targeting an extension to the gold-rich pumice breccia zone hosting intersections including 17m @ 22.05g/t Au (23LTRC002) and 8m @ 10.65g/t Au (LTDD22055),” Dr Keys said.

“A copper-rich lens and/or potential feeder fault zone is also being tested in the footwall zone of the Carrington Lode with nearest holes grading 4.65m @ 5.48% Cu, 2.05g/t Au from 188m & 2.35m @ 3.75% Cu from 197m (LTDD19029) and 6m @ 4.49% Cu from 252m (LTDD19008).

“Aside from the gold-copper footwall lodes currently being drilled, Resource growth opportunities remain in the under-drilled 400m ‘Gap Zone’ between Liontown and the 1.47mt @ 11.0% ZnEq Liontown East resource.

“We are excited with the progress we have made since taking control and look forward to further resource growth in 2024.”

Located near Charters Towers, the Ravenswood district has delivered some 20Moz of gold and 14Mt of VMS ore containing copper, gold, zinc, lead and silver across its history.

Sunshine Metals (ASX:SHN) share price today

NICKELX (ASX:NKL)

(Up on no news)

NickelX kicked off an RC program over at its Dalwallinu project in WA’s West Yilgarn a few days ago, testing for nickel, copper and PGE some 208km northeast of Perth.

The project sits around 150km from Chalice Mining’s (ASX:CHN) Julimar project as the crow flies. That discovery drew a rush of explorers into the previously underexplored region in early 2020.

NKL says its RC drilling campaign will test two high priority geochemical targets from modelled moving loop electromagnetic and fixed loop electromagnetic conductors at its DEM1 and DEM2 prospects, which it says are some of the most conductive prospects in the West Yilgarn region.

They are set to be tested to depths of 150m and 30-40m respectively, with real time pXRF scans to be used to determine whether to expand the drilling beyond that.

Four high priority geochemical targets will also be tested, having recorded PGE grades of up to 73.7ppb platinum and palladium and anomalous values for nickel and copper of up to 466ppm and 843ppm respectively.

The 86km2 Dalwallinu is the most advanced of NKL’s three projects, all located close to major nickel and gold projects.

Its Cosmos South project is located to the south of IGO’s (ASX:IGO) Cosmos mine in the Northern Goldfields and BHP’s (ASX:BHP) world class Leinster and Mt Keith projects, while it also holds the 342km2 Biranup project to the north of the Tropicana gold mine.

NickelX (ASX:NKL) share price today

TRUE NORTH COPPER (ASX:TNC)

Down around 65% since its listing day last year, True North is one of a number of juniors who have emerged in recent years to try bring some of Queensland’s dormant copper assets back to the market.

The thesis is solid. Copper demand is expected to double in the coming two and a half decades in response to the need for more of the metal to supply energy transition technologies.

That includes EVs, which use about four times as much copper as internal combustion engine cars, as well as a large increase in transmission infrastructure needed to support increase renewable penetration in electricity grids.

In short, more electrification means more copper. At the same time, supply continues to disappoint, which theoretically should push up prices.

But copper prices are still middling, with weak Chinese economic conditions keeping the red metal around US$8400/t for most of the year so far.

TNC produced just 70.38t of copper from its solvent extraction plant in Cloncurry, which produces a copper sulphate product.

That metal output came in the form of 288.612t of copper sulphate at a grade of 24.39% Cu, well behind expectations for the plant to produce at a rate of 12,000tpa.

But the sulphate project is only around 10% of TNC’s Cloncurry mine life. The bulk is conventional copper sulphide concentrate production, with the company having announced plans to restart its Great Australia and Wallace North mines in December.

To support that, TNC secured a US$28m ($42m) loan from the Nebari Natural Resources Credit Fund II LP, with up to 1Mt of ore a year to be processed through Glencore’s Mt Isa Smelter, where the junior miner will be able to access a 20% state royalty discount.

Today, it announced the first drawdown of US$18m from the Nebari fund would take place on Friday.

“We are looking forward to partnering with Nebari as we bring our Cloncurry Copper Project into production,” TNC MD Marty Costello said.

“We are incredibly proud to be working alongside international top-tier funding partners like Nebari and Tembo Capital and our toll processing and offtake partner Glencore International AG, who are all global leaders in their field. Their expertise and support have been crucial in our development and demonstrate what I believe is a strong vote of confidence in our Cloncurry Copper Project and its potential.

“We’re excited about restarting mining at the Cloncurry Copper Project, at a juncture when the global market is facing a looming copper supply gap.”

True North Copper (ASX:TNC) share price today

CHARIOT CORPORATION (ASX:CC9)

(Up on no news)

Chariot rode to prominence last year on listing, surging as high as $1 a share as it began to test its Black Mountain project in the sparsely populated US State of Wyoming.

The story of how it acquired the ground is the stuff of legend, as told to Reuben Adams back in November.

But since then lithium prices have cratered and the initial market response to Chariot’s first drill results — which saw a few significant lithium hits from its first three holes including 15.48m at 1.12% Li2O and 79ppm Ta2O5 from 2.74m — was muted.

But there are five holes still to be reported to the market, expected to be announced by April.

Today the stock is seeing a recovery amid a broader run in lithium stocks as investors get ready for more results following the release of its first set of numbers on Friday.

They were described by the company as the first hard rock lithium discovery in Wyoming to be confirmed by drilling.

A larger 5000-10,000m drill program is expected to take place in the North American summer, with intervals grading up to 0.6% copper, 1% zinc and 15.4% lead also demonstrating the project’s base metals potential.

READ: Chariot double dips at Black Mountain with lithium and base metals success

Chariot Corporation (ASX:CC9) share price today

Argonaut Resources (ASX:ARE)

Boss Energy (ASX:BOE) has seen a remarkable rise in the past three years after betting big on a uranium boom that only really emerged in the latter stages of 2023.

Prices are now at US$105/lb, just shy of 16-year highs of US$107/lb seen earlier this week, well above the US$65/lb mark long mooted as the incentive price for new U3O8 mines to get the green light.

Predictions from enthusiastic backers of the sector are getting extremely bullish … not uncommon for this point in the cycle.

Boss went early, announcing plans to restart its Honeymoon mine before the run on uranium prices really began. It’s up 12,000% in the past five years to a market cap of $2.5 billion. Wow.

No surprises then to see nearology plays rush in … even if Boss is not a new discovery but a brownfields development, which failed under different owners in a very different price environment over a decade ago.

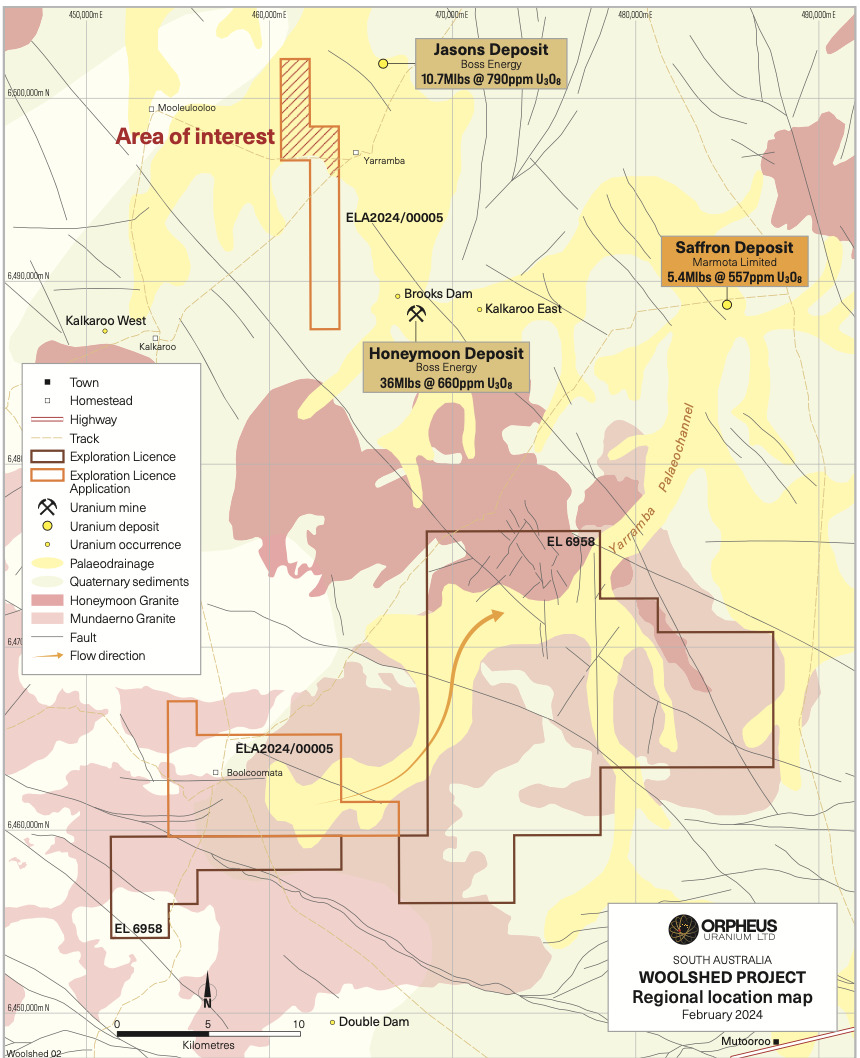

Sailing in is Argonaut Resources, which has applied for an exploration licence called the Woolshed project, consisting of two blocks including one in the north that sits 4km west of the Honeymoon mine and, appropriately, Boss’ satellite Jasons deposit.

The news had the junior running hot early before settling back to even for the morning.

Jasons contains 10.7Mlb at 790ppm U3O8, a higher grade outpost of the 36Mlb at 660ppm U3O8 at Honeymoon.

Argonaut’s area of interest in the northern block contains the Yarramba Palaeochannel, an ancient river bed in which minerals are believed to have settled.

Its southern block contains the headwaters of the Yarramba palaeochannel, which sit directly on top of mesoproterozoic granites and is contiguous with Argonaut subsidiary Orpheus’ Mundaerno project.

You may be familiar with that name Orpheus, and not just the possibly mythical bard of legend who graced Jason’s ship in search of the Golden Fleece. At one point a couple of years ago Argonaut was looking to spin out its uranium assets into a new IPO called Orpheus Minerals.

That never came to fruition. Instead Argonaut itself has zeroed in on uranium as it emerges as the market of the day, with the company to be renamed Orpheus Uranium.

The company says the ground at Woolshed was “remarkably” identified as open ground on the South Australian Government’s tenure portal. Orpheus has a swathe of uranium projects across the NT and SA, notable since they are the only two Australian jurisdictions where uranium projects have successfully been developed.

Boss’ Honeymoon is one of only three active uranium projects in Australia, all in SA, alongside the Beverley mine and Olympic Dam, where BHP (ASX:BHP) produces the energy fuel as a by-product of copper and gold production.

Argonaut Resources (ASX:ARE) share price today

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.