Chariot double dips at Black Mountain with lithium and base metals success

Mining

Mining

Special Report: Lithium hunter Chariot Corporation is making excellent progress at its flagship Black Mountain project, with a series of strong lithium drill intersections – even in the middle of the freezing Wyoming winter.

One of the biggest resources IPOs of 2023 has delivered strong, maiden hard-rock lithium results with multiple mineralised intersections from the first three of eight holes drilled so far at its big Black Mountain project in Wyoming, USA.

It’s talking high-grade spodumene that confirms the huge potential of Black Mountain’s LCT pegmatite swarms. And not only that, potential for drilling into a large base metals system (copper, zinc and lead) looks to be on the cards, too.

The site is a big, big deal for Chariot Corporation (ASX:CC9). As Stockhead’s Reuben Adams recently reported, “Black Mountain had never been drilled – until now – despite 60cm long spodumene crystals (~6-7% lithium) being observed back in 1997 and subsequent early-stage exploration returning assays up to 6.68% Li2O from rock chips. That’s high grade.”

The fact the company is moving ahead with its maiden 4,900m drill campaign at decent pace in harsh early-winter conditions is testament to the excitement and expectation of what lies beneath.

Weather permitting, CC9 says it plans to continue drilling until March 2024.

Preliminary assessment work is also being carried out for the remainder of its lithium portfolio, including the Resurgent North project where a drilling plan has been developed.

While Chariot waits for assays from the next five holes, some strong lithium-tantalum mineralisation has been uncovered in the first three.

Assays returned individual lithium and tantalum grades downhole of up to 3.79% Li2O from hole BMDDH23_01-0021 and 230ppm Ta2O5 from BMDDH23_01-0033.

This confirms the high-grade potential, through drilling, in the first hard rock lithium discovery in Wyoming.

The very first hole also intersected a zone of stockwork vein and disseminated pyrite-pyrrhotite mineralisation over an interval of about 100m.

This is of great interest to the company as it believes it may have struck the peripheral portion of a potentially larger base metal mineral system “with selected intervals grading up to 0.6% (6,012ppm) copper, 1% (9,931ppm) zinc and 15.4% (154,412ppm) lead”.

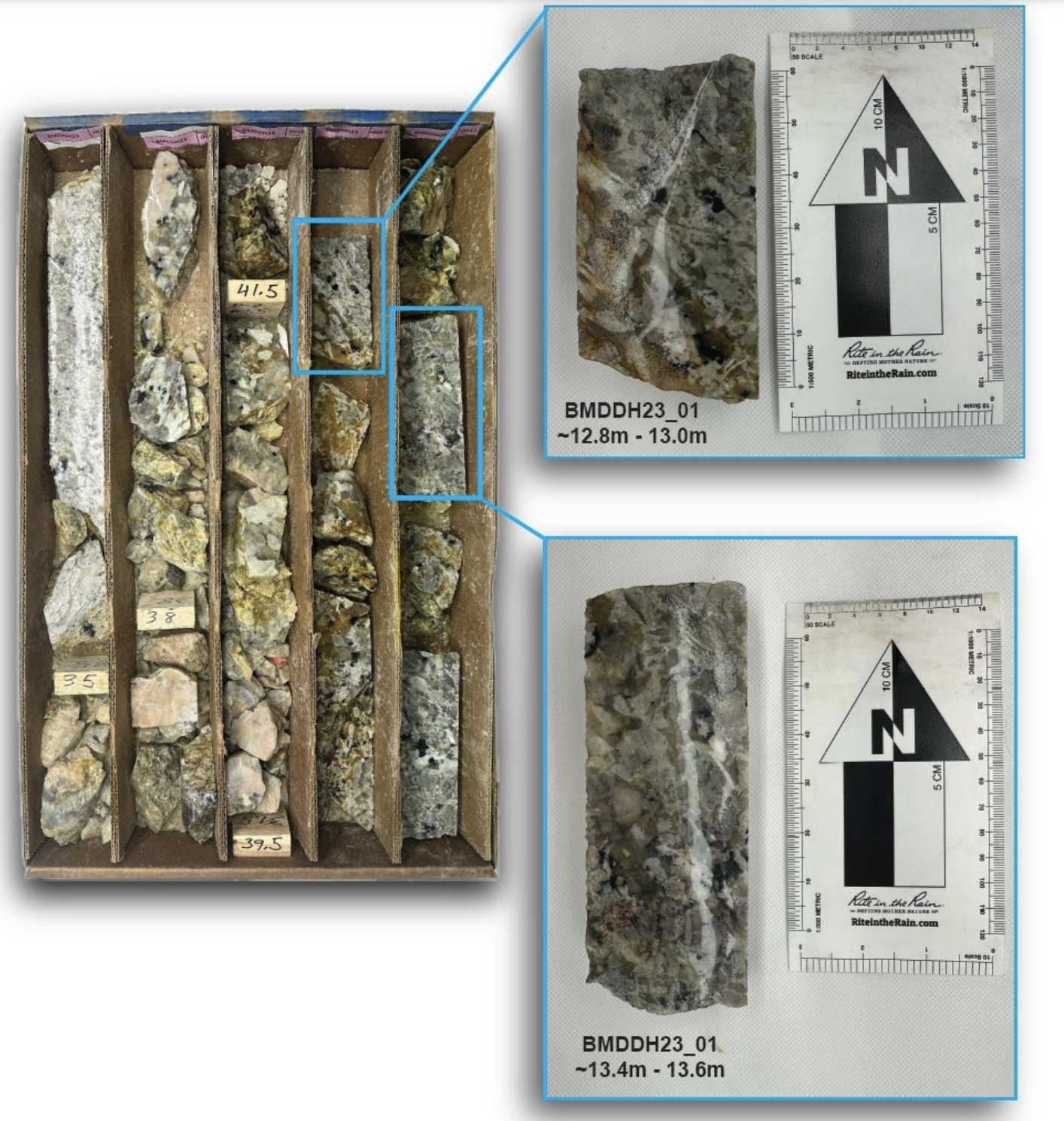

Want to see some rocks for your own visual evidence? Here you go…

Plenty of thermal wear, presumably, as the team drills further into the North American winter, deeper into Black Mountain beyond the initial eight holes.

Assay results on the other five drilled holes are pending and expected to be announced by April.

Meanwhile, regarding the potential large base metals find, CC9 plans to extend a soil sampling program and run preliminary IP lines over that anomaly in Q3 2024.

CC9’s geological consultant Edward Max Baker enthused:

“We’ve got stunning initial results in the midst of the North American winter. The targeted hard rock lithium system has been intersected in multiple holes, but we need to come back in the North American summer for a 5,000 – 10,000m drill program to get a better handle of the resource potential,” he said.

“The base-metals sulfide mineralisation is also very promising and indicates the potential for base metals and/or gold mineralisation, separate from the lithium mineralisation.”

This article was developed in collaboration with Chariot Corporation, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.