You might be interested in

Mining

Resources Top 5: Does this stonker copper hit bring back the Sandfire days for you as well?

Mining

Lanthanein Resources uncovers monstrous lithium soil anomaly at Lady Grey

Mining

Mining

Our High Voltage column wraps the news driving ASX stocks with exposure to lithium, graphite, cobalt, nickel, rare earths, manganese, magnesium, and vanadium

After 2022’s big year for lithium and pals, perhaps 2023 was always destined to struggle to live up to the same kind of hype. A bit like a second-album disappointment.

That said, Kings of Lithium and the Battered Metals are back in the studio for what they’re hoping will be a stellar next production – or just a decent year. Or at the very least, maybe a mild improvement on this one.

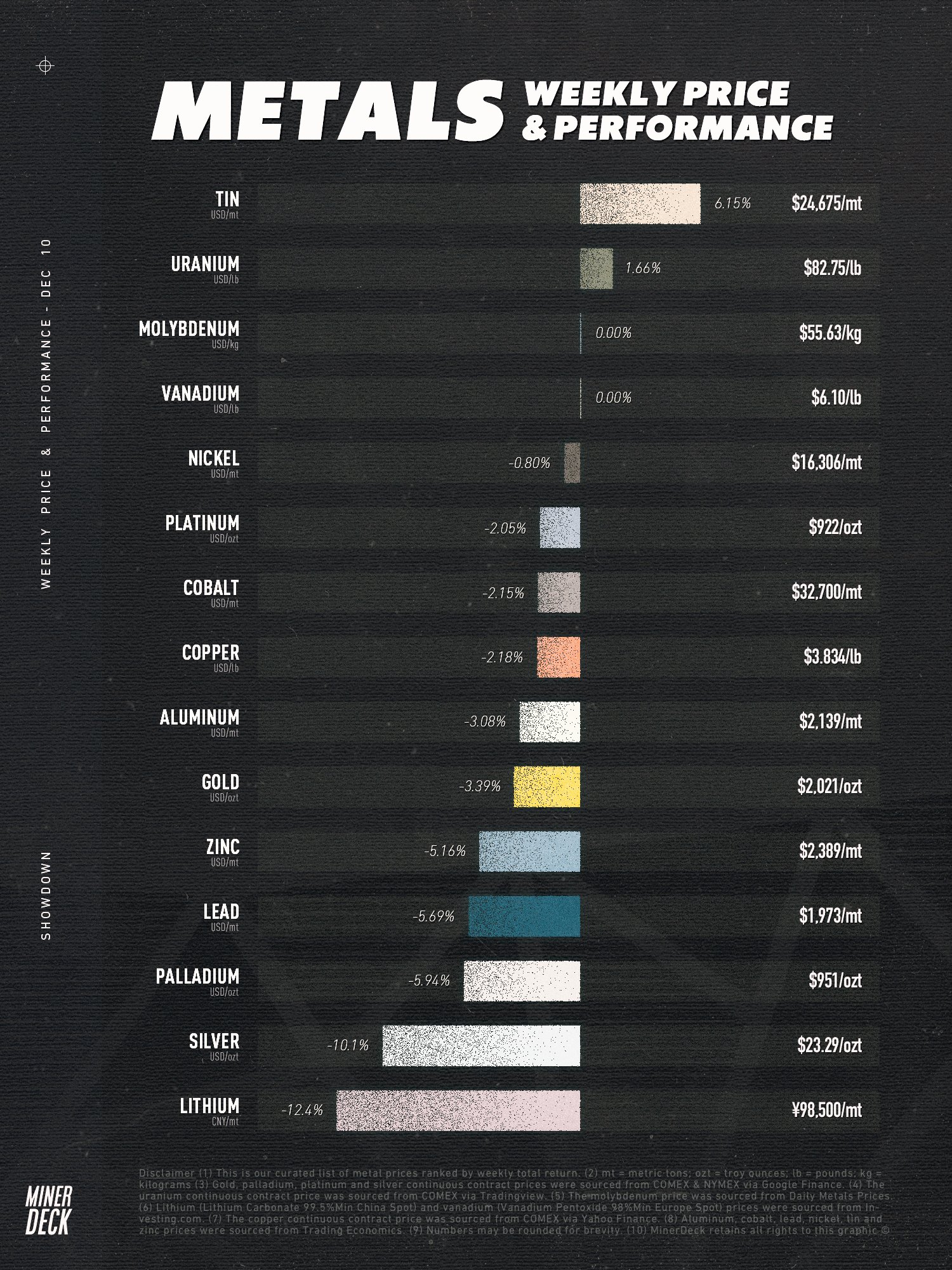

We’re not out of the 2023 woods yet, though, so how are things tracking? For a surface-level take on that, let’s turn to this weekly chart from Miner Deck, published Dec 11.

It’s only mildly crap for nickel pricing this week, but it’s downright ugly for lithium.

And here’s Lithium Price bot with specifics, below. Those YTD figures continue to get worse every week at present. This time last week, lithium carbonate’s YTD was about -75.6% and spod was around -70.8%.

2023-12-12#Lithium Carbonate 99.5% Min China Spot

Price: $15,590.40

1 day: $417.60 (-2.61%) 📉

YTD: -78.84%#Spodumene Concentrate (6%, CIF China)Price: $1,535.00

1 day: -30 (-1.92%) 📉

YTD: -73.65%Sponsored by @SiennaResources $SIE $SNNAFhttps://t.co/MmcWAPc9WW

— Lithium Price Bot (@LithiumPriceBot) December 12, 2023

Righto, so where’s this good news then?

Despite lithium prices floating somewhere beyond the S-bend, and despite the cooling off of many a battery metal stock this year (not you, WC8) thanks to a glut of Li supply and periods of slowed uptake of EVs, there are still reasons to be cheerful if you’re a battery metals investor.

And more than three.

We don’t think this is clutching at straws, because it’s a lot of straws if so. Here we go then, as briefly as we can make it… and in no order or priority…

1. Big increase in Chinese EV Sales: Just lately, there’s been a notable increase in electric vehicle sales in China, which appears to be bringing an end to a cool-off amid the troubling economic climate in the Middle Kingdom. Maybe it has something or everything to do with late-year fiscal stimulus over there, maybe not.

In any case, according to Electric Cars Report, Chinese motor vehicle company XPENG, for instance, reported a significant increase in Smart EV deliveries in November 2023, indicating strong growth in the Chinese EV market.

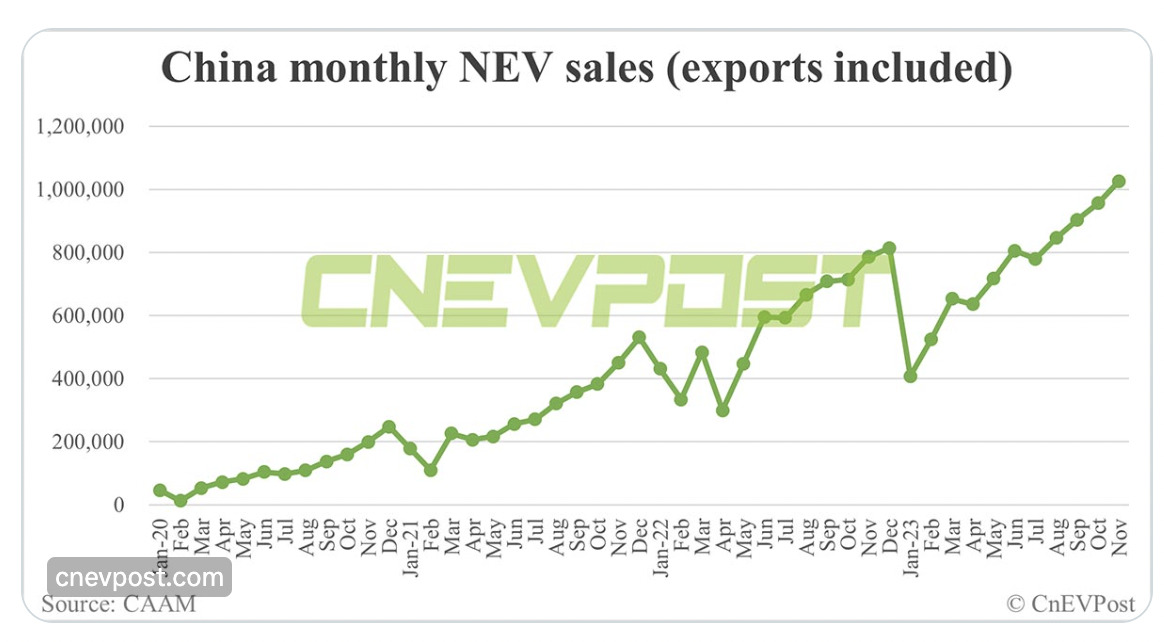

And according to CNEV Post (Chinese EV news media) stats (as pointed out by noted lithium bull Joe Lowry, below), monthly new EV sales have actually exceeded 1 million for the first time – in November.

“The demand for EVs globally is clearly strong,” writes Lowry, forecasting future FOMO/panic buying once again for lithium-related things.

Demand for #EVs globally is clearly strong. The longer China #lithium spot prices stay below the high end of the cost curve, the more likely another panic buying scenario happens when serious restocking starts in 2024. https://t.co/xoCYmU7pUp

— Joe Lowry (@globallithium) December 11, 2023

2. Rise in nationwide Chinese EV deliveries: Further to this, according to China Daily, wholesale deliveries of electric vehicles and plug-in hybrids in China were expected to reach 940,000 units in November – and that’s up 29% year-on-year.

And total sales in the first 11 months of this year are estimated to have reached 7.74 million units, up 35 per cent year-on-year, according to the China Passenger Car Association.

3. ExxonMobil’s monster lithium extraction plans: This is a big, underrated point of validation for the continuation of the lithium rush and continued demand, wethinks. As we wrote here, this American fossil fuels giant has major plans in the works to start lithium drilling in Arkansas, targeting lithium supply for over 1 million EVs per year by 2030.

“In many ways, extracting lithium from deep brine reservoirs is similar to our existing businesses,” said Exxon CFO Kathryn Mikells. “It involves upstream skills like geoscience and reservoir management, as well as efficient drilling.”

Exxon Mobil Gets More Confident Its Lithium and Hydrogen Bets Will Pay Off https://t.co/KHu3IjaNHj

— Barron's (@barronsonline) December 11, 2023

4. European Battery Funding Initiative: The EU is offering €3 billion in subsidies to battery makers to stimulate the electric vehicle industry.

That’s hardly a world shunning the EV and lithium-battery narrative, is it.

According to the the International Energy Agency (IEA), the European Commission has approved under EU State aid rules an Important Project of Common European interest (“IPCEI”) jointly notified by Belgium, Finland, France, Germany, Italy, Poland and Sweden to support research and innovation in the common European priority area of batteries.

“The seven Member States will provide in coming years up to approximately €3.2 billion in funding for this project, which is expected to unlock an additional €5 billion in private investments,” wrote the IAE.

ASX-listed Euro Manganese (ASX:EMN) liked the news, noting that the funding will create impact “across the entire battery value chain, including its upstream raw material segment”.

The European Battery Alliance, meanwhile, has also welcomed the new EU financial stimulus for the sector.

5. European and UK expansion of the EV market: Despite its well-documented current challenges, the global electric vehicle market continues to grow significantly. Toyota, for instance is planning to expand its EV lineup in Europe to six vehicle models by 2026, while Nissan is in the process of producing three new EV models at its UK plant.

6. Anglo American eyes up lithium: This mining giant, the world’s biggest producer of platinum, is reportedly actively seeking opportunities in the lithium market, further highlighting the commodity’s strategic importance for the energy transition.

7. Investment in lithium downstream processing: Investments in midstream processing facilities for lithium in Australia are also expected to enhance the economics of lithium projects throughout coming years.

Per a recent High Voltage, some of the WA state gov’s renewed strategic thinking on battery metals includes placing greater than previous emphasis on the midstream and downstream elements of the sector in resources-rich WA.

And, for the downstream element at least, this means potentially increasing the level of output when it comes to the processing stage of minerals, such as lithium and nickel, required for batteries.

“Domestic value-adding and manufacturing” is part of the newly energised strat. And “converting exploration activity into producing mines will be integral to WA’s ability to continue moving down the value chain,” reads a recent WA state gov report.

8. White-hot M&A activity in Australia’s lithium sector: This has been turning heads globally in the latter stages of this year. Notable merger and acquisition activities include the US$10.6 billion deal between Livent and Allkem and Albemarle’s US$3.7 billion offer for Liontown Resources, ultimately stymied by Hancock Prospecting’s blocking stake.

Going, Going … Albemarle pulls the pin on $6.6 billion Liontown mega lithium deal amid Rinehart shenanigans https://t.co/zOXYxHSA5u

— Maureen O'Mahoney (@cheerio46) October 16, 2023

9. SQM’s long-term outlook: Leading Chilean lithium producer SQM has made it clear it remains confident in the future of the EV market, forging ahead with its global operations and plans Down Under.

As Stockead’s Reuben Adams reported about a week ago:

Lithium darling Azure Minerals (ASX:AZS) has now filed paperwork for SQM’s proposed takeover at $3.52/sh, despite Gina Rinehart and MinRes potentially running interference, Liontown style.

Rinehart and Minres have accrued 18.9% and 13.6% stakes in the tier 1 explorer in the wake of SQM’s $1.63 billion takeover offer in October.

SQM, potentially learning from Albemarle’s mistakes, will launch a simultaneous conditional off-market takeover offer for $3.50/sh should the scheme not be successful.

The deal is being pushed through as lithium prices plumb new lows, with most stocks bearing the brunt.

Did we/I miss some big reasons to keep the battery metals faith? Let me know: [email protected]

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop. (Note: figures accurate per ASX at 3pm.)

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| PVW | PVW Res Ltd | 0.052 | 2% | -9% | -55% | $5,374,453 |

| A8G | Australasian Metals | 0.16 | -6% | -11% | -29% | $8,339,279 |

| INF | Infinity Lithium | 0.097 | -12% | 14% | -39% | $46,259,209 |

| LPI | Lithium Pwr Int Ltd | 0.54 | -1% | 3% | 10% | $342,694,766 |

| PSC | Prospect Res Ltd | 0.083 | -7% | -14% | -41% | $39,383,217 |

| PAM | Pan Asia Metals | 0.13 | -13% | -13% | -68% | $20,877,679 |

| CXO | Core Lithium | 0.24 | -6% | -34% | -80% | $534,233,886 |

| LOT | Lotus Resources Ltd | 0.275 | -11% | 12% | 38% | $482,868,651 |

| AGY | Argosy Minerals Ltd | 0.145 | -9% | -9% | -76% | $196,617,050 |

| AZS | Azure Minerals | 3.56 | -4% | -11% | 1269% | $1,637,486,083 |

| NWC | New World Resources | 0.034 | -15% | 10% | 0% | $81,422,714 |

| QXR | Qx Resources Limited | 0.021 | -25% | -25% | -58% | $25,431,741 |

| GSR | Greenstone Resources | 0.008 | -11% | 14% | -73% | $10,944,908 |

| CAE | Cannindah Resources | 0.105 | 14% | 11% | -59% | $57,807,995 |

| AZL | Arizona Lithium Ltd | 0.04 | 0% | 11% | -43% | $133,780,576 |

| RIL | Redivium Limited | 0.006 | 0% | -8% | -73% | $16,385,129 |

| COB | Cobalt Blue Ltd | 0.235 | -15% | -10% | -60% | $93,845,523 |

| LPD | Lepidico Ltd | 0.008 | -6% | -20% | -47% | $61,106,464 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | -25% | -67% | $15,569,766 |

| CZN | Corazon Ltd | 0.016 | -6% | 0% | -36% | $10,465,164 |

| LKE | Lake Resources | 0.12 | -4% | -29% | -87% | $177,805,588 |

| DEV | Devex Resources Ltd | 0.245 | -8% | -9% | -27% | $114,709,574 |

| INR | Ioneer Ltd | 0.125 | -14% | -22% | -76% | $295,597,701 |

| MAN | Mandrake Res Ltd | 0.042 | 2% | 20% | -7% | $24,014,637 |

| RLC | Reedy Lagoon Corp. | 0.005 | -29% | 0% | -57% | $3,083,418 |

| GBR | Greatbould Resources | 0.064 | -11% | -2% | -28% | $36,742,974 |

| FRS | Forrestaniaresources | 0.028 | -10% | -7% | -78% | $4,530,001 |

| STK | Strickland Metals | 0.155 | -14% | -3% | 260% | $260,907,211 |

| MLX | Metals X Limited | 0.275 | 4% | -2% | -5% | $249,498,168 |

| CLA | Celsius Resource Ltd | 0.013 | 0% | 18% | -32% | $26,952,620 |

| FGR | First Graphene Ltd | 0.069 | 1% | -12% | -40% | $41,100,286 |

| HXG | Hexagon Energy | 0.01 | 11% | 0% | -41% | $5,129,159 |

| TLG | Talga Group Ltd | 0.775 | -18% | -29% | -48% | $305,702,108 |

| MNS | Magnis Energy Tech | 0.042 | -7% | -14% | -90% | $50,378,922 |

| PLL | Piedmont Lithium Inc | 0.37 | -8% | -12% | -57% | $145,216,536 |

| EUR | European Lithium Ltd | 0.073 | 0% | 1% | -11% | $97,596,742 |

| BKT | Black Rock Mining | 0.083 | 4% | -28% | -46% | $92,174,850 |

| QEM | QEM Limited | 0.18 | -3% | -10% | 0% | $27,250,508 |

| LYC | Lynas Rare Earths | 6.03 | -6% | -15% | -29% | $5,907,268,204 |

| ESR | Estrella Res Ltd | 0.005 | 0% | -17% | -67% | $7,037,487 |

| ARL | Ardea Resources Ltd | 0.515 | 18% | -7% | -40% | $103,218,515 |

| GLN | Galan Lithium Ltd | 0.495 | -18% | -15% | -59% | $204,868,922 |

| JLL | Jindalee Lithium Ltd | 0.88 | -8% | -18% | -56% | $55,489,908 |

| VUL | Vulcan Energy | 2.11 | -9% | -12% | -69% | $380,281,348 |

| SBR | Sabre Resources | 0.028 | -20% | -28% | -38% | $9,776,397 |

| CHN | Chalice Mining Ltd | 1.58 | 2% | -3% | -76% | $632,065,369 |

| VRC | Volt Resources Ltd | 0.008 | 14% | 23% | -50% | $24,780,640 |

| NMT | Neometals Ltd | 0.18 | -8% | -26% | -81% | $112,143,708 |

| AXN | Alliance Nickel Ltd | 0.055 | 6% | 0% | -41% | $36,291,981 |

| PNN | Power Minerals Ltd | 0.21 | -5% | -16% | -60% | $18,342,879 |

| IGO | IGO Limited | 7.71 | -4% | -14% | -49% | $6,073,287,860 |

| GED | Golden Deeps | 0.046 | -4% | -21% | -54% | $5,429,550 |

| ADV | Ardiden Ltd | 0.17 | -6% | -21% | -51% | $10,627,976 |

| SRI | Sipa Resources Ltd | 0.029 | 26% | 38% | -24% | $7,301,060 |

| NTU | Northern Min Ltd | 0.03 | -12% | -3% | -23% | $183,240,357 |

| AXE | Archer Materials | 0.37 | -5% | -10% | -45% | $95,567,630 |

| PGM | Platina Resources | 0.023 | -12% | -8% | 15% | $14,333,148 |

| AAJ | Aruma Resources Ltd | 0.03 | -6% | -12% | -55% | $5,906,745 |

| IXR | Ionic Rare Earths | 0.021 | -5% | -19% | -46% | $88,578,203 |

| NIC | Nickel Industries | 0.68 | -4% | -14% | -33% | $2,978,637,867 |

| EVG | Evion Group NL | 0.032 | -9% | -16% | -59% | $11,070,694 |

| CWX | Carawine Resources | 0.12 | 9% | 14% | 32% | $28,335,054 |

| PLS | Pilbara Min Ltd | 3.5 | -1% | 0% | -22% | $10,834,084,602 |

| HAS | Hastings Tech Met | 0.64 | -7% | -22% | -83% | $86,028,824 |

| BUX | Buxton Resources Ltd | 0.19 | 0% | -7% | 73% | $33,783,144 |

| ARR | American Rare Earths | 0.145 | 0% | 7% | -34% | $66,963,495 |

| SGQ | St George Min Ltd | 0.033 | -8% | -13% | -55% | $31,490,770 |

| TKL | Traka Resources | 0.004 | 0% | 0% | -20% | $3,501,317 |

| PAN | Panoramic Resources | 0.035 | 0% | -5% | -81% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | -32% | $48,441,219 |

| IPT | Impact Minerals | 0.009 | -14% | -31% | 13% | $28,647,039 |

| LIT | Lithium Australia | 0.03 | 0% | -12% | -36% | $34,221,367 |

| AKE | Allkem Limited | 9.13 | 6% | 1% | -30% | $5,913,721,960 |

| ARN | Aldoro Resources | 0.083 | 0% | 0% | -69% | $11,173,771 |

| JRV | Jervois Global Ltd | 0.044 | 7% | 19% | -86% | $118,910,910 |

| SYR | Syrah Resources | 0.64 | 11% | -16% | -75% | $446,092,502 |

| FBM | Future Battery | 0.071 | -4% | -16% | 37% | $38,430,431 |

| ADD | Adavale Resource Ltd | 0.008 | 0% | 0% | -63% | $5,972,709 |

| LTR | Liontown Resources | 1.28 | -6% | -15% | -28% | $3,233,349,648 |

| CTM | Centaurus Metals Ltd | 0.45 | -8% | -7% | -63% | $235,057,376 |

| VML | Vital Metals Limited | 0.01 | 0% | 0% | -60% | $53,061,498 |

| BSX | Blackstone Ltd | 0.069 | -17% | -22% | -53% | $31,737,157 |

| POS | Poseidon Nick Ltd | 0.016 | -6% | -16% | -57% | $59,397,128 |

| CHR | Charger Metals | 0.19 | -22% | -42% | -68% | $15,997,161 |

| AVL | Aust Vanadium Ltd | 0.022 | -4% | 0% | -12% | $109,309,349 |

| AUZ | Australian Mines Ltd | 0.01 | -29% | -29% | -85% | $8,830,434 |

| TMT | Technology Metals | 0.24 | 14% | 9% | -29% | $54,671,487 |

| RXL | Rox Resources | 0.185 | -16% | -12% | 9% | $70,177,309 |

| RNU | Renascor Res Ltd | 0.12 | -11% | -29% | -59% | $317,425,937 |

| GL1 | Globallith | 1.23 | -2% | 0% | -42% | $325,331,624 |

| ASN | Anson Resources Ltd | 0.145 | 0% | -9% | -29% | $180,003,484 |

| SYA | Sayona Mining Ltd | 0.057 | 2% | -30% | -73% | $586,717,873 |

| EGR | Ecograf Limited | 0.145 | -9% | -33% | -41% | $70,374,932 |

| ATM | Aneka Tambang | 1.18 | 0% | 0% | 12% | $1,538,306 |

| TVN | Tivan Limited | 0.074 | -8% | -3% | -14% | $113,196,071 |

| ALY | Alchemy Resource Ltd | 0.01 | 0% | -9% | -63% | $11,780,763 |

| GAL | Galileo Mining Ltd | 0.255 | -4% | -9% | -71% | $55,334,980 |

| BHP | BHP Group Limited | 47.56 | 1% | 5% | 0% | $240,967,889,474 |

| LEL | Lithenergy | 0.545 | -8% | -9% | -39% | $57,685,600 |

| MMC | Mitremining | 0.235 | -16% | 12% | -22% | $14,171,906 |

| RMX | Red Mount Min Ltd | 0.004 | 33% | -20% | -20% | $8,020,728 |

| GW1 | Greenwing Resources | 0.09 | -10% | -33% | -73% | $17,425,148 |

| AQD | Ausquest Limited | 0.011 | -15% | -8% | -45% | $9,076,641 |

| LML | Lincoln Minerals | 0.006 | 20% | -8% | -12% | $10,224,272 |

| 1MC | Morella Corporation | 0.0055 | -8% | -21% | -66% | $30,893,997 |

| REE | Rarex Limited | 0.027 | 4% | -13% | -52% | $18,451,437 |

| MRC | Mineral Commodities | 0.031 | 7% | -3% | -51% | $28,549,705 |

| PUR | Pursuit Minerals | 0.009 | 13% | -10% | -25% | $23,551,771 |

| QPM | Queensland Pacific | 0.052 | 0% | -5% | -55% | $102,639,556 |

| EMH | European Metals Hldg | 0.52 | -5% | -17% | -22% | $68,511,809 |

| BMM | Balkanminingandmin | 0.125 | -7% | -11% | -58% | $9,235,267 |

| PEK | Peak Rare Earths Ltd | 0.315 | -13% | -18% | -32% | $84,685,269 |

| LEG | Legend Mining | 0.017 | -11% | -15% | -48% | $52,280,589 |

| MOH | Moho Resources | 0.009 | 0% | 29% | -62% | $4,823,470 |

| AML | Aeon Metals Ltd. | 0.011 | 0% | 22% | -61% | $12,060,407 |

| G88 | Golden Mile Res Ltd | 0.02 | -5% | -23% | -21% | $6,917,180 |

| WKT | Walkabout Resources | 0.12 | -20% | -27% | 9% | $92,298,450 |

| TON | Triton Min Ltd | 0.022 | -4% | -12% | -42% | $34,349,911 |

| AR3 | Austrare | 0.125 | -17% | -34% | -64% | $21,583,235 |

| ARU | Arafura Rare Earths | 0.195 | -3% | 0% | -55% | $433,239,762 |

| MIN | Mineral Resources. | 61.02 | 2% | 5% | -33% | $12,064,473,115 |

| VMC | Venus Metals Cor Ltd | 0.1 | -5% | -5% | 32% | $18,972,868 |

| S2R | S2 Resources | 0.18 | -10% | 0% | 9% | $84,189,712 |

| CNJ | Conico Ltd | 0.005 | 0% | 11% | -38% | $7,850,475 |

| VR8 | Vanadium Resources | 0.045 | 0% | 0% | -25% | $24,756,104 |

| PVT | Pivotal Metals Ltd | 0.014 | -22% | -39% | -71% | $10,805,893 |

| BOA | Boadicea Resources | 0.035 | -3% | -26% | -63% | $4,431,251 |

| IPX | Iperionx Limited | 1.275 | -10% | -14% | 72% | $279,960,435 |

| SLZ | Sultan Resources Ltd | 0.014 | -13% | -7% | -83% | $2,074,661 |

| NKL | Nickelxltd | 0.051 | -15% | -22% | -36% | $5,093,280 |

| NVA | Nova Minerals Ltd | 0.325 | 16% | 20% | -52% | $67,484,788 |

| MLS | Metals Australia | 0.034 | -6% | -8% | -35% | $21,841,267 |

| MQR | Marquee Resource Ltd | 0.028 | 0% | -13% | -49% | $11,988,147 |

| MRR | Minrex Resources Ltd | 0.017 | 0% | 13% | -55% | $18,442,748 |

| EVR | Ev Resources Ltd | 0.01 | 0% | 0% | -50% | $8,591,295 |

| EFE | Eastern Resources | 0.009 | 0% | -25% | -71% | $11,177,518 |

| CNB | Carnaby Resource Ltd | 0.8 | 13% | 16% | -4% | $130,277,070 |

| BNR | Bulletin Res Ltd | 0.125 | -4% | -22% | 25% | $33,765,532 |

| AX8 | Accelerate Resources | 0.035 | -15% | -29% | 21% | $20,487,663 |

| AM7 | Arcadia Minerals | 0.074 | -13% | -17% | -70% | $8,069,707 |

| AS2 | Askarimetalslimited | 0.185 | 3% | 6% | -53% | $12,376,034 |

| BYH | Bryah Resources Ltd | 0.013 | -13% | -38% | -49% | $5,636,894 |

| DTM | Dart Mining NL | 0.016 | 0% | -16% | -75% | $3,641,274 |

| EMS | Eastern Metals | 0.029 | -9% | 4% | -65% | $2,225,509 |

| FG1 | Flynngold | 0.06 | -21% | -33% | -35% | $8,455,720 |

| GSM | Golden State Mining | 0.016 | -16% | -36% | -66% | $3,821,764 |

| IMI | Infinitymining | 0.14 | 0% | 17% | -61% | $10,900,361 |

| LRV | Larvottoresources | 0.078 | -3% | -15% | -56% | $4,976,849 |

| LSR | Lodestar Minerals | 0.0045 | 13% | 0% | -10% | $9,105,288 |

| RAG | Ragnar Metals Ltd | 0.022 | 5% | -4% | 36% | $10,427,581 |

| CTN | Catalina Resources | 0.004 | 14% | 14% | -50% | $4,953,948 |

| TMB | Tambourahmetals | 0.14 | -10% | -10% | 4% | $11,611,649 |

| TEM | Tempest Minerals | 0.008 | 0% | -20% | -68% | $4,346,760 |

| EMC | Everest Metals Corp | 0.085 | -2% | -2% | -6% | $15,348,612 |

| WML | Woomera Mining Ltd | 0.031 | 19% | 24% | 55% | $37,004,531 |

| KZR | Kalamazoo Resources | 0.105 | -19% | -5% | -50% | $19,707,489 |

| LMG | Latrobe Magnesium | 0.059 | 2% | 20% | -21% | $105,923,022 |

| KOR | Korab Resources | 0.017 | 0% | 6% | -39% | $6,239,850 |

| CMX | Chemxmaterials | 0.059 | -21% | -26% | -69% | $3,566,581 |

| NC1 | Nicoresourceslimited | 0.35 | 17% | 9% | -51% | $36,742,698 |

| GRE | Greentechmetals | 0.445 | -5% | -45% | 218% | $32,536,667 |

| CMO | Cosmometalslimited | 0.06 | 0% | 20% | -52% | $2,081,800 |

| FRB | Firebird Metals | 0.14 | -10% | -18% | -22% | $19,482,596 |

| S32 | South32 Limited | 3.05 | -2% | -3% | -27% | $13,995,408,975 |

| OMH | OM Holdings Limited | 0.45 | -1% | 0% | -40% | $344,815,560 |

| JMS | Jupiter Mines. | 0.165 | -3% | -11% | -20% | $323,233,520 |

| E25 | Element 25 Ltd | 0.475 | -4% | 22% | -56% | $104,414,561 |

| EMN | Euromanganese | 0.105 | -13% | 8% | -71% | $25,627,658 |

| KGD | Kula Gold Limited | 0.018 | -28% | 38% | -40% | $9,226,047 |

| LRS | Latin Resources Ltd | 0.2 | 11% | -17% | 60% | $596,153,333 |

| CRR | Critical Resources | 0.019 | -21% | -44% | -61% | $39,112,706 |

| ENT | Enterprise Metals | 0.003 | 0% | -25% | -67% | $2,398,413 |

| SCN | Scorpion Minerals | 0.041 | 3% | -27% | -45% | $17,488,366 |

| GCM | Green Critical Min | 0.011 | 22% | 57% | -31% | $12,502,435 |

| ENV | Enova Mining Limited | 0.009 | 0% | 50% | -31% | $5,768,364 |

| RBX | Resource B | 0.08 | -5% | -27% | -16% | $6,614,759 |

| AKN | Auking Mining Ltd | 0.042 | -16% | 5% | -56% | $9,444,502 |

| RR1 | Reach Resources Ltd | 0.004 | -20% | -67% | -20% | $12,841,188 |

| EMT | Emetals Limited | 0.007 | 0% | 0% | -42% | $5,950,000 |

| PNT | Panthermetalsltd | 0.06 | 9% | -21% | -69% | $3,669,000 |

| WIN | Widgienickellimited | 0.115 | 17% | -28% | -68% | $24,431,494 |

| WMG | Western Mines | 0.295 | 0% | 5% | 90% | $18,705,833 |

| AVW | Avira Resources Ltd | 0.0015 | 0% | -25% | -50% | $4,267,580 |

| CAI | Calidus Resources | 0.17 | -13% | 0% | -48% | $109,842,661 |

| GT1 | Greentechnology | 0.265 | -16% | -35% | -71% | $75,940,093 |

| KAI | Kairos Minerals Ltd | 0.015 | 0% | -6% | -34% | $39,313,683 |

| MTM | MTM Critical Metals | 0.024 | -4% | 4% | -73% | $2,384,090 |

| NWM | Norwest Minerals | 0.029 | -3% | -12% | -45% | $8,339,516 |

| PGD | Peregrine Gold | 0.27 | 0% | -10% | -28% | $14,461,468 |

| RAS | Ragusa Minerals Ltd | 0.04 | 0% | -18% | -71% | $5,703,951 |

| RGL | Riversgold | 0.013 | -19% | 44% | -55% | $12,366,399 |

| SRZ | Stellar Resources | 0.0085 | 6% | -6% | -29% | $9,495,141 |

| STM | Sunstone Metals Ltd | 0.015 | -6% | -17% | -67% | $46,229,773 |

| ZNC | Zenith Minerals Ltd | 0.155 | 11% | -6% | -38% | $49,333,324 |

| WC8 | Wildcat Resources | 0.705 | 3% | -12% | 2418% | $860,330,131 |

| ASO | Aston Minerals Ltd | 0.028 | -10% | -18% | -70% | $37,556,864 |

| THR | Thor Energy PLC | 0.028 | -7% | 12% | -53% | $5,209,017 |

| YAR | Yari Minerals Ltd | 0.009 | -31% | -44% | -55% | $4,823,578 |

| IG6 | Internationalgraphit | 0.175 | 6% | -8% | -37% | $15,572,919 |

| LPM | Lithium Plus | 0.365 | -10% | -27% | -23% | $36,544,985 |

| ODE | Odessa Minerals Ltd | 0.007 | -13% | -22% | -53% | $7,576,895 |

| KOB | Kobaresourceslimited | 0.085 | 10% | 0% | -43% | $8,644,167 |

| AZI | Altamin Limited | 0.052 | -2% | -13% | -41% | $20,369,271 |

| FTL | Firetail Resources | 0.082 | -2% | -17% | -49% | $13,401,500 |

| LNR | Lanthanein Resources | 0.01 | 67% | 43% | -67% | $14,187,931 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -91% | $12,357,082 |

| NVX | Novonix Limited | 0.645 | -8% | -12% | -64% | $320,060,157 |

| OCN | Oceanalithiumlimited | 0.12 | -4% | 0% | -73% | $6,899,945 |

| SUM | Summitminerals | 0.105 | 0% | -16% | -38% | $5,003,998 |

| DVP | Develop Global Ltd | 2.87 | -4% | 1% | -2% | $720,337,827 |

| XTCDA | Xantippe Res Ltd | 0.2 | 0% | 0% | -67% | $17,528,005 |

| OD6 | Od6Metalsltd | 0.165 | 0% | -13% | -54% | $8,802,479 |

| HRE | Heavy Rare Earths | 0.07 | -22% | -24% | -53% | $4,294,643 |

| LIN | Lindian Resources | 0.165 | 0% | -6% | -6% | $195,826,780 |

| PEK | Peak Rare Earths Ltd | 0.315 | -13% | -18% | -32% | $84,685,269 |

| ILU | Iluka Resources | 6.83 | -3% | -4% | -35% | $2,897,019,654 |

| ASM | Ausstratmaterials | 1.32 | 0% | -20% | -19% | $216,829,577 |

| ETM | Energy Transition | 0.04 | -5% | 21% | -17% | $57,402,452 |

| VMS | Venture Minerals | 0.01 | -13% | 0% | -58% | $19,500,130 |

| IDA | Indiana Resources | 0.059 | -2% | -2% | 11% | $36,914,224 |

| VTM | Victory Metals Ltd | 0.21 | -5% | -13% | -7% | $17,907,924 |

| M2R | Miramar | 0.024 | 26% | 9% | -68% | $4,168,347 |

| WCN | White Cliff Min Ltd | 0.01 | -17% | -13% | -29% | $14,042,153 |

| TAR | Taruga Minerals | 0.01 | -9% | 11% | -74% | $7,060,268 |

| ABX | ABX Group Limited | 0.069 | 0% | 1% | -49% | $16,721,516 |

| MEK | Meeka Metals Limited | 0.042 | -5% | 14% | -35% | $49,967,775 |

| RR1 | Reach Resources Ltd | 0.004 | -20% | -67% | -20% | $12,841,188 |

| DRE | Dreadnought Resources Ltd | 0.031 | -6% | -11% | -65% | $110,622,250 |

| KFM | Kingfisher Mining | 0.14 | -18% | 0% | -73% | $7,520,100 |

| AOA | Ausmon Resorces | 0.003 | 0% | 20% | -60% | $3,020,998 |

| WC1 | Westcobarmetals | 0.079 | 34% | 32% | -54% | $8,575,144 |

| GRL | Godolphin Resources | 0.038 | 0% | 9% | -52% | $6,431,197 |

| DM1 | Desert Metals | 0.058 | 49% | 45% | -76% | $3,752,054 |

| PTR | Petratherm Ltd | 0.04 | 3% | -13% | -32% | $8,765,294 |

| ITM | Itech Minerals Ltd | 0.125 | -11% | -17% | -57% | $15,883,863 |

| KTA | Krakatoa Resources | 0.04 | -7% | 18% | -32% | $19,828,503 |

| M24 | Mamba Exploration | 0.038 | 27% | 27% | -77% | $2,134,417 |

| LNR | Lanthanein Resources | 0.01 | 67% | 43% | -67% | $14,187,931 |

| TKM | Trek Metals Ltd | 0.045 | 0% | -8% | -42% | $23,433,130 |

| BCA | Black Canyon Limited | 0.135 | 13% | -4% | -50% | $7,836,268 |

| CDT | Castle Minerals | 0.009 | -10% | -18% | -64% | $11,020,437 |

| DLI | Delta Lithium | 0.44 | -5% | -13% | -2% | $308,920,004 |

| A11 | Atlantic Lithium | 0.5 | 0% | 25% | -28% | $315,304,455 |

| KNI | Kunikolimited | 0.25 | -4% | -17% | -52% | $21,906,098 |

| CY5 | Cygnus Metals Ltd | 0.135 | -10% | -13% | -71% | $37,902,688 |

| WR1 | Winsome Resources | 0.97 | -14% | -22% | -26% | $194,197,628 |

| LLI | Loyal Lithium Ltd | 0.31 | -2% | -25% | -39% | $25,647,652 |

| BC8 | Black Cat Syndicate | 0.255 | -14% | 16% | -18% | $75,941,336 |

| BUR | Burleyminerals | 0.165 | 0% | -23% | -41% | $15,700,997 |

| PBL | Parabellumresources | 0.082 | -76% | -76% | -81% | $21,493,500 |

| L1M | Lightning Minerals | 0.145 | -3% | 7% | -26% | $6,122,634 |

| WA1 | Wa1Resourcesltd | 7.47 | -11% | -25% | 302% | $340,197,600 |

| EV1 | Evolutionenergy | 0.13 | 0% | -4% | -48% | $31,813,284 |

| 1AE | Auroraenergymetals | 0.075 | -3% | -23% | -62% | $12,258,934 |

| RVT | Richmond Vanadium | 0.305 | -2% | -15% | 0% | $26,293,381 |

| PMT | Patriotbatterymetals | 1.07 | 1% | -1% | -4% | $475,750,132 |

| PAT | Patriot Lithium | 0.205 | 8% | -2% | -43% | $13,018,255 |

| BM8 | Battery Age Minerals | 0.19 | -10% | -5% | -62% | $16,936,009 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | -54% | $3,786,192 |

| VHM | Vhmlimited | 0.7 | 6% | 47% | 0% | $105,432,546 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | 0% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.01 | 5% | 0% | -17% | $18,367,531 |

| SRL | Sunrise | 0.555 | -9% | -20% | -72% | $51,429,674 |

| SYR | Syrah Resources | 0.64 | 11% | -16% | -75% | $446,092,502 |

| EG1 | Evergreenlithium | 0.18 | -10% | -3% | 0% | $10,121,400 |

| WSR | Westar Resources | 0.022 | -12% | 10% | -61% | $4,633,938 |

| LU7 | Lithium Universe Ltd | 0.028 | -15% | -28% | -7% | $11,655,657 |

| MEI | Meteoric Resources | 0.205 | 0% | -15% | 1181% | $408,260,396 |

| REC | Rechargemetals | 0.095 | -10% | -30% | -27% | $11,135,197 |

| SLM | Solismineralsltd | 0.14 | -13% | -35% | 84% | $10,596,043 |

| DYM | Dynamicmetalslimited | 0.155 | 7% | -23% | 0% | $5,250,000 |

| TOR | Torque Met | 0.225 | 25% | 15% | 29% | $28,913,298 |

| ICL | Iceni Gold | 0.051 | -18% | -14% | -54% | $13,791,786 |

| TMX | Terrain Minerals | 0.005 | 0% | 25% | -29% | $6,767,139 |

| MHC | Manhattan Corp Ltd | 0.004 | 0% | 0% | -33% | $11,747,919 |

| MHK | Metalhawk. | 0.125 | -19% | -34% | -48% | $12,426,806 |

| ANX | Anax Metals Ltd | 0.025 | -7% | -14% | -56% | $12,022,941 |

| FIN | FIN Resources Ltd | 0.019 | -14% | -39% | -17% | $11,686,837 |

| LM1 | Leeuwin Metals Ltd | 0.18 | -10% | -32% | 0% | $8,282,813 |

| HAW | Hawthorn Resources | 0.09 | 13% | -10% | -31% | $30,151,405 |

| LCY | Legacy Iron Ore | 0.016 | 0% | -6% | -16% | $96,102,393 |

| RON | Roninresourcesltd | 0.225 | 13% | 45% | 18% | $7,694,572 |

| ASR | Asra Minerals Ltd | 0.007 | 0% | -13% | -59% | $13,031,966 |

| MGA | MetalsGrove Mining | 0.083 | 18% | 8% | 55% | $3,090,000 |

| PFE | Panteraminerals | 0.051 | -14% | -19% | -58% | $5,460,700 |

(Circa 5pm-ish on December 12)

Charged up 🚀

Lanthanein Resources (ASX:LNR)+67% (Acquiring a 70% interest in Lady Grey lithium-tantalum project, just 400m west of the massive Earl Grey lithium mine at Mount Holland, WA. More > here)

Desert Metals (ASX:DM1)+49% (Oversubscribed $3.75m funding placement to help support the company’s gold and lithium acquisition in Côte d’Ivoire – CDI Resources Limited. More > here)

West Cobar Metals (ASX:WC1)+34% (A battery metals hunter, yes, but actually making recent gains based on its Salazar REE project operations in WA. More > here)

Some more battery metals pertinence kicking about on the head of Tesla’s social platform…

This first one especially caught our eyes, given the attention lepidolite has been receiving lately as a potential rival to spodumene.

Thought i might do a quick post giving my view on lepidolite given its getting so much attention recently. The general consensus is that the reason the spot price of lithium hydroxide and spodumene concentrate are decreasing is due to the Chinese rapidly processing significant… pic.twitter.com/PSF2yoXGhS

— Dwayne Sparkes (@sparkes_dwayne) December 12, 2023

TLDR? The tweet’s author, prospector Dwayne Sparkes concluded with this:

“In my opinion, there is no chance that lepidolite will ever be processed cheaper than spodumene. Also, it seems that spodumene is actually more common than lepidolite from the deposits I’ve studied. Has anyone ever found an Andover that’s lepidolite dominated!? I think the market is flooded with artisian mined lepidolite that will soon become exhausted.”

Elsewhere…

The energy storage revolution 2016 to 2023 in one @benchmarkmin chart

We expect the total lithium ion battery market to stop just shy of 1TWh in size in 2023.

While the growth of EVs have been front and centre of the discussion, ESS is emerging and now accounts for 13% of… pic.twitter.com/a7uRDLoNmX

— Simon Moores (@sdmoores) December 11, 2023

The best indicator of #lithium demand is GWH produced. The 2023 narrative of “soft demand” requires nuance. Demand is clear – but much of the lithium supplied has been from dwindling inventory across the SC in the form of chemicals, cathode, cells. Guess what happens in 2024? pic.twitter.com/zXV252tf30

— Joe Lowry (@globallithium) December 11, 2023

All #lithium ore & chemical prices fell today in the Chinese spot market reinforcing the downward trend of the last 4 months or so. In addition, all futures but 2 also went down changing to a great extent last week's upward trend. Volatility continues to be the order of the day. pic.twitter.com/UhwovfsSuS

— Juan Carlos Zuleta (@jczuleta) December 11, 2023

LOL @GoldmanSachs was “right” like a stopped clock is correct twice a day. A gross over simplification of the #lithium mkt & price narrative. Let’s see if the “flood” of lepidolite does anything more long term than prop up the cost curve & ensure high margins for low cost brine. https://t.co/1sz5pFE52p

— Joe Lowry (@globallithium) December 11, 2023

In a lithium ion battery industry that has grown an order of magnitude in 7 years, what has become clear is the basic tailwinds for this technology.

✅ Lithium ion batteries are getting better

Cell chemistries, pack technology, vehicle engineering are all significantly…

— Simon Moores (@sdmoores) December 11, 2023