High Voltage: Exxon lithium pivot to push lithium narrative into overdrive; EV sales surge in Europe

Mining

Mining

Our High Voltage column wraps the news driving ASX stocks with exposure to lithium, graphite, cobalt, nickel, rare earths, manganese, magnesium, and vanadium.

If you’re a battery metals investor, there are several reasons to be optimistic about the future of the sector, or at least awake to it. Here are three…

1. Fossil fuels beast Exxon’s big shift into lithium

2. Growing evidence of long-term EV demand with sales picking up

3. Follow-the-money M&A activity in the Aussie lithium scene

And there’s more besides, too. The ducks seem to be lining up for battery metal hunters and producers – you just need to look at the big picture is all.

The “exponential age” is that big, wide-angle lens picture – one that encompasses rapidly accelerating technologies – artificial intelligence, machine learning, biotech, blockchain, clean, efficient energy narratives and more.

Battery metals mining and production and electric-powered vehicles (EVs) very much slots into the “and more” part. Which is not to say it’s not a massive part of the very near future.

American oil and gas energy major ExxonMobil has certainly woken in a cold sweat from its electric dreaming. It’s been known for a while it’s been shifting towards the EV narrative and has now confirmed it’s making a major move into the sector – lithium hunting and producing.

Meanwhile S&P Global sees the neon writing on the wall, too, citing exciting stats in its latest research, which we’ll touch on further below.

ExxonMobil announced this week that it plans to start lithium production in Arkansas by 2027, which marks a dramatic shift back into the lithium battery space.

We say ‘back’, because the lithium-ion battery was invented by an Exxon research scientist in the 1970s, before the company decided back then it was an un-scalable narrative, and that fossil fuels were absolutely the way to go for multiple decades.

It’s multiple decades later and Exxon has dubbed its new plan “Project Evergreen”. This is set to involve a partnership with Tetra Technologies to produce battery-ready lithium in bulk.

Earlier this year, ExxonMobil CEO Darren Woods told CNBC that his company expects all new car sales to be electric by 2040. Tesla’s Elon Musk, by the way, has a closer target for that – about 2035.

In early 2023, ExxonMobil gained the rights to 120,000 acres of the Smackover formation in southern Arkansas – “considered one of the most prolific lithium resources of its type in North America” says the company.

Exxon stated on Monday that it’s talking with “potential customers” in the electric vehicle and battery making space. And, by the start of the next decade, the company plans to produce “enough lithium to supply the manufacturing needs of well over a million EVs per year”.

That’s our italicisation there… and it works best if you can imagine it in a Dr Evil voice.

ExxonMobil has begun drilling for Lithium in Arkansas. How quickly will Exxon start processing lithium here in the U.S. for EV batteries. Watch, CNBC's full interview with Exxon Mobil's Dan Ammann @CNBC https://t.co/P1T8yGAsvS

— Phil LeBeau (@Lebeaucarnews) November 13, 2023

Exxon executive Dan Ammann told CNBC this week, too, that the company wants “to get in early” on domestic lithium mining.

And that desire to be a relatively early mover comes as the US and European governments, not to mention other global govs including Australia, begin to ramp up promotion of EVs and reducing fossil fuel consumption. Case in point, this…

Canberra's Parliament House is poised to become a hub for electric vehicle power after the launch of 10 charging stations and plans to install more than 50..https://t.co/JChGaOvbVL

— The Driven (@TheDriven_io) November 13, 2023

There are about 280 million vehicles in the US today, and fewer than 3 million are EVs, or about 1% of the total, Ammann said.

“There is still 99% to go, which suggests it is a very, very big opportunity,” he added. “In the long term, lithium really is a global opportunity.”

Exxon will be going the briny route for its lithium hunt in areas of Arkansas renowned for large lithium-rich saltwater deposits.

It will reportedly be using oil and gas drilling methods to access reservoirs more than 3,000m underground and will then use direct lithium extraction (DLE) tech to separate the lithium from the brine.

Ammann reckons the company’s approach will represent “far fewer environmental impacts than traditional mining operations”, which is a statement that would no doubt infuriate aquatic ecologists.

Still, a chunk of the opportunity is there for Exxon to seize, as the US has just one commercial-scale lithium mining site – run by chemical manufacturing titan Albemarle, in Nevada.

A “global opportunity”, it is indeed, though – and the race is on.

In S&P Global’s most recent Commodity Insights report, a few things jumped out at us, the following absolutely being one of them:

“S&P Global Mobility has forecast that an over 270% increase of lithium production levels is needed to meet forecast demand from the EV battery sector by 2030.”

That’s getting on for almost quadrupling current production levels for an expected boom in uptake of EVs by the beginning of the next decade.

Obviously Exxon wants to be a big part of that, as does a plethora of Aussie resources companies.

And we’re not forgetting this neat recent infographic from Visual Capitalist, which suggests that by 2030, the way things are potentially going, demand for lithium will outstrip supply by 46%.

Lithium is one of the world’s most critical natural resources and is central to our push toward sustainable energy ⚡️

Our sponsor @energyx asks: with over 350M EVs expected to be sold globally by 2030, can we meet tomorrow’s lithium demand?

Find out: https://t.co/u6IlifjAyU pic.twitter.com/TyAazAdSve

— Visual Capitalist (@VisualCap) October 27, 2023

The shorter-term story in the sector, though, as S&P Global notes is one of oversupply:

“The market is currently considered to be in a short-term supply surplus amid better-than-expected progress from eight projects that were due to come online in 2023 located in Australia, Brazil, China and Canada, and two each in Zimbabwe and Argentina,” reads the report.

“High supply chain inventories and consumer spending constrained by a weak macroeconomic environment” have played their parts.

S&P Global also notes, though, that despite recent bearish spot price sentiment for lithium, “there has been a surge of M&A activity in the lithium market as established players look to buy promising junior miners to secure lithium supply”.

Liontown Resources (ASX:LTR) , Wildcat Resources (ASX:WC8) and Delta Lithium (ASX:DLI), for example – as regular readers of Stockhead will be fully aware by now.

Okay, yeah, there’s this, too, from a World Economic Forum report this week, dated November 13.

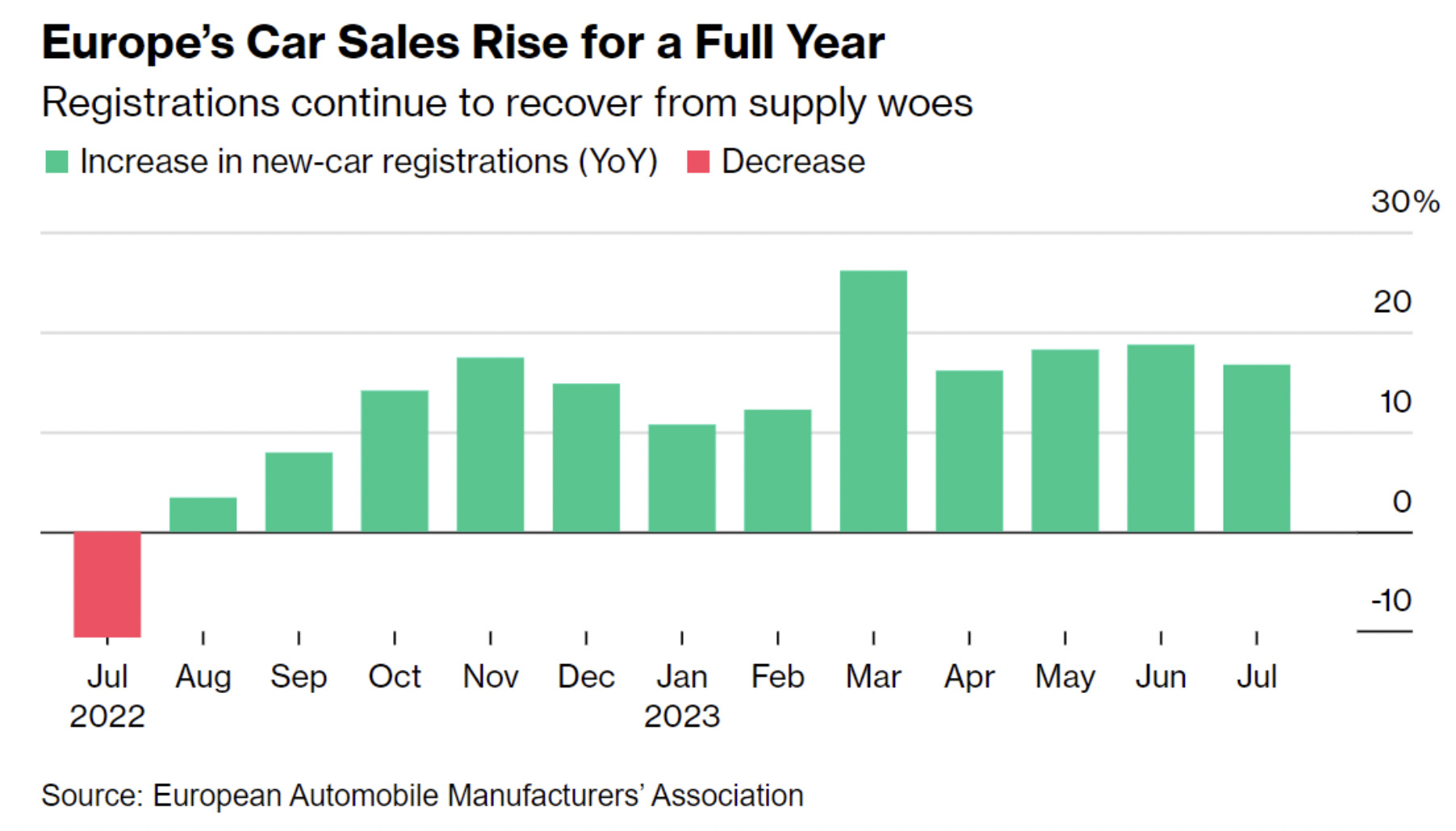

“Electric vehicle (EV) sales are surging, especially in Europe, where the market grew by 62% in the past 12 months.”

But…

“Mass-market EV adoption still faces barriers such as their high cost and lack of charging infrastructure.”

And…

“Supply chain issues also need to be addressed to ensure the production and affordability of electric cars, a goal that the World Economic Forum’s Resilient and Sustainable Automotive Value Chains initiative supports.”

Righto, WEF – where are you getting that Euro stat? Bloomberg. Which got it from the European Automobile Manufacturers Association (ACEA).

At Stockhead‘s High Voltage, we’re proudly first with the fourth-hand news (collated neatly we hope, with the eyes picked out for your benefit.)

“For the 12 months to July 2023, the region saw a surge of 62% in EV sales,” wrote Andrea Willigie for the WEF… “while diesel sales dropped by 9%, Bloomberg reports…

“In Germany, registrations in July 2023 alone jumped up by nearly 70%, with France and Spain also seeing double-digit growth.”

Here’s a colourful graphic:

S&P Global says that nickel and cobalt are also expected to be critical, but at a lesser degree to lithium “as deployment of iron-based chemistries will remedy their potential shortage”.

“In the longer term,” notes the report, “the entry and premium EV segments are consolidating toward two battery chemistries – lithium iron phosphate, or LFP, and nickel-cobalt-manganese.

“For light-duty vehicles, high-nickel NCM batteries are forecast to take a near-50% market share by 2030, with LFP and LMFP – or LFP batteries with a higher manganese component – taking close to 30% share by 2030.”

Like “spot lithium”, the price of cobalt, meanwhile, remains under pressure due to supply surplus.

“A surplus in the cobalt market is expected to persist until 2025, with growing supply of cobalt from the Democratic Republic of Congo and Indonesia keeping prices under pressure,” says S&P Global”.

Here’s a snapshot of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium are performing lately>>>

Battery metals stocks missing from our list? Shoot a mail to [email protected]

(Note: table’s data accurate as of 5pm, Nov 15.)

| Code | Company | Price | % Week | % Month | % Year | % YTD | Market Cap |

|---|---|---|---|---|---|---|---|

| PVW | PVW Res Ltd | 0.055 | -4% | -19% | -58% | -4% | $5,577,263 |

| A8G | Australasian Metals | 0.18 | -10% | -12% | -25% | -1% | $9,381,689 |

| INF | Infinity Lithium | 0.11 | 34% | 22% | -48% | -1% | $55,511,051 |

| LPI | Lithium Pwr Int Ltd | 0.535 | 2% | 23% | -5% | 10% | $337,092,437 |

| PSC | Prospect Res Ltd | 0.097 | 8% | 29% | -12% | -2% | $42,065,611 |

| PAM | Pan Asia Metals | 0.155 | 0% | -23% | -60% | -26% | $25,888,322 |

| CXO | Core Lithium | 0.38 | -1% | 1% | -76% | -65% | $801,350,829 |

| LOT | Lotus Resources Ltd | 0.29 | 16% | 35% | 23% | 9% | $481,927,098 |

| AGY | Argosy Minerals Ltd | 0.155 | -9% | -18% | -78% | -42% | $203,639,087 |

| AZS | Azure Minerals | 3.99 | 2% | 66% | 1435% | 377% | $1,829,425,023 |

| NWC | New World Resources | 0.035 | 9% | 21% | 3% | 0% | $74,637,487 |

| QXR | Qx Resources Limited | 0.032 | -6% | 19% | -47% | -1% | $35,383,291 |

| GSR | Greenstone Resources | 0.0065 | -7% | -28% | -74% | -3% | $9,557,914 |

| CAE | Cannindah Resources | 0.098 | 9% | -11% | -57% | -14% | $56,651,835 |

| AZL | Arizona Lithium Ltd | 0.041 | 28% | 173% | -49% | -2% | $152,664,157 |

| HNR | Hannans Ltd | 0.008 | 14% | 14% | -62% | -1% | $19,115,984 |

| COB | Cobalt Blue Ltd | 0.285 | 10% | 19% | -53% | -30% | $101,353,165 |

| ESS | Essential Metals Ltd | 0.5 | 0% | 4% | 1% | 18% | $135,278,382 |

| LPD | Lepidico Ltd | 0.009 | -10% | -22% | -53% | -1% | $68,744,772 |

| MRD | Mount Ridley Mines | 0.002 | 0% | 100% | -50% | 0% | $15,569,766 |

| CZN | Corazon Ltd | 0.017 | 13% | 21% | 0% | 0% | $9,849,566 |

| LKE | Lake Resources | 0.175 | 0% | -10% | -84% | -63% | $241,815,600 |

| DEV | Devex Resources Ltd | 0.265 | -5% | -12% | -7% | -2% | $112,503,621 |

| INR | Ioneer Ltd | 0.155 | -6% | -21% | -74% | -23% | $306,154,761 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | 0% | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0.036 | 0% | 0% | -10% | 0% | $21,555,357 |

| RLC | Reedy Lagoon Corp. | 0.005 | 0% | -17% | -53% | 0% | $3,083,418 |

| GBR | Greatbould Resources | 0.062 | 0% | -2% | -36% | -3% | $31,985,839 |

| FRS | Forrestania Resources | 0.029 | -3% | -17% | -86% | -11% | $2,966,747 |

| STK | Strickland Metals | 0.16 | -6% | 60% | 272% | 12% | $252,349,541 |

| MLX | Metals X Limited | 0.29 | 4% | 5% | -5% | -10% | $258,570,829 |

| CLA | Celsius Resource Ltd | 0.012 | 9% | 0% | 9% | 0% | $24,706,568 |

| FGR | First Graphene Ltd | 0.065 | -18% | -38% | -50% | -5% | $42,753,561 |

| HXG | Hexagon Energy | 0.009 | 0% | 0% | -40% | -1% | $5,129,159 |

| TLG | Talga Group Ltd | 1.13 | 7% | 1% | -21% | -27% | $407,652,214 |

| MNS | Magnis Energy Tech | 0.062 | -23% | -16% | -85% | -31% | $61,174,406 |

| PLL | Piedmont Lithium Inc | 0.44 | 0% | -21% | -54% | -21% | $152,569,272 |

| EUR | European Lithium Ltd | 0.08 | 0% | 14% | -14% | 1% | $110,144,895 |

| BKT | Black Rock Mining | 0.105 | -9% | 18% | -36% | -3% | $109,731,964 |

| QEM | QEM Limited | 0.19 | 0% | -5% | 3% | 1% | $28,764,425 |

| LYC | Lynas Rare Earths | 7.08 | 1% | 4% | -16% | -77% | $6,561,449,507 |

| ESR | Estrella Res Ltd | 0.006 | 0% | -14% | -45% | -1% | $10,554,431 |

| ARL | Ardea Resources Ltd | 0.52 | -5% | -12% | -44% | -19% | $103,170,815 |

| GLN | Galan Lithium Ltd | 0.695 | 18% | 1% | -57% | -38% | $210,167,257 |

| JRL | Jindalee Resources | 1.08 | -4% | -37% | -53% | -81% | $60,315,117 |

| VUL | Vulcan Energy | 2.58 | 4% | -6% | -66% | -375% | $412,421,487 |

| SBR | Sabre Resources | 0.041 | 8% | 14% | 3% | 0% | $16,787,872 |

| CHN | Chalice Mining Ltd | 1.69 | -8% | -20% | -65% | -461% | $634,010,186 |

| VRC | Volt Resources Ltd | 0.007 | 17% | -13% | -59% | -1% | $28,507,967 |

| NMT | Neometals Ltd | 0.26 | 4% | -24% | -76% | -54% | $143,860,064 |

| AXN | Alliance Nickel Ltd | 0.055 | -4% | 0% | -32% | -4% | $40,647,018 |

| PNN | Power Minerals Ltd | 0.26 | 4% | 4% | -54% | -27% | $21,110,714 |

| IGO | IGO Limited | 9.25 | -1% | -20% | -40% | -421% | $6,792,692,283 |

| GED | Golden Deeps | 0.053 | 6% | 2% | -47% | -4% | $6,122,684 |

| ADV | Ardiden Ltd | 0.005 | 0% | -17% | -44% | 0% | $16,130,012 |

| SRI | Sipa Resources Ltd | 0.021 | 0% | 11% | -53% | -1% | $4,791,321 |

| NTU | Northern Min Ltd | 0.03 | -9% | 3% | -25% | -1% | $183,240,357 |

| AXE | Archer Materials | 0.41 | -2% | -7% | -38% | -21% | $101,938,805 |

| PGM | Platina Resources | 0.0295 | 18% | 23% | 55% | 1% | $16,202,689 |

| AAJ | Aruma Resources Ltd | 0.036 | 3% | 6% | -51% | -2% | $6,497,420 |

| IXR | Ionic Rare Earths | 0.027 | 29% | 13% | -34% | -1% | $102,858,728 |

| NIC | Nickel Industries | 0.805 | -1% | 1% | -16% | -17% | $3,407,218,855 |

| EVG | Evion Group NL | 0.035 | -5% | 13% | -64% | -4% | $12,454,531 |

| CWX | Carawine Resources | 0.105 | 0% | -21% | 24% | 1% | $20,665,834 |

| PLS | Pilbara Min Ltd | 3.67 | -1% | -12% | -24% | -8% | $10,563,213,937 |

| HAS | Hastings Tech Met | 0.835 | 5% | 14% | -77% | -269% | $104,786,988 |

| BUX | Buxton Resources Ltd | 0.19 | -13% | -10% | 73% | 8% | $31,911,925 |

| ARR | American Rare Earths | 0.145 | 4% | 12% | -28% | -5% | $66,963,495 |

| SGQ | St George Min Ltd | 0.037 | -18% | -8% | -50% | -3% | $36,809,687 |

| TKL | Traka Resources | 0.0045 | -10% | -25% | -25% | 0% | $3,938,982 |

| PAN | Panoramic Resources | 0.035 | 0% | -8% | -81% | -14% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | -49% | -2% | $48,441,219 |

| IPT | Impact Minerals | 0.012 | 9% | 20% | 71% | 1% | $34,376,447 |

| LIT | Lithium Australia | 0.033 | 0% | 3% | -33% | -1% | $40,332,325 |

| AKE | Allkem Limited | 9.12 | -2% | -22% | -36% | -212% | $5,510,949,546 |

| ARN | Aldoro Resources | 0.083 | -3% | -13% | -78% | -8% | $11,173,771 |

| JRV | Jervois Global Ltd | 0.037 | 3% | -3% | -91% | -23% | $91,885,703 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | -151% | $751,215,521 |

| SYR | Syrah Resources | 0.755 | -7% | 56% | -70% | -131% | $493,405,343 |

| FBM | Future Battery | 0.09 | 6% | -25% | 64% | 4% | $45,381,633 |

| ADD | Adavale Resource Ltd | 0.008 | 0% | -27% | -71% | -1% | $6,208,139 |

| LTR | Liontown Resources | 1.525 | -3% | -45% | -26% | 21% | $3,621,645,259 |

| CTM | Centaurus Metals Ltd | 0.5 | -6% | -6% | -57% | -62% | $236,599,863 |

| VML | Vital Metals Limited | 0.01 | 0% | 0% | -67% | -1% | $53,061,498 |

| BSX | Blackstone Ltd | 0.099 | 9% | -14% | -43% | -4% | $44,526,757 |

| POS | Poseidon Nick Ltd | 0.0195 | 15% | 15% | -55% | -2% | $63,039,020 |

| CHR | Charger Metals | 0.33 | 10% | 136% | -47% | -12% | $21,118,885 |

| AVL | Aust Vanadium Ltd | 0.023 | 0% | -15% | -26% | 0% | $119,246,563 |

| AUZ | Australian Mines Ltd | 0.015 | 7% | 7% | -78% | -4% | $10,941,481 |

| TMT | Technology Metals | 0.23 | 2% | -10% | -33% | -12% | $57,214,346 |

| RXL | Rox Resources | 0.21 | -2% | -7% | 17% | 4% | $75,606,733 |

| RNU | Renascor Res Ltd | 0.16 | -6% | 39% | -40% | -6% | $406,305,200 |

| GL1 | Globallith | 1.335 | 9% | -1% | -42% | -51% | $334,020,586 |

| BRB | Breaker Res NL | 0 | -100% | -100% | -100% | -32% | $158,126,031 |

| ASN | Anson Resources Ltd | 0.165 | 0% | 14% | -34% | -2% | $225,004,355 |

| SYA | Sayona Mining Ltd | 0.081 | -7% | -12% | -66% | -11% | $823,463,681 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.2 | 3% | 60% | -41% | -2% | $92,781,335 |

| ATM | Aneka Tambang | 1.18 | 0% | -1% | 18% | 28% | $1,544,824 |

| TVN | Tivan Limited | 0.074 | -9% | 3% | -18% | 0% | $116,237,629 |

| ALY | Alchemy Resource Ltd | 0.011 | 0% | 10% | -62% | -1% | $12,958,839 |

| GAL | Galileo Mining Ltd | 0.29 | -2% | -11% | -75% | -59% | $60,275,603 |

| BHP | BHP Group Limited | 46.84 | 5% | 4% | 7% | 121% | $233,263,404,998 |

| LEL | Lithenergy | 0.59 | -9% | 5% | -43% | -18% | $59,745,800 |

| MMC | Mitremining | 0.24 | 14% | 0% | 23% | -4% | $10,884,024 |

| RMX | Red Mount Min Ltd | 0.004 | 0% | 0% | -11% | 0% | $10,694,304 |

| GW1 | Greenwing Resources | 0.15 | 15% | 3% | -61% | -13% | $24,395,207 |

| AQD | Ausquest Limited | 0.013 | 30% | 8% | -28% | 0% | $9,076,641 |

| LML | Lincoln Minerals | 0.008 | 14% | 0% | 17% | 0% | $11,856,917 |

| 1MC | Morella Corporation | 0.006 | 0% | 9% | -67% | -1% | $36,981,556 |

| REE | Rarex Limited | 0.03 | 0% | 0% | -41% | -2% | $20,501,597 |

| MRC | Mineral Commodities | 0.033 | 0% | 12% | -49% | -3% | $27,959,952 |

| PUR | Pursuit Minerals | 0.009 | -10% | 13% | -18% | -1% | $29,439,714 |

| QPM | Queensland Pacific | 0.056 | -5% | -14% | -69% | -5% | $112,700,158 |

| EMH | European Metals Hldg | 0.62 | 0% | -1% | -29% | -2% | $77,392,969 |

| BMM | Balkan mining and minerals | 0.16 | 33% | -6% | -50% | -17% | $9,977,040 |

| PEK | Peak Rare Earths Ltd | 0.395 | 1% | -2% | -6% | -6% | $105,856,586 |

| LEG | Legend Mining | 0.022 | 0% | -19% | -42% | -2% | $60,994,021 |

| MOH | Moho Resources | 0.01 | 67% | 25% | -58% | -1% | $2,720,355 |

| AML | Aeon Metals Ltd. | 0.008 | -20% | -47% | -73% | -2% | $8,771,205 |

| G88 | Golden Mile Res Ltd | 0.025 | 4% | 25% | 12% | 0% | $8,564,127 |

| WKT | Walkabout Resources | 0.15 | -8% | 36% | -13% | 1% | $96,679,482 |

| TON | Triton Min Ltd | 0.022 | -12% | 5% | -19% | -1% | $35,911,271 |

| AR3 | Austrare | 0.185 | -8% | -8% | -51% | -22% | $29,291,533 |

| ARU | Arafura Rare Earths | 0.19 | -12% | -16% | -46% | -28% | $401,539,291 |

| MIN | Mineral Resources | 62.8 | 6% | 0% | -22% | -1440% | $11,676,052,123 |

| VMC | Venus Metals Cor Ltd | 0.1 | -5% | -13% | 19% | 2% | $18,972,868 |

| S2R | S2 Resources | 0.18 | 0% | -16% | 16% | 1% | $71,766,016 |

| CNJ | Conico Ltd | 0.004 | -20% | -20% | -60% | 0% | $6,280,380 |

| VR8 | Vanadium Resources | 0.045 | -8% | -10% | -31% | -1% | $22,603,399 |

| PVT | Pivotal Metals Ltd | 0.021 | 5% | 5% | -48% | -2% | $11,505,234 |

| BOA | Boadicea Resources | 0.044 | 13% | 13% | -50% | -5% | $5,169,793 |

| IPX | Iperionx Limited | 1.49 | -4% | 12% | 108% | 80% | $326,203,635 |

| SLZ | Sultan Resources Ltd | 0.016 | 0% | -16% | -83% | -7% | $2,222,851 |

| NKL | Nickelxltd | 0.065 | 2% | 7% | -31% | -2% | $5,532,356 |

| NVA | Nova Minerals Ltd | 0.25 | -4% | -2% | -71% | -43% | $52,722,490 |

| MLS | Metals Australia | 0.037 | 3% | 12% | -5% | -1% | $23,089,339 |

| MQR | Marquee Resource Ltd | 0.03 | 15% | 11% | -45% | -1% | $11,988,147 |

| MRR | Minrex Resources Ltd | 0.0145 | -3% | -15% | -68% | -2% | $16,273,013 |

| EVR | Ev Resources Ltd | 0.012 | 9% | -14% | -43% | 0% | $10,392,578 |

| EFE | Eastern Resources | 0.012 | 33% | 20% | -74% | -2% | $13,661,411 |

| CNB | Carnaby Resource Ltd | 0.6 | -18% | -30% | -31% | -34% | $104,221,656 |

| BNR | Bulletin Resources | 0.175 | 0% | 46% | 25% | 8% | $48,442,532 |

| AX8 | Accelerate Resources | 0.052 | 30% | 73% | 79% | 3% | $23,600,110 |

| AM7 | Arcadia Minerals | 0.089 | 11% | -15% | -66% | -12% | $9,705,459 |

| AS2 | Askari Metals | 0.19 | 23% | 0% | -55% | -25% | $14,639,540 |

| BYH | Bryah Resources Ltd | 0.019 | 58% | 41% | -23% | -1% | $6,813,500 |

| DTM | Dart Mining NL | 0.019 | 6% | -12% | -71% | -4% | $3,683,066 |

| EMS | Eastern Metals | 0.033 | 10% | 6% | -72% | -4% | $2,720,066 |

| FG1 | Flynngold | 0.074 | 9% | 23% | -30% | -3% | $10,910,607 |

| GSM | Golden State Mining | 0.023 | -8% | -38% | -50% | -2% | $4,012,854 |

| IMI | Infinity Mining | 0.12 | 9% | -11% | -57% | -16% | $9,343,166 |

| LRV | Larvotto Resources | 0.12 | -8% | -4% | -33% | -4% | $8,070,567 |

| LSR | Lodestar Minerals | 0.004 | 0% | -20% | -20% | 0% | $8,093,589 |

| RAG | Ragnar Metals Ltd | 0.024 | -4% | 0% | 26% | 1% | $11,375,543 |

| CTN | Catalina Resources | 0.004 | 14% | 0% | -56% | -1% | $4,334,704 |

| TMB | Tambourah Metals | 0.135 | -13% | 8% | -21% | 3% | $12,441,053 |

| TEM | Tempest Minerals | 0.009 | 13% | 6% | -68% | -1% | $5,625,218 |

| EMC | Everest Metals Corp | 0.095 | 8% | -24% | -5% | 2% | $16,001,745 |

| WML | Woomera Mining Ltd | 0.024 | 41% | 140% | 60% | 1% | $26,261,280 |

| KZR | Kalamazoo Resources | 0.11 | 10% | 13% | -57% | -10% | $20,564,337 |

| LMG | Latrobe Magnesium | 0.055 | 20% | 17% | -33% | -2% | $94,965,468 |

| KOR | Korab Resources | 0.016 | 0% | 0% | -54% | -1% | $5,872,800 |

| CMX | Chemx materials | 0.076 | -5% | -6% | -55% | -11% | $4,311,837 |

| NC1 | Nico resources | 0.34 | 5% | -7% | -41% | -27% | $35,677,693 |

| GRE | Greentech metals | 0.77 | -9% | 175% | 470% | 63% | $46,960,666 |

| CMO | Cosmo metals | 0.049 | -2% | -6% | -69% | -9% | $1,734,833 |

| FRB | Firebird Metals | 0.175 | 13% | 21% | -17% | 2% | $16,137,625 |

| S32 | South32 Limited | 3.23 | 4% | -8% | -25% | -77% | $14,357,749,661 |

| OMH | OM Holdings Limited | 0.475 | 6% | 0% | -35% | -22% | $328,687,385 |

| JMS | Jupiter Mines. | 0.18 | -3% | -5% | 0% | -4% | $352,618,386 |

| E25 | Element 25 Ltd | 0.43 | 12% | 5% | -70% | -45% | $96,800,999 |

| EMN | Euromanganese | 0.105 | 5% | -19% | -68% | -25% | $27,039,703 |

| KGD | Kula Gold | 0.021 | 75% | 62% | -50% | 0% | $5,224,967 |

| LRS | Latin Resources Ltd | 0.23 | -13% | -22% | 119% | 13% | $623,813,895 |

| CRR | Critical Resources | 0.03 | 3% | -19% | -47% | -1% | $55,113,359 |

| ENT | Enterprise Metals | 0.004 | 33% | 0% | -56% | -1% | $3,197,884 |

| SCN | Scorpion Minerals | 0.055 | 8% | 0% | -21% | -2% | $18,375,428 |

| GCM | Green Critical Min | 0.008 | 0% | 14% | -38% | -1% | $7,387,803 |

| ENV | Enova Mining Limited | 0.007 | 17% | 0% | -36% | -1% | $4,486,505 |

| RBX | Resource B | 0.1 | -23% | -29% | 11% | 2% | $9,095,293 |

| AKN | Auking Mining Ltd | 0.047 | 18% | -18% | -53% | -5% | $7,960,045 |

| RR1 | Reach Resources Ltd | 0.006 | -50% | -50% | 20% | 0% | $19,261,783 |

| EMT | Emetals Limited | 0.007 | 0% | 0% | -63% | 0% | $5,950,000 |

| PNT | Panthermetalsltd | 0.076 | 9% | 7% | -58% | -11% | $4,586,250 |

| WIN | Widgie nickel | 0.16 | -6% | -22% | -57% | -17% | $48,416,071 |

| WMG | Western Mines | 0.265 | -5% | -18% | 121% | 11% | $18,677,833 |

| AVW | Avira Resources Ltd | 0.002 | 0% | 0% | -33% | 0% | $4,267,580 |

| CAI | Calidus Resources | 0.175 | -5% | 17% | -58% | -10% | $103,740,291 |

| GT1 | Green technology | 0.45 | 15% | -6% | -56% | -38% | $95,839,885 |

| KAI | Kairos Minerals Ltd | 0.016 | -6% | -20% | -43% | 0% | $44,555,507 |

| MTM | MTM Critical Metals | 0.025 | 9% | -24% | -75% | -5% | $2,384,090 |

| NWM | Norwest Minerals | 0.034 | 6% | 17% | -52% | -2% | $8,627,085 |

| PGD | Peregrine Gold | 0.285 | -8% | 14% | -39% | -10% | $15,807,848 |

| RAS | Ragusa Minerals Ltd | 0.054 | 26% | 46% | -72% | -6% | $7,129,939 |

| RGL | Riversgold | 0.011 | 22% | -15% | -74% | -2% | $12,366,399 |

| SRZ | Stellar Resources | 0.009 | 0% | -18% | -25% | 0% | $9,883,678 |

| STM | Sunstone Metals Ltd | 0.017 | -6% | 6% | -41% | -2% | $50,852,751 |

| ZNC | Zenith Minerals Ltd | 0.175 | 35% | 75% | -39% | -9% | $59,904,750 |

| WC8 | Wildcat Resources | 0.79 | -8% | 84% | 2721% | 77% | $811,862,614 |

| ASO | Aston Minerals Ltd | 0.036 | 3% | -5% | -49% | -4% | $45,327,249 |

| THR | Thor Energy PLC | 0.027 | 8% | 0% | -70% | -3% | $4,848,800 |

| YAR | Yari Minerals Ltd | 0.016 | 7% | 23% | -27% | 0% | $8,200,083 |

| IG6 | International graphite | 0.19 | 9% | 15% | -40% | -8% | $16,907,741 |

| LPM | Lithium Plus | 0.495 | -4% | 5% | -23% | 13% | $43,853,982 |

| ODE | Odessa Minerals | 0.01 | 0% | 0% | -39% | -1% | $7,576,895 |

| KOB | Koba Resources | 0.084 | 0% | 11% | -57% | -6% | $8,855,000 |

| AZI | Altamin Limited | 0.059 | -3% | -6% | -34% | -2% | $23,111,288 |

| FTL | Firetail Resources | 0.105 | 5% | 8% | -38% | -6% | $14,890,556 |

| LNR | Lanthanein Resources | 0.007 | -13% | -13% | -81% | -1% | $7,851,029 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -92% | -1% | $12,357,082 |

| NVX | Novonix Limited | 0.72 | -5% | 6% | -73% | -75% | $349,356,289 |

| OCN | Oceana lithium | 0.125 | 0% | -26% | -79% | -22% | $6,634,563 |

| SUM | Summit minerals | 0.11 | 10% | 0% | -50% | -4% | $5,480,570 |

| DVP | Develop Global Ltd | 2.95 | -2% | -7% | 11% | -23% | $714,562,998 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | -78% | 0% | $17,528,005 |

| OD6 | Od6 Metals | 0.195 | 8% | 22% | -54% | -14% | $10,452,944 |

| HRE | Heavy Rare Earths | 0.09 | 6% | 25% | -50% | -3% | $5,564,890 |

| LIN | Lindian Resources | 0.165 | -8% | -15% | -20% | 1% | $190,067,169 |

| PEK | Peak Rare Earths Ltd | 0.395 | 1% | -2% | -6% | -6% | $105,856,586 |

| ILU | Iluka Resources | 7.47 | 3% | 1% | -26% | -206% | $3,046,130,959 |

| ASM | Ausstratmaterials | 1.695 | 5% | 15% | -9% | 26% | $275,179,139 |

| ETM | Energy Transition | 0.035 | 6% | -8% | -30% | -3% | $47,602,033 |

| VMS | Venture Minerals | 0.011 | 10% | 10% | -54% | -1% | $21,450,143 |

| IDA | Indiana Resources | 0.058 | 5% | 0% | 2% | 0% | $36,746,224 |

| VTM | Victory Metals Ltd | 0.23 | -18% | -2% | -2% | 1% | $18,606,921 |

| M2R | Miramar | 0.024 | 9% | -45% | -74% | -5% | $3,275,130 |

| WCN | White Cliff Min Ltd | 0.012 | 0% | -8% | -33% | 0% | $13,827,204 |

| TAR | Taruga Minerals | 0.01 | 0% | 0% | -71% | -1% | $7,060,268 |

| ABX | ABX Group Limited | 0.07 | -1% | -7% | -52% | -5% | $18,175,561 |

| MEK | Meeka Metals Limited | 0.037 | 6% | 0% | -44% | -3% | $42,694,522 |

| DRE | Dreadnought Resources Ltd | 0.033 | 0% | -27% | -67% | -7% | $117,536,140 |

| KFM | Kingfisher Mining | 0.155 | 15% | -9% | -71% | -32% | $8,325,825 |

| AOA | Ausmon Resorces | 0.003 | 0% | 0% | -50% | 0% | $3,020,998 |

| WC1 | Westcobarmetals | 0.065 | 7% | -14% | -72% | -11% | $6,313,688 |

| GRL | Godolphin Resources | 0.035 | 0% | -5% | -61% | -5% | $5,923,471 |

| DM1 | Desert Metals | 0.041 | 5% | 3% | -87% | -15% | $2,901,643 |

| PTR | Petratherm Ltd | 0.044 | -4% | -14% | -23% | -1% | $11,237,557 |

| ITM | Itech Minerals Ltd | 0.165 | 14% | 40% | -37% | -10% | $18,938,452 |

| KTA | Krakatoa Resources | 0.043 | 65% | 126% | -30% | 0% | $18,265,713 |

| M24 | Mamba Exploration | 0.03 | 3% | -33% | -76% | -12% | $1,829,500 |

| TKM | Trek Metals Ltd | 0.05 | -2% | 52% | -48% | -3% | $25,877,284 |

| BCA | Black Canyon Limited | 0.14 | 0% | -3% | -36% | -10% | $9,239,212 |

| CDT | Castle Minerals | 0.011 | 10% | 10% | -52% | -1% | $13,307,173 |

| DLI | Delta Lithium | 0.49 | -11% | -29% | -14% | 3% | $261,544,665 |

| A11 | Atlantic Lithium | 0.565 | 41% | 9% | -35% | -6% | $235,713,039 |

| KNI | Kunikolimited | 0.275 | -2% | -8% | -54% | -24% | $22,765,161 |

| CY5 | Cygnus Metals Ltd | 0.155 | -7% | -3% | -70% | -23% | $46,406,822 |

| WR1 | Winsome Resources | 1.27 | -7% | 3% | 36% | 4% | $220,217,855 |

| LLI | Loyal Lithium Ltd | 0.42 | -2% | -21% | -32% | 13% | $34,603,975 |

| BC8 | Black Cat Syndicate | 0.275 | 31% | 41% | -28% | -8% | $85,054,296 |

| BUR | Burleyminerals | 0.175 | -19% | 9% | -27% | -5% | $21,272,319 |

| PBL | Parabellum Resources | 0.345 | 0% | 0% | -30% | 1% | $18,879,263 |

| L1M | Lightning Minerals | 0.14 | 8% | 4% | 0% | -3% | $5,701,509 |

| WA1 | Wa1 Resources | 9.81 | -11% | 107% | 454% | 842% | $435,027,681 |

| EV1 | Evolutionenergy | 0.14 | 0% | -3% | -47% | -9% | $24,550,784 |

| 1AE | Auroraenergymetals | 0.092 | -6% | -8% | -56% | -6% | $15,761,486 |

| RVT | Richmond Vanadium | 0.36 | 0% | -3% | 0% | 13% | $31,034,810 |

| PMT | Patriot Battery Metals | 1.085 | -1% | -10% | 0% | 34% | $408,716,152 |

| PAT | Patriot Lithium | 0.215 | 2% | 26% | 0% | -5% | $13,735,813 |

| BM8 | Battery Age Minerals | 0.2 | 0% | -13% | -60% | -30% | $17,827,378 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | -46% | -8% | $3,786,192 |

| VHM | Vhmlimited | 0.595 | 25% | 29% | 0% | 0% | $78,497,224 |

| LLL | Leo Lithium | 0.505 | 0% | 0% | -13% | 2% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.01 | -9% | -23% | -23% | 0% | $18,367,531 |

| SRL | Sunrise | 0.7 | -1% | -7% | -65% | -122% | $61,805,836 |

| EG1 | Evergreen Lithium | 0.185 | 3% | -29% | 0% | 0% | $10,121,400 |

| WSR | Westar Resources | 0.02 | -5% | -5% | -56% | -3% | $3,707,150 |

| LU7 | Lithium Universe | 0.039 | -3% | -20% | 30% | 1% | $14,763,832 |

| MEI | Meteoric Resources | 0.245 | -6% | 23% | 1650% | 19% | $466,477,710 |

| REC | Recharge Metals | 0.135 | 13% | -18% | -18% | 0% | $15,032,516 |

| SLM | Solis Minerals | 0.22 | -6% | -20% | 238% | 15% | $16,348,228 |

| DYM | Dynamic Metals | 0.18 | -12% | -3% | 0% | 0% | $6,300,000 |

| TOR | Torque Metals | 0.16 | -18% | -53% | -3% | -2% | $23,566,335 |

| ICL | Iceni Gold | 0.059 | 2% | -18% | -3% | -2% | $14,391,429 |

| TMX | Terrain Minerals | 0.004 | -20% | 0% | -38% | 0% | $6,090,425 |

| MHC | Manhattan Corp | 0.004 | -11% | 0% | -33% | 0% | $11,747,919 |

| MHK | Metalhawk | 0.18 | -23% | 114% | -18% | 2% | $14,178,782 |

| ANX | Anax Metals Ltd | 0.032 | 0% | -9% | -42% | -2% | $15,870,282 |

| FIN | FIN Resources | 0.031 | -3% | 35% | 48% | 1% | $21,422,567 |

| LM1 | Leeuwin Metals | 0.23 | -13% | -29% | 0% | 0% | $13,659,425 |

| HAW | Hawthorn Resources | 0.092 | -8% | 1% | 7% | -2% | $33,166,546 |

| LCY | Legacy Iron Ore | 0.017 | 6% | -15% | 6% | 0% | $102,509,219 |

| RON | Ronin Resources | 0.18 | 44% | 29% | 13% | 2% | $6,326,648 |

| PFE | Pantera Minerals | 0.062 | 7% | 5% | -58% | -43% | $6,640,000 |

| ASR | Asra Minerals | 0.014 | 56% | 75% | -30% | -1% | $20,386,879 |

Biggest gainers, past seven days (per table above) 🚀

Kula Gold (ASX:KGD) +75%

Krakatoa Resources (ASX:KTA) +65%

Bryah Resources (ASX:BYH) +58%

Ronin Resources (ASX:RON) +44%

Atlantic Lithium (ASX:A11) +41%

Biggest dippers, past seven days (per table above) 📉

Reach Resources (ASX:RR1) -50%

Metal Hawk (ASX:MHK) -23%

Magnis Energy Technologies (ASX:MNS) -23%

Terrain Minerals (ASX:TMX) -20%