Resources Top 5: Does this stonker copper hit bring back the Sandfire days for you as well?

Pic: Getty Images

- Orion hits 49m at 4.86% copper in South Africa to storm up the Ressie leaderboard

- Mineral sands miner Base Resources runs even higher on $375 million takeover by US uranium and rare earths producer Energy Fuels

- Lithium has Lanthanein, Lightning and Delta racing higher

Here are the biggest small cap resources winners in early trade, Monday April 22.

ORION MINERALS (ASX:ORN)

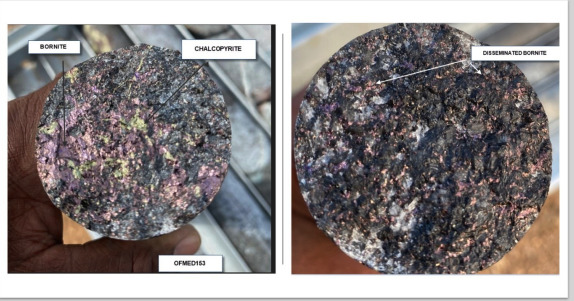

49m at 4.86% copper. 10.23m at 12.47% Cu.

These staggering strikes at Orion Minerals’ Okiep copper project in South Africa’s Northern Cape Province have sent its shares up more almost 40% today in hopes the new DeGrussa may have been found across the Indian Ocean.

To be fair, DeGrussa was a little more extreme. Its initial RC discovery was “just” 22m at 3.6% copper, 3.8g/t gold and 13.4g/t silver around 100m from surface.

But its first diamond drill hole in July 2009 hit 27% Cu over 8m. WA’s Doolgunna region — which delivered only one follow up discovery of note at Monty — is more attractive than South Africa as a development jurisdiction as well.

READ: Zero to Hero: This is how copper play Sandfire went from 4c to over $8 in 18 crazy months

But Orion will have hope that Okiep can be a rerate opportunity.

The recent success has prompted the company, dual listed in both Australia and Johannesburg, to roadshow in Australia in a bid to catch demand for lean copper options on the ASX. Copper prices have surged in recent weeks on short supplies, demand from underutilised Chinese smelters and a pause on Russian supplies to the LME which has sent net long positions in the metal to two-year highs.

At US$9876/t on Friday, prices are closing in on US$10,000/t fast. The all time record of a touch over US$10,700/t was set in May 2021.

“Investors are really looking for near term copper projects,” Smart said on a webinar today.

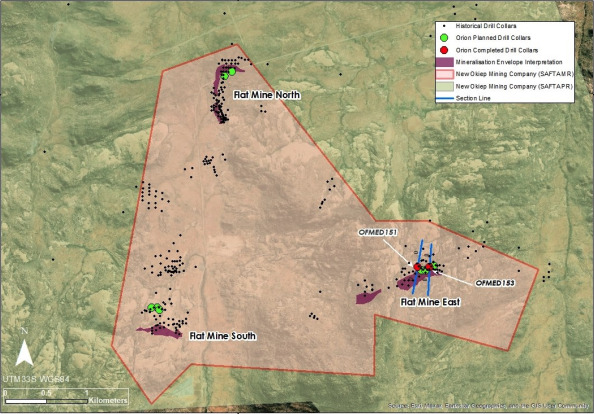

Okiep was owned by Newmont and Gold Fields in the 1980s and 1990s and high grade interceptions at its Flat Mines deposits were struck in 1995 by the latter. But the new discovery at Flat Mine East was blind to surface, raising hopes more high grade copper has been left behind by the old timers.

Orion has two drills at Flat Mine East and two at Flat Mine South, with 11 diamond holes to be drilled for 5800m.

The new hit stirring the cockles of mining investors has been pitched as the best South African copper intercept in 40 years.

“Of the 1170 copper deposits in the world that have been reported … this ranks as number 35 in the world for the past nine years,” Smart said.

“This is a world class intersection.

“It is in a zone where there were known intersections, but at least now we have proved that it isn’t a fluke, it isn’t a one off.

“There is a large zone of very high grade mineralisation at this site. I had a metal trader in Sydney last week that was saying to me if you guys have got anything above 11% we’ll take it as DSO — direct shipping ore — that they’ll collect the broken rock at the mine portal and drive it away and pay us for it. That puts us in the context of what it is.

“The original Okiep mine mined over 900,000t of hand sorted ore at over 21% copper. That’s just unheard of. There aren’t deposits like that in the world.”

Okiep is one of two South African base metals projects being advanced by Orion. The other, the fully permitted Prieska, is expected to produce 22,000t of copper and 70,000t of zinc a year over a 12-year mine life, but was studied at copper prices well below today’s booming levels.

Orion Minerals (ASX:ORN) share price today

BASE RESOURCES (ASX:BSE)

Most days that would be enough to take top spot on the resources leaderboard.

Not when there’s M&A afoot. Up 90% on a massive offer from US uranium producer Energy Fuels is Base Resources, which produces mineral sands at its soon to close Kwale mine in Kenya and is aiming to develop the ‘world-class’ Toliara project in Madagascar.

Energy Fuels will offer 0.026 shares for every Base share as well as a special unfranked dividend of 6.5c per share, valuing the deal at 30.2c or $375 million.

It’s a 188% premium to Base’s last closing price of 10.5c and 173% premium to its 11.1c 20-day VWAP as of April 19.

Along with that cash kicker the merger will give Base holders 16.4% of the combined US$1.14 billion group, in a deal that has been backed by its board and two shareholders in Matt Fifield’s Pacific Road Capital (26.5%) and African fund Sustainable Capital (24.8%) controlling more than half of the company between them.

“This transaction, which is the culmination of 12 months of discussions between Base Resources and Energy Fuels, reflects the exceptional quality of the Toliara Project and the efforts of the Base Resources team over the past several years to advance the project

towards construction readiness,” Base MD Tim Carstens said.

“The combined group will have the financial and technical capability to not only build Toliara into one of the best critical mineral projects in the world, but also to develop an integrated value chain for the rare earth elements that are essential to the global energy transition.

“Shareholders of Base Resources will receive both a compelling and immediate premium, and

the opportunity to further participate in the market recognition and development of a company with a unique diversified position in the critical minerals landscape.”

What is Energy Fuels chasing? Rare earths. The deal will enable it to procure Toliara’s monazite by-product and process it into separated rare earths at the White Mesa mill in Utah.

Since 1980 White Mesa has churned out 40Mlb of yellowcake and 46Mlb of vanadium, with Energy Fuels targeting a 1.1-1.4Mlb U3O8 runrate from mid-to-late 2024 supplied by mines in Utah, Colorado, Arizona and New Mexico.

But since 2021 it’s also produced rare earths carbonate from monazite, with plans to complete the first phase of a separation facility in the first half of 2024. That will enable it to sell NdPr oxide, the most sought after magnet product in the rare earths suite, with a first phase to produce 1000tpa to be followed by a second 3000tpa phase and finally heavy rare earth separation to produce higher price heavies dysprosium and terbium.

It’s the second plunge Energy Fuels has made into Aussie mineral sands listings, having announced an MoU in December to jointly develop Astron Corporation’s (ASX:ATR) Donald project in Victoria’s Wimmera mineral sands district. Exclusivity on that non-binding deal has been extended to April 30.

Base’s Toliara is expected to be producing from late 2027.

Base Resources (ASX:BSE) share price today

LANTHANEIN RESOURCES (ASX:LNR)

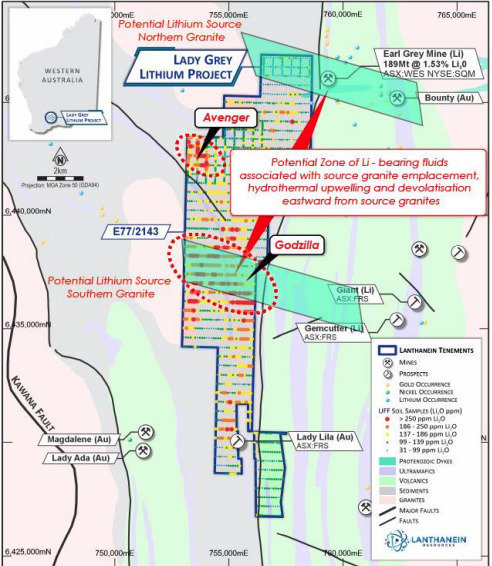

From one critical mineral to another and Lanthanein Resources is up a ripping 40% plus this morning after announcing the discovery of a 4km long lithium soil anomaly down the road from Covalent Lithium’s 189Mt 14 1.53% Li2O Earl Grey deposit.

A peak result of 454ppm Li2O was one of 527 soil samples that returned over 150ppm Li2O.

The prospect is, appropriately for its size, known as Godzilla. And its location directly adjacent to Earl Grey at Lanthanein’s Lady Grey project is auspicious.

Earl Grey, part of the Mt Holland JV between corporate monster Wesfarmers (ASX:WES) and Chilean lithium giant SQM, is the highest grade lithium deposit in WA after the legendary Greenbushes and among the largest as well.

Lanthanein technical director Brian Thomas thinks the Kaiju-sized anomaly at Godzilla could point to the early stages of a large lithium discovery.

“The discovery of such a large coherent lithium geochemical anomaly at the new Godzilla prospect leads us to believe that we may be in the early stages of a large lithium discovery. The geological rationale points to lithium rich fluids migrating eastward into the ‘goldilocks’ zone ~2.5-3km east of the respective source granite dome,” he said.

“Our view is the northern granite is responsible for the hydrothermal lithium mineralising event that deposited Earl Grey’s 189Mt mine, and we are seeing the geochemical fingerprints of another large lithium mineralising event associated with the southern granite.

“The southern granite located in middle western boundary of our tenement displays lithium anomalism extruding out all the way from the granite contact edge – east to our eastern tenement boundary and includes the sweet spot of 2.7km from source granite where our highest geochemical anomalism was recorded, like Earl Grey.”

Thomas said approvals are being processed with the intention of starting drilling in mid-2024.

Lanthanein Resources (ASX:LNR) share price today

LIGHTNING MINERALS (ASX:L1M)

I guess we’re back into Brazilian lithium fever with spodumene prices returning to fairly reasonable spot levels of US$1230/t.

These acquisitions gave a shot in the arm last year to a host of lithium hopefuls aiming to follow the lead NASDAQ and TSX listed Sigma Lithium and ASX-listed Latin Resources (ASX:LRS) into the new hard rock lithium district.

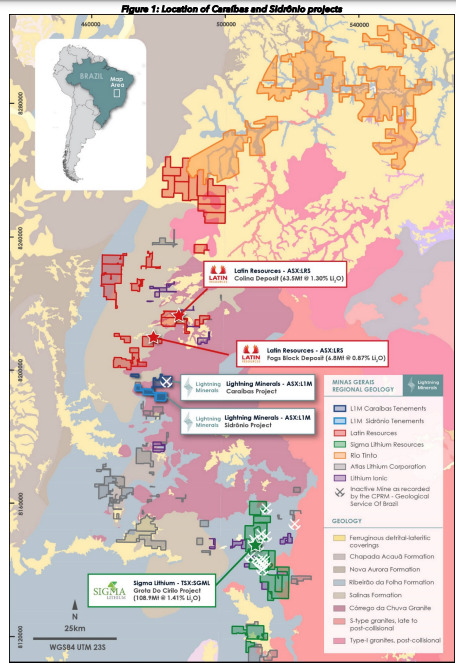

Lightning Minerals is up ~34% early doors after announcing it would acquire option agreements over the Caraibas and Sidronio projects in Brazil’s ‘Lithium Valley’ within the mining state (literally) of Minas Gerais.

L1M now holds projects in the three hot hard rock lithium districts globally of WA, Canada and Brazil.

Caraibas and Sidronio cover 3372 hectares over seven tenements currently held by a private Australian company called Bengal Mining Pty Ltd.

They are located to the north of Sigma’s Grota Do Cirilo project, the first operating lithium mine in Brazil with a resource of 108Mt at 1.41% Li2O. Further north from the options Lightning plans to pick up sits Latin Resources’ Colina and Fogs Block deposits, which boast a combined 70.3Mt at 1.27% Li2O.

And even further north of that are concessions where mining behemoth Rio Tinto appears to be scouring for white gold.

Lightning says multiple pegmatites have been identified already at Caraibas with lepidolite hosted lithium grades of up to 0.53% Li2O identified in rock chips, along with significant tantalum, rubidium and caesium concentrations — indicator minerals for lithium abundance.

Work will be supported by an already in the money placement of $1.5m at 7c per share, with transaction payments in the form of performance rights to be based on resource milestones at 5Mt, 10Mt and 30Mt at 1% Li2O.

“We believe in the lithium thematic and see now as a great opportunity to acquire highly prospective projects in known and established lithium regions,” L1M MD Alex Biggs said.

“Minas Gerais in Brazil has emerged as a proven lithium hub with the acquisition located in close proximity to the world class lithium resources of Latin Resources’ Colina project and Sigma Lithium’s Grota do Cirilo project.

“The Project presents some excellent early indicators of lithium mineralisation with prospective underlying geology that offers clear exploration targets. As part of the

transaction we welcome new key shareholders, to the Company and look forward to the next stage of evolution of the business.”

The 24 month option at Caraibas — costing US$100,000 up front and a monthly rate of US$5000 — can be exercised for US$1m per tenement, while Sidronio’s 12 month option — US$70,000 up front — can be exercised for US$200,000 per tenement with a bonus payment of US$200,000 due if Lightning identifies a resource of 10Mt at 1.3% Li2O or better.

Lightning Minerals (ASX:L1M) share price today

DELTA LITHIUM (ASX:DLI)

Everyone back aboard Delta Airlines, up more than 7% today after the $200 million capped MinRes backed lithium explorer announced a big lithium drill result from the second of its major prospects at the Yinnetharra project in WA’s Gascoyne region.

DLI, which still had over $100 million to play with as of March 31, is down almost 40% this year so far.

There’s some overhang there from MinRes’ big stake in the junior, which controls around 40Mt of spodumene resources across its Mt Ida and Yinnetharra projects in WA.

The hit at the Jameson prospect of 71m at 1.2% Li2O, including 45m at 1.8% Li2O, will give confidence the Chris Ellison chaired explorer can extend Yinnetharra’s 25.7Mt at 1% Li2O resource beyond its 1.6km long Malinda prospect.

It covers just a fraction of the 80km strike length under Delta’s command.

There were some less exciting, narrower or lower grade strikes from Malinda also reported. But a thick hit of 94m at 0.94% Li2O, including 34m at 2% Li2O, at the M1 pegmatite has given Delta MD James Croser confidence it can add a signficant amount of lithium metal to the Yinnetharra resource.

“Malinda continues to provide us with excellent lithium results that confirm our existing resource and build our confidence in the geology. Particularly a very wide intercept in YRRD471 which will add significant lithium metal to an important part of the M1 resource,” he said.

“The first hole assay results from the Jameson Prospect JREX002 has delivered fair reward for the team’s effort, with some of the coarsest visual spodumene seen to date at Yinnetharra over a very wide downhole interval, and individual assays in excess of 4% Li2O.”

Coarseness is good in lithium terms because it improves the prospect of stronger recoveries with cheaper DMS processing as opposed to fine grained spodumene, which requires a more expensive flotation process to extract lithia for a saleable concentrate.

Delta Lithium (ASX:DLI) share price today

At Stockhead we tell it like it is. While Lanthanein Resources was a Stockhead advertiser at the time of writing it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.