You might be interested in

Mining

Resources Top 5: Does this stonker copper hit bring back the Sandfire days for you as well?

Mining

Lanthanein Resources uncovers monstrous lithium soil anomaly at Lady Grey

Mining

Mining

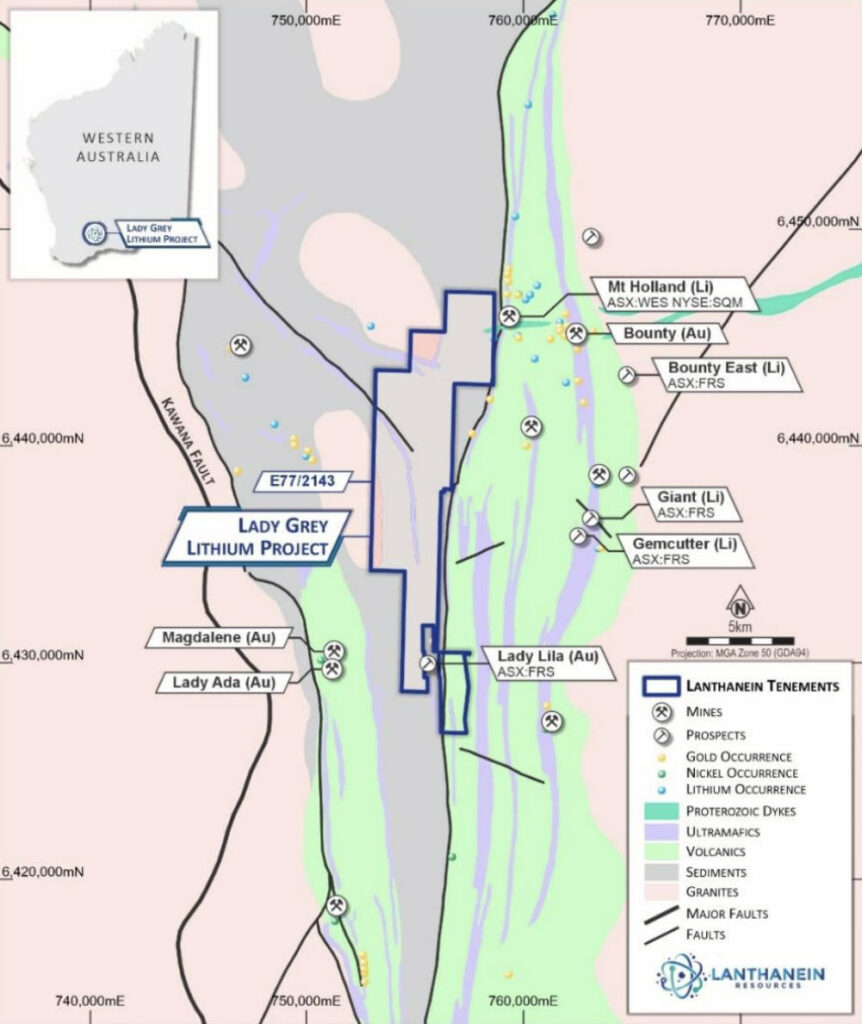

Special Report: Lanthanein Resources is acquiring a 70% interest in the Lady Grey lithium-tantalum project, which is just 400m west of the massive Earl Grey lithium mine at Mount Holland, WA.

Earl Grey – owned by Covalent Lithium, a joint venture between SQM and Wesfarmers (ASX:WES) – has a resource of 189Mt grading 1.53% Li2O and is hosted in the proven world-class Forrestania Greenstone Belt.

The Earl Grey pegmatite sill is exposed only in the south-western corner of the Earl Grey deposit.

It dips gently northward, sub-horizontally under the historic Earl Grey gold mine with Covalent Lithium’s pegmatite being the thickest against the western fault, thinning to stringer mineralisation along the eastern side of the deposit.

This indicates the direction of injected pegmatite intrusion is most likely west to east.

Notably for Lanthanein Resources (ASX:LNR), the 77km2 Lady Grey project hosts an 18km strike of the same Forrestania Greenstone Belt and a mapped continuation of the Earl Grey pegmatite.

Under the binding farm-in agreement, the company is paying Gondwana Resources $1.5m for the right to earn up to 70% of Lady Grey.

LNR can earn the first 50% by spending $7m on exploration within three years of the initial payment being made, with at least $1m spent during the first year.

It will also pay Gondwana $500,000 in cash at the earlier of the first anniversary or when aggregate exploration expenditure incurred by the company reaches $1m.

A further $500,000 payment will be made on earlier of the second anniversary or when exploration expenditure hits $3.5m.

The company can earn the remaining 20% by sole-funding exploration expenditure on the tenement until a decision to mine is made, within seven years of the Stage 1 start date, and paying Gondwana a $2.5m.

“This transaction positions Lanthanein with a prospective lithium project in one of the most desired jurisdictions for lithium explorers in Western Australia,” technical director Brian Thomas said.

Thomas – also the chairman of Azure Minerals and its exciting Andover lithium project – added that Lady Grey is immediately adjacent to one of the largest operating lithium mines in WA.

LNR plans to carry out project-wide evaluation of lithium hosting pegmatite potential that will be followed up by drilling in February-March 2024.

With a Program of Work already approved for 193 aircore and 50 reverse circulation drill holes, the company will also seek heritage approvals for expanded drill programs.

“Plans for evaluation and field work will commence immediately to assess potential for lithium pegmatites and I look forward to undertaking discovery-focused drill programs earmarked for early 2024,” Thomas said.

This article was developed in collaboration with Lanthanein Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.