You might be interested in

Mining

Monsters of Rock: BHP's $60 billion Anglo American gambit far from a done deal

News

Closing Bell: ASX clipped -1.3pc on broad selloff; BHP makes a $60bn play for Anglo American

News

Mining

Australia’s government forecasters say coal exports will pick up the slack from a softening iron ore price in 2021-22 to drive Australia’s resources exports to a record $349 billion, eclipsing the $310bn tipped into the country by trading partners in 2020-21.

That prediction is contained within the Department of Industry, Science, Energy and Resources’ latest edition of the Resources and Energy Quarterly.

Compiled by the Office of the Chief Economist, they believe strong commodity sales will increase exports by $15bn on figures posted in the June update, but the fall in 2022-23 will be sharper, sliding by $50bn to $299bn.

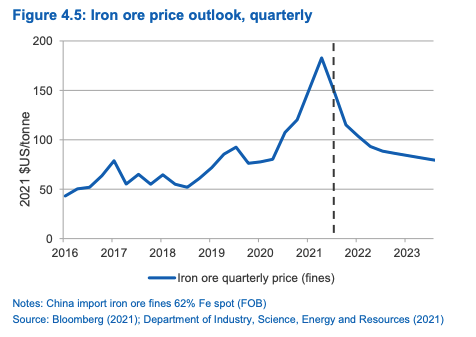

Iron ore exports, which delivered an incredible $153bn windfall in 2020-21, will drop to $132bn on forecast average prices of US$115/t (falling to US$85/t in 2022-23) before sliding to US$99bn next financial year.

Volume is expected to rise from 867Mt in 2020 to 870Mt in 2021 before climbing to 934Mt in 2022 and 948Mt in 2023, but that does not appear to take into account potential supply side discipline (or failures) from the majors or the exit of junior iron ore miners from the market.

Meanwhile, energy fuels are projected to fill the shortfall as prices for coal, oil and gas go through the roof and shake off the effects of the pandemic.

LNG exports will rise from $30bn last year to $56bn in 2021-22, with met coal export earnings climbing from $23bn to $33bn and thermal coal up from $16bn to $24bn.

Gold, a field in which Australia passed China to become the world’s biggest producer in 2020-21, will increase only marginally from $26bn to $29bn, while copper, crude oil, nickel, aluminium and zinc are all expected to provide incremental increases.

Lithium is the biggest growth market but coming off the smallest base, with export earnings set to rise from US$1.1bn last financial year to US$3.8bn by 2022-23.

The uranium spot price is expected to average US$31.10/lb this year, but future forecast prices are expected to rise sharply after that to US$36.30/lb in 2022 and US$41.70/lb in 2023. Prices charged temporarily to US$50/lb in recent weeks on the back of buying from the Sprott Physical Uranium Trust and other market participants.

Uranium exports are set to hit a low of $465m in 2021-22 before increasing as prices rise to $551m in 2022-23.

The figures have unsurprisingly been celebrated by Coalition Resources Minister Keith Pitt, who wants everyone to be grateful for the mining industry and its continuation during the Covid pandemic.

“The sector has gone from strength to strength and is performing better than it was pre-pandemic, further building on Australia’s reputation as a reliable and stable supplier of resources and energy,” he said.

“The forecast export earnings for 2021-22 are close to $100 billion higher than they were a year ago during the peak of the global pandemic and is testament to the outstanding work of all involved in this critically import sector.

“This forecast growth in both export values and volumes will help create further jobs and opportunities in the resources sector, particularly across regional Australia.

“We should take every opportunity to thank the industry for what it has achieved throughout the COVID outbreak, and to thank the hard-working men and women who are the backbone of the industry.”

Economic growth overseas which has fuelled rising commodity prices, production increases at operations in Australia and a weak Australian dollar relative to the US have all been attributed to for the forecast haul.

On China’s attempts to become self-sufficient in steelmaking

“Global iron ore markets are expected to remain tight, with slow growth in both supply and demand over the next few years.

“Market structure is not expected to alter significantly, with Australia’s market share expected to hold up. A recovery in Brazilian supply is likely in the short-term, but a number of high-cost mines in Brazil and China are also expected to face closure or depletion over the next 10 years.”

On the recovery in met coal markets

“Metallurgical coal export earnings were $23 billion in 2020–21, with the sector affected by the COVID-19 pandemic, and to a lesser extent by China’s informal import restrictions.

“However, a strong recovery is underway, with further gains expected throughout the outlook period, as mines resume operations and newly formed supply chains strengthen amidst a broader global economic recovery.

“Export volumes are forecast to rise back to 186 million tonnes, with export earnings reaching $30 billion by 2022–23.”

On a potential pullback in thermal coal prices

“As these disruptions pass, and the hot northern summer recedes, prices are expected to edge back late in 2021, falling further through the remainder of the outlook period.

“The market continues to be marked by high price differentials between 5,500kcal coal and 6,000kcal coal, which reached record levels in July, as a result of disruptions to South African and Australian high grade coal supply.

“On balance, thermal coal prices for Newcastle 6,000kcal product are expected to fall to US$85 a tonne in 2022 and US$71 in 2023 (from US$110/t in 2021 and +US$190/t currently), with inflated price differentials gradually reducing, though Chinese domestic prices are expected to remain elevated for the foreseeable future.”

Gold production expected to rise to new records

“Australian gold mine production is forecast to rise at an average annual rate of 8.8% between 2021–22 and 2022–23. Production of 379 tonnes by 2022–23 will be propelled by both production from new mines and existing mine expansions

“The risk to the outlook is the potential impacts of labour and skills shortages on Australian gold miners. Some parts of Australia are still implementing COVID-19 containment measures. Together with international border closures, these measures are likely to cause a postponement of new projects and a production cut from existing gold mines.”

Spod output forecast to rise to keep pace with demand and price increases

“Australian production is now expected to rise over the outlook period, from 217,000 tonnes LCE in 2020–21 to 306,000 tonnes LCE in 2021–22 and 374,000 tonnes LCE in 2022–23. Correspondingly, spodumene concentrate exports are forecast to increase from 1.5 million tonnes in 2020–21 to 2.5 million tonnes in 2022–23.”