Aussie resource players slapped with higher shipping rates from WA and African ports

Mining

Mining

The benchmark measure for global commodity shipping costs – the Baltic Dry Index – hit an 11-year high of 4,235 on 27 August.

And while it’s currently sitting at 3,643, that still up from 2,088 on 8 April.

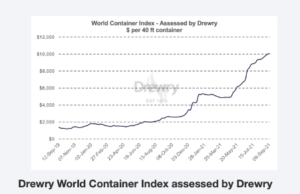

Not to mention that container shipping rates have quadrupled since the start of the year.

The Drewry World Container Index for Sept 9 states the weighted average freight cost of a 40-foot container on major trans-ocean trading routes rose 1.0% to $10,083.84.

And according to Argus Media, Australian resource companies are feeling the pressure from commodity exports from Aussie and African operations due to port congestion, delays and vessel shortage.

With just about every container ship in the world out on the high seas, shipping lanes and ports are facing unprecedented levels of delays and congestion – and many ports are being impacted by labour shortages.

Companies exporting copper concentrate from the Western Australian ports of Geraldton and Port Hedland, and mineral sands from Mombasa in Kenya are among the worst hit.

Argus said Base Resources (ASX:BSE) – which owns the Kwale mineral sands project in Kenya, and exports zircon and rutile from Mombasa – has seen a $52/tonne increase in costs.

The company’s paying $90/tonne, up from $28/tonne for a 55,000-tonne vessel shipping ilmenite to China last year.

Plus, freight rates for Sandfire Resources’ (ASX:SFR) copper concentrate exports to Asia and Europe have also increased.

However, the company said the financial impact was less than for lower value, higher bulk commodities.

Sandfire exported a record 23,274 wet metric tonnes (WMT) worth A$64.5 million to India in June and 23,000 WMT worth A$52 million to Europe in December last year.

These are higher-value tonnages than many large iron ore shipments.

Resource players exporting manganese from Australia and South Africa have also had to change their shipping programs.

Element 25 (ASX:E25), which exports manganese from its Butcherbird project in WA to China, has switched to exporting higher tonnages (55,000-60,000 tonnes) on larger ships to access more competitive cargo rates.

The company has even established a laydown area in Port Hedland where the larger shipments will be established before secondary hauling into the Utah Point facility.

And Jupiter Mines (ASX:JMS), which owns 49% of the Tshipi Borwa manganese mine in South Africa, declared a cautious half-year dividend because of sustained depressed manganese ore prices and an increase in shipping rates from southern African ports to its export markets.

Some companies – like Singapore-based ferro-alloys producer and trader OM Holdings (ASX:OMH) – have even seen reduced profits because of the shipping cost increase.

OMH said a negative earnings contribution from its mining division in the first half of 2021 was exacerbated by significantly higher freight costs.

The company owns the Bootu Creek manganese mine in WA and holds 13% in the Tshipi Borwa mine in South Africa.