Closing Bell: A big relief rally for the ASX today; copper continues its bull market rally

Relief rally for the ASX on Monday. Picture Getty

- The ASX staged a relief rally on Monday

- Gold, oil stocks struggled after tensions in the Middle East eased

- The focus has now shifted from Middle East tensions to company earnings

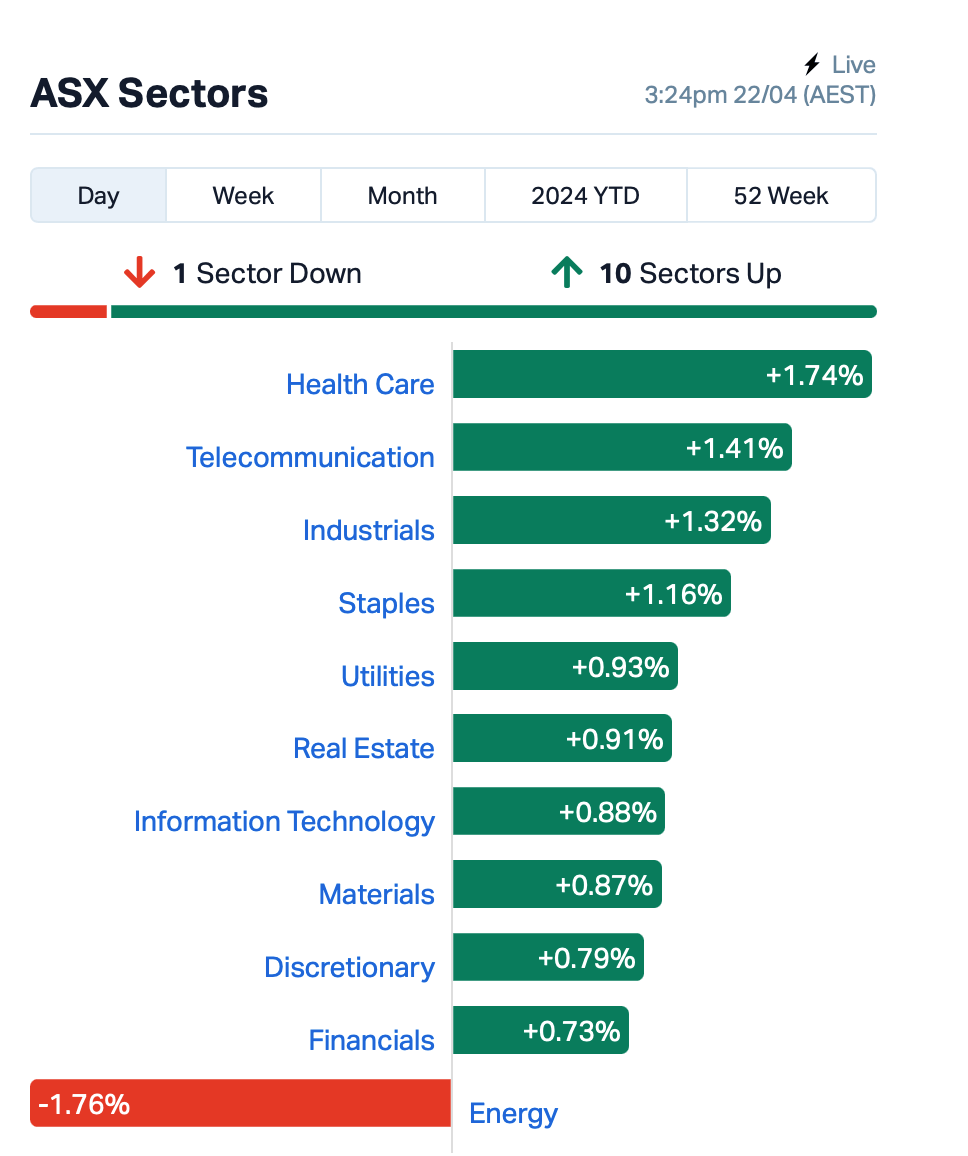

The ASX put on a relief rally after its -3% loss last week. At the close of Monday, the benchmark ASX 200 was up +0.8%.

All sectors except for energy rallied as tensions in the Middle East seem to have eased after Friday’s strikes in Iran by Israel.

The International Atomic Energy Agency said there had been no damage to nuclear sites in Iran following the strikes, with Tehran also saying that it wasn’t planning any immediate retaliation against Israel.

Gold stocks meanwhile struggled for direction today as bullion prices retreated from a 5-week rally after funds left safety in favour of risk equities.

Copper related stocks were rising today after the metal edged closer to $US10k a tonne, fulled by short supply and increasing demand.

Nick Snowdon of Goldman Sachs says the copper rally right now is “the foothills of what will be its Everest” – forecasting that prices will average US$15,000 per ton next year.

Weighing on markets today however was the US personal consumption expenditures (PCE) index released on Friday, which showed an increase of +0.1% month-on-month – which could support the case for a delay in Fed rate cuts.

Elsewhere…

Reports have emerged of North Korea conducting a test of a notably large cruise missile warhead on Saturday, following a previous test of an anti-aircraft missile on Friday.

Both NATO and the US House of Representatives approved additional funding for Ukraine.

And earlier this afternoon, China left its five-year loan rate – the rate many Chinese lenders base their mortgage rates on – unchanged this month after cutting it by 25 basis points in February.

Asian stock markets meanwhile, were mainly up today as the focus shifted from Middle East tensions to company earnings.

Tesla will report its quarterly earnings on Tuesday (US time). Other US companies to report their earnings this week include GE, Lockheed Martin, JetBlue, and Xerox.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BSE | Base Res Limited | 0.225 | 114% | 30,212,854 | $123,691,244 |

| OSX | Osteopore Limited | 0.185 | 95% | 188,009 | $981,225 |

| ORN | Orion Minerals Ltd | 0.019 | 46% | 16,434,752 | $76,001,701 |

| ZEO | Zeotech Limited | 0.035 | 46% | 6,918,639 | $42,082,154 |

| LNR | Lanthanein Resources | 0.005 | 43% | 75,436,557 | $6,842,181 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 253,966 | $11,677,324 |

| L1M | Lightning Minerals | 0.096 | 30% | 2,067,692 | $3,124,655 |

| NC1 | Nicoresourceslimited | 0.185 | 28% | 609,697 | $15,870,333 |

| RCR | Rincon | 0.034 | 26% | 11,285,812 | $5,971,087 |

| 1AG | Alterra Limited | 0.005 | 25% | 630,000 | $3,482,763 |

| ADY | Admiralty Resources. | 0.006 | 20% | 533,800 | $8,147,370 |

| NTM | Nt Minerals Limited | 0.006 | 20% | 95,000 | $4,299,515 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | 2,986,458 | $3,563,346 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 3,903,820 | $20,793,391 |

| ARL | Ardea Resources Ltd | 0.850 | 20% | 362,118 | $139,882,010 |

| MAG | Magmatic Resrce Ltd | 0.125 | 19% | 1,142,556 | $40,072,090 |

| NNG | Nexion Group | 0.019 | 19% | 2,005,373 | $3,236,926 |

| EMP | Emperor Energy Ltd | 0.013 | 18% | 14,235,541 | $3,748,112 |

| A3D | Aurora Labs Limited | 0.033 | 18% | 772,426 | $8,109,026 |

| GLL | Galilee Energy Ltd | 0.033 | 18% | 135,084 | $9,512,850 |

| IMU | Imugene Limited | 0.083 | 17% | 40,415,777 | $519,706,567 |

| HGL | Hudson Investment | 0.175 | 17% | 9,000 | $8,903,990 |

| GGE | Grand Gulf Energy | 0.007 | 17% | 1,800,440 | $12,571,482 |

| QPM | Queensland Pacific | 0.043 | 16% | 10,920,795 | $74,463,992 |

Absolutely circling the ASX from orbit on Monday is local critical mineral digger Base Resources (ASX:BSE) which has revealed a proposed 100% acquisition by NYSE-listed uranium and critical minerals producer, Energy Fuels. Energy Fuels will offer 0.026 shares for every Base share as well as a special unfranked dividend of 6.5c per share, valuing the deal at 30.2c or $375 million. It’s a 188% premium to Base’s last closing price of 10.5c and 173% premium to its 11.1c 20-day VWAP as of April 19.

Next up, Orion Minerals (ASX:ORN) says initial results from diamond drilling at Flat Mine East, part of the Okiep Copper Project in the Northern Cape Province of South Africa, are showing the highest-grade drill intercept ever recorded in the area and confirm high-grade copper intercepts returned from drilling completed in 1995 by the previous owners, Goldfields.

Lightning Minerals (ASX:L1M) announced it would acquire option agreements over the Caraibas and Sidronio projects in Brazil’s ‘Lithium Valley’ within the mining state (literally) of Minas Gerais.

L1M now holds projects in the three hot hard rock lithium districts globally of WA, Canada and Brazil. Caraibas and Sidronio cover 3372 hectares over seven tenements currently held by a private Australian company called Bengal Mining Pty Ltd.

Lanthanein Resources (ASX:LNR) says a new large lithium soil anomaly with a strike of ~4km has been identified in the recently completed soil sampling program at Lady Grey Project including a peak result of 454ppm Li2O, with a total of 527 samples returning ≥150ppm Li2O.

Rincon Resources (ASX:RCR) jumped after saying recently completed detailed ground gravity surveys have outlined multiple new anomaly high targets and enhanced three existing targets in the Pokali IOCG prospect (Arrow, Dune and Surprise). A program of works (POW) for reverse circulation drilling to test all targets has already been approved by the WA Department of Energy, Mines, Industry Regulation and Safety. A heritage clearance survey of new targets has also been submitted to accelerate drilling programs

Great Boulder Resources (ASX:GBR) said additional air-core (AC) and RC drilling at the Saltbush prospect has defined shallow, high-grade gold mineralisation over a strike length of ~300m. Highlights include: 4m @ 5.96g/t Au from 9m, and 3m @ 6.96g/t Au from 91m. Gold mineralisation appears to be plunging to the northwest, with RC drilling being planned to test this plunge in the next phase of drilling.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 1,118,367 | $11,649,361 |

| ERG | Eneco Refresh Ltd | 0.008 | -33% | 25,000 | $3,268,300 |

| ARC | ARC Funds Limited | 0.100 | -26% | 22,279 | $5,281,992 |

| KNB | Koonenberrygold | 0.020 | -23% | 995,913 | $3,580,498 |

| FHS | Freehill Mining Ltd. | 0.007 | -22% | 594,019 | $26,962,600 |

| SCN | Scorpion Minerals | 0.020 | -20% | 2,538,087 | $10,236,405 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 13,300,370 | $125,620,313 |

| DRO | Droneshield Limited | 0.925 | -17% | 16,812,758 | $690,484,044 |

| FXG | Felix Gold Limited | 0.068 | -17% | 111,233 | $16,991,639 |

| PL3 | Patagonia Lithium | 0.100 | -17% | 303,364 | $5,895,420 |

| AUH | Austchina Holdings | 0.003 | -17% | 249,023 | $6,301,151 |

| ENT | Enterprise Metals | 0.003 | -17% | 1,496,364 | $2,405,913 |

| EXL | Elixinol Wellness | 0.005 | -17% | 2,102,046 | $7,806,444 |

| FGL | Frugl Group Limited | 0.005 | -17% | 4,087,172 | $8,938,647 |

| NRZ | Neurizer Ltd | 0.005 | -17% | 622,381 | $9,008,465 |

| FCT | Firstwave Cloud Tech | 0.022 | -15% | 82,427 | $44,449,096 |

| SRR | Saramaresourcesltd | 0.022 | -15% | 239,546 | $2,155,896 |

| ZNO | Zoono Group Ltd | 0.051 | -15% | 40,450 | $12,820,644 |

| AUQ | Alara Resources Ltd | 0.068 | -15% | 3,897,252 | $57,447,003 |

| AUG | Augustus Minerals | 0.030 | -14% | 976,749 | $2,987,950 |

| AYT | Austin Metals Ltd | 0.006 | -14% | 533,394 | $8,996,339 |

| MRZ | Mont Royal Resources | 0.060 | -14% | 375,083 | $5,952,086 |

| NES | Nelson Resources. | 0.003 | -14% | 4,235 | $2,147,580 |

| SHO | Sportshero Ltd | 0.006 | -14% | 783,333 | $4,324,830 |

| CMX | Chemxmaterials | 0.043 | -14% | 105,000 | $5,764,034 |

DroneShield (ASX:DRO) says it has upsized its fully-underwritten two-tranche placement from $70m to ~$100m following strong support from existing and new domestic and international institutions and sophisticated investors. DRO says it’s also undertaking a share purchase plan to raise $5m, providing “the opportunity for all shareholders to participate in the capital raising”

Genetic Signatures (ASX:GSS) fell despite saying the TGA has completed the review of its re-designed EasyScreen Respiratory Pathogen Detection Kit, and included the updated device within the ARTG to allow supply within Australia. The company is now ready to commence sale of this product to customers in Australia, ahead of the influenza season.

IN CASE YOU MISSED IT

American West Metals (ASX:AW1) has started exploration drilling and geophysics

aimed at growing resources at its flagship Storm copper-zinc project in Nunavut, Canada.

Brazilian Critical Minerals (ASX:BCM) has defined a +1 billion tonne rare earths resource at its Ema project in Brazil, elevating it up into the top tier of REE projects globally by size.

European Lithium (ASX:EUR) is acquiring the Leinster lithium project in Ireland by transferring US$10m worth of shares it holds in Critical Metals Corp to the UK-based vendor Technology Metals.

Galan Lithium (ASX:GLN) has signed an agreement with the Catamarca provincial government in Argentina that allows for both domestic and international export of concentrate from its Hombre Muerto West (HMW) project.

Lanthanein Resources (ASX:LNR) has identified a large +4km strike lithium soil anomaly with assays of up to 454ppm Li2O at its Lady Grey project near Southern Cross, WA.

Miramar Resources (ASX:M2R) has completed a reverse circulation hole at the Blackfriars prospect that boasts the same geological setting as the >2Moz Paddington gold deposit along strike to the north.

Norwest Minerals (ASX:NWM) has upgraded resources at its Bulgera project to 217,600oz of gold after halving the cut-off grade to 0.3g/t due to high gold prices.

Pure Hydrogen (ASX:PH2) has entered the South Australian market with the first sale of its hydrogen fuel cell powered waste collection truck to Solo Recovery Resources.

Queensland Pacific Metals (ASX:QPM) has changed directions and opted to focus on its Moranbah gas project in order to help address expected gas supply shortages in eastern Australia.

Drilling at Scorpion Minerals’ (ASX:SCN) Pharos project in WA’s Murchison mineral field has uncovered several lithium-caesium-tantalum pegmatite intervals.

Spartan Resources (ASX:SPR) has successfully raised $69m after existing and new institutional investors flocked to participate in a share placement and the retail component of its entitlement offer to expand exploration at its Dalgaranga gold project.

Taiton Resources (ASX:T88) has started a reconnaissance Ultrafine soil sampling program at its Challenger West project to uncover new mineral deposits.

Over in southern Mali, Toubani Resources’ (ASX:TRE) drilling has returned an impressive 19m intersection grading 20.6g/t gold at its Kobada gold project, which is expected to boost the scale and confidence in its existing 2.4Moz resource.

Zeotech’s (ASX:ZEO) joint metakaolin testing program with CQUniversity has proved that high reactivity metakaolin can be successful produced using material sourced from its Toondoon project.

Taiton Resources (ASX:T88) is starting a reconnaissance Ultrafine soil sampling program at its Challenger West gold project to uncover its gold potential.

Anson Resources (ASX:ASN) has successfully completed the Green River exploration program after drilling the Leadville Formation to a depth of 11,210 ft at the Bosydaba#1 well. The dig is located on its just bought Green River Lithium Project in the Paradox Basin, in Utah, US of A. Drilling intersected the limestone units at a depth of 3,191.26m (10,470ft).

Viridis Mining and Minerals (ASX:VMM) says it’s received firm commitments in a heavily oversubscribed placement to raise A$8mn via an equity issue of 6.4 million shares at $1.25 per new share to institutional and high net worth investors. The company says funds raised via the placement will be used to accelerate work at the Colossus Project, including expanded drilling programs, resource definition and scoping studies.

Lithium Energy (ASX:LEL) has more time to complete its acquisition of Novonix’s (ASX:NVX) Mt Dromedary graphite project, adjacent to LEL’s Burke deposit in Queensland.

The Dromedary project is a high-grade natural flake graphite deposit with a 14.3Mt at 13.3% total graphite carbon (TGC) resource. LEL and NVX will spin-out the consolidated graphite assets via an Initial Public Offering (IPO) by Axon Graphite to form a vertically integrated battery anode material (BOM) business in QLD. The spin-out and ($15 Million to $25 Million) IPO of Axon Graphite is advancing parallel to the due diligence process.

TRADING HALTS

Ardea Resources (ASX:ARL) – Price query from the ASX and to give an update on progress on the Ardea and Japanese Consortium KNP – Goongarrie Hub.

At Stockhead, we tell it like it is. While Taiton Resources, Anson Resources, Viridis Mining and Minerals, Lithium Energy, American West Metals, Brazilian Critical Minerals, European Lithium, Galan Lithium, Lanthanein Resources, Miramar Resources, Pure Hydrogen, Scorpion Minerals, Spartan Resources, Taiton Resources Toubani Resources and Zeotech are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.