ASX juniors are feeding off nearology to WA’s nickel producing hotspots

Mining

Mining

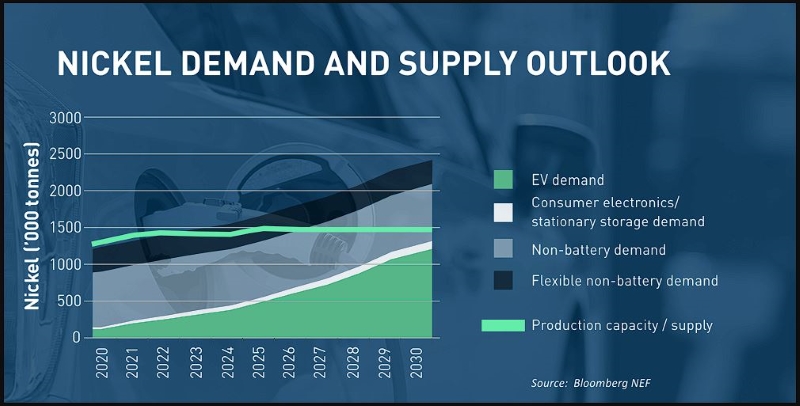

While some ASX juniors’ approach to mining exploration could be classed as ‘game-watering‘ – where companies flood their commodity portfolio and rapidly snap up tenements around new, “in vogue” mineral orebodies en-masse, (thereby forcing developers and producers to cash them out to expand their own projects) – demand for nickel is projected to be so high, and so immediately necessary, they might just be erring on the side of righteousness in this case.

According to Benchmark Intelligence, US$66 billion will need to be sunk into producing nickel by 2030 – the highest cost of any battery-related commodities.

This year, demand accounts for 15%, yet Benchmark analysts envisage this to rise to ~32% by 2030.

It’s rejuvenating shuttered projects and attracting a plethora of explorers that are looking to take advantage of ‘nearology’ to operating nickel mines, processing plants and associated infrastructure.

Let’s take a look at WA’s nickel hot spots and which ASX-listed juniors are looking to cash in.

Glencore is hoping juniors will prove up resources in the vicinity of its vastly underfed Murrin Murrin nickel-cobalt plant in WA’s northern Goldfields.

One such explorer close by is Alliance Nickel (ASX:AXN), which is well on its way to developing its NiWest project of 456,000t of nickel in nickel sulphate and 31,400t of cobalt in cobalt sulphate over its mine life, with an annual production of 19,200t of nickel and 1,400t of cobalt over its first 15 years.

Cavalier Resources (ASX:CVR) also has its Maleta Creek nickel-cobalt project just 10km from the Murrin Murrin nickel plant.

Across to the Fraser Range north of Esperance where IGO (ASX:IGO) is in production at its 11.8Mt averaging 1.76% Ni, 0.71% Cu and 0.06% Co Nova-Bollinger mine.

The region is experiencing high levels of exploration activity from nearby juniors as they look to take advantage of nearology to IGO’s nickel mineralisation.

Diamond drilling at Legend Mining’s (ASX:LEG) Octagonal prospect at its Rockford project at the end of last month intersected nickel-copper sulphide increasing with depth, which the explorer says has characteristics for a Nova-style orebody.

Diamond drilling of target areas are currently being conducted to test a seismic zone with focused intrusions along strike at Target Area B of the prospect.

Constellation Resources (ASX:CR1) has been busy conducting ultrafine infill soil sampling at its Fraser Opheus JV with Enterprise Metals (ASX:ENT) and plans to test prospective basement units with AC drilling this quarter.

Galileo Mining (ASX:GAL) has a JV with Creasy Group over tenements prospective for nickel-copper sulphide deposits similar to Nova, with recent regional EM surveys aim to define new undercover nickel targets for drill testing.

It’s also exploring the nearby Norseman project that contains a near-surface laterite deposit with over 122,000t Co and 26,000t Co.

A recent 4,000m RC drill campaign is ongoing at the project’s Jimberlana and Mission Still prospects and drilling at the Callisto deposit is focused on defining mineralisation within a 5km target horizon extending to the north.

Canadian miner First Quantum Minerals produced 22,000t of contained nickel last year at its Ravensthorpe nickel-sulphide operation on WA’s south coast.

Nearby NickelSearch’s (ASX:NIS) Carlingup project is strategically located adjacent to the Ravensthorpe nickel mining complex, with recent drilling showing up sulphide mineralisation from 285m down plunge.

NickelSearch is currently waiting on assay results from two diamond holes, which will be combined with the DHEM data to generate follow-up drill targets to extend mineralisation.

It will also consider historical EM surveys at the B1 target area and the opportunity to conduct further ultrafine soil sampling.

This could result in the consideration of further drilling within the B1 mineralised horizon to test areas where sulphides may have accumulated.

Mincor Resources (ASX:MCR) kickstart to historic WMC Resources’ mines – including its flagship Cassini operation in North Kambalda – helped BHP’s Nickel West concentrator back into action, and there’s a flurry of explorers eager to get in on the action.

Down the road from BHP’s Nickel West concentrator itself is Lunnon Metals (ASX:LM8), which owns four historic mines once developed by WMC, including Foster, Jan, Fisher and the Silver Lake shaft.

Yet it’s the new Kambalda-style discoveries at Baker and Warren looking exciting as a PFS showed an ore reserve @ 2.86% Ni for 17,500t that would cost just shy of $18m to bring into production.

Then there’s Dynamic Metals (ASX:DYM), exploring for Kambalda komatite-type massive suplhide nickel at the Dordie Far West prospect at its Widgiemooltha project.

In May, geochemical analysis from drilling revealed a nice bump in nickel grades, including a 5m hit at a sizeable 2.84% nickel from 30m.

A 12-hole RC drilling program for 1,600m is planned to test fresh rock nickel sulphide mineralisation at the D3 and D5 prospects and is expected to begin at the end of this month.

Widgie Nickel (ASX:WIN) is another explorer progressing its Mt Edwards nickel project in the region.

Recently, drillholes through the lower zone of its 132N prospect confirmed the presence of massive sulphide mineralisation with readings up to 26.5% Ni from pXRF data.

Moho Resources (ASX:MOH) is about to undertake a 6-hole, Phase 2 RC drilling campaign at its Silver Swan North project to test the ultramafic sequence to give a true measure of the Duke target area’s potential.

IGO acquired Western Areas’ Forrestania nickel operation 400km east of Perth in 2022, which includes the Cosmic Boy concentrator and the Flying Fox and Spotted Quoll mines – endowed with some of the highest nickel grades in the world.

Close by, Nimy Resources (ASX:NIM) is exploring its MONS project at the northern end of the Forrestania belt.

Recent activities include surface geochemical sampling and drilling nickel sulphide targets at its East Prospect, North Lake and Dease prospects.

Across the Indian Ocean and Tanzanian nickel explorer Adavale Resources (ASX:ADD) is exploring across 1,316km2 in the Kabanga-Musongati mafic-ultramafic belt that looks to have good potential for Ni, Cu, Co, Cr and PGEs hosted in layered intrusions.

Significantly, its six southernmost licences are adjacent to the world-class Kabanga Nickel deposit which has a JORC resource of 58Mt @ a significant 2.62% Ni and part-owned by BHP.

Adavale recently intersected a cumulative 21.55m of nickel sulphides, the thickest to date.

The explorer is now four from four after yet another drillhole intersected multiple massive and semi-massive nickel sulphide zones at the Luhuma Central prospect and is expected to release more news soon as two rigs are currently spinning within the Luhama trend.

Adavale currently has two rigs operating within the Luhuma trend.

One rig is focused on Luhuma Central step out drilling, to test both depth and strike extensions of the massive nickel sulphide intersections, whilst the multipurpose rig is presently focussed on “deeper” 500m+ high priority targets at HEM2.

In the coming weeks, the company expects to report on visual interpretation from drilling planned holes, assay results, DHEM results, and diamond drilling and RC drilling.

At Stockhead, we tell it like it is. While Adavale Resources, Dynamic Metals, NickelSearch and Alliance Nickel are Stockhead advertisers, they did not sponsor this article.