All Systems Go: Arizona Lithium boosts Prairie resource 40pc ahead of PFS and pilot production

Mining

Mining

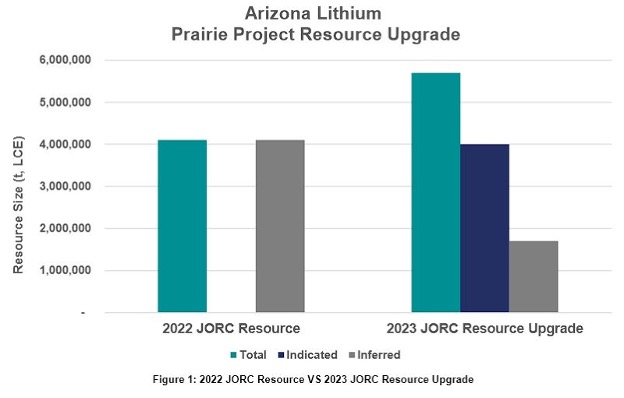

Arizona Lithium will start the engines at its DLE lithium plant in November and release a PFS by the end of the year after a 39% upgrade to the resource at its Prairie lithium brine project in Saskatchewan, Canada.

The Prairie resource went from 4.1Mt LCE to 5.7Mt LCE, which represents ~8 years of current worldwide demand for LCE.

4Mt LCE was upgraded to the higher confidence indicated category, with the majority of that in the Middle Wymark unit, which grades @ 127mg/L Li.

That makes it the highest indicated-grade lithium brine resource in the country.

The large, indicated category resource now allows the company to proceed with a preliminary feasibility study (PFS) – a detailed look at the economics of building a project — and commence operations at its pilot direct lithium extraction (DLE) test plant.

A pilot plant is a smaller version of the real thing which ensures the technology can work at scale.

Direct extraction technology is nothing new – it’s been used in water treatment for decades – but its use to extract lithium from brines is just now coming into its own.

DLE tech promises to produce cheaper, higher quality, and more environmentally friendly lithium than incumbent processes.

Its why companies like Lake Resources (ASX:LKE), Vulcan (ASX:VUL) and Anson Resources (ASX:ASN) have it at the heart of their respective projects.

Arizona Lithium (ASX:AZL) says it’s got a rare lithium brine resource on its hands that does not require the depleted brine to be injected back into the producing lithium aquifer like other DLE projects.

This supports “extends the life of the well network infrastructure and ensures resource stability over time”, it says.

“The geology of the Prairie lithium project in Southeast Saskatchewan enables it to be one of the only DLE brine projects that does not require the depleted lithium brine to be re-injected into the producing aquifer after the lithium has been extracted from the brine,” AZL says.

“This is due to Prairie currently having enough natural pressure, permeability, and lateral continuity to sustain the production rates required for commercial production of brine.

“Furthermore, the geology of the Williston Basin in Southeast Saskatchewan has world-class fluid storage capabilities, providing the company with the option to explore multiple potential disposal formations without the risk of diluting the resource in place.”

The operations of producing brine from one formation and disposing it in another formation is an extremely common occurrence in southeast Saskatchewan.

AZL says that between January and April this year, the oil and gas industry in Saskatchewan produced and disposed of an average of 149,654,188 bbl3 (23,792,399 m3) of brine per month from various formations across Saskatchewan – well exceeding the anticipated brine volumes that will be required for a commercial lithium brine operation.

AZL MD Paul Lloyd says after acquiring the Prairie project for $80m at the end of last year, the explorer put plans in motion to fast-track the development of the resource.

“Completing the first indicated resource upgrade in a timely and efficient manner highlights the technical capability of the team and our commitment to production of lithium from the Prairie project,” Lloyd says.

“The combination of the resource upgrade and the upcoming DLE pilot plant operation in November and a PFS to be released, sets the stage for a very exciting second half of the year for the company.”

An investor seminar will be held tomorrow at 10am AEST with MD Paul Lloyd and CTO Brett Rabe providing a company update. Register your interest here.

This article was developed in collaboration with Arizona Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.