Resources Top 5: Lithium back on menu, while BMO dines out on high-grade Swedish copper

"These pretzels are making me thirsty." (Pic via Getty Images

- Bastion Minerals hits high-grade copper at hard-to-pronounce Swedish REE project

- ASX lithium stocks are having a very good day, for a change, including CHN, PLL and AZL

- Critical minerals player 5EA meanwhile continues to barnstorm

Here are some of the biggest resources winners in early trade, Wednesday February 28.

Bastion Minerals (ASX:BMO)

This early-stage exploration minnow, on the hunt for copper, gold, and green metals, hits the news and the gains again.

Last time BMO was pumping, which was only about a week ago, the news was centred around Chile, and the company’s announcement of its divestment of its Cometa copper project to Hot Chili (ASX:HCH).

The latter has officially entered into an option agreement to acquire Cometa for up to US$3.3 million, which BMO plans to put towards its primary focuses – its Canadian lithium project, but also its lithium/REE operation in WA and its REE hunting in Sweden.

It’s the latter focus that BMO is excited about today, with reports of an update on the high-grade copper potential that exists within the Gyttorp REE project.

Based on four over-range samples collected in the north of the property, BMO is reporting copper results between 2.5% and 8.5% Cu, plus 7.27% TREE+Y.

This continues the recent strong high-grade results found at Gyttorp, which is in Southern Sweden and is a project located on the southern end of a belt of iron and REE-enriched skarns, more than 100km long, known locally as the “REE-line”, with Bastnäs type REE mineralisation.

Four over-range samples were re-analysed from the $BMO.AX highly prospective high-grade #RareEarthElements & Copper Gyttorp Project in Sweden, returning values of between 2.5% & 8.5% #copper, clustered in one area in the north of the property.https://t.co/D3bBDFAyEx pic.twitter.com/bHJ4H2g86z

— Bastion Minerals Limited (@BastionLimited) February 28, 2024

Among other things this morning, BMO’s executive chairman, Mr Ross Landles, imparted the following:

“These results confirm high copper grades from 2.5 to 8.5%, associated with chalcopyrite in historical magnetite skarn mine workings sampled over a distance of 80 m, and open in both directions.

“Sampling shows the REE mineralisation (up to 7.27% TREE+Y) is separate from the copper and associated with tremolite/actinolite skarn and or biotite schist, adjacent to magnetite skarn.

“We plan to carry out some higher resolution magnetic surveys, to provide higher resolution than the government 200 m line spaced airborne data. This will allow us to better define the magnetite skarn and areas of potential mineralisation.”

BMO share price

Chalice Mining (ASX:CHN)

Critical minerals hunter/developer Chalice is up today, based on not much other than the fact it’s putting its name up in lights in front of potential investors at the 2024 BMO Global Metals and Mining Conference in Hollywood, US of A.

Wait, what… BMO? Bastion’s hosting a conference in Hollyw… nah, it’s a different BMO.

BMO Capital Markets is the investment banking subsidiary of Canadian Bank of Montreal. Cool, got it – moving on…

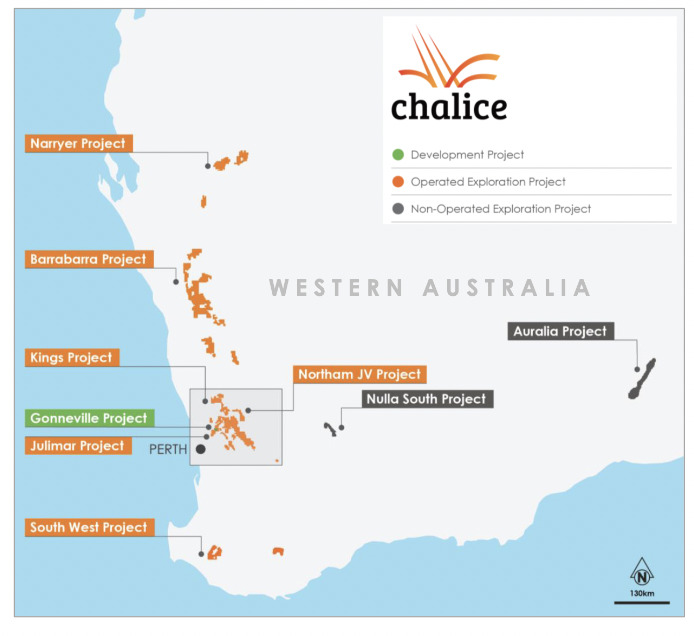

Chalice is focused on advancing its 100% owned WA-located Gonneville nickel-copper-PGE project towards development. That, it notes is the largest undeveloped palladium resource and one of the largest critical minerals discoveries in the western world (16Moz of Pd–Pt–Au (3E), 860kt Ni, 520kt Cu, 83kt Co contained.)

The company highlights in its presso:

“Gonneville is positioned to become a strategic asset for Australia and the western world, given its rare palladium–nickel–cobalt content.

“Gonneville is the first major PGE discovery in Australia and one of the few recent large-scale magmatic Ni-Cu-PGE discoveries in the western world.”

Chalice also makes the point that the western world is extremely reliant on Russian palladium supply (about ~43% of the market), which it notes is a compelling reason why CHN believes its deposit is a particularly strategic asset.

“Gonneville is located in one of the world’s most stable and friendly mining jurisdictions with a commitment to sustainable development,” reads the presso, adding:

“The Australian Government has committed US$3.9 billion to accelerate strategically significant projects and strengthen internal critical mineral security and supply chains.”

The company would happily grab a slice of that, no doubt, but in the meantime, it reports it has US$73M in cash and no debt, with “no need to raise capital in the foreseeable future”.

CHN share price

Piedmont Lithium (ASX:PLL)

(Up on no big news)

Last week, US-focused Aussie lithium big gun ($404m market cap) Piedmont Lithium hit the news after it announced it’s selling its shares in Sayona Mining (ASX:SYA).

PLL says the decision to divest the SYA shares aligns with its commitment to maintain a prudent balance sheet while simultaneously minimising dilution of PLL shareholders.

More on that > here, but regarding PLL making a strong double digits move today, there’s no big news on that other than the fact it, like Chalice above, is doing some corporate presenting over in the States, showing off its best side(s).

Piedmont is keen to jump on what seems to be a potential turnaround in lithium-related market sentiment and possible price recovery, noting the lithium futures prices are “in contango” and that “demand growth remains strong”.

According to Investopedia, contango, by the way, means:

“A futures market occurrence marked by futures contract prices rising above spot prices. It means that traders and investors anticipate an increase in prices in the coming months. The opposite of contango is backwardation, when futures prices are lower than spot prices.”

The odd notable lithium analyst has been highlighting the lithium futures contango for a little while now – read more on that > here.

$PLL is strategically positioning for the #lithium market recovery we anticipate, bolstering our balance sheet by monetizing non-core assets, deferring capital spending & employing cost-saving plans to protect shareholder value in the downturn. https://t.co/dEdS9CQRVD pic.twitter.com/LXAflBqHF3

— Piedmont Lithium (@PiedmontLithium) February 22, 2024

PLL share price

Arizona Lithium (ASX:AZL)

Several lithium stocks are actually performing notably well today – see the Market Index chart we’ve screen ripped, below, to see what we mean. This is likely due to the lithium futures contango getting a bit more attention, as well as a positive note released on lithium by Morgan Stanley overnight.

We’ll get to that elsewhere today.

But regarding, AZL, it’s one of the best-performing ASX lithium stocks today, and we’re highlighting it here because it at least has relayed some news of some note.

The company has announced an update on its claims dispute saga with US-focused British lithium firm Bradda Head Lithium.

Essentially, that appears to be settled now, well post mediation.

“AZL is pleased to announce that the outstanding mining claim amendments and claim exchange outlined under the Settlement Agreement have now been finalised with the recording of such amendment and conveyance documentation in the Mohave County, Arizona public records,” wrote the company.

“As announced, pursuant to the Settlement Agreement, Arizona Lithium and Bradda Head reached a mutually agreeable claim exchange in lieu of litigation or further dispute resolution proceedings, which will enable both parties to proceed with the development of each of their respective lithium projects in the area.”

Arizona Lithium’s main focus remains on the sustainable development of two large lithium development projects in North America – the Big Sandy lithium project and the Prairie lithium project.

AZL share price

5E Advanced Materials (ASX:5EA)

This US-focused critical minerals player continues its head-turning, stonking rise this week, barnstorming up 28% over the past 24 hours bringing it to a +48% gain over the past seven days, and +34% YTD.

Josh covered this comprehensively in yesterday’s Top Resources column, but to quickly recap, the company has announced it remains on track to kickstart commercial operations at a new boron and lithium mine in California in the second quarter of this year.

5EA is planning to open what will be only the second major boric acid operation in America. The other is a non-core asset owned and operated by Rio Tinto (ASX:RIO), which has been in business since 1927.

Josh adds:

New sources of the ‘supermaterial’ — used alongside rare earths metals in permanent magnets, fire retardants, ceramics, fertiliser, detergent and more — are essential given the concentrated nature of the market.

Update! 5E Advanced Materials Advances Closer to Initial Commercial Production

The company remains on track to commence commercial operations in CY Q2 2024 at the 5E Boron Americas Complex in California.

Read the full update in our latest press release: https://t.co/GWXoHlmyUH— 5E Advanced Materials (@5EAMaterials) February 26, 2024

5EA share price

At Stockhead we tell it like it is. While Arizona Lithium was a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.