Trading Places: Chinese mining giant backs Tietto Minerals and LGI’s new substantial shareholders

News

News

Trading Places is Stockhead’s semi-regular, pretty damn fascinating recap of the latest red flag buying and selling of ASX stocks. It is here that the rubber really hits the road for fund managers, stakeholders, distant (and not-so-distant) relatives and other famous or infamous investors.

Specifically, Trading Places tracks substantial shareholder movements – namely when a trade in a company’s stock crosses or falls below the 5% threshold.

Substantial shareholders are usually directors, individual investors, institutional investors… or their distant (and not-so-distant) relatives, which they will refer to as listed related bodies corporate or something similar. You can see in detail these listed bodies on the company’s ASX announcement.

Shareholders are required by basic human decency (and the law) to publicly declare via the exchange when their personal stake goes below or above 5%, and from there, every movement in their holdings while owning above 5%.

The becoming and ceasing to be substantial shareholders are the ones we think are worth noting, where a trade takes an investor over the 5% threshold or has them drop back below.

Here’s the form to get you started, if reading this makes you twitchy.

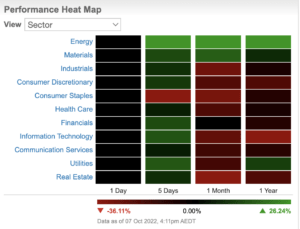

Interest rates and inflation continue to impact markets, which remain reactive to news on inflation and interest rates with the release of key data points seeing large swings either up or down.

By close on Friday the S&P/ASX 200 (ASX:XJO) was up 4.84%. All sectors were in the green except consumer staples which were down 0.15%. The ASX Emerging Companies (XEC) index was also up more than 5%.

As Stockhead’s Christian Edwards aptly summed it up the equity bounce which kicked off the new month was given a little extra thanks to the Poms making a fine full tax backflip, softer US manufacturing and jobs data and, for fans of local stocks, the newly dovish RBA.

However, the ASX was sharply lower on Monday as utilities and tech led falls in all index sectors. Throughout the recent volatility there have been some large buys and sells on the ASX.

| Code | Company | Market cap | Date | Holder | Holding |

|---|---|---|---|---|---|

| LGI | LGI Limited | $150M | Oct-06 | McGavin Holdings (Aust) Pty Ltd - Timothy McGavin | 15.05% |

| LGI | LGI Limited | $150M | Oct-06 | Robert McGavin | 11.56% |

| VBS | Vectus Biosystems | $26M | Sep-28 | Regal Funds Management Pty Ltd and its associates | 9.43% |

| TIE | Tietto Minerals | $619M | Oct-03 | Zhaojin Capital, Zhaojin International Mining & related bodies corporate | 7.25% |

| AHL | Adrad Holdings | $121M | Sep-30 | Perennial Value Management Limited | 7.23% |

| LGI | LGI Limited | $150M | Oct-06 | Rodney Bloomer and Vivienne Bloomer (The Coolabine Family A/c) | 5.71% |

| LGI | LGI Limited | $150M | Oct-04 | Perpetual Ltd & related bodies corporate | 5.29% |

| PNT | Panther Metals | $6M | Oct-03 | Ranko Matic | 5.27% |

| NAN | Nanosonics | $1.12B | Sep-28 | JPMorgan Chase & Co. and its affiliates | 5.07% |

| RRL | Regis Resources | $1.30B | Sep-30 | IPConcept (Luxembourg) S.A. | 5.05% |

| SIG | Sigma Healthcare | $699M | Oct-06 | Commonwealth Bank of Australia | 5.05% |

Tietto Minerals (ASX:TIE) has a new substantial shareholder with Zhaojin Capital, Zhaojin International Mining and related bodies corporate. TIE is focused on developing its Abujar Gold Project in Côte d’Ivoire as West Africa’s next gold mine, targeting first gold in Q4 CY2022.

Zhajoin International Mining is one of China’s biggest gold miners. The company last week announced more high grade gold intercepts from step out drilling at seven prospects at the 3.45 Moz Abujar Gold Project. Results included:

TIE’s other Chinese investor Hong Kong based Chijin International became a substantial shareholder with a 7.87% holding in September. The company’s share price has risen ~16% year to date.

LGI (ASX:LGI) has new substantial shareholders since listing on the bourse on October 4. The company is focused on solving gas emission issues for landfill sites while generating dispatchable, distributed and renewable electricity and creating Australian Carbon Credit Units (ACCUs).

LGI has a current portfolio of 26 projects with long-term contracts, across the Australian eastern seaboard, and says it has a strong pipeline of growth opportunities, investing capital to optimise the conversion of biogas to revenue.

The company’s plan is to increase biogas revenue through additional ACCU projects and landfill biogas-to-power stations, and expanding existing biogas-to-power stations; increase exposure to high quality landfill gas sites; and strengthen the premium electricity offering deploying hybrid battery systems that increase LGI’s ability to optimise the price it receives for electricity.

Among new substantial shareholders is non-executive director of LGI and agri-based fund manager, Laguna Bay founder and managing director Timothy McGavin and his brother Robert McGavin. Robert is also chair and non-executive director of Cobram Estate Olive (ASX:CBO).

| Code | Company | Market Cap | Date of change | Holder |

|---|---|---|---|---|

| NUF | Nufarm Ltd | $1.92B | Sep-29 | Australian Retirement Trust Pty LTD |

| TTT | Titomic Ltd | $45M | Sep-27 | Credit Suisse Holdings (Australia) Limited (on behalf of Credit Suisse Group AG and its affiliates) |

| TPW | Temple & Webster Group Ltd | $711M | Sep-28 | Pinnacle Investment Management & its subsidiaries |

Lunnon Metals (ASX:LM8) LM8 owns the highly prospective Kambalda Nickel Project in one of the world’s most famous nickel camps, the Kambalda Nickel District, which has historical production in excess of 1.4 million tonnes of nickel metal since its discovery by WMC Resources Ltd in 1966.

Note: A previous version of this article suggested that Aurora Prospects and Mainglow had “sold out” of the Company. This is incorrect. The Form 605 “Notice of ceasing to be a substantial shareholder” submitted by both parties to the ASX on 6 October 2022 was required simply due to the recent issue of 21,505,376 shares to St Ives Gold Mining Co. Pty Ltd in consideration of the acquisition of nickel rights announced on 12 April 2022.

The subsequent dilution resulted in both Aurora Prospects and Mainglow therefore falling below the 5% substantial shareholder threshold. Neither has sold any shares.

LM8 recently announced favourable results from the Baker shoot, part of the Kambalda Nickel Project. The company made its ASX debut in June 2021 and has seen its share price rise ~118% in the past year.

Homewares e-commerce stock Temple & Webster (ASX:TPW) has lost Pinnacle Investment Management and its subsidiaries as substantial shareholders.

Superannuation giant Australian Retirement Trust has ceased to be a substantial shareholder in crops and seeds company Nufarm (ASX:NUF). In May NUF saw its share plunge after announcing Sumitomo Chemica sold its 15.9% stake in the company. However, in a tough market environment the company’s price has still managed to stay in the green, up ~13% in the past year.