Weekly Small Cap and IPO Wrap: Lithium Energy booms 88% higher in week that started OK and ended in a state of decay

News

News

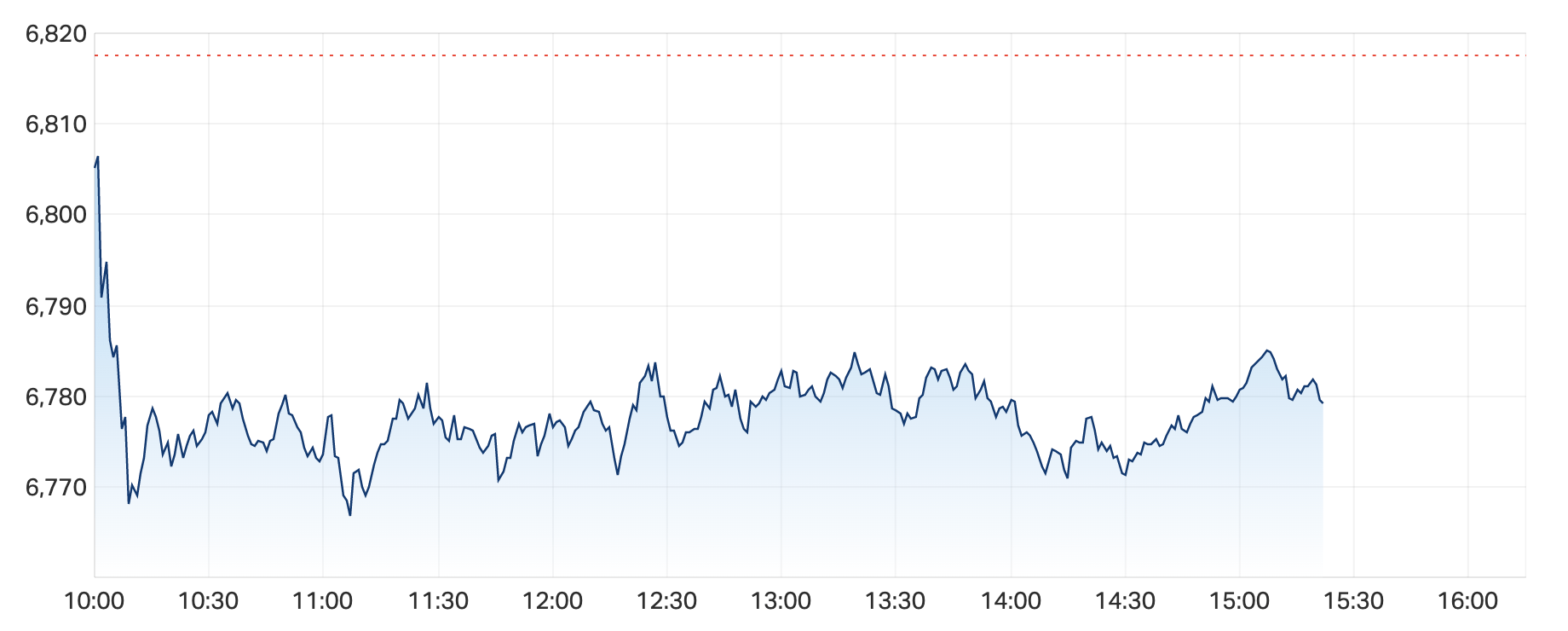

This is some fine, choppy trade from the ASX 200 on Friday, closing out the week ahead by about 3.5% despite this for a seasick session:

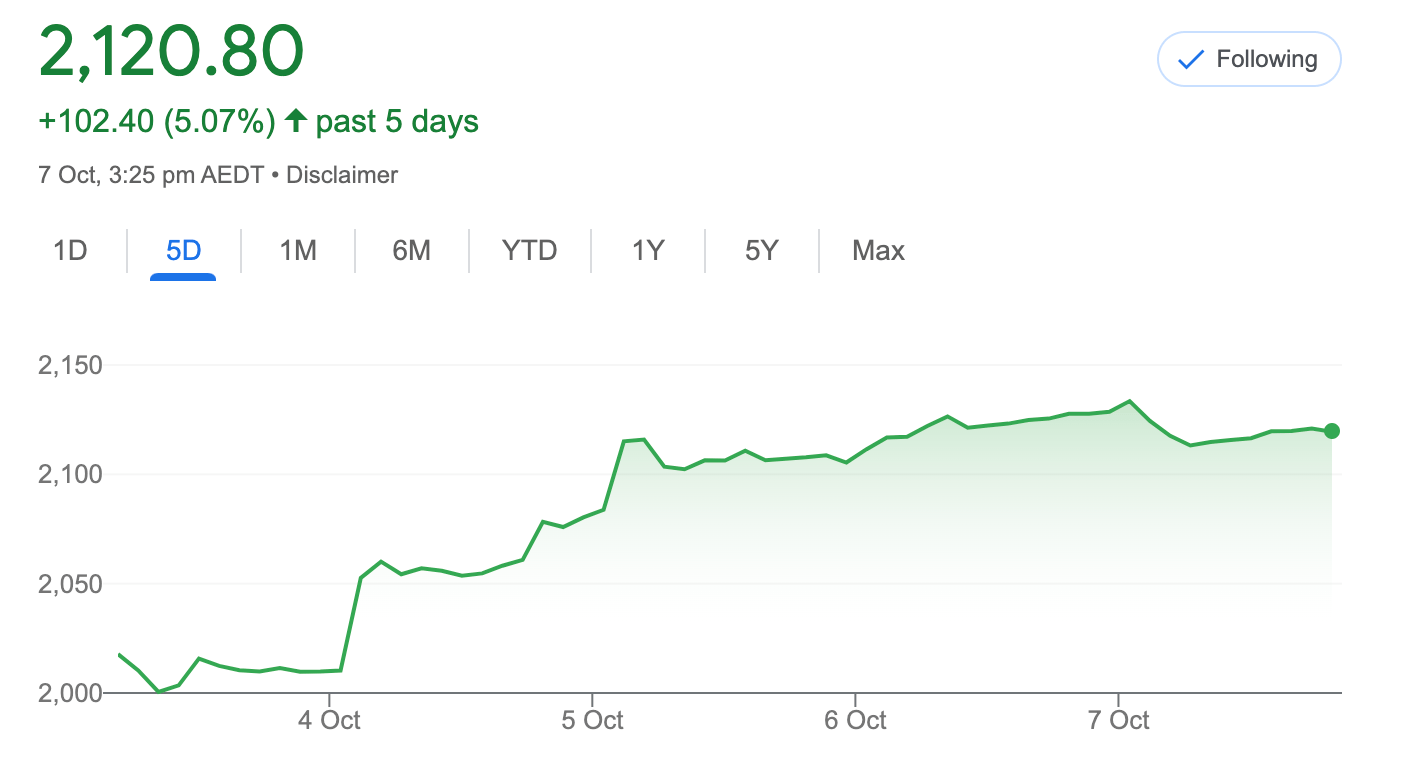

Down 0.6% on Friday, this is the ASX Emerging Companies (XEC )index this week:

T’was another tense week, starting optimistically, pausing for an RBA surprise, before deteriorating into something of an emergency visit to the dentist.

The equity bounce which kicked off the new month was given a little extra thanks to the poms making a fine full tax backflip, softer US manufacturing and jobs data and, for fans of local stocks the newly dovish RBA.

Morningstar published its Australia and New Zealand Equity Market Outlook for Q4 2022.

Naturally, inflation concerns dominate and the analysts fear that the bear market could continue into next year.

“Markets were choppy, with a rally early in the quarter on hopes of a peak in inflation and interest rates fizzling out,” Morningstar Australia noted.

“The era of cheap and easy debt appears to be over.”

And while growth is slowing, the Australian economy is “sound with low unemployment and strong export earnings.”

According to the Reserve Bank of Australia which lifted again this week, but by only 25 basis points, which helped the broader All Ords life by circa 4% for the week with gains led by energy, Tech stocks, material and financial stocks.

Even as OPEC+ culled their energy output, freaking global markets midweek, the RBA says the inflation rate in Australia is likely to peak close to 8% by the end of the year.

Overall, Morningstar reckons that the market is undervalued on a long-term view, but warns there’s potential for near-term downside as higher rates flow through the economy.

Morningstar sees earnings risk particularly in firms with heavy debt loads, homebuilders, and consumer discretionary stocks.

Here’s a summary in lovely bullies:

- All sectors of the Australian market are now fairly valued or undervalued on a long-term view. Technology, real estate, and energy are most undervalued.

- About two-thirds of our Australia and New Zealand coverage is trading below our fair value estimates.

- The impacts of higher rates are yet to fully flow through to the real economy. The ongoing war in Europe and growing friction with China add to risks.

- With major headwinds, the bear market in stocks may continue. We see most potential downside in firms with heavy debt loads, those exposed to discretionary spending and housing, and those on high P/E multiples.

Listing: 6 October

IPO: $4.5m at $0.20

Homegrown SaaS firm Bridge listed under the ASX code “BGE”, having raised $4.5 million via an IPO of 22.5 million shares at $0.20 apiece.

This company provides Software-as-a-Service (SaaS) based Customer Relationship Management (CRM) and workflow solutions to employment, care and support industries. The software is a single platform that simplifies the unique data, compliance and documentary evidence requirements of major government-funded programs through a unified user interface, BGE says.

The IPO is Bridge’s trigger to accelerate growth across the $60 billion Disability, Aged Care and Disability Employment Service markets.

The Software as a Service firm brings together some of Australia’s most respected names in the field, creating an all-in-one tech platform with the single objective of driving efficiencies throughout the nascent $60 billion NDIS system and markets like it.

“The success of the IPO is testament to the market’s enthusiasm for what is a highly-scalable platform, its undeniable potential and the extraordinary need of the many millions of Australians relying on it,” MD Jamie Conyngham told Stockhead

“We have a proven ability to continue to innovate and that’s nothing but great news to our customers who are always seeking greater efficiency solutions,” he added.

Listing: 4 October

IPO: $4.5m at $0.20

After successfully raising $9m through a heavily oversubscribed IPO priced at 20c per share, Australia’s newest uranium play is began trading on the ASX earlier this week.

Hitting a high of 20.5 cents BSN enjoyed strong support for the IPO from Australian and North American specialist resource and energy funds.

This ain’t no surprise given the growing realisation that nuclear energy is necessary for energy security and could support the shift to net zero emissions.

This positive outlook for nuclear is coupled with basin’s suite of highly prospective assets located within the world-class Athabasca Basin in Saskatchewan, Canada, which is widely acknowledged as the highest-grade uranium district in the world.

With the influx of capital from the IPO, the Company is now well funded to kick off surface mapping and sampling, geophysical data review and target generation work across its North Millennium, Geikie and Marshall projects, with drilling at Geikie expected to commence in the first quarter of 2023.

Managing director Pete Moorhouse said the Company was delighted with the strong demand for its IPO and believes the quality of its assets and executive team is reflected by the calibre of its investors.

“Basin identified and gained interests in three projects located in the southeast corner of Canada’s world class uranium mining district, the Athabasca Basin,” he added.

“Each project has a clear exploration pathway defined, with work now underway to allow targeted exploration drilling to be completed at all three projects throughout 2023.

“The pedigree of the Athabasca Basin speaks for itself, being home to the highest grade and some of the largest uranium deposits globally.”

Listing: 11 October

IPO: $15m at $0.20

This O&G junior has two exploration permits in the Surat Basin in South East Queensland, ATP 2037 and ATP 2038. The two permits represent an area of over 250,000 acres and are located approximately 50km away from critical gas transmission infrastructure.

The exploration program will explore the Permian Deep Gas play which, if successful, represents a potential multi-TCF gas resource.

Listing: 13 October

IPO: $5m at $0.20

This explorer is focused on the exploration and development of manganese and rare earths projects in the NT and WA.

Projects include the Amadeus Project (prospective for manganese), the Coomarie Project (prospective for heavy rare earths), the Nolans East Project (prospective for light rare earths) and the Pargee Project (prospective for heavy rare earths).

Here are the best performing ASX small cap stocks for September 24 to September 30:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| LEL | Lithium Energy | 1.325 | 82% | $69,172,500 |

| PCL | Pancontinental Energy | 0.005 | 67% | $45,325,337 |

| ALY | Alchemy Resource Ltd | 0.033 | 65% | $31,451,516 |

| QXR | Qx Resources Limited | 0.073 | 52% | $67,021,536 |

| MEB | Medibio Limited | 0.0015 | 50% | $4,980,891 |

| SIH | Sihayo Gold Limited | 0.003 | 50% | $18,306,384 |

| T3D | 333D Limited | 0.0015 | 50% | $4,581,445 |

| BYI | Beyond International | 0.75 | 50% | $46,002,726 |

| TMK | TMK Energy Limited | 0.019 | 46% | $56,332,500 |

| CBE | Cobre | 0.195 | 44% | $42,778,981 |

| CY5 | Cygnus Gold Limited | 0.39 | 44% | $54,458,567 |

| MI6 | Minerals260Limited | 0.375 | 44% | $83,600,000 |

| WML | Woomera Mining Ltd | 0.023 | 44% | $15,797,161 |

| DGR | DGR Global Ltd | 0.064 | 42% | $46,966,207 |

| AIV | Activex Limited | 0.045 | 41% | $8,642,103 |

| FCT | Firstwave Cloud Tech | 0.058 | 38% | $96,416,527 |

| AXP | AXP Energy Ltd | 0.0055 | 38% | $31,966,994 |

| GGE | Grand Gulf Energy | 0.019 | 36% | $29,385,603 |

| BPH | BPH Energy Ltd | 0.023 | 35% | $18,234,383 |

| DTI | DTI Group Ltd | 0.023 | 35% | $10,316,683 |

| MAG | Magmatic Resrce Ltd | 0.135 | 35% | $34,123,284 |

| DNA | Donaco International | 0.058 | 35% | $74,123,363 |

| EFE | Eastern Resources | 0.043 | 34% | $43,849,069 |

| AO1 | Assetowl Limited | 0.002 | 33% | $3,144,260 |

| GSN | Great Southern | 0.044 | 33% | $24,487,287 |

| GTG | Genetic Technologies | 0.004 | 33% | $36,935,861 |

| HXL | Hexima | 0.02 | 33% | $3,035,036 |

| KEY | KEY Petroleum | 0.002 | 33% | $3,935,856 |

| LNU | Linius Tech Limited | 0.004 | 33% | $9,522,132 |

| RIE | Riedel Resources Ltd | 0.008 | 33% | $8,573,656 |

| CPH | Creso Pharma Ltd | 0.04 | 33% | $57,142,629 |

| MRR | Minrex Resources Ltd | 0.056 | 33% | $56,314,229 |

| CMM | Capricorn Metals | 3.67 | 33% | $1,349,869,918 |

| PAR | Paradigm Bio. | 1.67 | 33% | $539,651,702 |

| NKL | Nickelxltd | 0.165 | 32% | $10,246,500 |

| OBM | Ora Banda Mining Ltd | 0.079 | 32% | $107,171,010 |

| CBR | Carbon Revolution | 0.28 | 30% | $51,727,478 |

| FBR | FBR Ltd | 0.056 | 30% | $153,084,779 |

| NVU | Nanoveu Limited | 0.013 | 30% | $2,799,243 |

| ARV | Artemis Resources | 0.061 | 30% | $83,299,859 |

| AS2 | Askari Metals | 0.395 | 30% | $18,142,062 |

| AAJ | Aruma Resources Ltd | 0.073 | 29% | $11,458,190 |

| CE1 | Calima Energy | 0.13 | 29% | $70,351,338 |

| TIE | Tietto Minerals | 0.565 | 28% | $582,944,845 |

| CVV | Caravel Minerals Ltd | 0.255 | 28% | $106,892,015 |

| TI1 | Tombador Iron | 0.028 | 27% | $30,302,784 |

| DNK | Danakali Limited | 0.33 | 27% | $127,075,349 |

| VN8 | Vonex Limited. | 0.085 | 27% | $28,349,296 |

| WWI | West Wits Mining Ltd | 0.019 | 27% | $38,190,716 |

| PNV | Polynovo Limited | 1.765 | 27% | $1,194,346,919 |

Lithium Energy (ASX:LEL), is enjoying Octoberfest.

Up 88% this week LEL is on track for success at its Solaroz project if the significant intersection of highly conductive brines in its maiden diamond drill hole is an indicator.

Hole SOZDD001 intersected about 105m of highly conductive brines from a depth of approximately 65m in sandstones and fine gravels, which are considered positive due to their porosity and permeability for potential future brine extraction.

The high conductivity readings of more than 200 mS/cm along with high brine density readings indicate highly saturated brines, which are very encouraging for the company.

Adding further interest for LEL are further significant zones of conductive brines are expected as drilling progresses through to a ‘lower aquifer’ from current drill levels of approximately 170 m to a target drill depth of about 300m.

Samples from the intersection have been sent to the laboratory for lithium concentration analysis.

“The confirmation of highly conductive brines at our first drill hole at Solaroz is highly encouraging, as it confirms our geological model and recent geophysical survey results which indicated the existence of such conductive brines beneath the Solaroz concessions,” managing director William Johnson said.

Located 10km from Allkem’s (ASX:AKE) Olaroz production field and just 3km from its recently acquired Maria Victoria concession, the diamond drill hole is the first of a high impact 10 hole, 5000m program to convert the massive brine exploration target at Solaroz into resources.

Solaroz currently has a conceptual exploration target of 1.5 to 8.7 million tonnes of lithium carbonate equivalent based at between ~500mg/L Lithium and 700mg/L Li.

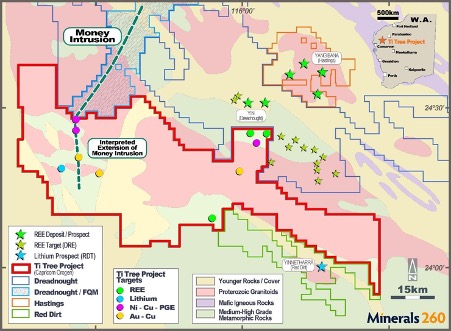

And ahead by a cracking 44% this week is Minerals 260 which agreed to acquire Capricorn Orogen’s Ti Tree Project and all of the 20 exploration licences that collectively form the Gascoyne Province-based project.

And Ti Tree looks like a sterling spot – surrounded, hemmed in and right on top of all sorts (of what an understated MI6 (ASX: MI6)) calls “significant mineral occurrences.”

Not only does it adjoin the southern boundary of Dreadnought Resources’ (ASX: DRE) Mangaroon Project, where significant Rare Earth Element (REE) and nickel-copper (Ni-Cu) mineralisation has been discovered recently, but Hastings Technology Metals’ (ASX: HAS) Yangibana REE Project (where mine construction is underway) is also a quick drive to the north.

Then, located immediately to the south, is the Yinnetharra Lithium Project, recently acquired by Red Dirt Metals (ASX: RDT).

MI6 snapped up Ti Tree for $1.3m cash and the issue of 54,965,000 Mineral 260 shares, which will represent 19.99% of the company’s issued capital following the issue of these shares.

That sits very well with Minerals 260’s strong cash position (~$23 million at 30th June 2022) and ensures exploration momentum can be conjointly maintained both at Ti Tree and the company’s other key asset, the Moora/Koojan Project in the rapidly emerging Julimar province, where a 10,000-15,000m Reverse Circulation (RC) drilling program is planned for the coming summer.

The acquisition follows hot on the heels of the headline Mi6 encounter with the latest of its significant gold mineralisation hits, intersected last week in follow-up reverse circulation (RC) drilling at the Angepena prospect, which is part of the company’s 100%-owned Moora Project in WA.

Those results included 16m @ 2.8g/t Au from 48-64m and others that struck a note with investors.

The Ti Tree project has previously been explored for precious and base metals, most recently by Capricorn and neighbouring tenement holders, underlining the region’s prospectivity for REE and lithium mineralisation.

Here are the best performing ASX small cap stocks for September 19 to September 23:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| CNJ | Conico Ltd | 0.02 | -44% | $58,198,724 |

| AVW | Avira Resources Ltd | 0.003 | -40% | $6,356,370 |

| GSR | Greenstone Resources | 0.039 | -39% | $70,581,397 |

| JAV | Javelin Minerals Ltd | 0.001 | -33% | $9,454,153 |

| RAG | Ragnar Metals Ltd | 0.027 | -33% | $9,858,807 |

| TOY | Toys R Us | 0.02 | -29% | $19,822,807 |

| FGL | Frugl Group Limited | 0.011 | -27% | $2,913,346 |

| CPT | Cipherpoint Limited | 0.003 | -25% | $2,487,490 |

| MTH | Mithril Resources | 0.0045 | -25% | $14,701,165 |

| RBR | RBR Group Ltd | 0.003 | -25% | $3,862,861 |

| SIT | Site Group Int Ltd | 0.003 | -25% | $3,153,735 |

| BRX | Belararoxlimited | 0.455 | -24% | $18,206,760 |

| LCT | Living Cell Tech. | 0.01 | -23% | $14,139,001 |

| OPN | Oppenneg | 0.1 | -23% | $17,668,573 |

| TGH | Terragen | 0.1 | -23% | $19,401,924 |

| AOA | Ausmon Resorces | 0.007 | -22% | $6,858,315 |

| EDE | Eden Inv Ltd | 0.007 | -22% | $16,267,368 |

| GMN | Gold Mountain Ltd | 0.007 | -22% | $10,382,044 |

| CMD | Cassius Mining Ltd | 0.029 | -22% | $12,515,968 |

| BBL | Brisbane Broncos | 0.9 | -21% | $98,040,631 |

| 5EA | 5Eadvanced | 1.8725 | -21% | $555,205,903 |

| BEZ | Besragoldinc | 0.031 | -21% | $8,435,092 |

| CAD | Caeneus Minerals | 0.004 | -20% | $24,055,223 |

| CLE | Cyclone Metals | 0.002 | -20% | $12,233,474 |

| SW1 | Swift Networks Group | 0.012 | -20% | $7,088,959 |

| VPR | Volt Power Group | 0.002 | -20% | $18,689,067 |

| BTN | Butn Limited | 0.125 | -19% | $9,796,111 |

| HPC | Thehydration | 0.105 | -19% | $15,824,145 |

| MTR | Metal Tiger | 0.3 | -19% | $6,526,941 |

| FIJ | Fiji Kava Limited | 0.022 | -19% | $4,762,566 |

| KLL | Kalium Lakes Ltd | 0.04 | -18% | $68,017,731 |

| HAR | Harangaresources | 0.16 | -18% | $6,690,243 |

| BXN | Bioxyne Ltd | 0.023 | -18% | $15,363,490 |

| KTG | K-Tig Limited | 0.115 | -18% | $24,450,020 |

| ENV | Enova Mining Limited | 0.014 | -18% | $5,141,011 |

| G50 | Gold50 | 0.12 | -17% | $6,833,160 |

| TTB | Total Brain Ltd | 0.039 | -17% | $5,215,124 |

| FAU | First Au Ltd | 0.005 | -17% | $4,657,055 |

| LGM | Legacy Minerals | 0.125 | -17% | $5,723,850 |

| MYG | Mayfield Group Ltd | 0.25 | -17% | $22,646,474 |

| OAR | OAR Resources Ltd | 0.005 | -17% | $10,855,189 |

| UCM | Uscom Limited | 0.065 | -17% | $15,493,599 |

| RNO | Rhinomed Ltd | 0.13 | -16% | $40,000,757 |

| HPP | Health Plant Protein | 0.063 | -16% | $7,737,706 |

| BCK | Brockman Mining Ltd | 0.021 | -16% | $185,604,643 |

| PYR | Payright Limited | 0.08 | -16% | $6,413,566 |

| FOS | FOS Capital Ltd | 0.19 | -16% | $2,993,881 |

| AVM | Advance Metals Ltd | 0.011 | -15% | $5,256,651 |

| ODM | Odin Metals Limited | 0.022 | -15% | $13,976,264 |

| TMG | Trigg Minerals Ltd | 0.055 | -15% | $9,520,787 |