Rise and Shine: Everything you need to know before the ASX opens

News

News

On Stockhead today, the ultimate guide to energy stocks in 2023, a Twiggy-backed lithium IPO makes its debut, and Buffett goes all-in on semiconductors.

But first, the day ahead.

Listing: 12pm AEDT

IPO: $7m at 20c per share

This explorer is focused on high-demand battery minerals including lithium, nickel, cobalt, copper and PGEs across four project areas in WA.

Its main focus is the Dundas South project which is close to Alliance Mineral Assets’ (ASX:A40) Bald Hill lithium and tantalum project, Greenstone Resources’ (ASX:GSR) Mt Thirsty cobalt-nickel project and Liontown Resources’ (ASX:LTR) Buldania/Anna lithium project.

Listing: 12:30pm AEDT

IPO: $6.5m at 20c per share

This TSX-ASX listed gold stock player is focused on West Africa.

The company is primarily focused on the development of the Kobada Gold Project in Southern Mali, which has a global resource base of over 2.3 Moz of gold and the potential to produce more than 100,000 ounces of gold per annum.

The following companies went into trading halts yesterday and are expected out in the next few days:

Southern Cross Gold (ASX: SXG) – Capital raise

Australian Mines (ASX:AUZ) – Capital raise

Audeara (ASX:AUA) – Capital raise

Vectus Biosystems (ASX:VBS) – Material fundraising

Aurora Energy Metals (ASX:1AE) – Material resource update for the Aurora uranium deposit

MRG Metals (ASX:MRQ) – Capital raise

ReNu Energy (ASX:RNE) – Capital raise

Playside Studios (ASX:PLY) – Contract signing

Life360 (ASX:360) – Capital raise

Gold: $US1,740.80 (-0.52%)

Silver: $US20.265 (-1.26%)

Nickel (3mth): $US27,532/t (-9.00%)

Copper (3mth): $US8,293.5/t (-0.99%)

Lithium Carbonate, China (Benchmark Minerals Intelligence, NOV 16): $US77,900/t (+0.7% weekly, +127.4% year-to-date)

Lithium Hydroxide, China (Benchmark Minerals Intelligence, NOV 16): $US77,275/t (+0.7% weekly, +171.2% year-to-date)

Oil (WTI): $US79.663(-0.51%)

Oil (Brent): $US87.23 (-0.44%)

Iron 62pc Fe: $US99.50 (+2.05%)

AUD/USD: 0.6615 (-0.84%)

Bitcoin: $US16,056.00 (-1.25%)

Enough said.

Picture of the Week: Exponential growth in #EV sales continues.Over 25% of new #cars sold this year in both #China & #Europe are electric.4 Years ago, #EV purchase rates were 2%.In 2018 there were 1.8m EV sold. This year it is likely to be over 11m up 70% on last year!! #lithium pic.twitter.com/e4nfhb2lR1

— James Harvie (@TereaAfrica007) November 21, 2022

Keep up to date with Stockhead coverage or you’ll miss gold like that EVERY DAY. Follow our Twitter page.

For all you crypto lovers Stockhead’s Coinhead Facebook group is the place to share your views, insights, tips and ideas.

Also, be sure to check in preopen each day for ‘Market highlights and 5 ASX small caps to watch’, and 10.30am for our daily ‘10 at 10’ column — a live summary of winners & losers at the opening bell.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ICL | Iceni Gold | 0.155 | 142% | 17,785,553 | $8,204,571 |

| RDS | Redstone Resources | 0.013 | 136% | 73,868,661 | $4,052,578 |

| GGX | Gas2Grid Limited | 0.0015 | 50% | 63,867 | $4,058,102 |

| MEB | Medibio Limited | 0.0015 | 50% | 85,175 | $3,320,594 |

| WBE | Whitebark Energy | 0.0015 | 50% | 21,009,062 | $6,464,886 |

| AQS | Aquis Ent Ltd | 0.18 | 38% | 88,816 | $4,643,493 |

| NZS | New Zealand Coastal | 0.004 | 33% | 5,575,955 | $3,381,015 |

| XST | Xstate Resources | 0.002 | 33% | 1,501,000 | $4,822,772 |

| LME | Limeade Inc. | 0.17 | 26% | 218,818 | $34,544,692 |

| LSA | Lachlan Star Ltd | 0.015 | 25% | 4,994,949 | $15,828,153 |

| AQX | Alice Queen Ltd | 0.0025 | 25% | 1,026,000 | $4,400,500 |

| GLV | Global Oil & Gas | 0.0025 | 25% | 8,138,361 | $3,746,709 |

| SIH | Sihayo Gold Limited | 0.0025 | 25% | 337,013 | $12,204,256 |

| OD6 | Od6Metalsltd | 0.545 | 21% | 2,690,487 | $22,203,223 |

| BPH | BPH Energy Ltd | 0.025 | 19% | 29,098,094 | $18,124,359 |

| NOR | Norwood Systems Ltd. | 0.025 | 19% | 2,760,561 | $7,973,229 |

| 1VG | Victory Goldfields | 0.285 | 19% | 2,262,430 | $11,935,235 |

| SW1 | Swift Networks Group | 0.019 | 19% | 545,619 | $9,484,747 |

| EXL | Elixinol Wellness | 0.034 | 17% | 467,952 | $9,171,702 |

| ERL | Empire Resources | 0.007 | 17% | 492,778 | $6,231,433 |

| FGL | Frugl Group Limited | 0.014 | 17% | 35,717 | $3,178,195 |

| JTL | Jayex Technology Ltd | 0.007 | 17% | 223,864 | $1,495,371 |

| NES | Nelson Resources. | 0.007 | 17% | 7,230,159 | $3,531,566 |

| RFA | Rare Foods Australia | 0.09 | 15% | 25,407 | $15,657,937 |

| RB6 | Rubixresources | 0.19 | 15% | 40,000 | $4,463,250 |

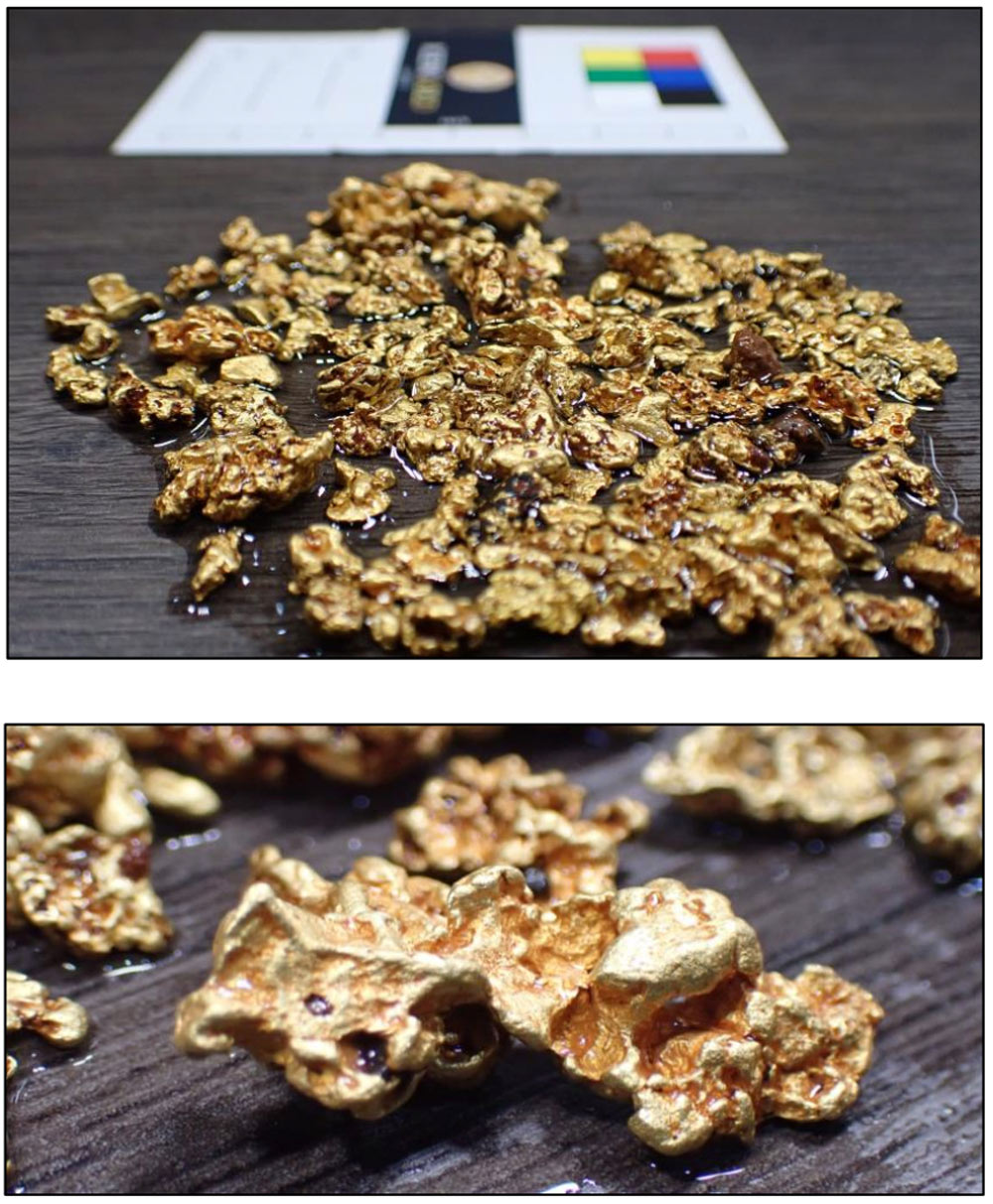

Iceni Gold (ASX:ICL) is picking up gold nuggs like this over several kilometres at the Guyer prospect in WA:

Redstone Resources (ASX:RDS) has announced “outstanding” high grade copper – including 10m at 2.51% Cu from 174m – at the Tollu copper vein deposit.

Limeade (ASX: LME) – “an immersive employee well-being company that creates healthy employee experiences” — inked a new contract worth $US10.5m over three years.

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PRM | Prominence Energy | 0.001 | -50% | 395,461 | $4,849,218 |

| ANL | Amani Gold Ltd | 0.001 | -33% | 1,793,224 | $35,540,162 |

| DW8 | DW8 Limited | 0.002 | -33% | 51,724,244 | $9,304,568 |

| RAS | Ragusa Minerals Ltd | 0.13 | -28% | 9,782,023 | $23,799,267 |

| CSF | Catalanoseafoodltd | 0.07 | -26% | 40,000 | $3,091,566 |

| GMN | Gold Mountain Ltd | 0.01 | -23% | 37,568,959 | $19,280,939 |

| W2V | Way2Vatltd | 0.021 | -22% | 122,439 | $4,801,793 |

| PLG | Pearlgullironlimited | 0.02 | -20% | 821,545 | $1,372,558 |

| GNM | Great Northern | 0.004 | -20% | 2,631,981 | $8,545,255 |

| MTH | Mithril Resources | 0.004 | -20% | 126,169 | $14,701,165 |

| RMX | Red Mount Min Ltd | 0.004 | -20% | 717,324 | $8,211,819 |

| BUR | Burleyminerals | 0.25 | -19% | 713,787 | $10,640,145 |

| GCR | Golden Cross | 0.009 | -18% | 5,136,444 | $12,069,817 |

| HFY | Hubify Ltd | 0.023 | -18% | 90,000 | $13,891,816 |

| PGO | Pacgold | 0.37 | -18% | 372,612 | $24,732,817 |

| SMN | Structural Monitor. | 0.39 | -17% | 252,214 | $63,064,424 |

| AFL | Af Legal Group Ltd | 0.125 | -17% | 551,849 | $11,480,463 |

| TG1 | Techgen Metals Ltd | 0.092 | -16% | 653,686 | $6,022,385 |

| QUE | Queste Communication | 0.031 | -16% | 641,183 | $1,001,676 |

| FFF | Forbidden Foods | 0.055 | -15% | 308,929 | $6,721,202 |

| DDT | DataDot Technology | 0.006 | -14% | 190,196 | $8,707,086 |

| ESR | Estrella Res Ltd | 0.012 | -14% | 14,761,429 | $20,684,516 |

| ICN | Icon Energy Limited | 0.006 | -14% | 4,000,261 | $5,376,096 |

| MBK | Metal Bank Ltd | 0.003 | -14% | 559,638 | $9,153,367 |

| AYA | Artryalimited | 0.5 | -14% | 31,609 | $36,420,243 |