Going Berkshire for semiconductors: Warren’s got chips on the value buffet and they taste a lot like Apple

Via Getty

Poring through the treasure trove of recent third quarter US Securities and Exchange Commission (SEC) filings, we were delighted over the weekend to discover the Oracle of Omaha – Warren Buffett – had made his first ever stake in the lately troubled global semiconductor sector.

Buffett’s Berkshire Hathaway – despite his No 1 stock being Apple (APPL) – has never tinkered with the chipmaking sector.

Now we learn Warren snapped up well over US$4.1bn shares of the Taiwan Semiconductor Manufacturing Company (TSMC) over the last quarter, in one swing for the outfield emerging as the single biggest holder of the Taiwanese chipmaker’s American depositary receipts (ADR).

The synergy doth please

Turns out TSMC – the biggest chip producer in the world by revenue – is also the exclusive chip provider for Apple, which has been and remains (by a very long way) Berkshire’s most valuable stock holding across the entire Buffett-inspired portfolio.

Add to that this kind of global market share:

Buffett has built up an impressive US$120bn stake in Apple over the tech giant’s consecutive years of growth. It now represents some 40% of his entire portfolio, making Apple Berkshire’s “second-most important investment,” coming in behind Berkshire’s complex of insurance holdings.

The investment suddenly brings TSMC into the Top 10 Berkshire Hathaway stakes, with a bullet, and doubles-down on his clear confidence in the trajectory of Apple at the same time.

A TSMC Buffet

It’s been a real tough run for the Saudi Aramco of Semiconductors which was running the world long before the world knew that manufacturing semiconductors in Taiwan was pretty much central to everything with a chip – and we mean everything – from shoulders and blocks to cars and phones.

When we first really met TSMC it was copping a right lashing from the onset of COVID-19 thanks to the global supply bottlenecks and (interestingly) not enough water. Since then there’s been the ever-almost war with the ever-angry, well-armed mainland China, and now TSMC finds itself in the centre of a China-US chip trade war.

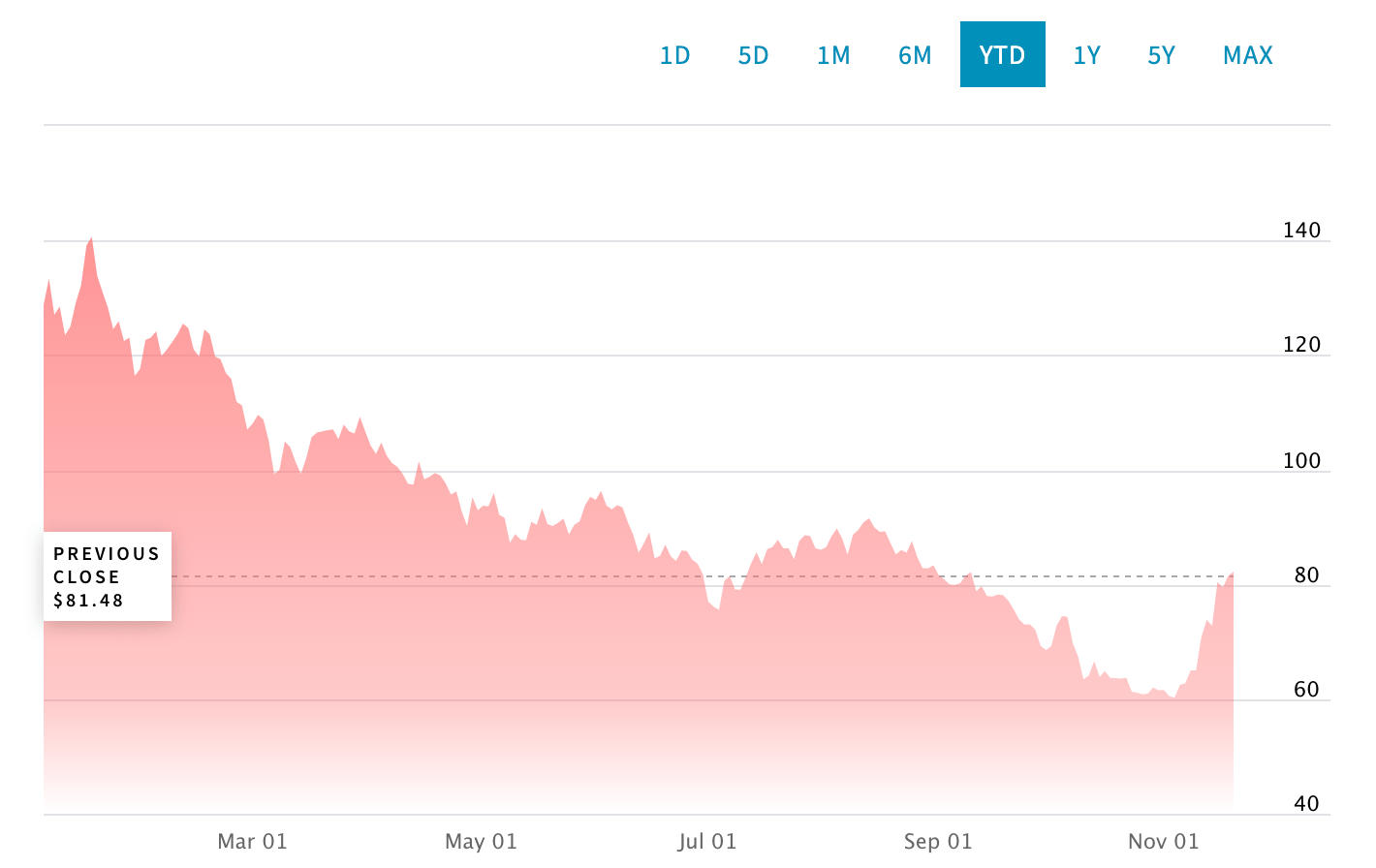

Until the last four weeks or so, Taiwan Semiconductor had lost around 65% over 2022.

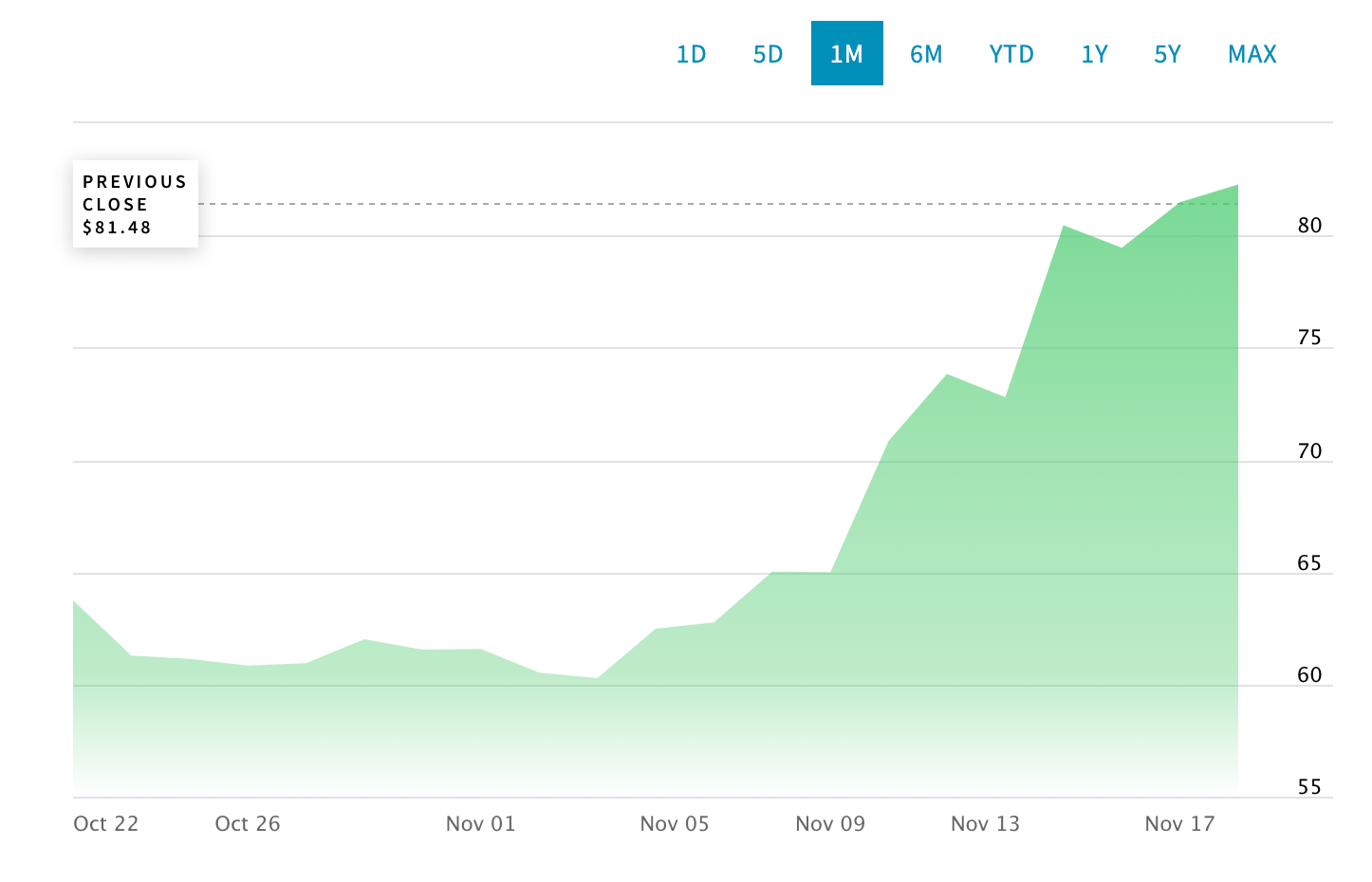

In a busy month, TSMC has recovered about 31% of those losses.

Over its brief life, the Taiwanese company, (formed back in the ’90s) has now produced more than half of the world’s semiconductors for companies like Apple, Ford, Nvidia, and AMD, and has of late copped swirling headwinds like the global economic angst, dimmed demand, geopolitical tension and emerging competition.

It began the year with a share price knocking at the door of US$150, and found itself at the start of last month trying hard to stay above US$60.

Then last week, after Warren Buffett’s US$4.1bn disclosure, the chipmaker rallied hard and fast jumping 12%.

In the States, any institutional investor waving about some US$100 million or more in US securities has to report its holdings every quarter by filing a form 13F with the SEC.

The latest filings also show Chase Coleman’s Tiger Global snapped up its own US$1.3bn stake in the chipmaker.

According to the SEC, from July to September, Berkshire Hathaway had already acquired some 60 million shares of TSMC.

The light at the end of the warren

Dan Ives, senior equity analyst at Wedbush Securities told CNBC that by betting on TSMC, Buffett is essentially backing Apple.

“Taiwan Semi is the hearts and lungs of the Apple ecosystem,” said Ives. “They build the chips, the silicon that are key in the iPhones, the Macs and really the future of Apple. It’s about 25% of their revenue… when you are betting on TS, you are really betting on Apple.”

Even after the Buffett bounce, shares of Taiwan Semi are still down more than 30%, but IG Markets’ Aussie analyst says with Buffett on board, the stock – even the sector – may’ve turned a corner.

“With decades of impressive investment record, Warren Buffett is highly regarded as a legacy and strong believer in ‘value investing’. His time-tested investment strategy is looking for the best-valued stocks with solid fundamentals and long-term growth potential.

“Hence, the highlight of TSMC in his investment portfolio has profoundly improved the sentiment for Taiwan’s chipmaker, despite its share price just plummeting to a two-year-low.”

The White House is moving quickly to cut its former reliance on Taiwan for chip supplies and cut off China from American-made chips.

Apple – adding further upbeat to the TSMC afterburners – last week also announced its intention to similarly cut the reliance on Asian chips by sourcing from a factory in Arizona potentially from 2024.

This “Made-in-US” chip factory is currently under construction and confirmed to be run by Apple’s exclusive supplier and is already planning for a second US facility as part of its long-term strategy in the face of White House policy and the likely continuation of geopolitical tension.

TSMC has found itself being touted as a ‘deep value’ stock, selling at less than 12 times forward earnings after hitting an all time low in October.

Hebe Chen at IG Markets: TSMC is the home of the super-nanometer chip

Down in Melbourne, IG Markets’ market analyst Hebe Chen – who has written a cracking exploration of what else Warren might see in TSMC – says traders seem particularly aware that Taiwan Semi has that unique quality Buffett always seems to be won over by – the competitive edge (or the so-called wide moat).

TSMC is light years ahead in its field – and despite attempts elsewhere, remains one of the few companies which produces the kind of hardcore semiconductors which have become so essential to powering the most futuristic and ambitious tech, like the artificial intelligence plays and the tsunami of electric cars en route.

Hebe Chen says when it comes to tech, TSMC “continues to lead the market”.

“In the most advanced segment 54% of total (TSMC) revenue comes from 7-nanometer and below wafer (chips).

“Currently, TSMC and Samsung are the only companies capable of producing the highest-end 5-nanometer chips that go into iPhones, whilst TSMC is one step ahead to plan on 3nm chips that will start production from Q4, 2022,” IG’s Hebe Chen says.

And the chipmaker has a strong cash flow and the brick-sh*thouse shaped balance sheet – conservative, free from a lot of debt and prepped for a downturn – that Buffett and his offsider Charlie Munger are historically big fans of.

As of FY22, the TSMC stock was also paying out a 1.7% dividend.

Big in Japan

And in new filings reviewed by Reuters and published on Monday our time, Berkshire has also raised its various stakes in each of Japan’s five biggest trading houses.

Berkshire said in 2020 that its investments in the Japanese trading houses are for the long-term and the stakes could even head toward 10%.

The latest moves are all more than 1% increases, (to over 6%), according to regulatory filings.

Reuters has Berkshire lifting its stakes:

-

to 6.59% from 5.04% in Mitsubishi Corp 8058.T

-

to 6.62% from 5.03% in Mitsui & Co Ltd 8031.T

-

to 6.21% from 5.02% in Itochu Corp 8001.T

-

to 6.75% from 5.06% in Marubeni Corp 8002.T and:

-

to 6.57% from 5.04% in Sumitomo Corp 8053.T

Read More: 7 Buffett buys to get you through a downturn

What else was on Berkshire’s Q3 buffet

According to the SEC, Berkshire and Buffers added to the position in Paramount Global (PARA) to the tune of 16%, as well as buying well over $270 million of Uber (UBER) shares, but exited its holding in Xpeng [XPEV].

Berkshire Hathaway’s only other big exit was the real estate investment trust, Store Capital (STOR).

Buffett’s Biggest Holdings as of Q3:

-

Apple (AAPL): Strong iPhone 14 sales, subscription revenue growth

-

Ally Financial (ALLY): Automotive loan portfolio growing

-

Activision Blizzard (ATVI): Its buyout price is rising well past current share price

-

Chevron (CVX): Energy inflation continuing to rise globally

-

HP (HPQ): The PC market is moving in diff directions still surfing the hybrid/WFH environment

-

Coca-Cola (KO): Makes Vanilla Coke! And has inflation proof portfolio of products

-

Occidental Petroleum (OXY): Increasing share buybacks, dividends, cash flow.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.