Buffett and Berkshire: An earnings smorgasbord of results and resourcefulness

Picture: Getty Images

While small caps is the game, there is yet widespread admiration in the room for the name Warren Buffett.

And although the given name Warren is of course Tasmanian for ‘clever’ and Buffett is human for All You Can Eat – this affection goes beyond the mere aesthetic.

Editor Peter Farquhar in particular has a bit of a fancy for the audacious Oracle from Omaha – whose investment vehicle Berkshire Hathaway cashed in on the crash by buying the dip over the last quarter to the tune of AUD$5.5bn.

Our own Nadine McGrath is a a bit of a Buffett biographer as well; she says the Nebraskan-native moulded his business chops on the value investing based fundamental analysis pioneered by economist and investor Benjamin Graham.

Buffett Partnership Ltd was established in 1956 with the firm later acquiring a textile manufacturing business called Berkshire Hathaway, forming a diversified holding company with subsidiaries across insurance, freight rail transportation, energy generation and distribution, manufacturing and retail.

As for me, being investment agnostic, I spent Saturday night giving our survivalist cat mouth-to-mouth because of a recent lamentable Cat AIDS diagnosis, and popping over to the Berkshire Hathaway internet address for a re-giggle at the olde-school, cheap-arse, Times Roman Numeral-rich website to steal an early peek at the conglomerate’s Q2 numbers.

And while global volatility still managed to tear a US$43bn loss on its ranging investment choices, the $650bn market cap beast still eked out an impressive – near 40% – year-on year boost in operating earnings (to well over $9.2 billion).

Operating earnings are the profits Berkshire made from the huge range of businesses it owns across infrastructure, insurance, transport infrastructure and utilities. Revenue increased about 10% as well, a good sign not only of BH businesses but the US economy as well.

And while the paper value of Berkshire investments may’ve dropped, Buffett and right-hand man Charlie Munger (born New Year’s Day 1924) will share 190 years of combined lived experience at the end of the month when Buffett turns 92. They reiterated their mantra to investors not to fret over momentary fluctuations across its equity positions.

“The amount of investment gains/losses in any given quarter is usually meaningless and delivers figures for net earnings per share that can be extremely misleading to investors who have little or no knowledge of accounting rules,” their company said in a press statement alongside the earnings report.

Nadine also collated a few of these nuggets of Nebraskan wisdom to carry with you during times of volatility”

-

“If you cannot control your emotions, you cannot control your money.”

-

“Widespread fear is your friend as an investor because it serves up bargain purchases.”

-

‘Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance.”

-

“What you need is the temperament to control the urges that get other people into trouble in investing.”

And this chart Pete sent me on Sunday night shows why their experience counts.

(“40 years ago was the price of Amazon now. So if Bezos can copy it, you could drop 10k on Amazon now and in 40 years have $4m. Great gift to your kid for their 21st.”)

Just so much clever

Occidental Petroleum has been the best-performing stock in the S&P 500 this year, more than doubling in price on the back of surging oil prices.

Buffett has been making headlines with his aggressive pursuit of Occidental and he now controls some 19%.

Whether Berkshire is looking to take over the energy giant or not, his bet is clear on long-term oil prices and the quality of the Permian Basin oil field.

Less worthy of column space has been the confident progress of the Berkshire-backed Chinese carmaker – the one which recently overtook Tesla as the world’s largest producer of electric vehicles according to the way the South China Morning Post sees things.

That’d be the Shenzhen-based BYD Co, which sent a further warning shot across the bow of Elon et al, by shipping its maiden 1,000 Atto 3 SUVs into the home of SUV adoration, Australia.

If you’re keen there, Attos will go for $45,000 to around $48,000. It’s called the Yuan Plus (that’s the yuan for distance not the yuan for dollar, although even China appreciated a double-entendre) in the mainland, and this’ll be the first car BYD’s designed and manufactured for the rest of the world.

And what of this one?

In July, speaking to none other than the AFR, Charlie Munger called crypto an investment in nothing.

“I regard it as almost insane to buy this stuff or to trade in it.”

In March, the 98-year-old Nebraskan compared investing in crypto to catching a venereal disease, beneath contempt.

Yet just last week, a Buffett-backed challenger bank officially clocked one million cryptocurrency users in Brazil, barely a month after launch.

The Badman is all over what’s happening with the São Paulo-HQ’d Nubank. The largest fintech in Latin America is a crypto-focused digital lender which provides a platform to invest in crypto exchange-traded funds.

Berkshire invested $1 billion in Nubank, sometime before Christmas, according to a filing with American Securities and Exchange Commission (SEC).

Nubank’s co-founder David Vélez said they’d been expecting to hit the 1 million target after a year of operating.

“And we reached it in three weeks.”

What else? Ah. This is interesting…

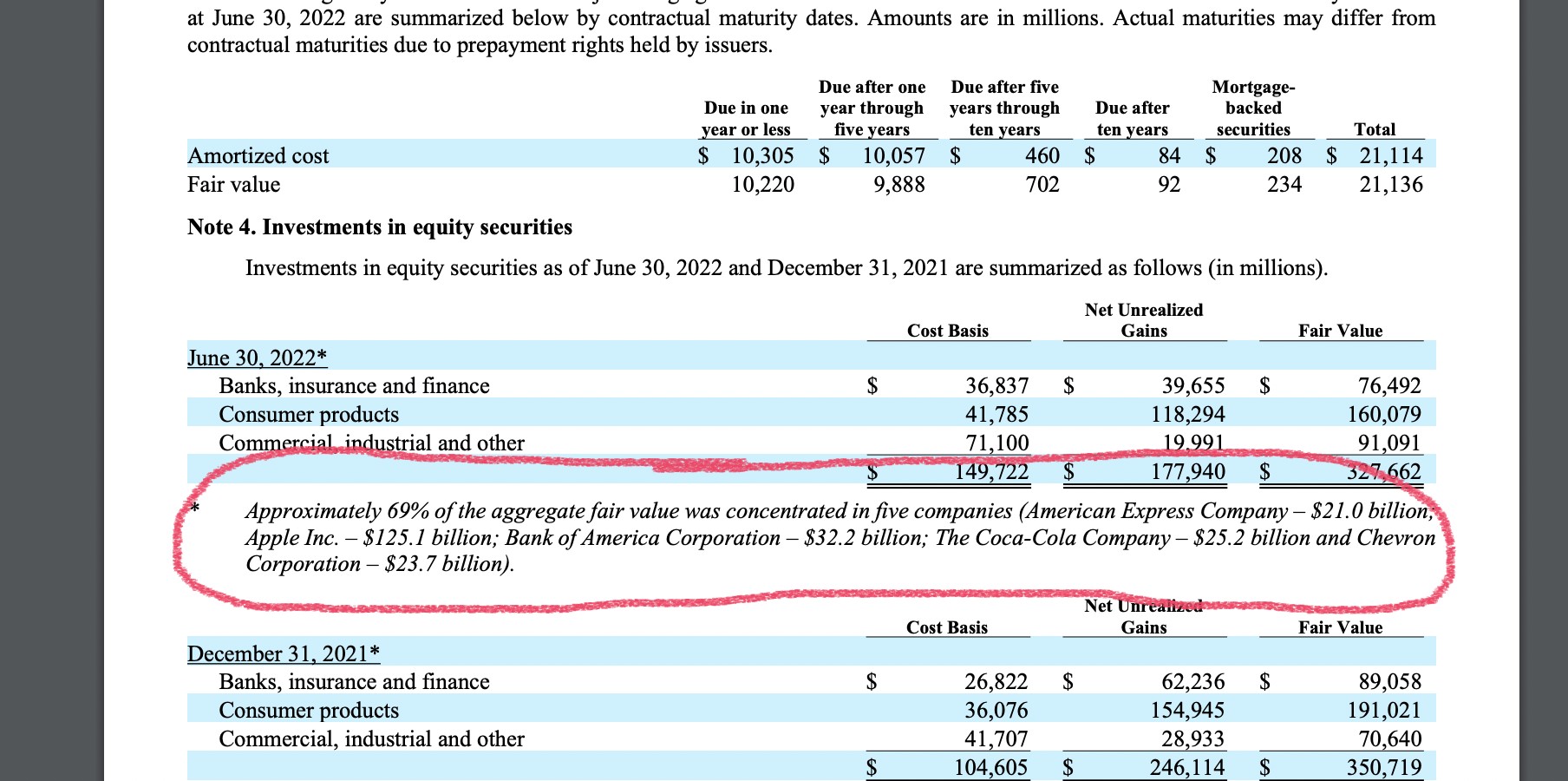

I had no idea almost 70% of Berkshire’s equity portfolio is tied up in just five names.

How’s this for high-conviction: Apple is Berkshire’s largest common stock investment with a market value above $125bn.

The tech giant has shown some cracking resilience too – despite the appalling tech-related flight to defensive stocks, the growth-oriented Apple is still ahead of the S&P 500 year to date.

Then it’s Chevron – up 30% year-to-date and valued near $24bn followed by the usual suspects Coca-Cola, American Express and Bank of America.

But it’s all about the books

And the books are good.

End June, Buffett and Munger were sitting on a (wipes brow with hanky) $105 billion war chest, ready to be deployed at their next whim, and this despite the furious purchases of the last three months.

NVM either that Berkshire’s Class A stock shed 22% over 2Q, it’s still outperforming the benchmark by a decent whack.

On the buyback front – a favourite pasttime of Messrs Buffett and Munger – some $1 billion in share repurchases over Q2, solid, but also well down on the $3.2 billion it spent on its own stock in Q1.

And finally, Berkshire has addressed a looming conflict of interest regarding the holdings of its likely CEO-in-waiting, vice chair Greg Abel, buying up the $870m of shares Abel held directly in its energy unit.

Abel joined the Buffett executive buffet when Berkshire bought the utility MidAmerican Energy, where he’d held the near $900m instead of transferring it into shares of Berkshire.

One more bit which I like:

Buffett and Munger each wrote lovely long special letters to shareholders in February. This is from Buffet on the next 50 years at Berkshire:

Berkshire is now a sprawling conglomerate, constantly trying to sprawl further…

The Next 50 Years at Berkshire. Now let’s take a look at the road ahead. Bear in mind that if I had attempted 50 years ago to gauge what was coming, certain of my predictions would have been far off the mark. With that warning, I will tell you what I would say to my family today if they asked me about Berkshire’s future. ‹ First and definitely foremost, I believe that the chance of permanent capital loss for patient Berkshire shareholders is as low as can be found among single-company investments. That’s because our per-share intrinsic business value is almost certain to advance over time.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.