CLOSING BELL: A crazy ride for tech stocks and Wildcat as the ASX dips 0.22%

News

News

After sinking as low as -0.4% in the middle of the day, a steady rally has seen local markets recover to -0.22% as the afternoon dragged on longer than a 4th grade “talent show”, the last one of which I attended featured what felt like a nine-hour performance from Aiden Walker and His Amazing Screaming Violin.

There are still nights where I wake in horror, the sound of a partially-frozen cat being run through a bandsaw still ringing in my ears.

*ahem* – my apologies for the digression.

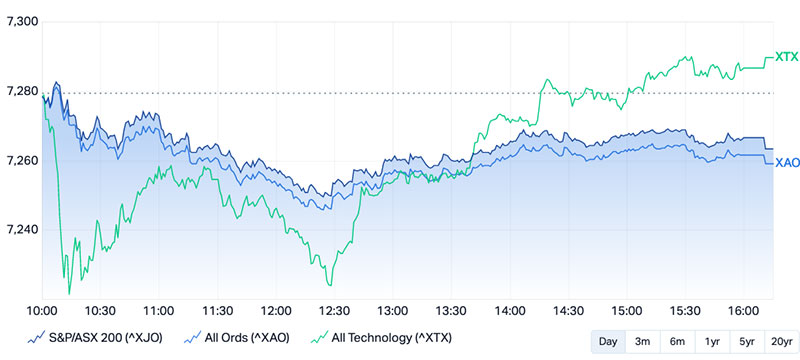

Looking at the market sectors today, it’s been a really strange day for tech stocks, with the XTX All Ords Tech index putting on an interesting double-rally over the course of the session.

This morning, the XTX sank like a stone by around 20 points, only to rally by lunchtime to pare losses back to be broadly in line with the rest of the market. But then it sank again, precipitously, before rallying again to finish the day as the best-represented sector, well above the rest of the market.

XTX va All Ords and ASX 200 today. Chart via MarketIndex.com.au

See? I’m not making it up. What a wild ol’ ride it’s been.

InfoTech, natch, finished the day on top at +1.2%, with Energy (+1.0%) and Health Care (+0.5%) the only sectors making meaningful stabs into positive territory.

Those gains were, sadly, more than offset by the rest of the market, with Real Estate (-0.69%), Telcos (-0.62%) Financials (-0.57%) and Consumer Discretionary (-0.51%) all being very basic and boring and costing people money. Booooo.

Up the expensive end of the ASX, BrainChip (ASX:BRN) extended its gains from this morning out to a +8.5% performance, which has dragged the company past the psychologically important $900 million market cap. Well-played.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| 1ST | 1St Group Ltd | 0.006 | 50% | 510,671 | $5,667,965 |

| IS3 | I Synergy Group Ltd | 0.01 | 43% | 104,701 | $2,023,563 |

| SI6 | SI6 Metals Limited | 0.007 | 40% | 7,283,149 | $7,476,973 |

| WC8 | Wildcat Resources | 0.078 | 34% | 28,131,879 | $38,397,318 |

| AYM | Australia United Min | 0.004 | 33% | 127,700 | $5,527,732 |

| M4M | Macro Metals Limited | 0.004 | 33% | 2,245,543 | $5,961,233 |

| RDN | Raiden Resources Ltd | 0.004 | 33% | 14,905,003 | $5,563,747 |

| WSR | Westar Resources | 0.05 | 33% | 22,133,486 | $4,169,783 |

| FGL | Frugl Group Limited | 0.009 | 29% | 1,400,243 | $6,692,434 |

| ZAG | Zuleika Gold Ltd | 0.018 | 29% | 646,214 | $7,322,709 |

| GTK | Gentrack Group Ltd | 4.09 | 28% | 581,677 | $325,536,592 |

| DC2 | Dctwo | 0.023 | 28% | 126,036 | $2,351,059 |

| NHE | Nobleheliumlimited | 0.195 | 26% | 941,211 | $19,123,815 |

| ICN | Icon Energy Limited | 0.005 | 25% | 49,591 | $3,072,055 |

| RML | Resolution Minerals | 0.005 | 25% | 5,000,000 | $5,029,167 |

| MAN | Mandrake Res Ltd | 0.047 | 21% | 9,873,171 | $23,351,637 |

| AVE | Avecho Biotech Ltd | 0.006 | 20% | 26,678,159 | $10,810,796 |

| POL | Polymetals Resources | 0.365 | 20% | 210,552 | $29,640,721 |

| OSM | Osmondresources | 0.19 | 19% | 501,931 | $5,296,001 |

| LVE | Love Group Global | 0.065 | 18% | 3,489 | $2,229,379 |

| VMM | Viridismining | 0.235 | 18% | 84,279 | $6,241,800 |

| ADG | Adelong Gold Limited | 0.0105 | 17% | 2,171,598 | $4,804,401 |

| BVR | Bellavistaresources | 0.21 | 17% | 159,597 | $6,835,052 |

| BAT | Battery Minerals Ltd | 0.0035 | 17% | 851,741 | $10,070,827 |

| FAU | First Au Ltd | 0.0035 | 17% | 250,000 | $4,355,980 |

In Small Caps news, Wildcat Resources (ASX:WC8) has resumed its effort to reach interstellar space this morning, up 34.5% to take its gains for the month past 160% after announcing that it had entered into a conditional, binding agreement to acquire 100% of the Tabba Tabba Tantalum Mine and Lithium-Tantalum Project, 50km from Port Hedland in the Pilbara, WA.

In second place, after a sharp sell off last week Westar Resources (ASX:WSR) is booming again, this time on no news. It waa up 28% at lunchtime, and closing in on its recent 15 May high of $0.052 per share.

It’s been a week since Westar told the market it had found “numerous thick pegmatite intersections (up to 44 metres)” which it considered “very promising” at its Olga Rock prospect.

But, despite the fact assays from Olga Rocks are still around 5 weeks away, investors seem to be back on board, pushing WSR higher by 33.3% for the session.

And in third (and being justifiable) place, it’s Noble Helium (ASX:NHE), up 25.8% today after releasing a very promising operational update from its North Rukwa project in Tanzania.

The company says it’s on track to complete its farmout by the end of May (a bit over a week away), and a deal has been struck that will see Sofori’s Drillmec HH102 rig – which is currently undergoing maintenance in Tunisia – mobilised to Tanzania in mid-June.

And a noteworthy mention for Zuleika Gold (ASX:ZAG), which is by far the day’s prime candidate for a “please explain” postcard from the ASX, after there was a massive spike in volume (646,214 against a 4W avg of 51,841) that sent the trading price up 28.6%, despite not even a hint of a whiff of news since the company dropped its quarterly in late April.

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTH | Mithril Resources | 0.002 | -33% | 1,900,000 | $10,106,413 |

| MCT | Metalicity Limited | 0.0015 | -25% | 2,163,214 | $7,009,079 |

| WNR | Wingara Ag Ltd | 0.045 | -24% | 101,557 | $10,357,008 |

| PYR | Payright Limited | 0.01 | -23% | 1,079,951 | $11,451,507 |

| TYM | Tymlez Group | 0.007 | -22% | 27,263,538 | $9,829,758 |

| AAP | Australian Agri Ltd | 0.011 | -21% | 35,714 | $4,271,393 |

| 8VI | 8Vi Holdings Limited | 0.41 | -21% | 11,000 | $22,038,339 |

| EMU | EMU NL | 0.002 | -20% | 390,633 | $3,625,053 |

| ODE | Odessa Minerals Ltd | 0.008 | -20% | 2,578,972 | $7,514,597 |

| SFG | Seafarms Group Ltd | 0.004 | -20% | 884,499 | $24,182,996 |

| YPB | YPB Group Ltd | 0.002 | -20% | 524,321 | $1,548,122 |

| FFF | Forbidden Foods | 0.025 | -19% | 113,500 | $4,122,397 |

| Z2U | Zoom2Utechnologies | 0.06 | -19% | 41,540 | $10,359,236 |

| IMI | Infinitymining | 0.135 | -18% | 333,020 | $12,618,923 |

| WEC | White Energy Company | 0.091 | -17% | 486 | $4,462,622 |

| FIN | FIN Resources Ltd | 0.015 | -17% | 505,440 | $11,133,637 |

| GTG | Genetic Technologies | 0.0025 | -17% | 2,355,651 | $34,624,974 |

| PAB | Patrys Limited | 0.01 | -17% | 5,068,438 | $24,687,221 |

| RBR | RBR Group Ltd | 0.0025 | -17% | 4,600,000 | $4,855,214 |

| TYR | Tyro Payments | 1.2875 | -16% | 17,932,403 | $798,654,997 |

| OPL | Opyl Limited | 0.021 | -16% | 161,585 | $2,001,627 |

| CII | CI Resources Limited | 1.01 | -16% | 39,359 | $138,697,328 |

| R8R | Regener8Resourcesnl | 0.15 | -14% | 45,000 | $4,489,844 |

| CPH | Creso Pharma Ltd | 0.012 | -14% | 21,722,140 | $31,024,030 |

| CPO | Culpeominerals | 0.06 | -14% | 252,186 | $4,642,071 |

Creso Pharma (ASX:CPH) has some good news out of Canada, thanks to its wholly-owned Canadian subsidiary Mernova Medicinal.

Mernova has reported a great month for May, delivering strong growth in purchase orders generating AUD$662,131 in new purchase orders from a range of province partners and wholesalers across Canada and for the company’s dried flower, pre-roll joint and electronic vaporiser products.

Those sales take Mernovas’s take total unaudited Q2 FY2023 sales to AUD$1,215,365, and follows the AUD$553,957 in purchase orders generated in April 2023 and the division’s maiden cashflow positive position in Q1 FY2023.

On top of that, Creso is also celebrating Mernova’s extension of licences with Health Canada and Canada Revenue Agency, in accordance with the Cannabis Act and Cannabis Regulations, for an additional five years, through to February 2028.

“Mernova continues to deliver strong sales growth via province partners, and we have a positive outlook through to the end of Q2 and beyond,” CEO and managing director William Lay said.

”We continue to witness pleasing demand for the group’s product range which is now sold through eight Canadian provinces.”

Some not-so-great news has come in from Seitel (ASX:SSL), with the release of its half-year report today.

SSL is – for those (like me) who are not in the know – ”engaged principally in investment in industrial, commercial, retail estate, provision of finance and lease facilities and plant and management services to its controlled entities and management, evaluation and expansion of these and other business opportunities”.

I’ve read through that half a dozen times and I’m still not entirely sure what they do there… but whatever it is, it’s not been working out so well for them recently.

According to the Halfly (that’s, like, two Quarterly reports at the same time), Sietel’s profits are down 60% to $588,000 for the period ending 31 March 2023.

But! – through the magic of Gains on Financial Assets at Fair Value through Other Comprehensive Income, to which Sietel has assigned a positive value of $2.99 million, things aren’t looking completely terrible, so there’s that.

And in more positive news, Centrex (ASX:CXM) has announced that its wholly-owned subsidiary Agriflex has exported its first shipment of phosphate rock to a substantial customer in South Korea.

The 15,000-tonne shipment is headed to a substantial commercial fertiliser-producer customer of SamsungC&T and “represents a further step forward in Centrex realising its potential as a mass exporter of some of the highest quality phosphate in the world”, the company says.

Pharmaxis (ASX:PXS) – Announcement regarding top line results of an investigator initiated Phase-1c clinical trial in established scars.

Cohiba Minerals (ASX:CHK) – Acquisition and capital raising.

Latrobe Magnesium (ASX:LMG) – Capital raising.

Superior Resources (ASX:SPQ) – Capital raising.

Aurora Energy Metals (ASX:1AE) – Capital raising.

Openn Negotiation (ASX:OPN) – Capital raising.

Benz Mining (ASX:BNZ) – Announcement regarding an upgraded mineral resource estimate for the company’s Eastmain Gold Project.

Technology Metals Australia (ASX:TMT) – Capital raising.

Rubix Resources (ASX:RB6) – Acquisition and capital raising.

Kalgoorlie Gold Mining (ASX:KAL) – Acquisition and farm In.

Golden State Mining (ASX:GSM) – Capital raising.

Global Oil and Gas (ASX:GLV) – Announcement with respect to a Petroleum Application.

Top Shelf International (ASX:TSI) – Capital raising.