Kick Back: The biggest stories you may have missed this week

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Just another week, really.

For a brief moment, Bitcoin plunged after Elon Musk consulted with his planet-sized brain and it told him the cryptocurrency was really, really bad for the environment. Which is weird – everyone else knew this was decade-old news because the ABC reported on it four weeks ago.

Twitter lit up with the haters, absolutely beside themselves as stimmy blances were drained by the crash they warned was coming, eventually. If they kept warning it was coming, enough. Any minute now. Maybe next year, but it is coming.

Something about broken clocks, something about right twice a day.

And YES. LOL. Watch all those greedy imaginary money buying losers run for their… uh, wallets?

It took literally minutes for the dip to be bought. Here’s what a BTC “crash” looks like over 12 months:

Um, ouch?

Here’s what a crash using real money looks like over the past four months:

That’s how to lose money legitimately, on the ASX. Where sensible investors shop.

And that’s the ASX, which booted Animoca out back in March 2020 due to its “involvement in cryptocurrency-related activities”.

Yesterday, Animoca became a Aussie unicorn due to its “involvement in cryptocurrency-related activities”.

This is going well.

Here’s a light graze from the ASX pasture over the past week.

There’s a new plan to unlock a magnetite mining hub in WA’s Mid-West

“Will somebody please unlock this magnetite mining hub in WA’s Mid-West?” has been a call ringing out for more than 50 years.

Well, not really. There have been many times when the price of iron ore means it’s really not worth it, because look:

It’s a long way from anywhere.

It almost got a planned ~$10 billion rail system and deep water port called ‘Oakajee’ near Geraldton, but that was canned in the post-2011 iron ore price slump.

And no, it’s not back on the table just because prices are stupidly high in 2021. Small cap engineering service provider Verbrec (ASX:VBC) reckons it can facilitate magnetitie out of the WA Mid-West with a slurry pipeline and feeder vessels out to a “floating harbour”.

And even if the iron ore price drops to $US80/t, the plan is still “very robust”.

Iron ore aspirant Juno times its ASX run to perfection

So that’s good news for the host of small caps in the region, some of which we’ve highlighted in the post above.

But it would could also be amazing timing for the ASX’s newest listing, Juno Minerals.

It was spun out from Jupiter Mines (ASX:JMS) at midday, and managing director Greg Durack believes it has the potential to be a tier one magnetite mine.

And yep, it’s major projects are smack bang in Western Australia’s Yilgarn region. At this stage, Juno’s considering the truck and rail route to get its ore to Esperance, but more choice is always the best choice…

IPO Wrap: 2021 is fast catching up to the IPO rush of last year

The latest gold IPO Australasian Gold (ASX:A8G) didn’t have a great debut yesterday, shedding 15% off its opening price of 20 cents.

We’re seeing a few of these muted debuts in 2021, but overall, the pace of listings is on trend with 2020. The latest data shows a total of 42 new companies have so far floated on the ASX in 2021, for a combined total market cap of around $5.5 billion.

There were 113 IPOs all up in 2020, and their total market value is now up by 148 per cent to $35.7 billion.

AI recruitment tech stock Hiremii also dropped by around 25 per cent on debut this week.

Energy efficiency software company, EP&T Global (ASX:EPX) – down 1c on its debut yesterday.

But along with Juno, there was a biggie to close the week; the debut of pathology services Australian Clinical Labs (ASX:ACL). It was incorporated in 1987 and is based in Clayton, Australia, and hit the bourse with a market cap of $809 million.

Next week, hearing tech company Audeara (ASX:AUA) is set to float on Tuesday. It makes headphones designed to help people with hearing loss, and is not at all like Nuheara. We know, because we asked them “how are you not at all like Nuheara?”

If you’re into some IPO action, here’s a Coming Soon guide:

| Code | Company | Price per share | Capital raised | Listing Date | Sector |

|---|---|---|---|---|---|

| A8G | Autralasian Gold | 0.2 | $6m | 13-May | Resources |

| FG1 | Flynn Gold | 0.2 | $10m | 20-May | Resources |

| JNO | Juno Minerals | 0.25 | $20m | 13-May | Resources |

| LEL | Lithium Energy | 0.2 | $9m | 24-May | Resources |

| PWR | PWA Holdings | 2.9 | $260m | 27-Apr | Consumer |

| AM7 | Arcadia Minerals | 0.2 | $6.4M | 28-May | Resources |

| AUA | Audera | 0.2 | $7m | 14-May | Tech |

| LDR | Lode Resources | 0.2 | $7.5m | 1-Jun | Resources |

| MMG | Monger Gold | 0.2 | $6m | 8-Jun | Resources |

| TOR | Torque Metals | 0.2 | $7m | 20-May | Resources |

| AGN | Argenica Therpaeutics | 0.2 | $7m | 10-Jun | Health |

| ACL | Australian Clinical Labs | 4 | $409M | 14-May | Health |

| DGL | DGL Group | 1 | $100M | 24-May | Industrial |

| FOS | FOS | 0.25 | $3m | 9-Jun | Industrial |

| HIQ | hitIQ | 0.2 | $10m | 7-Jun | Tech |

| LM8 | Lunnon Metals | 0.3 | $15m | 1-Jun | Resources |

| POL | Polymetals Resources | 0.2 | $7m | 15-Jun | Resources |

| PPM | Pepper Money | 2.89 | $500m | 1-Jun | Financial |

| SB2 | Salter Brothers Emerging Companies | 1 | $20m | 8-Jun | Financial |

| TRJ | Trajan Group Holdings | 1.7 | $80m | 7-Jun | Health |

The Secret Broker: ALERT- Soap Box Rant incoming

Mrs Broker has quietly ducked off for a few days and the kids have stopped pinching the bacon out of the fridge. Looks like the Eight Year Storm…

Yep, even the poor girl at the Woolies checkout is copping it from TSB this week, because he hasn’t had a good rant since 2013 and now ScoMo’s gone and put his favourite country in exactly the kind of poo pile he left behind in the 80s.

1989, to be precise. Just two years after the crash of ’87 that everyone is either too young to remember, too enamoured with their property portfolio to want to remember, or simply old enough to know they can’t do anything about it.

“It” is the next crash, signalled by populist politics and ridiculous BNPL valuations. Here’s your free warning, and don’t come whining in three years when rates start doing what they absolutely have to.

So what happened to house prices in the UK in 1989? They got cut in half. We understand if you’re still trying not to accept the potential reality.

Help us TSB, you’re our only hope…

BNPL gets battered after another US inflation fright

So let’s have another look at what can happen when investors who’ve been pumping market tech darlings get a sniff of inflation fears:

| Security | Description | Last | % change | MktCap |

|---|---|---|---|---|

| APT | Afterpay Limited | 85.16 | -4.6% | 25,850,938,025 |

| Z1P | Zip Co Ltd | 6.71 | -1.0% | 3,761,114,650 |

| SPT | Splitit | 0.625 | -5.3% | 301,989,978 |

| SZL | Sezzle Inc | 7.1 | -6.0% | 777,606,701 |

| ZBT | Zebit Inc | 1.08 | -1.4% | 103,576,674 |

| HUM | Humm Group Limited | 0.865 | -1.1% | 433,359,778 |

| LBY | Laybuy Group Holding | 0.655 | -3.0% | 117,762,004 |

| OPY | Openpay Group | 1.71 | -2.6% | 173,861,218 |

That $194 target for whoever lobbed into the APT convertible note offering back in February is suddenly looking a looooong way off.

( Psst don’t buy crypto you’ll lose all your money)

And there’s more – if inflation rises quicker than expected, the outlook for interest rates may also change.

I was thinking the RBA would be hiking interest rates in late 2022 – that might turn out to be too late.

— Stephen Koukoulas (@TheKouk) May 12, 2021

Some wobbles evident in 2021. Fortunately, investor Ron Shamgar told us how he’s navigating the structural shift, and highlighted some under-the-radar tech stocks which have attributes (like actual profits, or different post-COVID tailwinds) that could see them outperform in a higher inflation environment.

Tech is officially on the nose. Stay safe, folks.

The iron ore equation: Do structural supply gaps and China policy stimulus = US$200/t?

Um, maybe?

Dalian iron ore has been on a bit of a rollercoaster this week. Scutty on Monday:

Dalian iron ore resembling a crypto pump…

Limit up 10% and the bids keep on coming $AUD #ausbiz pic.twitter.com/ufyENHrala

— David Scutt (@Scutty) May 10, 2021

Scutty on Thursday:

Has @elonmusk been tweeting about Dalian iron ore, too??#BTC pic.twitter.com/L8zTXe7U7P

— David Scutt (@Scutty) May 13, 2021

But there are some fundamentals in place, according to Magnetite Mines (ASX:MGT) director Mark Eames. History, for starters.

From around 2005 to 2015, during the last China-led mining boom, prices ranged between about US$120 and US160 – a solid decade of highs. It took that long for producers to ramp up operations enough to meet the demand.

And now here we are again, because those producers stopped ramping up operations once they met demand. And now “they’re all flat out and can’t get another tonne out of their ports”, according to Eames.

We haven’t even got to the special bond quota for local governments. You’ll have to click for that.

Just a note on Mindax

The tiny iron ore explorer Mindax was flying in 2018 (one of our top explorers for the year), but fell into a hole in June 2019 for a breach of ASX listing rules 12.1 and 12.2.

If you were stuck holding, you were stuck holding at 0.5 cents.

Upon reinstatement today, the stock rose as high as 20c. Party time.

Especially since it yesterday announced a new development at its flagship Mt Forrest magnetite iron project, located in WA’s Yilgarn province. According to MDX’s website, the project has a JORC resource of over 1.7 billion tonnes.

Iron ore = bonus. But the Mt Forrest project also this week welcomed a new 19.9% earn-in partner – Norton Gold Fields. Norton Gold Fields is a subsidiary of the China-based Zijin Mining Group.

In the midst of an all-out trade war, it clearly helps to have some fast-talkers on the exec team facing the FIRB.

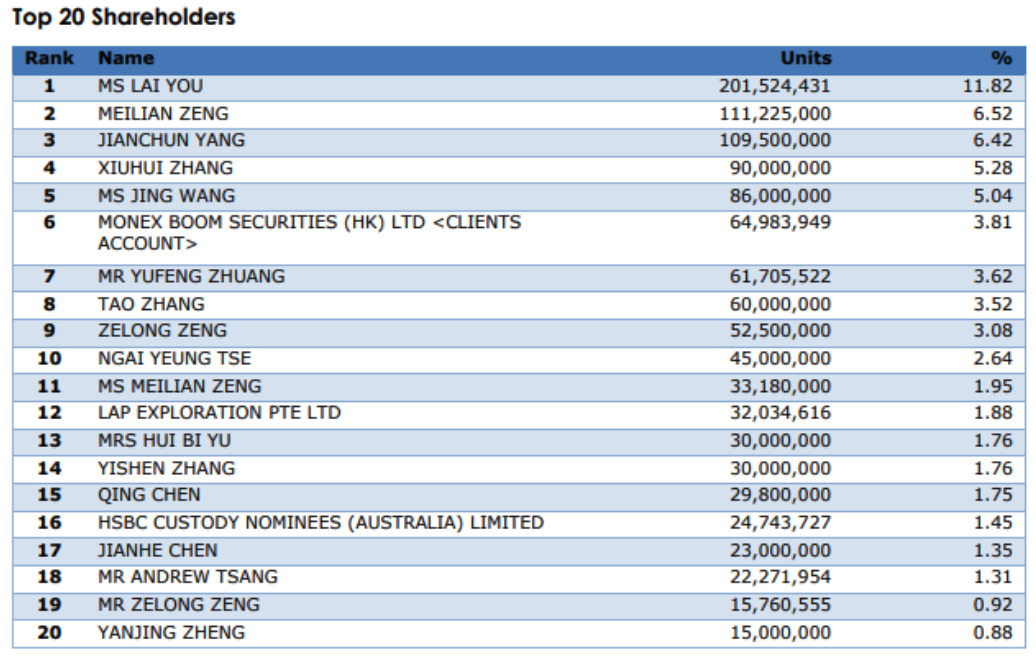

There’s certainly no arguments here from the Mindax top 20:

Province Resources’ David Frances on the ‘wall of money’ coming for hydrogen projects

Hydrogen, huh? 2021 began with only one listed player but now there are seven small caps in the space. All of them are enjoying supersized gains.

By 2050, according to Goldman Sachs, green hydrogen could supply up to 25 per cent of the world’s energy needs and become a US$10 trillion (~AU$13 trillion) market.

We’re doing the rounds. First off the blocks this week was Province Resources (ASX:PRL), which has gained ~1500% since announcing plans to buy the HyEnergy zero carbon hydrogen project in WA in February this year.

Reuben Adams spoke to managing director David Frances about viability, reality, being a first mover and basically, why investors should care about Province.

Nick Sundich jumped on the newest entry, Lion Energy (ASX:LIO). Traditionally focused on oil and gas in Indonesia, it surprised the market last month with a $2.8 million capital raising to undertake hydrogen feasibility studies.

When asked why, Lion’s boss Tom Soulsby had a pretty simple answer: “It would be irresponsible not to.”

ASX battery storage plays such as Redflow are leading the world; ScoMo’s Budget acts like they don’t exist

The Federal Budget was a bit of a miss. Given no stocks or sectors in particular soared on Wednesday, you might even say it was… sensible?

But if you’re into renewables, it bordered on irresponsible. No direct funding for renewables save a $30m commitment over the next year for a battery and microgrid project in the Northern Territory.

That drew predictable responses from environmental groups, but it also kicked sand in the face of some fairly forward-thinking entrepreneurs in this country. Such as zinc bromine flow battery specialist Redflow (ASX:RFX), which recently took to Youtube to showcase its new megawatt-scale energy storage module for grid-scale applications.

Here’s some world-leading power conversion technology on display:

And once again, because it just feels so far removed from reality that once isn’t enough, is Federal Minister for Resources, Water and Northern Australia Keith Pitt absolutely refusing to say the word “battery”:

No, #MadAsHell hasn't started yet – he really is the Australian government's Resources Minister. Keith Pitt, LNP, Qld. https://t.co/a09zQ908p4

— Michael Pascoe (@MichaelPascoe01) May 10, 2021

What a world. See you Monday, and thanks for joining us.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.