The Secret Broker: ALERT- Soap Box Rant incoming

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Every eight years or so, I can build myself up into a ranter of some rage.

Not on domestic issues, but on financial issues. Anyone who is in my vicinity will cop an earful, whether they like it or not. Even the dog will avoid being in the same room as me.

About a week later, when I have got everything off my chest, things go back to normal.

Unlike other people, I am not into sport, bar motor racing, but even the F1s are starting to bore me. This lack of outlet release leads me to rant, so even the local 18-year-old on checkout gets an ear-bashing as she loads up my bags.

Mrs Broker quietly disappears for a few days and the kids know not to pinch anything out of the fridge. Hell hath no fury like a hungover broker having no bacon for breakfast.

So what has got me going at the end of this latest eight-year cycle? This.

You heard it here first

Let’s start with a) the stupidity of people, b) the journalists that feed them information, and perhaps above all, c) the idiot politicians who preside over said people.

What I am about to put into this article will shock people – shock them! And no doubt it will also fall on deaf ears, until they will remember this article in a future date when they will say TSB predicted this would happen.

We should have listened to TSB, they’ll be saying.

Having been around to witness the crash of ‘87 and seen the carnage that happened on that day and for years afterwards, I know how the crowds react. They follow each other to the top and then sell out at the bottom.

This time around it will be interest rates and not shares, which will get everyone in trouble. A person born on the day of the ’87 crash would be 34 today. They have never experienced an event like it.

In ’89, just two years later, house prices halved in value. It can happen.

With age comes wisdom, but when the soul carrying that knowledge dies, so does the wisdom that was attached to it. When Warren kicks the bucket, 90 years of financial wisdom will be lost forever.

So before I do, here’s my prediction to you all. Interest rates in Australia will be 3% within three years and over 5% within five years.

That’s it. That one’s for free.

Put it in your diary and decide whatever action you should take. Although I already know what that action will be.

Young ones will ignore, middle-agers with debt will hope it’s not true and the older and wiser ones will already know.

Help us, Obi Wan

If my prediction becomes true then mortgage rates will hit between 5% and 8% and I reckon even those who have locked in will get caught in the downdraft of the ensuing financial wreckage.

The Lucky Country, as Australia likes to refer to itself as, has allowed itself to create a massive amount of debt, which has to be repaid at some point in the future.

The current politicians will be long gone before hard and unpopular decisions have to be made. Politicians don’t like to deliver bad news, only good news. They will take too long to increase interest rates, until they are forced to.

In the UK, trying to shore up the value of sterling, politicians in their wisdom allowed interest rates to go from 10% to 12% in one day. Sterling was under pressure and they thought that hiking interest rates by 20% would be the solution.

Wrong. It had the opposite effect and sterling continued to fall.

This was in 1992 and was known as Black Wednesday. George Soros made £1bn on that day and in desperation, John Major, the then-Prime Minister stated that they may push rates to 15% by the end of the day, if sterling didn’t recover.

Well, it didn’t.

Eventually, they threw their hands up in the air and put rates back down to 10% the next day.

If the UK Government hadn’t sold down their holdings of £24bn in forgein currencies, the falling currency rate would have made the country over £2.4bn on the day. Instead they lost £3.3bn.

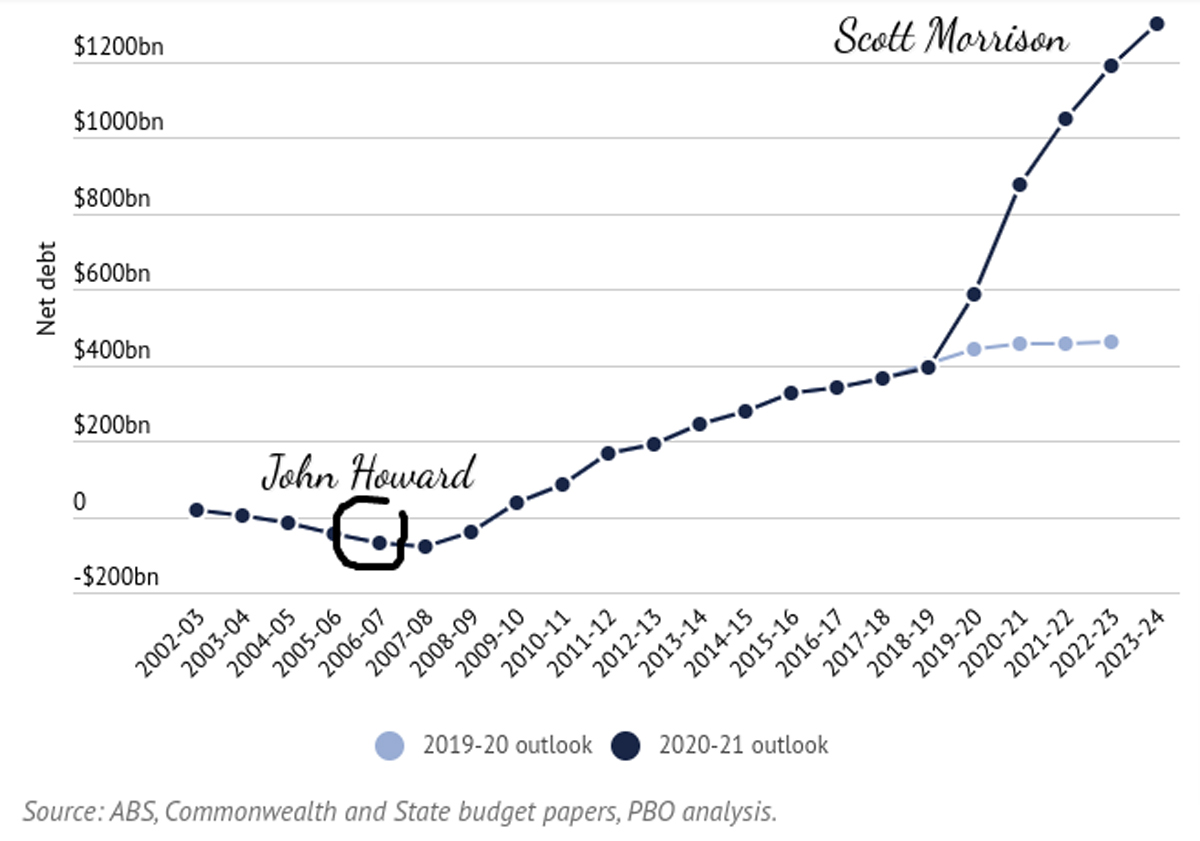

So, in Australia, you (sorry, “we”, given yours truly is now as Australian as a Thursday night meat raffle) have gone from having no debt in 2007, thanks to John Howard, to moving towards having over $1 trillion worth of debt, thanks to Scott Morrison and COVID.

So, history tells us that politicians can not be trusted to take actions ahead of being forced to. We talked about inflation being the elephant in the room back in February and now that commodity prices are hitting all time highs, inflation will definitely stop the low-interest-rate partying.

With house prices going through the roof and companies like AfterPay getting valued at over $30bn (without making a profit) – and now the inkling of inflation being allowed to get out of control – you know something has to give. And it won’t be pretty.

Now that’s off my chest, everything should be back to normal by Monday.

Phew!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.