The top 10 resources small caps that outperformed everyone in 2018

Australia's first ever Winter Gold medal winner Steven Bradbury crosses the line.

It’s been a rough old year for small cap resources stocks.

Over the past 12 months only 94 stocks on our list have come out ahead. Over 445 stocks look like finishing the year in negative territory.

Nonetheless, there’s still a few stocks that have made some huge gains over the past 12 months — even if some of those gains have been pared by a volatile market.

Our top 10 for 2018 is very balanced, covering gold, copper, coal, iron ore, lithium, phosphate, silica sands, tungsten, and vanadium.

>>Scroll to the end for our Top 50 resources performers of 2018

TOP 10 for 2018

#1 GOLDEN CROSS RESOURCES (ASX:GCR) — up 260%

Market Cap: $5.4 million

Copper-focused explorer Golden Cross went from a low of 1.5c to a high of 8.7c on July 24 for no apparent reason.

It’s softened since then, but still takes our number one spot — which is strange because the cash-strapped explorer didn’t do much of anything in 2018.

Currently funded by loans from major shareholder HQ Mining Resources (76 per cent owner), Golden Cross will need more money if it wants to progress its flagship Copper Hill project in NSW next year.

#2 MINDAX (ASX:MDX) — up 225%

Market Cap: $10.7 million

Iron ore explorer Mindax wants to develop its Mt Forrest project in the Mid-West region of Western Australia.

The cash-strapped explorer is currently chatting with a Chinese conglomerate about funding feasibility studies into project development.

Mindax is also looking at collaborating with other companies surrounding Mt Forrest to create a large-scale infrastructure project.

#3 VANGO MINING (ASX:VAN) — up 200%

Market Cap: $98.3 million

Explorer Vango Mining soared earlier in the year after launching a study into a gold mining and processing operation at its Marymia project in Western Australia.

The company says it is now “laying all the groundwork” towards joining the ranks of Australian gold producers on the back of its high-grade Trident deposit at Marymia.

#4 GALAN LITHIUM (ASX:GLN) — up 180%

Market Cap: $23.1 million

Galan Lithium – formerly Dempsey Minerals – surged in July after buying a project in Argentina’s “lithium triangle”.

The company reckons that the high grade, low impurity Candelas target has the potential to host a substantial volume of lithium brine.

It now has the permits to start drilling at Candelas in January.

#5 FERTOZ (ASX:FTZ) — up 163%

Market Cap: $25.5 million

Organic fertiliser company Fertoz moved sharply higher in February after it was selected to supply its organic rock phosphate to a major US company.

Soon after, it reported sales growth of 238 per cent for 2017 from its Australian business, FertAg.

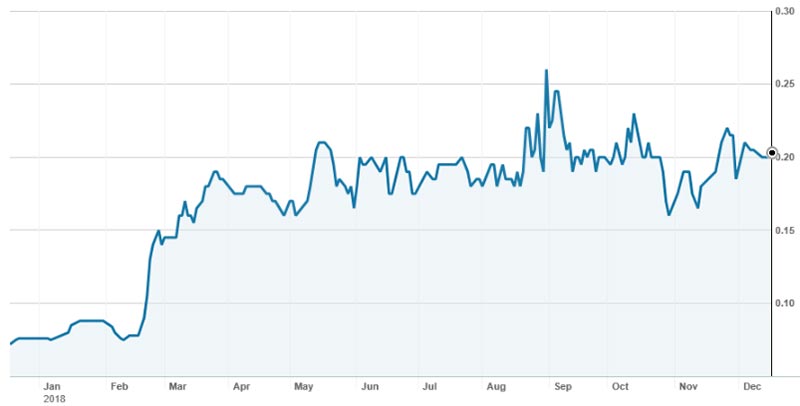

#6 VRX SILICA (ASX:VRX) — up 136%

Market Cap: $45.5 million

Explorer VRX – formerly copper play Ventnor Resources — is focused on its Arrowsmith silica sands project near the fishing village of Dongara on Western Australia’s west coast.

Silica sand has a range of uses, including in construction, glassmaking, and ceramics.

The share price spiked in October on the back of a maiden resource for its Arrowsmith North project — at 193.6 million tonnes grading 98 per cent SiO2, it was 38 per cent bigger than VRX’s previous exploration target.

#7 ADMIRALTY RESOURCES (ASX:ADY) — up 128%

Market Cap: $18.4 million

Shares in explorer Admiralty spiked in April after the iron ore explorer received long awaited approvals to start mining its Mariposa development in Chile.

The company says this completed the full approvals process for Mariposa, which meant it could begin mining works on the site.

A mining plan is being finalised for initial production of one million tonnes per annum.

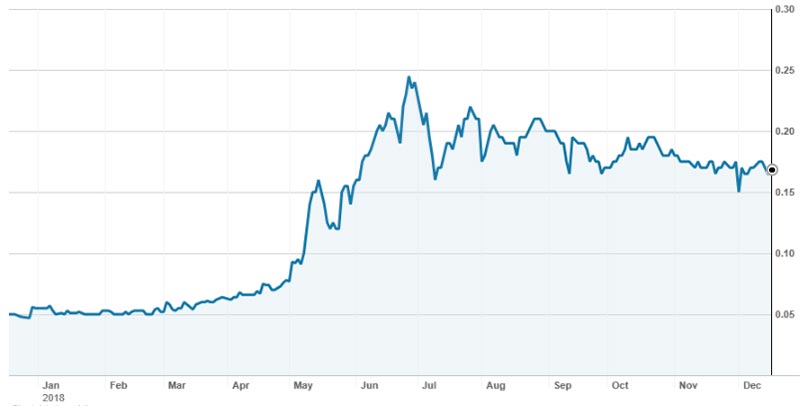

#8 TUNGSTEN MINING (ASX:TGN) — up 124%

Market Cap: $211.4 million

Shares spiked in early May when Tungsten Mining bought the “development ready” Watershed tungsten project in Queensland for $15 million cash.

But its Mt Mulgine project in Western Australia remains “the highest priority development project” for the company.

Tungsten Mining is now implementing a “staged approach” to development at Mt Mulgine, initially focussed on a low cost start-up before ramping up to large scale mining and processing.

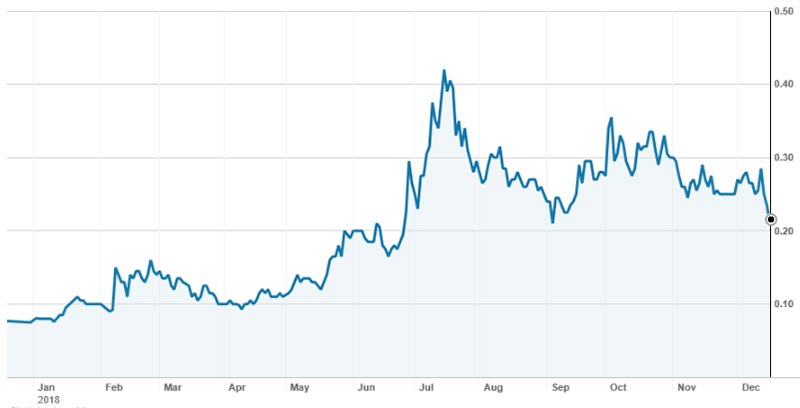

#9 ASPIRE MINING (ASX:AKM) — up 110%

Market Cap: $66.5 million

Coking coal explorer Aspire is developing a huge coal project known as Ovoot in north-western Mongolia — but first it needs a railway link between the project and Mongolia’s existing rail system.

The 250 million tonne Ovoot project would potentially produce up to 10 million tonnes a year of high quality coking coal over a 21-year mine life.

In June, Aspire shares jumped on news the Russian and Mongolian governments were planning to upgrade the Russian-Mongolian Ulaanbaatar Railway and lower tariffs to boost trade flow between the countries.

In the meantime, Aspire has kicked off studies into a smaller road-based operation — the OEDP — which will give the miner early cash flow while waiting for rail access.

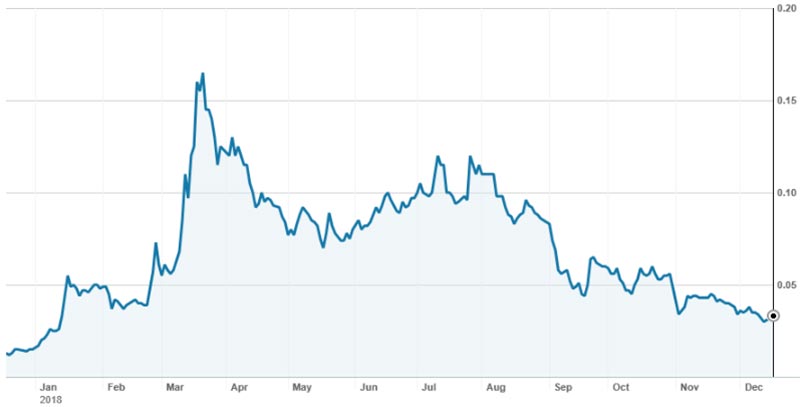

#10 KING RIVER RESOURCES (ASX:KRR) — up 106%

Market Cap: $39.6 million

The share price of vanadium-focused explorer King River jumped in March after test work on its Speewah project returned “the highest vanadium concentrate grade of all Australian deposits”.

It’s been on a slow decline since then, but still makes our top 10.

In November, an early study put Speewah development costs at an eye-watering $2 billion.

This was poorly received by investors — King River says it is now examining lower cost project development strategies.

Here’s our Top 50 ASX small cap resources stocks for 2018>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

TOP 50

| Ticker | Name | Market Cap Dec 2018 | Price Dec 18, 2018 (Intraday) | Price Dec 18, 2017 | Total Return YTD (%) |

|---|---|---|---|---|---|

| GCR | GOLDEN CROSS RESOURCES | $5,487,601 | 0.054 | 0.015 | 260 |

| MDX | MINDAX | $10,776,012 | 0.013 | 0.004 | 225 |

| VAN | VANGO MINING | $98,303,664 | 0.165 | 0.055 | 200 |

| GLN | GALAN LITHIUM | $23,199,948 | 0.21 | 0.075 | 180 |

| FTZ | FERTOZ | $25,558,270 | 0.2 | 0.076 | 163.1579 |

| VRX | VRX SILICA | $45,581,652 | 0.125 | 0.053 | 135.8491 |

| ADY | ADMIRALTY RESOURCES | $18,465,850 | 0.016 | 0.007 | 128.5714 |

| TGN | TUNGSTEN MINING | $211,378,384 | 0.28 | 0.125 | 124 |

| AKM | ASPIRE MINING | $66,530,612 | 0.021 | 0.01 | 110 |

| KRR | KING RIVER RESOURCES | $39,636,432 | 0.031 | 0.015 | 106.6667 |

| KIS | KING ISLAND SCHEELITE | $20,931,112 | 0.08 | 0.0394 | 103.1746 |

| TMT | TECHNOLOGY METALS | $25,916,034 | 0.345 | 0.2 | 72.5 |

| BGH | BLIGH RESOURCES | $13,723,781 | 0.048 | 0.028 | 71.4286 |

| AIS | AERIS RESOURCES | $79,749,536 | 0.18 | 0.1055 | 70.6423 |

| TNO | TANDO RESOURCES | $16,648,489 | 0.089 | 0.053 | 67.8286 |

| DRM | DORAY MINERALS | $156,339,904 | 0.345 | 0.21 | 64.2857 |

| CAY | CANYON RESOURCES | $76,316,680 | 0.2 | 0.13 | 53.8462 |

| NKP | NKWE PLATINUM | $61,849,608 | 0.069 | 0.045 | 53.3333 |

| AVL | AUSTRALIAN VANADIUM | $48,304,836 | 0.028 | 0.019 | 47.3684 |

| RDG | RESOURCE DEVELOPMENT | $13,890,889 | 0.025 | 0.017 | 47.0588 |

| PTR | PETRATHERM | $5,985,058 | 0.035 | 0.024 | 45.8333 |

| ANW | AUS TIN MINING | $33,628,904 | 0.016 | 0.011 | 45.4546 |

| BGL | BELLEVUE GOLD | $176,698,800 | 0.385 | 0.265 | 45.283 |

| GWR | GWR GROUP | $29,154,506 | 0.115 | 0.08 | 43.75 |

| RED | RED 5 | $101,939,688 | 0.083 | 0.058 | 43.1034 |

| CMC | CHINA MAGNESIUM | $10,573,157 | 0.03 | 0.021 | 42.8571 |

| CZL | CONSOLIDATED ZINC | $19,756,282 | 0.02 | 0.014 | 42.8571 |

| CHK | COHIBA MINERALS | $9,304,599 | 0.014 | 0.01 | 40 |

| AHQ | ALLEGIANCE COAL | $26,069,438 | 0.052 | 0.038 | 36.8421 |

| MYE | MASTERMYNE GROUP | $106,141,912 | 1.1 | 0.81 | 35.8025 |

| CYL | CATALYST METALS | $119,712,216 | 1.65 | 1.23 | 34.1463 |

| WLC | WOLLONGONG COAL | $74,935,816 | 0.008 | 0.006 | 33.3333 |

| AGS | ALLIANCE RESOURCES | $11,472,332 | 0.12 | 0.09 | 33.3333 |

| MRC | MINERAL COMMODITIES | $71,585,568 | 0.16 | 0.13 | 32.9955 |

| SLR | SILVER LAKE RESOURCES | $269,219,968 | 0.505 | 0.38 | 32.8947 |

| CXM | CENTREX METALS | $34,725,388 | 0.11 | 0.085 | 29.4118 |

| TRY | TROY RESOURCES | $57,678,340 | 0.125 | 0.098 | 27.551 |

| FGR | FIRST GRAPHENE | $72,365,648 | 0.165 | 0.13 | 26.9231 |

| AIV | ACTIVEX | $35,445,680 | 0.2 | 0.16 | 25 |

| G1A | GALENA MINING | $60,664,112 | 0.175 | 0.14 | 25 |

| GIB | GIBB RIVER DIAMONDS | $10,744,767 | 0.06 | 0.048 | 25 |

| CZI | CASSINI RESOURCES | $30,750,132 | 0.088 | 0.071 | 23.9437 |

| HXG | HEXAGON RESOURCES | $40,849,676 | 0.13 | 0.105 | 23.8095 |

| VMC | VENUS METALS | $13,949,017 | 0.16 | 0.13 | 23.0769 |

| RBR | RBR GROUP | $9,213,569 | 0.011 | 0.009 | 22.2222 |

| DAU | DAMPIER GOLD | $6,459,966 | 0.039 | 0.032 | 21.875 |

| TLM | TALISMAN MINING | $40,853,972 | 0.22 | 0.23 | 21.6004 |

| SIH | SIHAYO GOLD | $31,522,462 | 0.017 | 0.014 | 21.4286 |

| MGV | MUSGRAVE MINERALS | $30,737,948 | 0.095 | 0.079 | 20.2532 |

| BSR | BASSARI RESOURCES | $41,171,276 | 0.018 | 0.015 | 20 |

| GSN | GREAT SOUTHERN MINING | $8,362,370 | 0.03 | 0.025 | 20 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.