When will Australia’s hydrogen industry mature and who else might enter it? Here’s recent aspirant Lion Energy’s take

Stockhead speaks with Lion Energy (ASX:LIO) boss Tom Soulsby about his firm's hydrogen ambitions and where in the industry it wants to fit in

The growth of the hydrogen industry in Australia and stocks within it is exciting investors but arguably is raising more questions than answers.

There’s little doubt that investors are excited about hydrogen. 2021 began with only one listed player but now there are seven small caps in the space.

But will the hype match reality and when? Which companies may enter in the future and which will be the best at it? And whereabouts in the industry might recent ASX entrants fit into?

The most recent entrant into the hydrogen industry is Lion Energy (ASX:LIO). The company, traditionally focused on oil and gas in Indonesia, surprised the market last month with a $2.8 million capital raising to undertake feasibility studies.

Shares rocketed from 2.8 cents to as high as 9.8 cents last week.

Lion Energy (ASX:LIO) share price chart

‘Irresponsible not to’ consider hydrogen

Stockhead spoke with Lion’s boss Tom Soulsby about his firm’s hydrogen ambitions, whereabouts in the industry he wants his company to fit in and how long his firm and the industry’s endeavours might take to come to fruition.

He was not walking away from his firm’s oil endeavours but said it would be irresponsible not to have considered this opportunity.

“I think it’s my duty as a guy that’s in the fossil fuel business to also be exploring what’s going on in hydrogen because you have to know what competitors are doing, and hydrogen is a competing fuel,” Soulsby declared.

“We’ve got a large methane gas discovery in Indonesia, we’re excited we’ll be pursuing [Indonesia] vigorously and hydrogen with same vigour because it’s potential substitute product and we’re putting a foot in that camp. We’re excited about it, we see the same set of skills developing in hydrogen.”

Who else might enter the hydrogen industry in Australia?

Soulsby argued while we might see more companies enter hydrogen, oil and gas companies like his were uniquely skilled to handle it.

“Hydrogen is a gas, it’s a highly combustible gas, it needs careful management, it needs effective project management and engineering and it needs commercialisation. These are the skills that the oil and gas sector has and the skills we have in our team,” he said.

“So from that perspective we feel we can extend ourselves because the team have run gas businesses, particularly in Asia, Indonesia (where) we managed molecules and this is what the business is all about.”

Mining and resources exploration companies however may not be in an optimal location from a resources or export market perspective and may not even have the appropriate land use rights.

“Where do I want to be positioning Lion? It’s the location where I can optimise the electrolyser technologies with best renewable locations with water resources and hydrogen markets,” Soulsby said.

“I want to be close to a hydrogen market, otherwise there’s no point in having fantastic wind resources and being able to put electrolyser up there if my cost to market is high.

“In fact, we understand when you need to move hydrogen more than 2-300km the transport costs are higher than production costs of the hydrogen. You need to fit all three of those elements into any hydrogen strategy.”

Why would an Australian company enter the hydrogen industry?

While there is no promise an opportunity would eventuate from the feasibility study, Soulsby said his company was fair dinkum about wanting to pursue hydrogen.

While hydrogen technology had been around since the 1930s, costs had made it prohibitive until recently; both the cost of generations and producing electrolysers, machines that undertake electrolysis which generates hydrogen.

Soulsby also credited the positive macro outlook and sentiment both in the private sector and for the government for the hydrogen industry in Australia and globally.

“I’m based in Queensland and the minister up here has got a title ‘Minister for Public Works, Energy and Hydrogen’. He’s got it in his name, that’s how serious states like Queensland are about hydrogen so it’s beyond an idea and it’s been implemented,” he said.

There was also substantial investment in Europe, the US and China.

But where exactly will all this money fall? There had been speculation it might be in motor vehicles but Soulsby (and Elon Musk) agree on the “less so” side of that argument.

“The application for hydrogen is more in heavy vehicles, equipment, trains, ships, industrial applications and less so in motor vehicles,” he said.

“And so when Elon Musk is sceptical he’s probably right in motor vehicles, but (not so much) in heavy use machinery – because batteries do not last long when you’ve got heavy weight and long distances to travel. But hydrogen is very competitive with diesels and fossil fuels doing that.”

“And so we talk about wide-ranging industrial applications – high density to weight ratio makes it suitable for use in high energy industrial vehicles rather than batteries. It burns at high temperatures, it’s suitable for use in hard and decarbonised industries [like] steel, cement…

“Steel is where people like Fortescue are getting excited because they want to be improving what you’d call their ‘social licence’.

“So why are people embracing this? Because everyone’s got a conscience and a social licence in the world and hydrogen is a good way to improve that standing.”

Where in the global hydrogen industry might Australia and Lion Energy fit in?

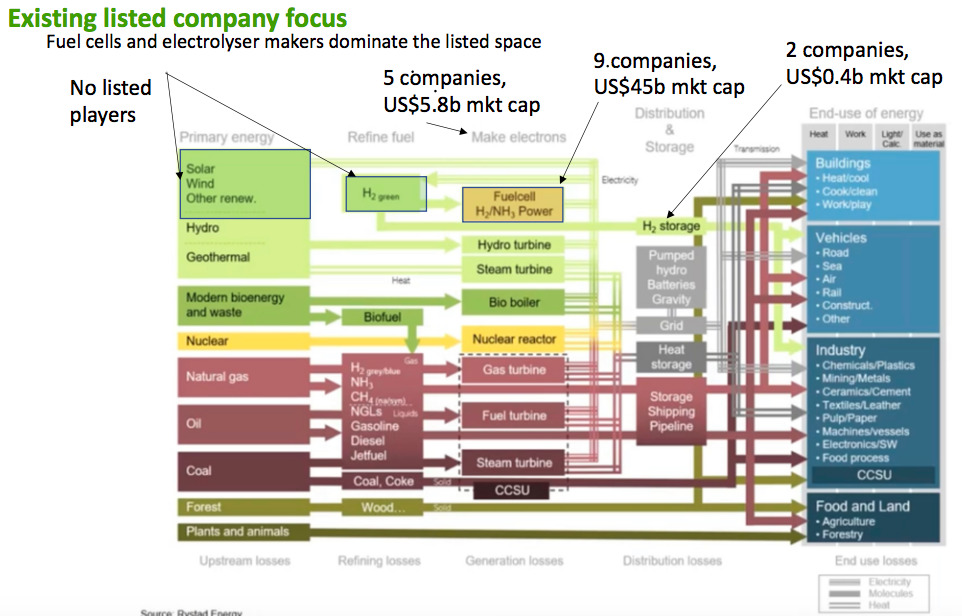

Soulsby referred Stockhead to a recent company presentation in which it outlined the industry. He argued most companies were focused on electrolysers, storage and fuel cells but Lion wanted to cut out its own hydrogen niche.

“We’re focused in on the green hydrogen production from solar and wind.We feel that’s the space to be in,” he said.

“If you go down [on the chart] you’ll see where it’s brown; 99.5 per cent of hydrogen is produced from natural gas in refining processes.

“So it’s an integral part of refineries and so it’s produced basically from fossil fuels – and that’s the opportunities in the displacement of fossil fuels there.”

How long will it take for Lion Energy & the broader hydrogen industry?

If LNG’s any guide, it might take a while for a substantial industry to rise. Soulsby noted Australia’s LNG took 20-30 years to reach where it is now.

But the foundations might be laid quicker than people expected.

“I think the interest in hydrogen is tremendous, the market potential is enormous and there’s plenty of room for players,” Soulsby said.

“I think whilst you’re getting some interesting smaller local companies getting into the space like Lions, Province Resources (ASX:PRL) and Pure Hydrogens (ASX:PH2), these types of players, you’ll also be getting larger players. It could even be people that want to improve their social licence and their social footprint could expand into the space, partner up.

“You’ll see all sorts of companies come in but it’s a big, like, vaccine process in the US – get private sector actively involved where there’s plenty of sugar and you’ll be amazed at how fast it can move.”

Back to Lion Energy and what’s next for its hydrogen ambitions. Soulsby thinks his company will be honing in on a location in the next few months.

“But we’re not going to rush [because] it’s high capex industry and you need to make those capital expenditure decisions – they have to be well founded,” he said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.